This article continues from here (part 1). It is also available to download (for free) in full, as a standalone report – from here. The report features additional information. It forms part of Enterprise IoT Insights’ ongoing Making Industry Smarter report series, which has also covered Energy & Power, Agriculture & Farming, Supply Chain & Logistics, Cities & Towns, and Production & Manufacturing.

FIRST PRINCIPLES

But industrial companies, everywhere, have to get the basics right, first. The challenge, in many cases, is just to get a handle on the data, which is often available, but often disjointed. The first rule of industrial IoT is to order your data, before harvesting the rising chaos of it.

Polish coal mining company JSW (Jastrzębska Spółka Węglowa, if you can pronounce it) has been on just such a journey, with Provencher’s firm. It is the largest producer of coking coal in the European Union, and one of the biggest on the planet, with 14 per cent of global trade.

In 2018, the company put 15 million tonnes of the stuff into the market – giving lie to the idea the digital divide in mining is between big and small firms, or, perhaps, that real industrial ‘smartness’ goes much beyond clever data management, as yet.

But anyway; JSW has four coal mines (seven, if the digging sites are counted separately) and another under construction, alongside three coking plants, where it processes around half of the coking coal it produces – enabling it to offer a higher-grade, higher-value product.

But anyway; JSW has four coal mines (seven, if the digging sites are counted separately) and another under construction, alongside three coking plants, where it processes around half of the coking coal it produces – enabling it to offer a higher-grade, higher-value product.

It also mines iron ore; both materials are used for feedstock in steel production. All of its mines are in Poland, the “industrial heartland of Europe”; they have 5.5 billion tonnes of reserves, it reckons, giving 30-40 years of operation.

As for every industrial outfit, tasked with transforming legacy operations for the new digital era, JSW’s essential challenge has been to get more from its processes and machinery, more safely. “Monitoring systems for machines and mining equipment are essential to effective management of the mine, to allow for safe operation and efficiency,” comments Jacek Kwasnica, project development coordinator at JSW.

Until 2017, its systems were a mess, however. The company was running independent proprietary SCADA systems (“by the machine makers”), and sometimes even two, for each longwall.

A so-called ‘dispatch system’ showed only the workings of critical machines at each site. It is a familiar tale, from across the industrial space. Kwasnica comments: “Data was distributed in local databases; we had no direct access to it. There was no integration between those OT and IT systems. Everything was in silos.”

His work, in charge of implementing OSIsoft’s PI System, has seen JSW start to combine data from its shearers, conveyors, and hoists in a single database, badged internally as a ‘central tech data server’ (CTDS), bridging the IT/OT divide.

With this integration, the company has been able to ascertain relational data between data sets: minute-by-minute analysis of its machine operations, with time-stamps for uptime and downtime, and trends for system usage, made digestible in dashboards showing site performance, and averages across its mining network.

It is only a first phase, acknowledges Kwasnica; it gives JSW a fuller picture about blockages. Report writing has gone from a couple of hours to a couple of minutes, he says; the company wants to extend to the wider operation, including data acquisition in its coal processing and coking plants, as well as monitoring of auxiliary processes like ventilation and drainage.

“What we next will depend on how much data we can obtain from our systems,” says Kwasnica.

CHANGE PLATFORM

It sounds rather simplistic, just to make better use of existing data. But the discipline, to order and manage operational data, is crucial as a springboard for more advanced analytics and automation. The impact should not be understated, either.

Provencher at OSIsoft references an analytics programme by Arcellor Mittal, another PI user, to run business intelligence on its operational data.

The steel maker was able to produce an additional three million tonnes of iron ore using the same core assets, he says, just augmented with newly integrated data and analytics software. It went from 23 to 26 million tonnes, he says. “That’s direct profit; productivity was the most important aspect.”

Aurelia Metals, a gold mining company in Australia, and another OSIsoft stalwart, tells the same story, about increasing the gold recovery rate in the refinery process at its Hera-Nymagee plant from 74.6 per cent to 88.6 per cent in a little over 12 months, just from joining its IT and OT systems in an orderly fashion (see pages 12-13 of report).

“It isn’t a trailblazer or a revolutionary, but it now has the means to be,” says Gavin Strack, executive director at Convergio, the solution provider for the change programme.

