Greetings from Lake Norman and Charlotte, North Carolina. It’s been an amazing week, and, as the picture shows, we are using videoconferencing more than ever. Pictured is the first ever Patterson/ Delmege family Zoom conference call we held on Saturday morning. Five states, seventeen participants and a lot of needed laughter. Fortunately, our Spectrum High Speed Internet only crashed once during the call and we had audio via our smartphones (Verizon’s network performed spectacularly). Worth every minute, especially for my Mom and Dad.

Greetings from Lake Norman and Charlotte, North Carolina. It’s been an amazing week, and, as the picture shows, we are using videoconferencing more than ever. Pictured is the first ever Patterson/ Delmege family Zoom conference call we held on Saturday morning. Five states, seventeen participants and a lot of needed laughter. Fortunately, our Spectrum High Speed Internet only crashed once during the call and we had audio via our smartphones (Verizon’s network performed spectacularly). Worth every minute, especially for my Mom and Dad.

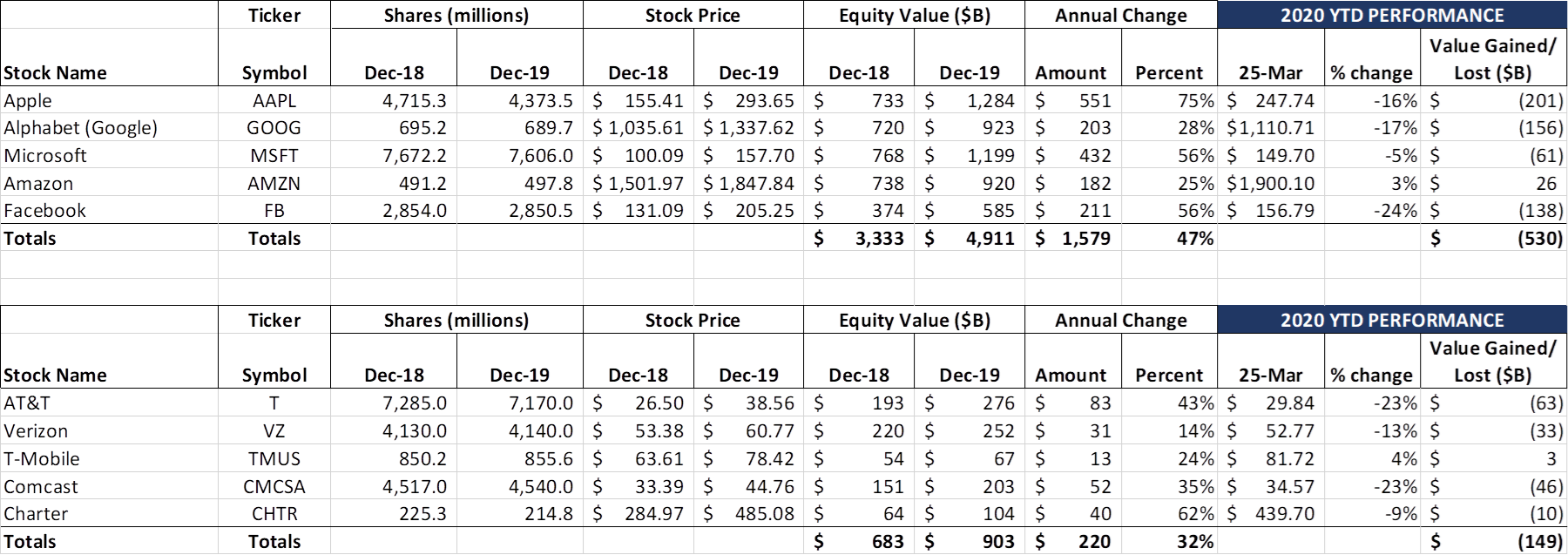

This was a recovery week in the financial markets thanks to Fed and government interventions (and, as Paul Tudor Jones indicated on CNBC this week, there’s probably some quarter-end window dressing going on) . Here are the numbers from the week that was:

Year to date, the Fab 5 have lost $530 billion in market capitalization (the entire equity value of Facebook) and the Top 5 Telcos have lost $149 billion (slightly more than one half of AT&T’s 2019 year-end market capitalization). While breathtaking compared to February’s gains, these losses still represent 34% and 68% of 2019’s market gains. Last week, those numbers were 49% and 86% respectively – a significant weekly improvement. In fact, as you can see above, every share price except for Verizon is higher than it was at the beginning of 2019.

