Nokia’s enterprise business showed growth of almost 20 percent during the first quarter of 2020, compared with a year ago, on the back of continued sales momentum for private LTE networks to the industrial sector.

The Finnish firm, in the process of fielding a hostile takeover according to industry chatter, said it expected “double-digit” growth through the rest of 2020, despite the majority of COVID-19 impact to hit in the second quarter.

It said just €200 million had been wiped off sales in the quarter, and that the industry at large is buoyant. “We believe that our industry is fairly resilient to the crisis, although not immune,” said Rajeev Suri, president and chief executive.

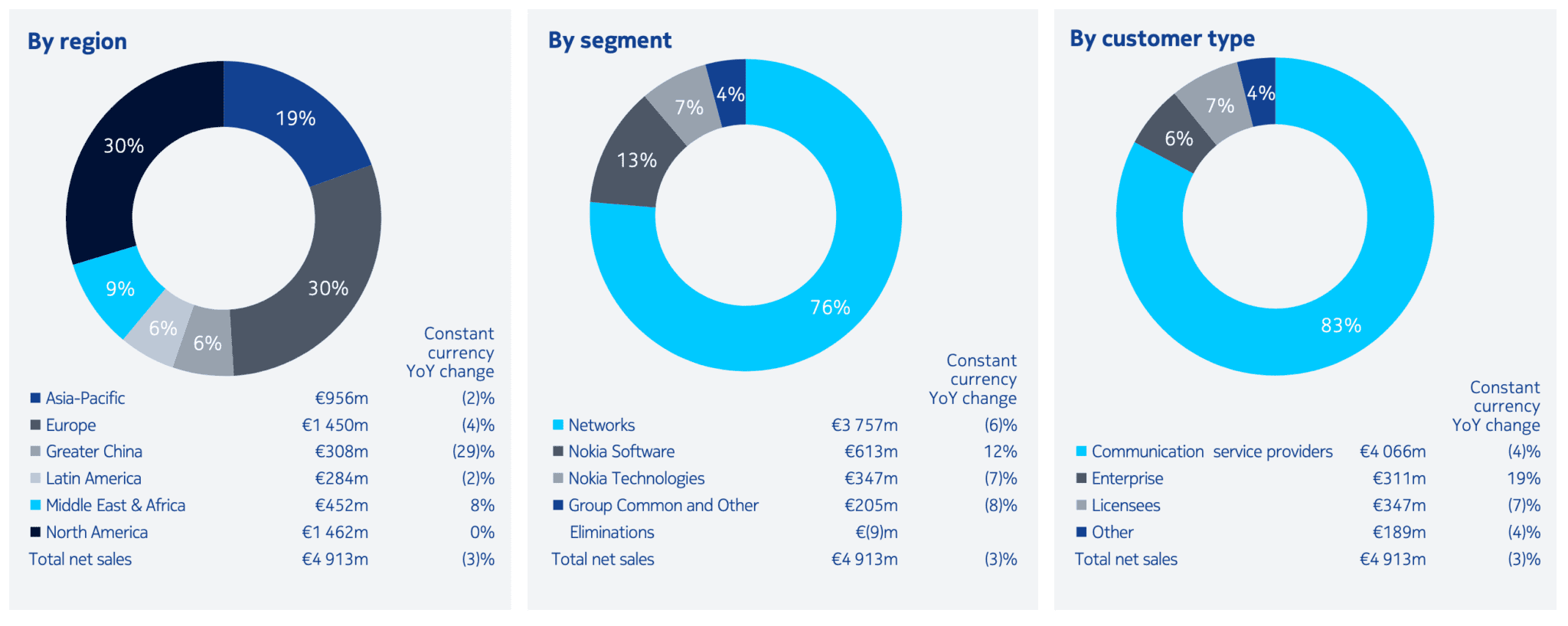

The company saw overall net sales slide by two percent in the three months to March 31 (to €4.9 billion), but adjusted operating profit rise to €116 million, from a loss of €59 million a year ago.

Nokia net sales | Q1 2020

Nokia’s enterprise business saw net sales of €311 million, up 19 percent year-on-year; net sales to every other customer type fell in the period, with operator revenues down four percent to €4.066 billion and licensing down seven percent to €347 million.

At the same time, split by product segment, Nokia’s software business rallied hardest, with growth of 12 percent in the period, hitting €613 million. Nokia Software covers cloud core software portfolio, which dovetails with private core networking, and software applications for customer experience management.

