Graduation greetings from Davidson/ Lake Norman, NC, where we virtually celebrated the college graduation of our son (Jimmy). We are proud of his accomplishments and share his excitement as he begins his software development career at Cerner Corporation (Kansas City) later this summer. Finally, a Patterson will be returning to Kansas City after a two-year absence.

As we committed to many of you in previous weeks, we are updating our Essential Economy thesis with some key points that impact the telecommunications industry in this week’s Brief. We also have TSB Updates on what’s behind Microsoft’s acquisition of Metaswitch.

Another shout out to those of you who have been forwarding this publication to others as we have recently grown our readership (including WordPress email notifications) past the five-digit mark. We put a lot of work into every edition and are very thankful for your comments and insights. Please continue to share and we’ll keep the Brief coming.

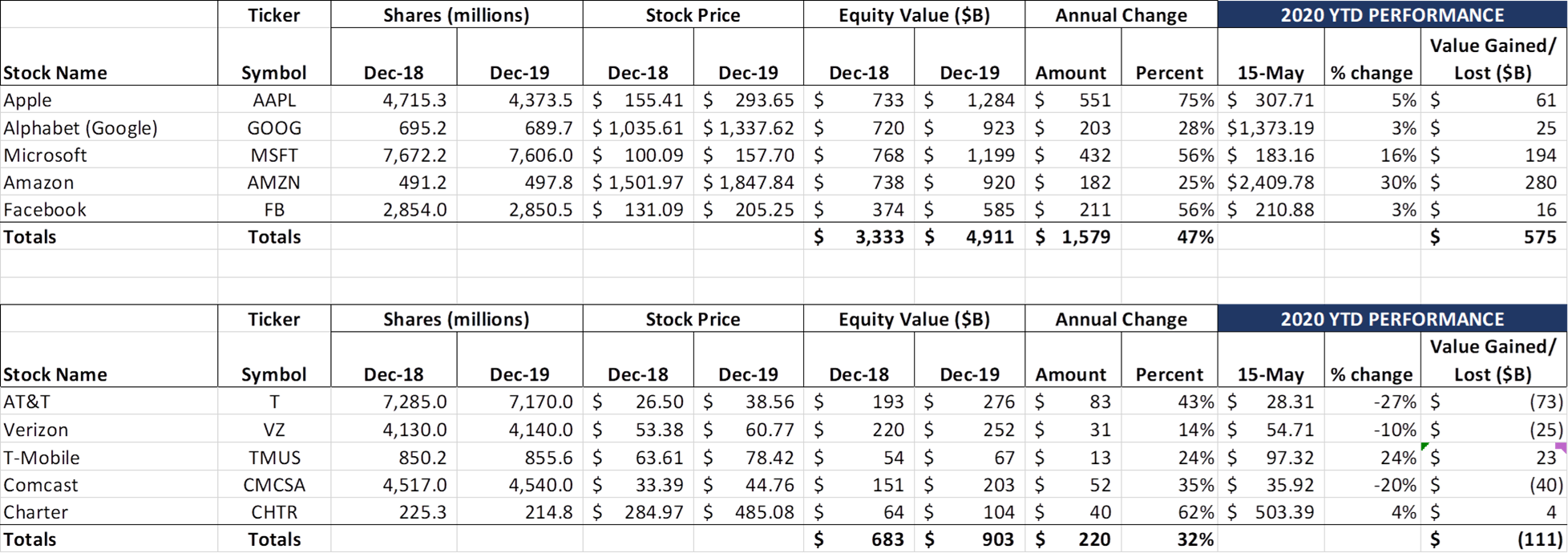

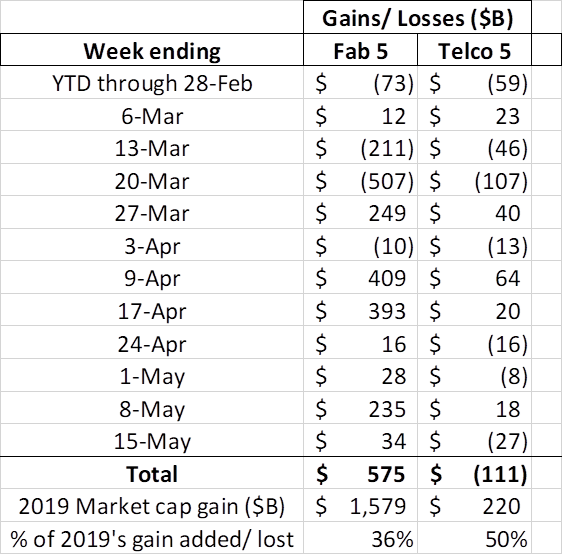

We describe this week’s changes in market capitalization using a similar “glad to be in telecom/ technology” refrain. Despite industry pundits grousing about market capitalization concentration (an undeniable trend that has been occurring since 2012), the Fab 5 had another strong week of gains and are still on track to create as much value as they did in 2019.

We describe this week’s changes in market capitalization using a similar “glad to be in telecom/ technology” refrain. Despite industry pundits grousing about market capitalization concentration (an undeniable trend that has been occurring since 2012), the Fab 5 had another strong week of gains and are still on track to create as much value as they did in 2019.