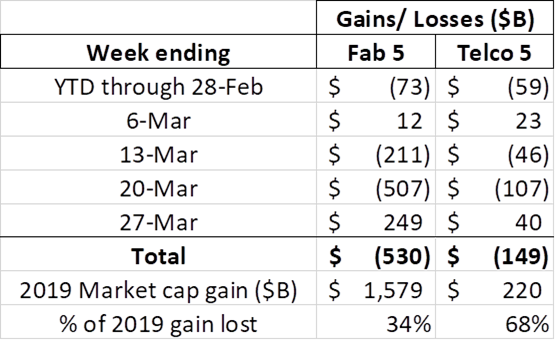

Since several dozen of you liked the “We haven’t seen prices this low since _____” table last week, we thought we’d keep it updated. Here’s a chart showing the last time we saw a lower weekly closing price for each of the 10 stocks above (source is Yahoo! Finance historical prices adjusted for dividends and splits, and if the stock has been consistently rising we note that as well):

The bottom line for this week is similar to last week: For 20% of these stocks, prices are higher than they were at the end of 2019. For another 50% of these stocks, the decrease is still dramatic (especially compared to late January share price peaks), but we could still say “We haven’t seen a weekly closing level this low in several months.” Verizon, Facebook, and Comcast have stock price pressures for very different reasons, but are still all within 15 months of current prices. The virus is bad, but the Sunday Brief is thankfully not a retail, travel, or petroleum industry blog.

The essential economy’s impact to the telecommunications industry

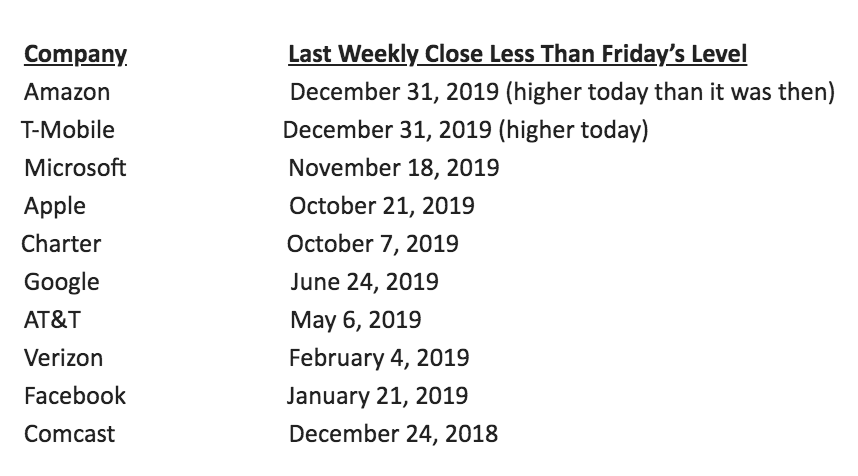

Starting two weeks ago, we coined the term The Essential Economy. At that time, we discussed the principle of economizing – finding better values, particularly with wireless plans but also with cable TV and increasingly expensive smartphone monthly installment payments.

Last week, during the worst of the stock market declines, we looked at the swift actions of the FCC and wireless companies to implement fallow spectrum (T-Mobile with 600 MHz and Verizon and AT&T with AWS-3 and AWS-4 spectrum). After we sent out last Sunday’s column, we started to put together a more comprehensive definition of The Essential Economy and conversation-starting timeline. We did this with the best information we had at the time (some of the slides you will see are not perfectly in line with the $2 trillion stimulus bill but are certainly directionally correct), and we tried above all else to be realistic and unbiased (hard for us to do).

