Greetings from Lake Norman and Charlotte, North Carolina where temperatures are above average and sunrises are magnificent. Social distancing with a lake breeze – one of the many advantages of being a Tar Heel state resident.

Greetings from Lake Norman and Charlotte, North Carolina where temperatures are above average and sunrises are magnificent. Social distancing with a lake breeze – one of the many advantages of being a Tar Heel state resident.

This has been a tough week in the markets without a doubt. Friday’s meltdown was the first end-of-week dive since early February (several of you brought this to my attention – thanks!). Day-to-day gyrations will continue, but our economy will recover and our daily lives, although different, will resume.

Here are the numbers from the week that was:

As a result of the past four weeks of turmoil, the Telco Top 5 has given back nearly all of their gains since the beginning of 2019 and the Fab 5 nearly half. The week-over-week losses were nearly a half trillion for the Fab Five alone. There’s no way to sugar coat this – the week was abysmal.

Companies with future growth prospects (e.g., theme parks at Comcast, HBO Max at AT&T) got hammered as (re-) launch estimates were slashed. Housing starts, which played a big role in the growth of High Speed Internet, will pause as the nation recovers. Wireless and wireline service downgrades will place pressure on ARPUs as customers switch to lower-priced alternatives such as Spectrum Mobile. And advertising, the lifeblood of the “free” economy, is in free fall (and, before Friday’s liquidation, the primary reason why Google and Facebook were the hardest hit of the Fab 5).

It’s important to keep all of these changes in context. Here’s a chart showing the last time we saw a lower weekly closing price for each of the 10 stocks above (source is Yahoo! Finance historical prices adjusted for dividends and splits):

*Amazon actually hit a lower level in February (as China supply chain fears acccelerated) but even as recently as December 16, 2019 (pre-Corona), Amazon had been at lower levels than today.

For 70% of the stocks, the decrease is still dramatic, but we could still say “We haven’t seen this closing level in nearly a year.”

Bottom line: Telecom is still very strong. Cloud and Internet provider values are still holding up very well. We are neither the travel nor the energy industries (American Airlines last saw these levels in 2012; Exxon Mobil in 2003) who are truly experiencing multi-year lows. And, as we discuss below, the ability for the telecom and Fab 5 companies to bounce back is far greater than most of their Fortune 500 peers.

The economizing effects of the essential economy

Many of you have asked for my thoughts on how our economy will recover (assuming the “shelter in place” state we are currently seeing now is not a good indicator of what will happen in 6-8 weeks). We are reiterating our themes from last week – this will be the “Essential” Economy (focusing on only essential items) operating under the mantra of “economize.” Discretionary purchases will be as popular as insider-trading senators or Hamptons-fleeing renters or virtue-signaling former governors who instruct on social distancing while smoking cigars from a hot tub.

Smartphones, which were already essential for information and comunication, move even higher up the needs scale for most consumers. But, with economics as the mantra, devices like the Moto G Power ($249 when released), Moto G Stylus ($299 when released) and the Samsung Galaxy A50 ($274.99 on sale at Target) are all winners. Assuming the rumors are correct, Apple’s iPhone SE2 will hit the shelves in late summer even with COVID-19 delays. Each of the devices above will come in unlocked versions and will work with Sprint’s BYOD plan ($35/ mo. + taxes and fees) or you can go with the Spectrum/ Xfinity mobile solution described above. We might even see 36-month terms as the standard for premium devices (maybe if financed through one’s Apple Card or the Verizon/Synchrony Card).

Expect longer smartphone retention, longer terms (or more aggressive trade-in allowances) for new 5G devices to increase adoption, and an increase in the sales mix of low-end Android (and perhaps Apple) devices.

