Greetings from Lake Norman and Charlotte, North Carolina, where the local media are complaining that 80 degree weather is driving too many folks outside in the parks, creating the potential for a lack of social distance discipline. Still thankful for a terrific spring, however, as we are getting our yard and garden in shape a lot earlier than last year.

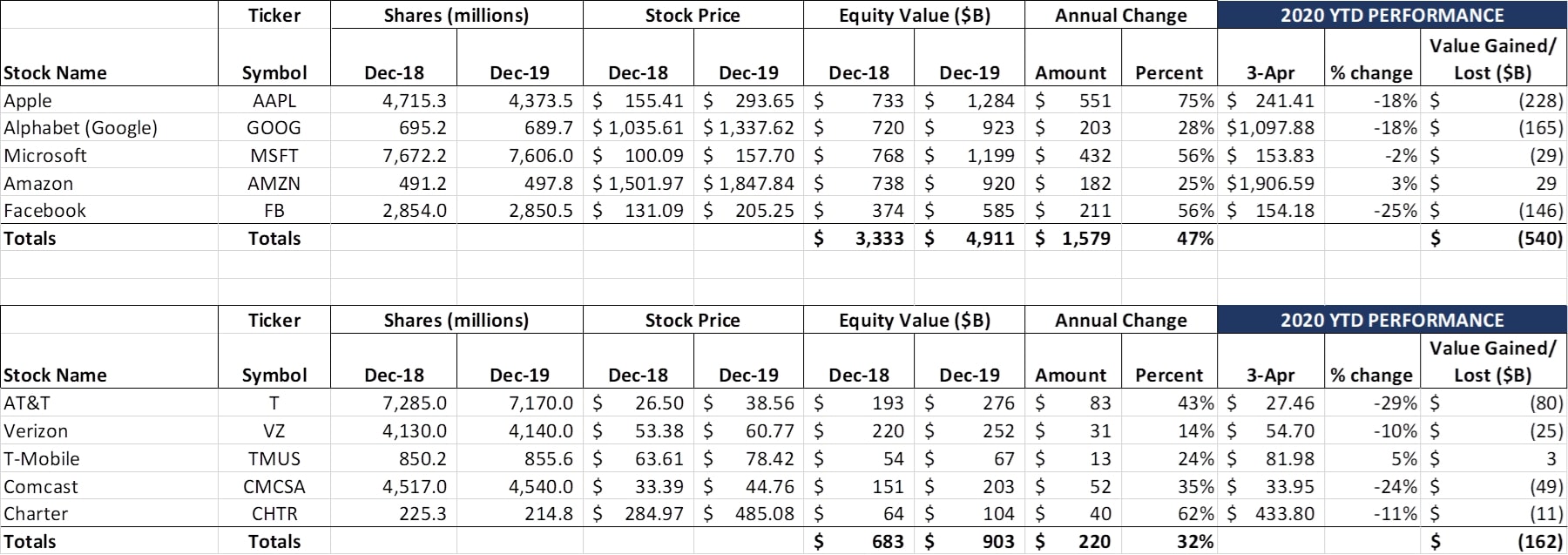

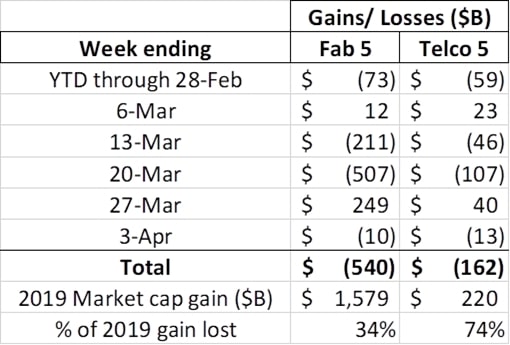

Last week, we talked about month-end window dressing and the temporary lift that this activity can provide. Turns out it was right. Absent significant news (T-Mobile’s announcement of the completion of the Sprint merger aside), there were more sellers than buyers last week. Here are last week’s numbers:

The week-over-week changes are pretty docile, mirroring that of the first week of March. Earnings season is just around the corner, however, and it’s likely that there will be some big differences in performance among the ten companies after their earnings commentaries.