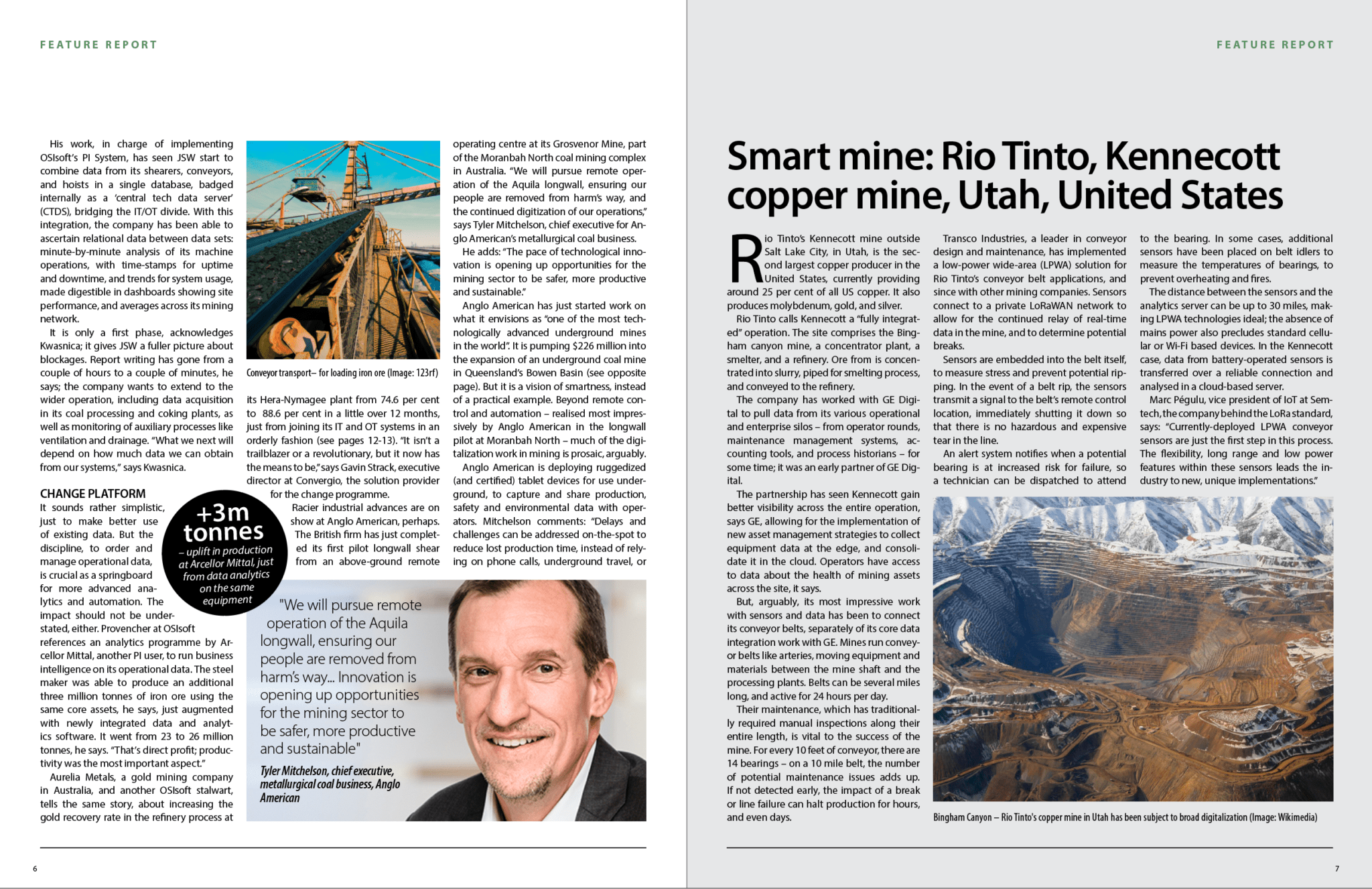

Racier industrial advances are on show at Anglo American, perhaps. The British firm has just completed its first pilot longwall shear from an above-ground remote operating centre at its Grosvenor Mine, part of the Moranbah North coal mining complex in Australia.

“We will pursue remote operation of the Aquila longwall, ensuring our people are removed from harm’s way, and the continued digitization of our operations,” says Tyler Mitchelson, chief executive for Anglo American’s metallurgical coal business.

He adds: “The pace of technological innovation is opening up opportunities for the mining sector to be safer, more productive and sustainable.”

Anglo American has just started work on what it envisions as “one of the most technologically advanced underground mines in the world”. It is pumping $226 million into the expansion of an underground coal mine in Queensland’s Bowen Basin (see page 7 of report).