Service plans are also going to be under pressure, with consumers looking for extra ways to economize. One of the most interesting plans (see last week’s article for their recently improved markets) is Sprint’s Ultimate Unlimited Plan which is a potential Internet cord cutter if you are single or no-kids/non-gaming couple. Here’s what that $80 (+ taxes/ fees) monthly plan includes:

-

- 100 GB Mobile Hotspot (per line)

- Full HD streaming (10 Mbps or higher)

- Amazon Prime ($10/ mo. value)

- Hulu ($6/ mo. value)

- Unlimited Talk/ Text

Two lines are $140 (assume $155 with taxes). If you are paying for Single Play High Speed Internet from your cable provider (month-to-month is ~ $75-90) then this could look very attractive in many metro markets. As we discussed in our column last month, make sure that any new device purchased has T-Mobile’s 600 MHz (LTE Band 71) band. If your family is already paying for Amazon Prime, a well-well timed service plan change will not dramatically impact your Jack Ryan viewing schedule.

If cord-cutting isn’t possible (or Sprint’s service, even with roaming on T-Mobile’s networks, is not a good fit), the next best deal is Mint Mobile’s multi-month plans. Starting March 15 and through April 14, all add-ons are free (more details here). That would reduce unlimited plan costs to $15/ mo for at least the next month, and a 12GB plan is $25/ mo. if you buy a year in advance ($300 annually is an incredible value if you have ready access to Wi-Fi at home and in office, have decent T-Mobile coverage, and have the cash now to make that leap).

Video cord-cutting is perhaps even more at risk than ever before. Earlier this month, the Leichtman Research Group (LRG) released their esitmates of 2019 cord cutting (and vMVPD additions) by segment. At the end of 2019, LRG estimated that there were 45.8 million video subscribers across the top 7 cable providers (down 920K in 2019), 25.4 million satellite video subscribers (down 3.7 million), 8.3 million telco subscribers (down 665K) , and 6.7 million publicly-reporting vMVPD subscribers (Sling, Hulu + Live TV, and AT&T TV Now – up about 1.0 million). Notably absent from these figures is YouTube TV who now (per Google’s Feb earnings call) has more than 2 million subscribers.

Could the video subscriber base follow the slope of the stock market? The short answer is no, but only due to bundling terms and conditions with some providers’ contracts. It’s likely, however, that many customers will increase their investigation into alternatives, and, with multiple months of no sports programming, may be eligible for cable winback promotions by mid-summer. The discount packaging of AT&T Fiber + AT&T TV ($80/ mo. bundled first year and jumps to $150/ mo. or so for the second) might also be attractive to families who are fibernating and are willing to postpone high prices until 2021.

Video margins have always been the slimmest of the triple play (except high-user Unlimited mobile customers), and discounting is reduced when a bundled element is removed. As a result, many cable companies see a $15 gross margin loss per video Revenue Generating Unit (RGU) as a good trade if it results in a $10 increase in gross margin on Internet.

Bottom line: The effect of an economic jolt of this magnitude is difficult to predict. However, with Disney+, Hulu, YouTube TV, Sling and new entrants (NBC Peacock, HBO Max, others), the highest at-risk revenue stream is traditional video. The risk is mitigated when sports leagues come back to the screen. Wireless downgrades are also likely (except for Sprint’s Premium plan which might actually be a cord-cutter for some, especially couples), and $1000 smartphones are off the list for many, even if they can be financed across 36 months. High Speed Internet upgrades are likely, especially for the next 90 days, and will recede once “shelter in place” restrictions are lifted. The Essential Economy is here, and it’s all about economizing wherever possible.

Dish (and others) lend spectrum for 60 days. What’s the impact?

In the midst of the health and stock market news cycles, Dish and others allowed T-Mobile, Verizon and AT&T to use some fallow spectrum for 60 days. We mentioned the T-Mobile 600 MHz spectrum actions in last week’s Brief, and the Verizon and AT&T releases are here and here.

AT&T’s access to Dish’s AWS-4 spectrum is probably the biggest spectrum opportunity (additional 10 MHz uplink and downlink), and, judging from comments made by AT&T to analysts on Friday, should be able to be implemented shortly across already deployed AWS-3 spectrum. AWS-4 operates on LTE Band 66 which is available on iPhone 8, iPhone X, iPhone XS, iPhone XR, and iPhone 11 models.