This week’s big decliners were AT&T (which now accounts for half of the total market capitalization lost for the Telecom Top 5 in 2020) and Apple (42% of the Fab 5). The major difference between the two, however, is that, since the beginning of 2019, Apple’s market cap is still up 55% vs. AT&T’s 4%. Ma Bell’s Elliott-induced bump is gone.

AT&T’s decline this week is due to concerns about their cyclical businesses: business wireline, Warner Media and DirecTV. Wells Fargo analyst Jennifer Fritzsche lowered her estimate on AT&T to $28 (from $36) on Thursday and Craig Moffett of MoffettNathanson lowered his estimate to $23 on Friday (Craig’s analysis on the economic conditions which might be required to spur the rating agencies to force AT&T to cut their dividend is robust and thought-provoking. Definitely worth a close read if you receive MoffettNathanson publications). We will have more thoughts on Q1 earnings in total in next week’s column, and our commentary on last summer’s Elliot memo is here.

Since prices did not change much from the previous week, we are foregoing the historical price comparison (although we will mention that the last time we saw this weekly closing price for AT&T was during the December 2018 market dip).

Separately, if you have not seen the CNBC interview with Lawrence Kurzius, McCormick’s CEO, it’s a very interesting view on how the global (including Wuhan) seasonings company is coping wih this pandemic. Also, if you need another terrific non-telecom read, the Wall Street Journal’s summary of an internal Walmart memo outlining the “phases” of sales for each period in March is terrific (as is WMT’s 20% month-over-month sales change). It’s outside our expertise to discuss retail sales by category here, but if you are sick of daily press briefings, these two items are very insightful.

Bottom line: Not much equity change this week, which is a good thing. While there are a lot of puts and takes with each of the ten companies, the tailwinds are currently greater than the headwinds. More details in our telecom earnings preview next week.

T-Mobile completes its acquisition (except for the CA PUC)

Amidst the pandemic whirlwinds, T-Mobile and Sprint closed their merger and placed $19 billion dollars of debt at an average rate of 3.94% this week. This compares to Charter’s recent (Feb) placement of $1.65 billion of 10-year notes at 4.5% and Verizon’s mid-March note placement of 7, 10, and 30-year notes at rates lower than T-Mobile’s.

There are many ways to finish a blockbuster turnaround tenure, and I am imagining that John Legere’s unflourished departure was not what had previously been envisioned, but it is definitely worth recognizing his significant contributions to the telecommunications industry and to shareholders. As we have noted many times (including the Nov 24 Sunday Brief here), T-Mobile’s stock price increases from 2012-2019 were not driven by the manipulation of the earnings per share denominator (via share buybacks) but by the numerator (earnings growth).

For a chronology of the merger, see the July 14 Sunday Brief (the October 2012 “Dear John” Sunday Brief is somewhere deep in my computer archives but available upon request). Also, John’s first YouTube video as T-Mobile’s CEO (Sept 2012) is here and the management team’s appearance at the 2012 Deutche Telekom Capital Markets Day (replete with lots of white carpet and tables) is here.

Now to T-Mobile’s punch list (in approximate order):

Now to T-Mobile’s punch list (in approximate order):

Get those synergies. Nearby is the slide that T-Mobile shared in April 2018 on synergy attainment. These are largely intact. Our estimate is that half of these synergies (mostly network and management headcount reductions) are well planned and ready for execution. We are confident that no grass is growing under these tasks.

- Get enterprise wins based on a complete, coherent strategy. T-Mobile publicly disclosed that their enterprise share (with Sprint) is ~ 10%. Nowhere to go but up from there, and, as we discussed in great detail in the February 14 Sunday Brief, it’s an area where T-Mobile not only needs to lean on Sprint enterprise expertise (including their newly acquired global IP backbone), but also needs to build more robust fiber and in-building strategies. As we have noted in previous columns, Sprint does not have a lot of buildings (excluding data centers and rooftop tower locations) connected to fiber. Partnership opportunities abound, and Magenta’s key to success is the formation of a global ecosystem (or alliance) to challenge the current duopoly. That ecosystem includes the assets of their two largest shareholders (Softbank and Deutsche Telekom).