Behind the two slides we will discuss below are reams of information from Business Intelligence, Statista, MoffettNathanson, two large banks, and at least 20 different interviews this week with telecom leaders and analysts. We looked at recessions one, two, and three decades ago. Then we applied a lot of Midwestern and Southern common sense.

With those caveats, let’s define The Essential Economy.

The essential economy

When we come out of our respective shelter-in-place orders, a new economic structure will emerge. Some (we think this is a small percent) will go back to exactly the way things were in January before the virus hit the US. Others are going to economize to different degrees. Many (we are estimating 40% of the population) are going to be covering essentials for several months and nothing else. Driving this Essential Economy psyche are the following questions:

Covering the basics will be critical for 40% of the US households who will still be struggling economically after the checks stop coming. Our basis for this figure is shaped by the fact that ~50% of the population was living paycheck to paycheck (studies here from LendingTree and here from GoBank) before COVID-19, and 60% of them had accumulated less than $1000 in savings.

Those consumers are going to be very focused on meeting essentials: food, rent, car/transit, health care, and broadband/ mobile basics. Those who lose their job are going to be actively looking for work, perhaps in a different location (we saw this with the accelerated southern and western migrations during the last recession). Many of those who keep their job are going to be looking for greater stability and working conditions (the “survivor mentality” after large changes is not as emotional as for those who lost jobs, but can be stressful nonetheless). Those who keep their jobs are not going to be “back to normal” but will more than likely be economizing/ saving for the next contagion.

To economize, the remaining 60% of households are going to ask a critical question “Can I live without it?”

- Can I bring my own lunch to the office?

- Can I live without Red Lobster every Sunday (vs. Wendy’s)?

- Can I live with Trader Joe’s cabernet vs. Robert Mondavi?

- Can I live with a higher car/home/renters/health insurance deductible?

- Can I live without an iPhone upgrade this year?

- Can I live without 1080p data or that home internet upgrade?

- Can I live without phone insurance?

- Can I live without unlimited data?

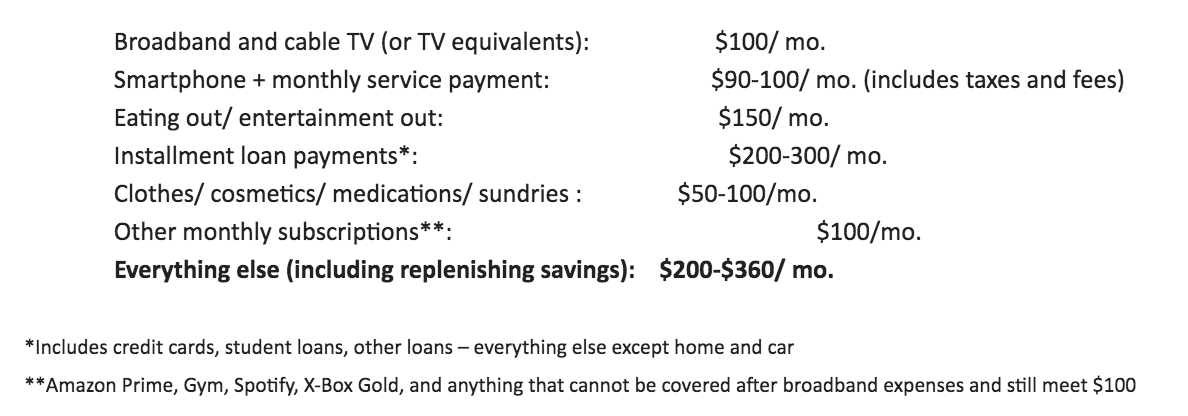

Let’s assume, for example, that a single person earning $55,000 annually ($4,583/ mo.) takes home $40,800 after taxes and health care ($3,400/ mo.), has $1,425 or 42% in rent + gas/electric/water payments (we discovered wide geographic variances in our study), has $625/ mo. (18.4% of income) in transportation related expenses (car payment, gas, insurance, etc.), and spends $300/ month or 9% of income on basic food needs (family expenses would be more). That leaves $1,050 monthly to cover the following:

Lifestyle changes are going to be required for savings to be replenished (or new savings accumulated). Some sacrifices will be necessary – and economizing will start with $10-20-40/ mo. trimmings of discretionary spending. That’s where many of the questions above are answered, and why things like cable TV (without an olympic draw), a fourth streaming channel monthly charge, and unlimited plans are at risk.

To understand consumer spending, consider the following:

Spending follows confidence. If the economy bounces back, it’s because everyone is confident. In fact, consumer confidence determines whether the shape of the economy is an L (low/ no confidence), U (uncertain), or V-shaped. We think the shape is somewhere between an L and a U, simply because of the attenuating fear that will continue even after the current shutdown is over.

Confidence follows evidence. If new home sales dry up, confidence will be diminished. If durable goods purchases (dishwashers, furnaces, lawn mowers, furniture, etc.) slow down, confidence will dip. Most importantly, every month that passes without increased news of furloughs and layoffs increases confidence.

We strongly believe that one cannot treat needed short-term stimulus as evidence simply because it’s temporary. The relief measure that was signed Friday includes unemployment benefits and payments to cover work stoppages. While necessary, the government assistance passed last week only treats near-term (2-6 month) needs – it should not be interpretered as a giant “resume” button. Too many disruptive weeks have passed, and confidence is shaken.

The bottom line is that everyone is going to being economizing, whether you earn $45,000 annually as an individual or $145,000 as a family. Evidence drives confidence which in turn drives spending. That’s why we think AT&T’s HBO Max will be good but not a blockbuster (even with greatly desired new programming), and why we think that high-end 5G smartphone payments are at great risk (not good news for Samsung Galaxy G20 sales).

The aggregate effect of economizing

The Essential Economy will pare down consumer discretionary spending, and businesses, jolted by the COVID-19 impact, will in turn remain cautious about risky expansions and other initiatives. The recently passed relief helps businesses recover their labor costs, but not the revenue and profit impact of economizing purchasers. The allure of more debt, even at low interest rates, keeps companies solvent but will need to be paid back. And government equity ownership of any company/ industry, while passive today, can change dramatically with one election result.

Many small businesses (25% for any disaster, on average, according to the Small Business Administration) will not reopen after this disaster has ended. Those that do open will only hire and invest when absolutely necessary. They will go through the same economizing steps we discussed with consumers, although businesses will be highly focused on labor, marketing and capital investments (with more emphasis on “Can I Defer This Purchase?”).