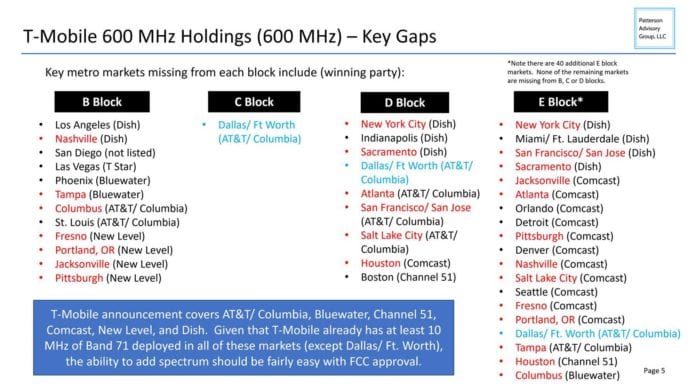

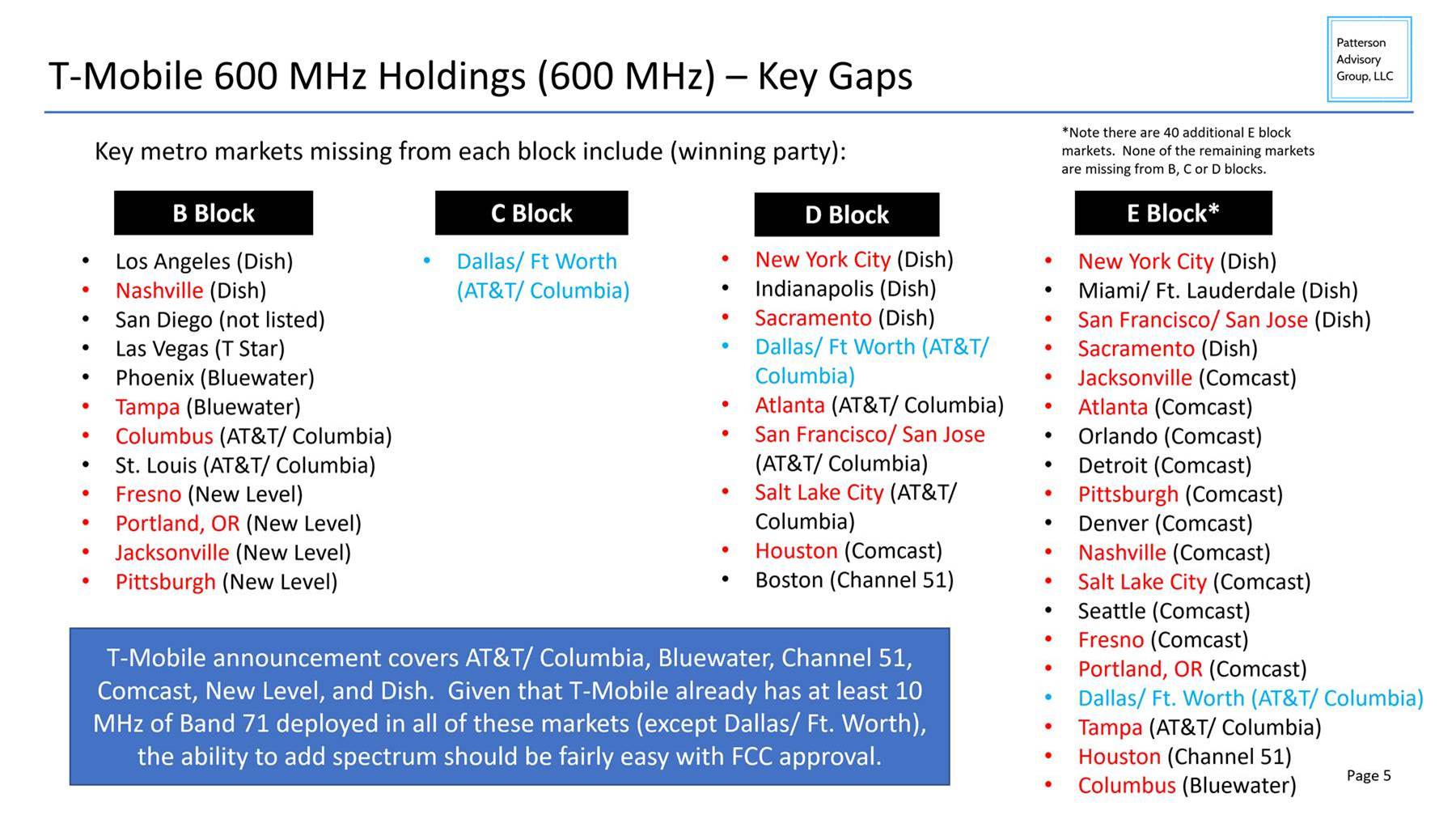

The bigger impact, however, is the Dish/ T-Mobile transaction that was announced last Saturday/ Sunday as we were going to press. Here’s a market-by-market assessment of the 60-day lease (full report available upon request):

The 600 MHz spectrum was separated into seven 5 megahertz blocks (Block A-G) of uplink, as well as a similar pairing for downlink (70 megahertz total) across 416 Partial Economic Areas (PEA). As the chart above shows, T-Mobile bid aggressively on the B, C and D Blocks and won most of the available PEAs there (94%-98% of the 416), yet there are gaps, especially in Dallas (3 of the 4 key blocks).

As we have discussed in many T-Mobile earnings reviews, they were aggressive in deploying 600 MHz spectrum to improve their non-metro coverage (as of 4Q, they had deployed 248 million POPs with 600 MHz 4G LTE spectrum and had cleared an additional 27 million POPs). They also reported that they had 33 million devices being used that were LTE Band 71 (600 MHz) compatible (more than 45% when you remove estimated M2M/ IoT devices).

The result of the T-Mobile announcement is a clean sweep of B-E blocks (this is where T-Mobile would have deployed 600 MHz radios), with the potential to use the entire 70 MHz for capacity purposes. And, thanks to T-Mobile’s Reddit thread, it appears that Magenta is making good on their deployments. Some examples include:

- Anaheim: 15 Mhz capacity

- Trinity, FL (NW of Tampa): 10 MHz capacity

- Parkersburg, PA (between Lancaster and Downingtown – Central PA): 15 MHz capacity

- San Diego, CA: 15 MHz capacity

One of the Reddit contributors posted a link to T-Mobile’s MVNO map which should be able to indicate the strength (and availability) of 600 MHz spectrum. Their ability to deploy this spectrum quickly has likely helped their in-building/ in-home penetration and kept work-from-home (WFH) grumbling to a minimum.