- Get Sprint retail customers transitioned as quickly as (practically) possible. This is really a subset of #1 (it’s a precondition of turning over the 850 MHz band to Dish), but, once the Clearwire spectrum (2.5 GHz, or LTE Band 41) is available to current T-Mobile customers, the legacy Sprint base should enjoy a spectacular experience improvement (we are sure that there will be an occasional bump in the road, but it’s not out of the question that we will see 50-60 Mbps downstream and 10-15 Mbps upstrem LTE data speeds as the minimum standard for wireless customers prior to 5G). For more details on this transition, see the February 23rd Sunday Brief.

- Get into the home. We have been skeptics of broadband to the home except in underserved/ rural markets. However, we are in different economic times (see last week’s column and below). If T-Mobile can micro-target a $50/ mo. 500 GB capped offering to residential customers that can deliver four concurrent data streams (a home-broadband version of Binge On), demand will emerge from customers currently paying substantially more than that for stand-alone High Speed Internet. In our opinion, this may be the initiative that surprises everyone (including cable).

- Get friendly with the FCC and the states. While probably not on their list right now (considering the recent Attorneys General lawsuit which held up the merger), T-Mobile needs to “bat above their average” in every major state and in Washington, DC, as an economic savior for tens of millions of Americans. Given the rapid need for federal solutions to our current crises, T-Mobile has the opporutnity to provide new and innovative solutions to spectrum allocation, privacy, and the “homework gap.” It will not happen overnight, but an FCC and state PUC strategy needs development and attention as the interaction between business and government changes by the day (even the hour).

These are a small portion of what is a very long list, and new CEO Mike Sievert will have many day-to-day problems to tackle (although, as one long-time Sprint veteran shared this week,“While his name begins with M, he’s not Marcelo or Masa and that’s good enough for me”), T-Mobile has a blockbuster set of assets and brands to build a compatitive advantage.

Congrats to all involved for the nearly 2-year wait. Now it’s time to deliver a command performance.

Another essential economy result: The great American move

Last week, we defined the Essential Economy using three questions:

- Do I absolutely need it to survive?

- Can I live without it?

- Can I defer this purchase (or “Is it worth using savings for this purchase now”)?

While some of you have questioned (and we have questioned ourselves) whether our tone is too alarmist, the headlines back up the dire tone: New jobless claims quickly approaching 10 million for the last two weeks (implying an April unemployment rate in the 10-13% range); theater chain AMC quickly readying a bankrultcy filing; Silicon Valley start-ups collapsing at a greater pace than 2000-2001. The list is long as companies struggle to survive.

Americans will come out of their apartments and homes in the next few months, and many will be looking for a fresh start. Whether it’s the bad memory of failing in the Valley, or the fear of being at Ground Zero when the next pandemic strikes, or simply to try something now, our country will be on the move like never before.

