Some major urban business hubs of the U.S. are seeing less traffic, and what traffic there is, is moving faster. Hot spots of mobile activity have shifted from the heart of city centers into more diffuse areas, and Wi-Fi usage has spread out across metro areas as well.

Those conclusions come from data analysis by network benchmarking and analytics company umlaut (formerly P3), which has been tracking the impact of the COVID-19 pandemic on where and how mobile users are using their devices. After recently analyzing trends in major European cities, umlaut turned its focus to U.S. cities and looked at how patterns have changed in Los Angeles, California; New York City; the Washington, D.C. metropolitan area; and Chicago, Illinois.

Umlaut found that the use of business applications, particularly Zoom, rose in all of those areas beginning in mid-March. Cisco WebEx saw heightened use in the New York City metropolitan area, and Microsoft Teams saw a spike in the Chicago area earlier this month. The shift to educational app use for remote learning was spread across a wider variety of platforms, from DuoLingo to Google Classroom and Hangout Meet and others, and varied by metro area. Interestingly, umlaut found a rise in the use of communications apps in L.A., New York and D.C., and a bump in mobile shopping apps (Amazon in particular) in D.C. and Los Angeles, but didn’t find a statistically significant change in the use of entertainment apps on mobile in any of those major metros.

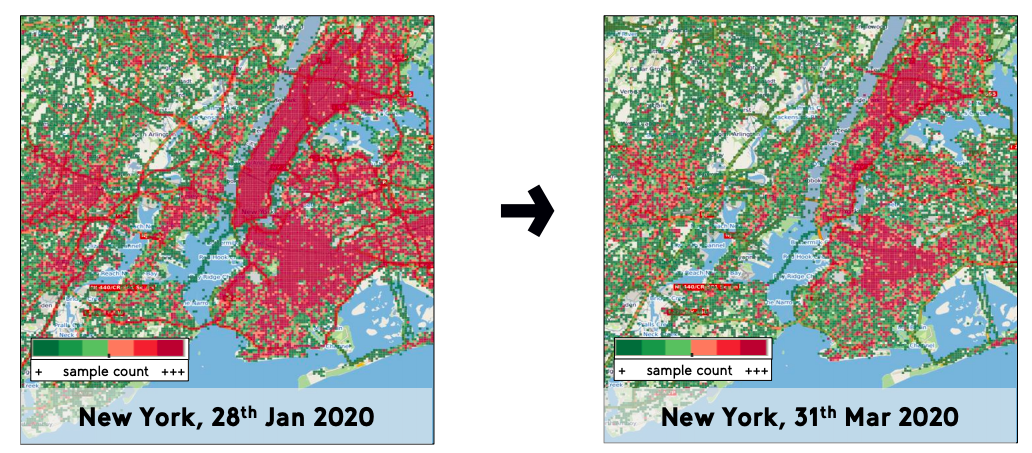

In terms of whether mobile users are staying at home, umlaut found a marked decrease in mobility as of mid-March, with NYC seeing the most profound impacts. Comparing user density and outdoor duration of stay from late January to late March in New York City, the changes are immediately visible:

Umlaut also said that its data for NYC shows that Wi-Fi traffic has shifted to Brooklyn, and mobile traffic has moved away from Manhattan. In Washington D.C. and Los Angeles, its data reflects reduced mobility as well as traffic is moving faster than usual, since fewer vehicles are on the roads.

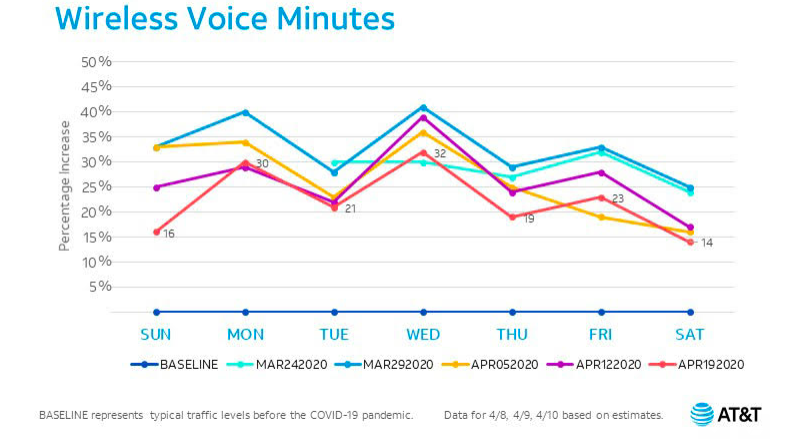

AT&T continues to see heightened voice call volume

In related news, AT&T continued to report increases in various types of voice calling — which has persisted since stay-at-home orders began to take effect. In a network update from Saturday, April 25, the carrier said that compared to a typical Saturday, wireless voice minutes were up 14%, consumer home voice call minutes were up 25%, and Wi-Fi calling minutes were up 45%.

While the increase in voice usage has been a sustained trend since March, AT&T is reporting that over time, the amount of the increase is dropping slightly. When comparing volumes on days of the week, home calling minutes have been peaking on Sundays and Wednesdays, wireless voice is the highest on Mondays and Wednesdays, and Wi-Fi calling is highest on Wednesdays.