Since the recent bottom (which ended the week of March 20), the Fab 5 have gained more than $1.3 trillion in value. This compares to $78 billion of equity value created by the Telco Top 5 over the same period ($17.40 in market capitalization created by the Fab 5 for every $1 created by the Telco Top 5 since March 23). It is important to note that the Fab 5 total market capitalization was only about 5.4x larger than their telco brethren at the end of 2019 – a 17:1 value difference is significant. The market appears to be seeing a faster recovery for Google, Apple, Microsoft, and others than for AT&T and Comcast. Even Charter, who has some exposure to live sports, is up 4% year to date (on the heels of a 62% gain in 2019).

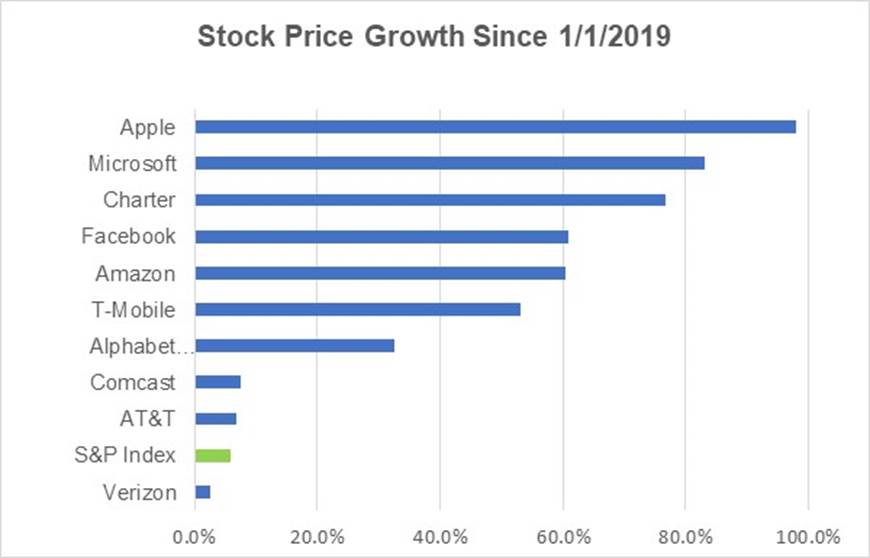

In fact, the market appears to be uneven in its rewards with a clear bias towards low/no-dividend  stocks. Since the beginning of 2019, here are the pre-dividend returns for the 10 stocks above:

stocks. Since the beginning of 2019, here are the pre-dividend returns for the 10 stocks above:

Even with concerns about China demand, potential retaliation, 5G phone launch timing, and supply chain interruptions, Apple (1.06% dividend yield) has had the highest percentage growth while Microsoft (1.13% yield) holds a narrow lead in total market capitalization over the last 16+ months. Charter (no dividend) is the only Telco 5 company in the top 5 for percentage growth, and #4-7 in the nearby chart do not pay a dividend either.