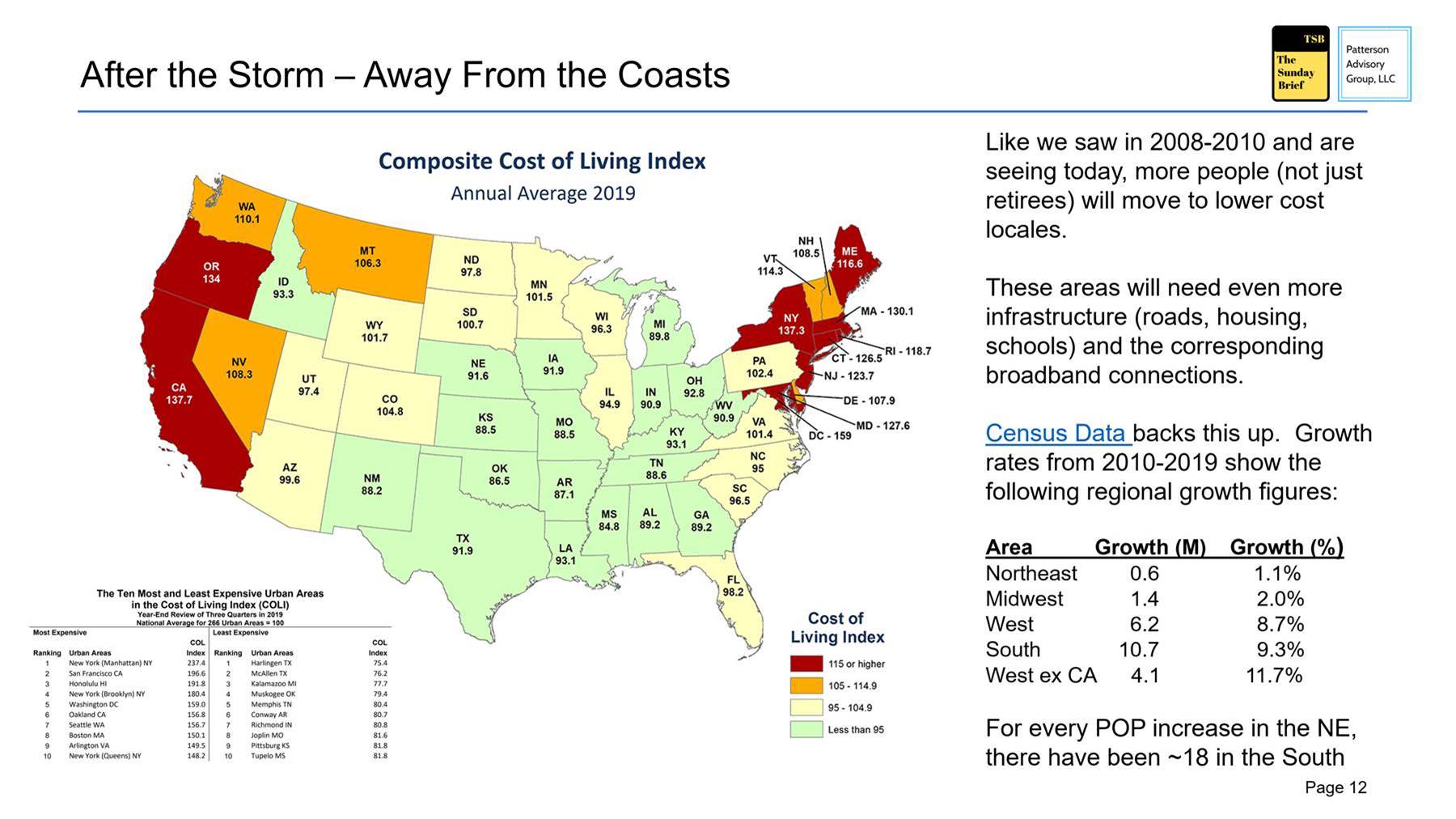

In the Essential Economy presentation, we constructed two slides which form the basis for a subtheme we call “The Great American Move.” Here’s the pre COVID-19 state, which outlines the differences in the cost of living as well as population migration over the previous decade (source: Council for Community and Economic Research, who has been measuring this for the last 52 years):