Once deployed, how easy is it going to be for T-Mobile (and Verizon and AT&T) to return the spectrum, versus implementing a short-term lease? The lease estimates for Dish alone are in the mid-hundreds of millions of dollars per year. That could fund a lot of short-term network build. And Dish had already committed to good faith negotiations to lease its New York metro 600 MHz spectrum to T-Mobile.

Bottom line: While short-term spectrum implementations help America cope with the COVID-19 pandemic, the medium-term financial potential for Dish and other lessees are significant if/as these emergency uses translate into full scale leases, particularly for Comcast (perhaps as an alternative to Verizon as an MVNO partner) and Dish (already tied to New T-Mobile as an MVNO and eventual competitor). For T-Mobile, the capacity could put their in-building coverage on the same footing as AT&T and Verizon.

One final thought – when we talked about the increase in WFH usage last week, we wondered if the networks would hold up. One site that examines home network performance for a living, Downdetector, posts their week-to-date outage issues on their site. As of Saturday afternoon, of the top 10 problem areas, 4 were gaming platforms (X Box Live, Blizzard, Discord, Call of Duty). Other non-network outages included streaming service Hulu, website Reddit, and popular app Snapchat. Spectrum, Comcast, and Verizon were the only carriers (so far) to make the weekly list.

That’s it for this week. Thanks again for your readership. Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here. If you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Have a great week!