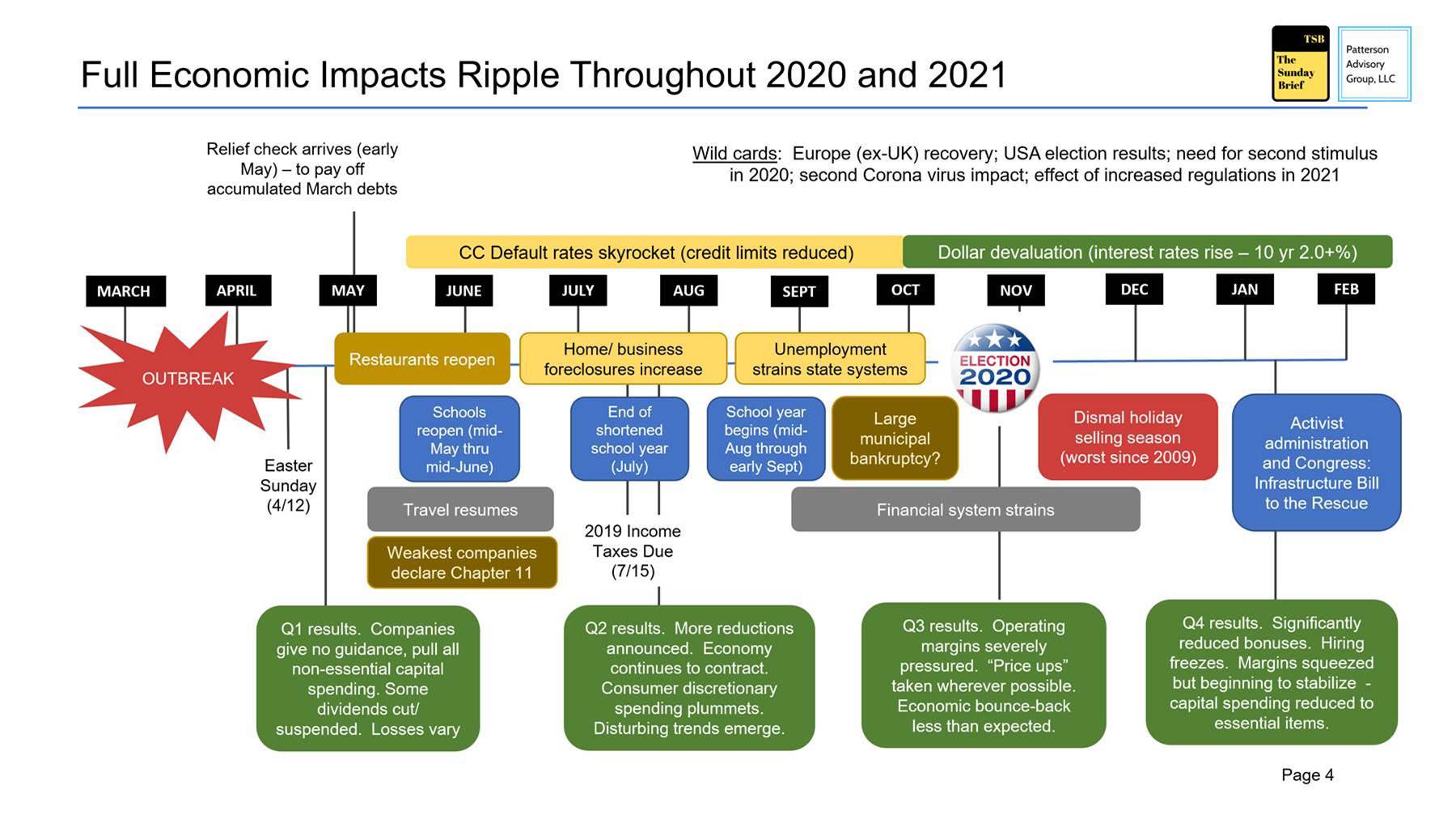

For example, a small business located near Lake Delavan, Wisconsin (a nice vacation spot) may reopen in May assuming that the summer tourist season will still be solid despite a shortened school year (see chart below). But they will not triple staffing, order large inventories, or double advertising (plans they might have had earlier in 2020). And, if tourists shorten their stays due to family budgets or school year constraints, they may not earn enough to reopen in 2021.

What happens on Lake Delavan will happen with the theater owner, fitness center, smoothie stand, nail salon, mechanic, coffee shop, steakhouse and ice cream stand in communities around the country. It will shape the psyche of the local banker, insurance agent, and government official. The aggregate economic impacts of The Essential Economy are shown on the next slide:

There’s a lot to discuss in the slide above, but we firmly believe that what’s depicted is within the “range of reasonableness.” If anything, we are optimistic that the beginnings of normalcy start May 1 (just in time for Cinco de Mayo, which features a lot of – you guessed it – Corona beer). We are already seeing most companies (even those who announced quarterly earnings this week) pull 2020 guidance. Internally, some in the retail and travel/ leisure industries are assessing whether they can survive if the shutdown is prolonged (Neiman Marcus here; Kohl’s and Macy’s less dire situation here). No one is predicting a robust holiday selling season. And, even with 24,000+ store closures in the past three years, the retail trades still employ more than 15.5 million US workers, with travel and leisure accounting for 16.9 million. These two industries alone represent more than a quarter of the country’s non-agricultural, non-government workforce (data here and here).