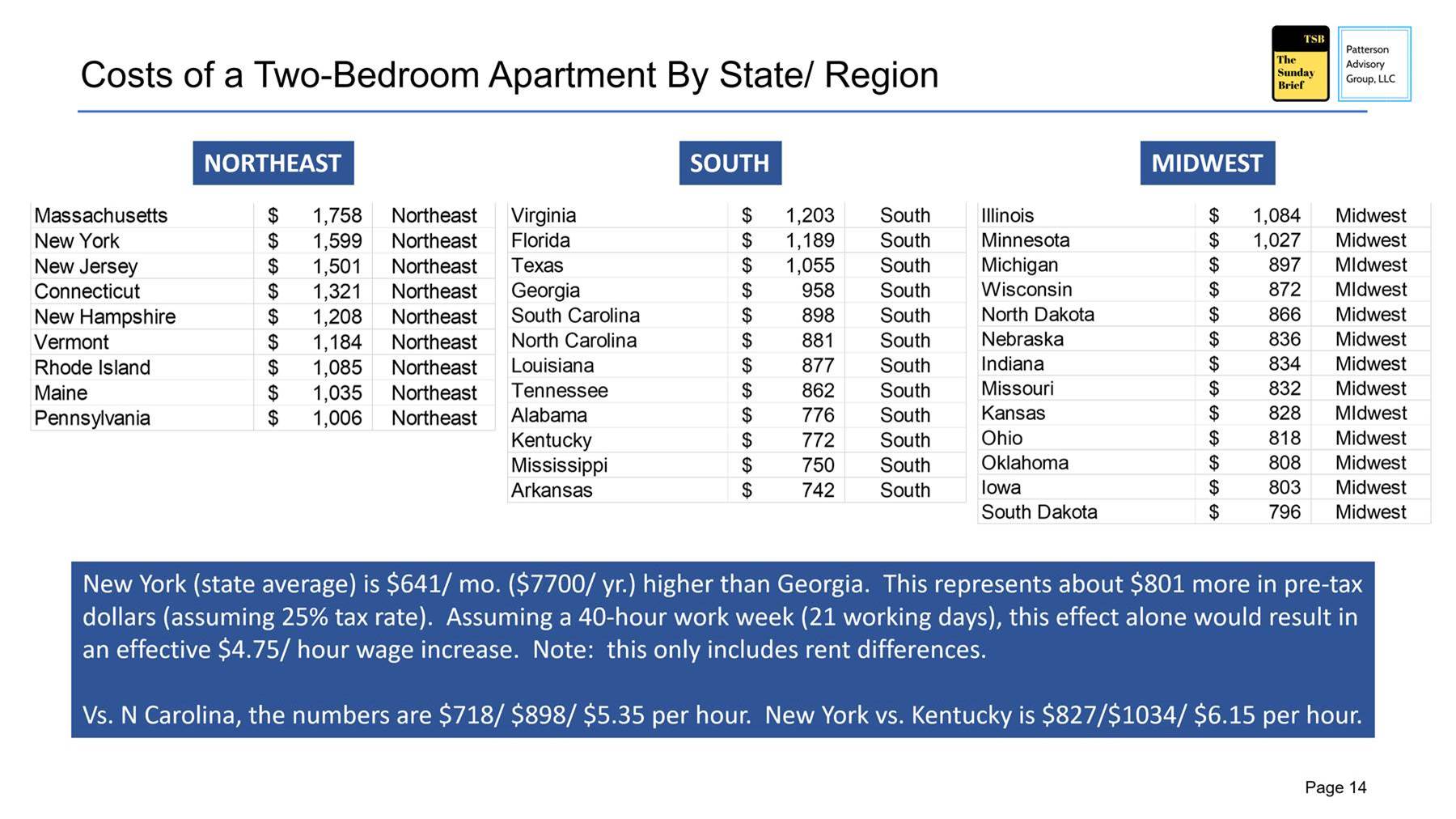

And here is a housing-focused slide that compares the cost of a 2-bedroom apartment in various states in the Northeast, South, and Midwest (source is the June 2019 National Low Income Housing Coalition report):

The changes between states are staggering. According to bestplaces.net, the salary required for a single homeowner to have the same standard of living in New York City versus Charlotte, NC is nearly 2x ($73,000 salary in Charlotte purchases as much as a $143,195 salary in New York City). That may be one reason why Alliance Bernstein recently moved 1,000 employees (1/3rd of the total staff) form The Big Apple to Nashville (similar cost of living differences), and, as the article states, plans on adding 200 more.

These cost of living differences are the most important factor driving the diaspora. A few weeks ago, the Census Bureau released their final data on population changes by major metropolitan area from 2010-2019. As noted in the slide, for every person added in the Northeast, eighteen were added in the South (Note: this should have resulted in substantial gains for AT&T residential broadband but didn’t – a topic we will take up next week).

On top of this, excluding California’s population growth (2.1 million), the West also grew significantly with 4.1 million population growth or 11%. Cities like Denver, Portland, Salt Lake City, Phoenix, and even Las Vegas added hundreds of thousands of new residents largely to the benefit of Cox and Comcast, not CenturyLink.

