Early Earth Day greetings from Lake Norman/ Charlotte, North Carolina. Pictured are some peach iris in our front yard – nature is not missing a step in April, and reminds us all of its beauty on crisp, sunny spring mornings.

Len Lauer (1958-2020)

We have a lot to cover in this week’s Brief, but before we dive into equity valuations and earnings questions, a short tribute to Len Lauer who passed away unexpectedly at his home last Monday. Many Sprint veterans remember Len as a dry-witted, nuts-and-bolts executive who approached his career with steely resolve and customer focus. As many of you commented this week, Len built long-lasting teams on the foundation of “every voice matters.” He was friendly and approachable to everyone.

On top of roles leading Sprint Business and Consumer long distance groups, Len led Sprint PCS through the tumultuous post-Chuck Levine era, ultimtely being promoted in 2003 to President and Chief Operating Officer of Sprint Corporation. He was instrumental in combining Sprint and Sprint PCS. While he left Sprint in 2006 as a sacrificial lamb of the failed Sprint Nextel merger, his impact on the company is felt to this day.

My most vivid memory of Len was during one of Sprint’s darkest days in 2002. While orchestrating the turnaround at Sprint PCS, the Long Distance market (particularly the enterprise segment) was collapsing. I was leading Access Management at the time, and the sales team losses were mounting due to a resurgent MCI/ WorldCom. Len asked our team (Scott Heideman, Paul Woelk, Cheryl Ritchie, Mike Howard, Mike Nelson, and many others) to put together an analysis of Sprint’s competitiveness by Local Exchange Central Office (neighborhood-level) to use as we determined our strategy.

After many weeks of analyzing data, locating tariff information and truing it up with actual wins and losses to Ma Bell, we were able to determine our circuit costs versus AT&T +/-5% for about 10,000 locations across the country. Using the same tariff information, we were able to get WorldCom costs, but when we trued it up to actual wins and losses, nothing made any sense. One week, the lost bid in the Southeast would directly contradict the baseline tarrif data. The next week, it would be the US portion of a global frame relay contract loss. Something must be askew in our analysis, Len posited, and we reiterated (and reiterated) throughout late May and early June.

Little did we know that special access costs would be the foundation of the accounting fraud that would topple the once great MCI/ WorldCom. Len’s tone changed after their disclosure of $3.8 billion in capitalized access costs that the rest of the industry was expensing (which happened just before the aforementinoed strategy meetings). His comment was short and sweet: “Those SOBs runined our Father’s Day.” That pretty much summarizes Len – competition, fairness, and family.

For a great interview featuring then Time Warner Cable CEO Glenn Britt, former Cox CEO Jim Robbins, and Len Lauer, click here. All three were giants in their respective fields and have all passed on. Our thoughts and prayers go out to the Lauer family during this difficult time.