Nine of the top ten stocks have outperformed the S&P before dividends, which says a lot about the industry. But clearly, three of the ten are laggards, and two of those three have a high dependency on content creation and broadcasting.

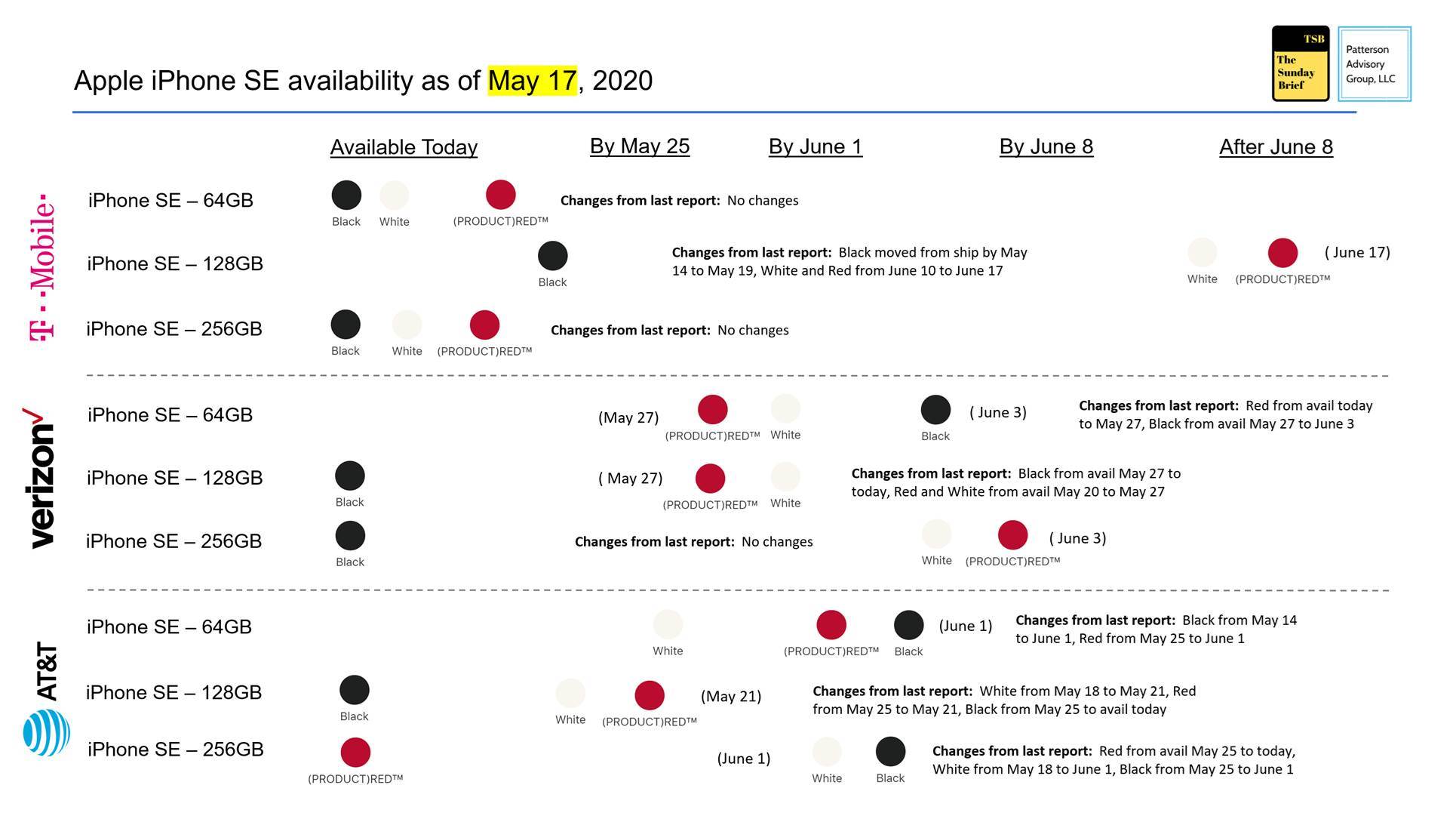

Apple iPhone SE availability update

As forecasted in last week’s Brief, the iPhone SE back order situation improved somewhat for the major carriers this week (especially if you are willing to settle for black), but five of the nine models are still sold out at Best Buy (including all storage options in white). It’s safe to categorize any back order status as specific to a size/ color combination, with 256 GB options requiring the longest wait time for both Verizon and AT&T (white and red available June 3 for Verizon, white and black delivered by June 1 for AT&T).

We will monitor for one additional week to make sure that longer store hours and increased store openings do not further strain inventories. All in all, we think that the iPhone SE was a well-timed launch and served its purpose. Small is beautiful for many smartphone users.

Implications of accelerated technology adoption and work/learn from home

Eight weeks ago, we began to lay out the “new normal” through what we termed The Essential Economy. While we segmented elements of the economy and identified key trends (essentials payments, upgrade/ purchase deferrals, downgrades), we missed two additional components: accelerated adoption of new technologies and processes, and the institutionalization of behavioral changes. In this week’s Brief, we will discuss these two factors and their implications on the telecommunications industry.

- The home will permanently serve as an extension (but not a replacement) of schools and businesses. Prior to March 2020, most consumers thought of home broadband connectivity primarily as an information and entertainment “pipe.” Broadband speeds increased (thanks to increased fiber deployments by incumbent telcos and broad deployment of DOCSIS 3.1), and more entertainment, gaming, and social media formats emerged.