Its networks and technologies units fell by six percent (to €3.757 billion) and seven percent (to €347 million), respectively.

The company said in a statement: “The strong growth in net sales to enterprise customers was primarily driven by increased demand for mission-critical networking solutions in industries including utilities and the public sector, with continued momentum in private wireless solutions. Net sales also benefitted from the timing of completions and acceptances of certain projects.”

Nokia said in February it had signed “nearly” 40 new customers for private LTE networks in the three months to the end of 2019. It grew its private LTE client base by around 50 per cent in the period. Nokia now has contracts for private LTE networks with 130 customers in total, it said.

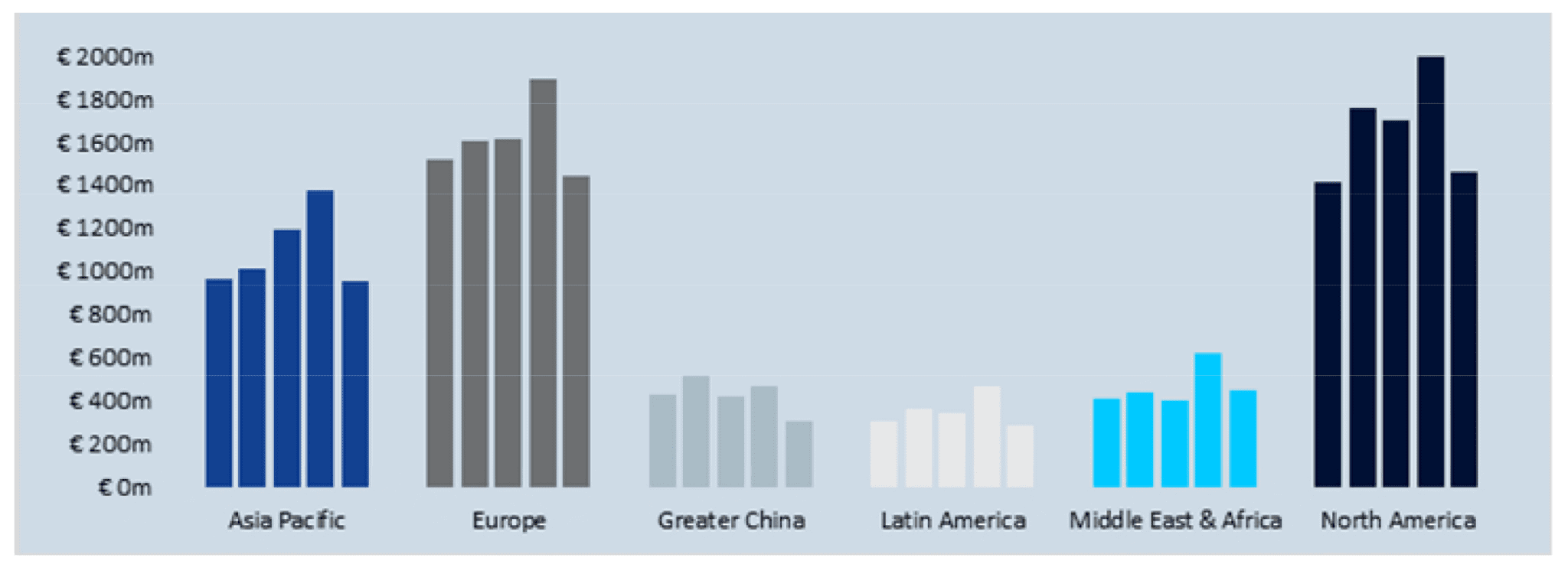

Nokia net sales | Q1 2019 – Q1 2010

Since then, it has also signed with Indian operator Bharti Airtel to offer private LTE and industrial AI to enterprises in India’s manufacturing and distribution sector (followed by a $1 billion deal for 5G upgrades in the operator’s main network).

New deals around private LTE have also been completed with: the Société du Grand Paris (SGP) in Paris, responsible for the Grand Paris Express metro; an underground mine belonging to NORCAT in Ontario, in Canada; Kansas-based industrial services provider PK Solutions, for oil-and-gas deployments in the 3.5 GHz CBRS band in the US; and Polish energy sector company PGE Systemy, for a pilot network in the 450 MHz band.