The week that was

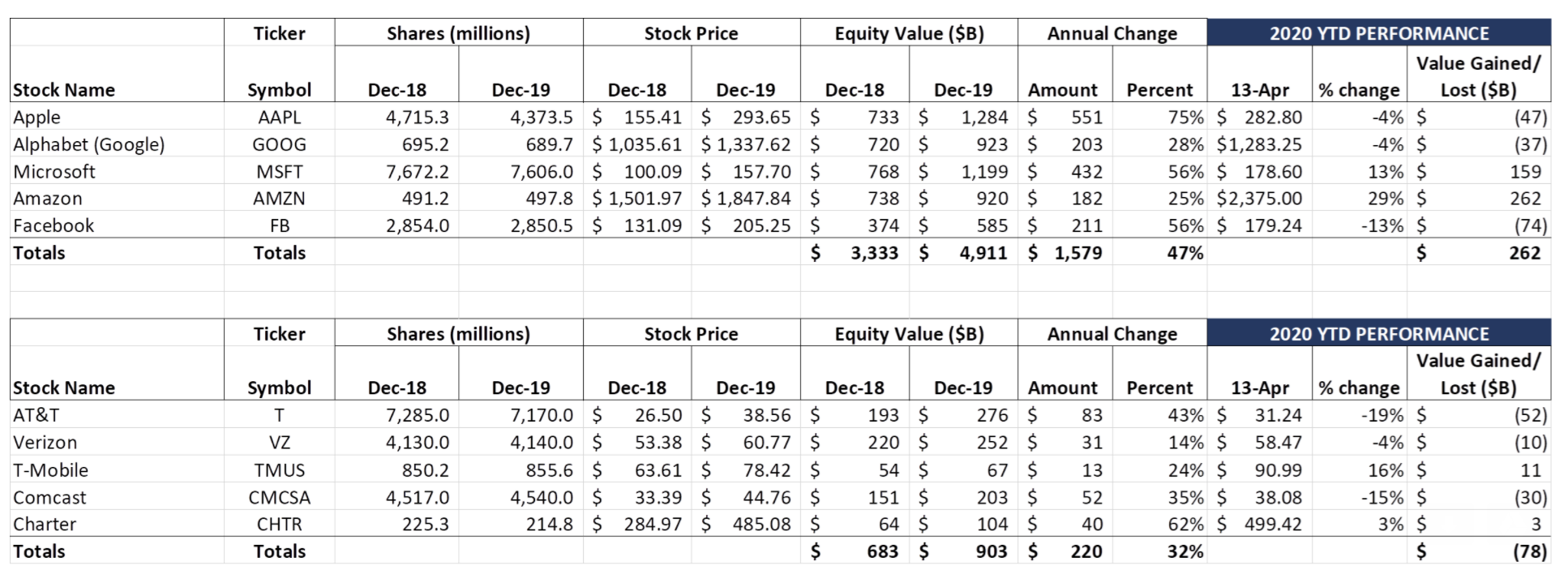

If you felt a sense of déjà vu this week with respect to the markets, you weren’t alone. The second week of bounceback for the Fab 5 has led to more than $800 billion in increased market capitalization in the past two weeks, erasing the more than $700 billion in market capitalization they lost during mid-March. In fact, if you notice the bottom line YTD performance figures, they have now turned positive for the year, driven by Amazon and Microsoft (as I indicated to many of you on conference calls and phone conversations this week, Amazon’s gains in the first 15+ weeks of 2020 now exceed their entire gains for 2019).

The bottom line is that the Fab 5 has added $262 billion and the Telco Top 5 has lost $78 billion in equity market value thus far in 2020. This represents a gain of over $1.1 trillion in market capitalization in just four weeks. Since the beginning of 2019, the Fab 5 have gained over $1.8 trillion in market capitalization and the Telco Top 5 have gained over $140 billion (Microsoft, not Apple, has gained the most over this period – $591 billion – or the accumulated equity market value of AT&T, Verizon, and T-Mobile combined). Four of the ten stocks shown above are higher than they were at the beginning of the year, and three more are within one good Q1 earnings report of reaching this status. As we repeat every week, we are thankful this is not an oil & gas or travel-focused blog.

Many of you have struggled with the fact that markets are rising during the middle of skyrocketing unemployment claims, business shutdowns, and uncertain reopening schedules. It’s important to understand, however, that there was a lot of cash on the sidelines prior to the market collapse ($3.4 trillion in money market cash by one estimate here). Those investors did not buy in mid-March, but are starting to look at reentering as we get to the other side of this pandemic. Also, as has been studied many times over the past decade, the markets recovered faster in 2011 and 2010 than the overall economy.

Our comfort level with Fab 5 equity market values rests in the fact that each of them are global powerhouses (the Telco Top 5 are more domestically focused). And each of them have very large cash cushions to weather disruptions and perhaps pick up cheap assets. We will learn a lot more during earnings calls over the next four weeks, but it’s likely that distributed work and reemerging economic activity will have a net benefit to companies like Google and Facebook.

Earnings preview: I don’t know

Going into earnings season, many will prognosticate about the implications of The Essential Economy on individual stocks. And, as we discussed last week, companies should be able to define with great clarity their pre-COVID 19 state. When pressed on earnings guidance, impact to per customer revenues, cord cutting acceleration, and a host of other questions, we will likely hear a variant of these three words: I don’t know.

Here are the five questions that no one can answer today, but will become answerable by 2Q earnings (late July) guidance:

- When will businesses (including professional sports) resume normal operations?

- When will consumers resume discretionary spending?

- What does the Holiday season look like (to the extent this drives things like handset renewals)?

- How will government activity (Paycheck Protection Program, loan programs, infrastructure bills) impact the investment landscape?

- How does COVID-19 impact 2021 planning?

There are clues to answering these questions. As we discussed with consumer behavior last week, there is a Frozen, Anxious Middle segment (25-30% of households) that holds the key to the success of recently announced products like the iPhone SE (announcement here). Apple’s generous trade-in allowances make the SE more affordable, and there is no doubt that this phone may be the best sub-five inch product on the market. But, in an environment where familes are retreating to their separate corners of the house (or apartment), will a 4.7 inch Retina screen be enough? Would it be better accompanied by a slight (~$50) reduction in the iPhone 11 price or increased marketing dollars to the carriers?

There is no doubt that Apple will market this device like no other (since there was no mass gathering to announce, it’s likely that they are going to disproportionately market “small is beautiful” as well as highlighting free Apple Plus TV for a year). And, as we will explore below, advertising slots to market the iPhone SE should be abundant throughout the summer.

This product will be especially valuable to T-Mobile, where they are bending over backwards to bring over switching families (including free devices if you switch to T-Mobile and trade in an iPhone 7 or 8 series, or up to $300 off if you trade in an iPhone 6S). Even though these are applied via bill credits (and the customer will have to pay sales tax and other fees up front), the attractiveness of (nearly) “free” could not come at a better time.

Xfinity Mobile is also offering a very generous promotion with $200 off of the iPhone SE for every new line that ports their number within 30 days. No trade-in required (which unlocks an additional $125-250 in value for iPhone 8 and iPhone 11 devices). Like T-Mobile, the $200 is applied in 24 installments and the customer foregoes the remaining bill credits if they cancel early. This should be a gross add bonus for Xfinity Mobile, and we are scratching our heads why their counterparts Spectrum Mobile and Altice are not doing it (although Altice is offering a 36-month financing option – more details in the link).