Then came COVID-19. Schools and businesses closed, and our homes became the primary (sole?) hub of working and learning. The number of simultaneously connected devices grew, and corresponding network demands bent but did not break our telecommunications infrastructure. Application availability expectations also grew, and patience with frequent crashing of videoconferencing applications wore thin.

Work (or Learn) From Home (WFH/ LFH) setups proliferated, and our “WFH Look” suddenly mattered (see Best Buy Logitech availability here – still slim pickings). Commutes were measured in feet not minutes, and the kitchen became the lunch cafeteria. And every day was “take your pet to work” day.

After several weeks of this altered routine, many proclaimed “I could get used to this.” Twitter, Amazon, Microsoft, Facebook and many other companies have extended the work from home option through the end of 2019 (see Business Insider article here). It took a pandemic to launch this involuntary experiment, and it’s going to take a lot more than an HR memo to stop WFH progress.

The extent to which the pendulum swings back toward an “in office” environment (post-vaccine or virus treatment) depends on the productivity impact. Unlike previous WFH trials (a Friday or holiday here, a few remote employees there), there’s now a baseline. It may have some drawbacks, but there are likely a lot more discussions occurring about office space cutbacks than widescale additions. And, once the threat of this virus passes, it’s likely that co-working space (in suburbs, even in destination locations like N. Myrtle Beach) will make a big comeback.

The education process will undoubtedly change as well. Mathnasium could become the Math teacher. The History Channel (for kids) could become the social studies teacher. Grammar and writing could be app-based, and Duolingo could teach any language. It’s easy to see this happening along with a WFH parent periodically supervising. Perhaps small, supervised co-learning environments (neighborhood schoolhouses) will blossom, at least for a while. The bottom line is that the “new normal” is not a “return to January 2020 normal”, and that change has a dramatic impact on business and residential wireless and broadband needs. Online will supplement classroom-based learning far faster than anyone expected.