Our guess is that the businesses that reopen will know by June/ July whether they will be able to make it through 2020. Not all of them will close this year, but their activities will be extremely risk averse. Activities will include pricing services higher where possible and increased sales of nonessential business units (to preserve liquidity).

As more people lose their jobs, home foreclosures will rise. These will be scooped up because there is a home shortage. However, retailers are already closing left and right, and there’s plenty of retail space (Papyrus, Modell’s, Art Van, and Pier 1 Imports already announced 1100+ store closures in 2020 before the outbreak). The Essential Economy will deeply impact the retail industry, leaving, as Jim Cramer of “Mad Money” fame posited, three nationwide retailers: Walmart, Amazon, and Costco.

The biggest unknown is the effect of significant liquidity into the banking system as we emerge from shelter in place orders. While we are not in the same situation as Great Britian (whose sovereign debt was downgraded over the weekend), real GDP growth assumptions drive our relative attractiveness as a safe haven currency and also as a reliable investment. If our predictions of a “U” shaped economy are incorrect (and it’s a “V”), inflation will inexorably rise (we make no prediction on inflation, but do think that interest rates will return to early 2019 levels). Dealing with persistent inflation is new territory for anyone under 50 (I included a Whip Inflation Now button for those who remember that era).

If however, this liquidity “nuclear bomb” (Paul Tudor Jones’ term – see link above) drives no growth, the question becomes “what do we do next?” That’s a more troubling state, as it indicates that many more households are focused on meeting essential expenses than any Fed or administration official anticipated.

Bottom line: After Americans emerge from their shelters and temporary government assistance ends, businesses will need to adjust to The Essential Economy. A few parts of the economy will quickly normalize, but most (particularly travel/ leisure and retail) will see significant change. New hiring will be frozen, and investments will be defered. Inflation will likely be tamed by lower fuel prices, but certain industries will have demand-driven gains. As mentioned in the slide, there are a lot of “unknowns” that could impact the economy as well, with the most important being November’s election.

Implications to the telecommunications industry

We have discussed a lot of changes that will emerge (read the last two Sunday Briefs here and here for a reminder). Here’re a few bigger items to consider:

- The economic conditions clearly place Dish Network’s plans in focus. We think that they will have a backer (Amazon frequently mentioned), but the Seattle retailer might be busy with other national items (Amazon could just as easily invest $10-20 billion in an airline to improve their cargo costs – and shareholders would be happy with the low basis). If an infrastructure bill emerges (see below), expect to see Charlie Ergen emerge as a winner (more to come in future Sunday Briefs).

- “The Great American Move” is going to change where networks are built. We will discuss more next week, but have modeled an 8-10% acceleration out of the most densely populated areas, which translates into increased infrastructure needs in the South and West (excluding California). Space does not permit us to go into details this week, but for some thoughts on data driving our decision, see this article from the state of Missouri here.

- The cable industry’s move to DOCSIS 3.1 (and Altice’s fiber initiatives, as their balance sheet permits) will accelerate, placing pressure on AT&T, CenturyLink and others to expand their fiber builds. Cable could complete this buildout in 2021 – so will T-Mobile. The suburbs are going to see significant competition as we predicted late last year.

- The Emergency Spectrum System (analog to the Emergency Broadcast System) concept will take hold. This is a part of the right hand side of the timeline above. It will have bipartisan support, and telecom carriers will be active participants in designing the solution.

That’s it for this week. Thanks again for your readership. Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here. If you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the new website).

While we will not be distributing the full presentation publicly, there will be opportunities starting Thursday (April 2) to take your team through our view of The Essential Economy. Please connect with Jim directly at [email protected] if your team is interested. Plan on a couple of hours.

Stay safe and keep your social distance!