AT&T is offering a $5/ month payment plan over 30 months for new lines of service, while Verizon is offering generous trade-ins but no other incentives. Bottom Line: Apple’s iPhone SE will be successful, especially for upgrading and new customers looking for value and willing to sacrifice screen size. Because the termination liability is low, it should be attractive to value-conscious customers looking to try out T-Mobile’s new network or the Verizon network via Xfinity Mobile.

Comcast’s Peacock streaming service launched to their Flex customer base this week and to Xfinity X1 and eventually all Comcast and Cox customers by summer. When it was launched, Comcast touted their unique advertising-focused/ premium content business model (see nearby slide from their January presentation for a strategy reminder). It seemed like a solid idea at the time (especially with the upcoming summer Olympics) , in essence recreating a “super channel” of curated NBC and Dreamworks original content.

Now the success of Peacock seems to be muted. Nearly all of the original content has been delayed, and advertisers are rare during the pandemic (although this market should recover). Comcast understands the marketing and advertising landscape better than anyone, however, and they will be as aggressive as possible with targeted ads. Can this network thrive (not merely survive) until the 2021 summer Olympics? Will customers devote tune-in time versus AT&T HBO Max, Netflix, Hulu, YouTube TV, and other competing services? Why is fellow cable company Cox Communications offering the Peacock service but Charter/ Spectrum passing (and, in fact, offering the competing HBO Max product from AT&T to all existing HBO customers – more details here).

The simple answer is “I don’t know.” The July launch of Peacock to the masses is going to be big – there’s no way to halfway launch something like this with the aforementioned competition. A simple bundle like “free premium service tier for all existing and new Xfinity Mobile customers” almost seems necessary at this point, but will that be sufficient?

Bottom line: Peacock will launch to everyone in July with Cox (and hopefully Charter) support. They are missing out on the ability to bundle with wireless (and Xfinity Internet), and need solid advertising partners that grow the addressable market (versus adding capacity and driving down rates). Advertising partner success is highly dependent on both political and holiday spending in the second half of the year, and the latter is driven by business confidence. Comcast might be best served to offer significant ad discounts to their Comcast Business customers until the economy recovers.

Work From Home (a.k.a., WFH 2020) impact on telecom and business spending is the last “I don’t’ know” issue we will tackle in this earnings analysis. Here’s what we know:

- Many customers upgraded their High Speed Internet service as a result of sky high usage. This should provide a short-term benefit to Verizon FiOS, Comcast Xfinity, Spectrum, and Altice. It’s uncertain how long residential customers will pay for these broadband upgrades after stay-at-home orders have abated.

- Customers who wanted to change service providers (particularly to Verizon) were quoted lengthy wait times. Verizon has not and will not be able to deploy techs to fix existing services or install new ones for months, according to this Business Insider report. We could not find a similar story on Altice, Comcast, or Spectrum so it’s likely that their techs continue to actively install and maintain High Speed Internet customers.

- Verizon is actively petitioning municipalities to use empty streets to accelerate their 5G (millimeter wave) deployments (see CEO Hans Vestburg’s CNBC interview here and Friday’s PCMag.com article on 5G deployments during the virus here).

In many ways, Wi-Fi data usage could positively impact some customer averages. If wireless customers remain in their homes for long periods of time each day and have reliable Wi-Fi, macro network data usage will go down. Alternatively, a home full of data-starved children could drive some wireless customers to macro wireless usage including hotspots, even if download data speeds under normal conditions are slower than Wi-Fi.

Bottom line: Timing is everything, and it’s clear from this week’s news that some parts of the country are going back to work in the next few weeks while others could be waiting until July. The longer the WFH 2020 condition exists, the higher the home broadband dependency becomes.

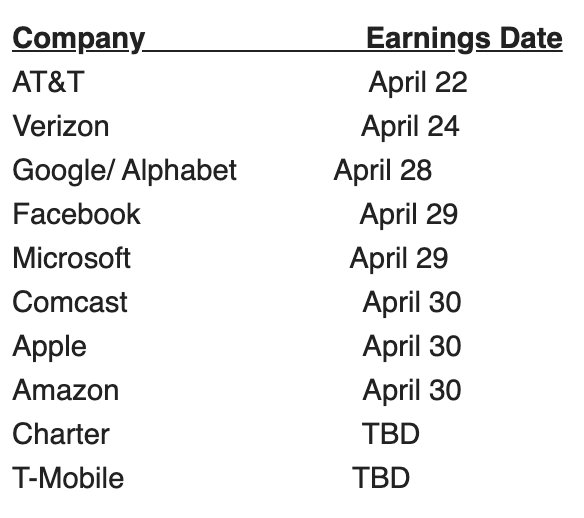

For reference, here are the earnings dates for each of the 10 companies above:

That’s it for this week. Thanks again for your readership. Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here. If you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!