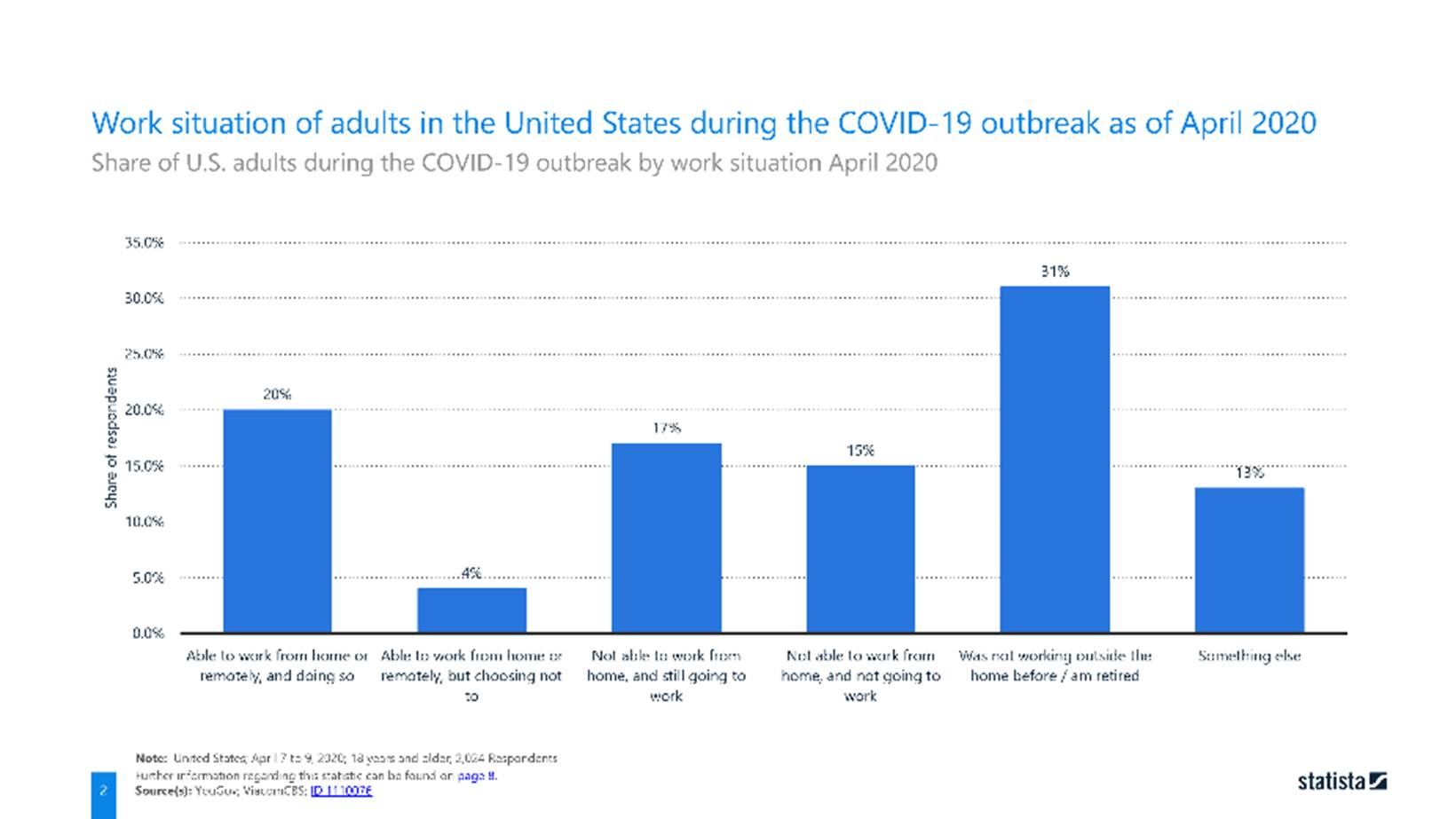

Final caveat: As the nearby chart shows, this WFH phenomenon impacts around 25% of the population (the sum of the first two columns). As we have discussed in previous Sunday Briefs, retirees or those not working outside of the home still make up about 1/3rd of all adults, and those not able to work from home may still value community schools.

Bottom line: How far the pendulum swings back to “in office” has a big impact on network demand. More home-based work/ learning means more home broadband and less commuting. It also likely translate into higher than average Zoom bandwidth demands for those who go into the office (until 60%+ are back on site).