But it is a vision of smartness, instead of a practical example. Beyond remote control and automation – realised most impressively by Anglo American in the longwall pilot at Moranbah North – much of the digitalization work in mining is prosaic, arguably.

Anglo American is deploying ruggedized (and certified) tablet devices for use underground, to capture and share production, safety and environmental data with operators. Mitchelson comments: “Delays and challenges can be addressed on-the-spot to reduce lost production time, instead of relying on phone calls, underground travel, or hard copy reports,” says Mitchelson.

The initiative is important, but, rather like the basics of IT/OT integration, it is tempting to see it as humdrum, at least in the face of more futuristic digital pyrotechnics, as an underground version of the kinds of above-ground work tools that have been available for years.

But this misses the point. Just as with automation of industrial machinery and equipment – shifted up a gear with advanced connectivity and analytics – the motivation for mining companies to invest in technology is to save lives and money.

In this light, the deployment of underground tablets looks transformative, just keeping workers in touch in difficult terrain. The mining industry, so often out of reach, is making gains just by connecting assets and ordering data.

In this light, the deployment of underground tablets looks transformative, just keeping workers in touch in difficult terrain. The mining industry, so often out of reach, is making gains just by connecting assets and ordering data.

Hughes at 451 Research comments: “It is key to tap into the existing machinery and data to drive the first wave of benefits. Mining can use IoT data and tools such as predictive maintenance to keep the machinery operational and improve yields. Optimising transportation, fuel efficiency, and energy usage are also key first projects.”

Provencher, again, has a number of illustrative upsides of better-managed machinery, and specifically mining vehicles: there are ‘cap-ex’ improvements, from managing with five haulage trucks rather than six, he says, from keeping a closer (automated) eye on tyre pressures (“$25,000 just to replace a tyre”), and from putting sensor on the exhausts (“$3.5 million for an engine blowout”).

He says: “Underground, mining companies are losing assets, sometimes worth $20 million. They’re underground somewhere, they just don’t know where. It is a huge problem. They start digging, and they start extracting the ore here and there, and then somewhere else. In the end, there are thousands of tunnels, and the asset is in one of them, somewhere.”

It is the same with losing people, he says. “Whenever there’s an emergency, they want to know where people are. Which is why communications are so important, even if they are not currently available in all mines. Once you have those capabilities, then of course you start to capture data from your assets, as well.”

WORKER SAFETY

The two objectives, lives and money, are intertwined; saving lives saves money, and a new era of automation, spurred by digital technologies, affords a way to reduce the workforce, and therefore injuries and deaths.

Josefsson at Ericsson comments: “There is high pressure and cost incentives to reduce the human workforce and allow for remote working – via remote controlled machinery.”

Worker safety is the priority for all mining companies; that is the line. Mines are inherently dangerous; work is repetitive, carried out in cramped conditions. Behavioural training is compulsory; mining companies run courses on everything from no-go zones to emergency protocols to posture improvement.

But more could be done, given the technology available.

Provencher says: “The fact they now have access to data and wearables means they can know where employees are – a buzzer goes ‘beep’ if staff go out of bounds. That is so easy to implement; everyone has a phone, and you don’t even need a phone; just a [smart] bracelet will do.”

Such devices can record data to analyse posture and movement, as well, and feedback to managers and workers to prevent injuries, just as with predictive maintenance on machinery. “The analytics can be set to identify a failure or an injury, down to a person lifting boxes the wrong way.”

Not many mining companies are properly managing safety risks, given the technology available to them, reasons Provencher; the measure of workplace injuries, called the ‘total recordable injuries frequency rate’ (TRIFR), could always be lower, after all. “Nobody is at zero,” he says.

But worker safety is not a straightforward calculation for technological investment, even if its financial bearing is clear. “If someone gets killed, it has an impact on financial results as well,” comments Provencher.

There is work to be done to “democratise” safety solutions, he says. The problem is their heads are elsewhere. “They are not implementing digitalization for safety. They see clearer returns elsewhere. They’re looking at it to improve efficiency, mainly.”

This article continues here (part 3). It is also available to download (for free) in full, as a standalone report – from here. The report features additional information. It forms part of Enterprise IoT Insights’ ongoing Making Industry Smarter report series, which has also covered Energy & Power, Agriculture & Farming, Supply Chain & Logistics, Cities & Towns, and Production & Manufacturing.