Unlike 2009-2010, when many were scrambling to salvage any equity out of their homes, this decade’s inhabitants are still in rental housing (and, as we have discussed alonside cable results, home inventories in the South and West are not plentiful). Pew Research estimates that 37% of all Americans rent, and among Millennials, this figure is significantly higher. While slightly dated (2016 data), their conclusions are striking:

“Millennials’ prominence among renters reflects more than their youth. They are also significantly less likely to own their home than prior generations of young adults when they were the same age. For example, in 1982, 41% of households headed by those younger than 35 (the approximate age of Boomers at the time) owned their homes. In 1999, 40% of households in this younger age bracket (then Gen Xers) owned their dwelling. By 2016, the share had dropped to 35%. The Great Recession did lead to a widespread increase in renting across households of all ages, but homeownership declined most among younger households.”

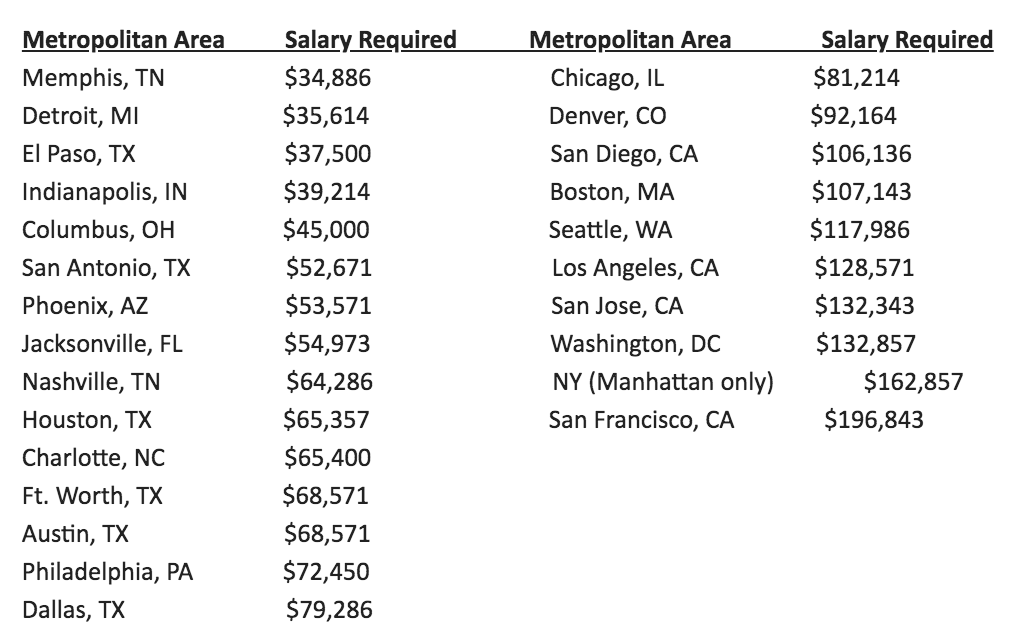

If those younger homeowvers are living in California or the Northeast, where will they head to next? Business Insider penned a terrific article in late 2018 using data from SmartAsset that outlines the salary required to spend 28% percent of income on rent (full article here). The lower salary markets (left column) were telling:

Of the markets in the left column, nine are in the South and two are in the West (counting El Paso with Phoenix). Three are in the Midwest and only one is in the Northeast (re: this study only considered rent costs, and states like Florida and Texas have the extra benefit of no state income tax). Of the markets in the right column, six are in the West and three are in the Northeast. The only non-coastal cities in the “High Salary 10” are Denver and Chicago (#9 and #10 respectively).

The implications of this phenomenon to the telecommunications industry are straightforward:

- More wireless growth will occur in the the South and West

- More homes and apartments are going to be built in the South and West (which could include nearby smaller towns as Work-From-Home habits are accepted/ adopted)

- Small business development will follow the population migration

With the allure of increased infrastructure spending starting to appear as a source of new jobs, it’s important for the telecom industry to weigh in on where increased spending should occur. To quote the great Wayne Gretsky, we should “skate to where the puck is going, not where it has been.” If this decade repeats the twenty-teens, we’re going to need a lot of construction in between the coasts.

Bottom line: The recipe for accelerated moving is ready for the oven: a) higher rental % (especially among millennials), b) significant job uncertainty, particularly within the travel and leisure industry and small businesses, and c) the threat of another contagion. Let the Great American Move begin.

That’s it for this week. Thanks again for your readership. Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here. If you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!