- The technology adoption curve just became a lot steeper. Our willingness to try new things changed quickly during this crisis. We are doing some tasks with greater frequency (e.g., restaurant take-out/ delivery, Disney+, e-commerce, reading books, driving vs. flying) and stopped others (e.g., congregating in large groups, getting haircuts, staying in hotels, sprinting between gates at airports).

On top of start/ stop, we are adopting new habits (e.g., WFH, curbside pick-up, wearing a mask in public, supermarket home delivery, video calling, at-home fitness, telehealth). Many of us would not have adopted these new techniques as quickly (if at all) were it not for COVID-19.

Sometimes mandated change produces a backlash. Other times, it is embraced. Consider the use of collaboration tools (Microsoft Teams, Evernote for Teams, etc.). Many new users of these tools cemented them as a standard early into their 2+ months of continuous usage. Slack, which had a wide adoption in some parts of companies, now has become a critical customer communications (and service) tool. Microsoft Teams is replacing phone and communication systems with rapidity.

Each of these software packages produces data that can be searched and analyzed. This could drive more immediate process/ customer experience improvements. Consider the plight of jewelry stores in the post-COVID 19 era. Could “in-home” jewelry try-ons be just around the corner? How about in conjunction with other high-end wardrobe items such as footwear, clothing and accessories? Add a glass of wine and some socially distanced friends, and bunko night could be transformed!

Each of these software packages produces data that can be searched and analyzed. This could drive more immediate process/ customer experience improvements. Consider the plight of jewelry stores in the post-COVID 19 era. Could “in-home” jewelry try-ons be just around the corner? How about in conjunction with other high-end wardrobe items such as footwear, clothing and accessories? Add a glass of wine and some socially distanced friends, and bunko night could be transformed!

To make “to the home” selling profitable, a lot of data needs to be analyzed. Logistics are critical to economic sustainability, and most home visits may not be free (unless a certain spending threshold is met). Converting the home into the showroom could become the next “hot” marketing trend (others that we do not have the print space to discuss can be found from our friends at Gartner here).

On the commercial front, it’s highly likely that businesses large and small will be evaluating ways to improve their supply chains post COVID-19. This could involve changing logistics flow (including locations), ensuring timely arrivals, sourcing from a variety of smaller suppliers, or a myriad of other objectives. Productivity expectations will be higher than ever. Each of these factors are important leading indicators of accelerated technology adoption. Great news for nimble challengers – bad news for stodgy incumbents (and other rules-based hierarchies).

Bottom line: Adoption is highly dependent on a) impact to business process performance; b) impact to short and long-term profitability, and, especially with applications c) ease of use/ intuitiveness. Willingness to try new technologies and applications will likely be higher than any time we have seen since the mid-1990s. The impact to health care, manufacturing, education, state/ local government, retail and other industries could be significant.

TSB follow-up: Microsoft acquires Metaswitch – the last laugh?

Following April’s acquisition of Affirmed Networks (which prompted this Sunday Brief), Microsoft announced this week that they were buying Metaswitch. While there is product overlap, think of Affirmed Network’s forte as network interfaces (the “gateway” function), and Metaswitch as the 5G processing engine (the “core processing” function). The combined companies should enable a carrier-class 5G operating system. Metaswitch was named as one of the first AT&T Domain 2.0 suppliers, and also counted Sprint as a customer (case study here).

As we mentioned in the previous Sunday Brief linked above, it’s important to think of Microsoft’s actions not as a replacement for Ericsson or Nokia, but as a complete rethinking of the interaction between business computing and communication. In this new realm, communications are enabled between applications and devices that historically have been primarily used for data (laptops, tablets and the like). While we are not privy to Microsoft’s strategy, I would bet that they see the day when computing devices are solely the communications devices. And, with Microsoft as the primary interface between every Apple and Android device used in a business setting, the dynamics could not be any more intriguing. Maybe Satya gets the last laugh.

That’s it for this week. Thanks again for your readership. We will be publishing a Memorial Day Weekend edition with some additional comments on earnings and companies that raised money during the first part of 2020.

Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here. If you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Congratulations to the class of 2020! Stay safe and keep your social distance!