The 5G use cases span a number of different industry sectors

After speaking with over 1,000 IT decision-makers at U.S. and U.K. enterprises, Nokia released a new study called “Mapping demand: The 5G opportunity in enterprise for communications service providers,” which revealed the top five 5G use cases across a number of different industry sectors, including energy, manufacturing, government/public safety and automotive/transportation.

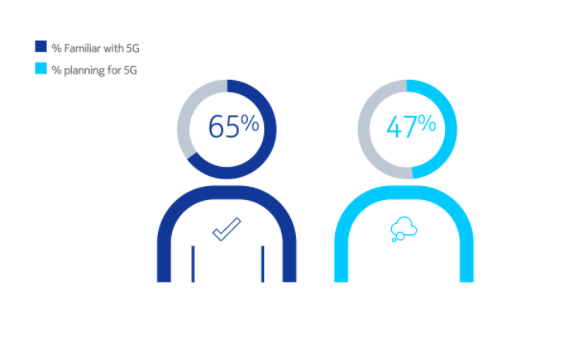

Beyond identifying where 5G interest lies, the report also revealed that nearly two-thirds of IT decision-makers are aware of 5G, while almost half — 47% — stated that their organizations have already begun to plan for it.

However, lack of information on the true value of 5G continues to be a setback for the new technology, coming second only to the current lack of 5G coverage. Nokia reported that 30% of respondents said they would like to understand the value of 5G better before developing a plan to use it in their organization.

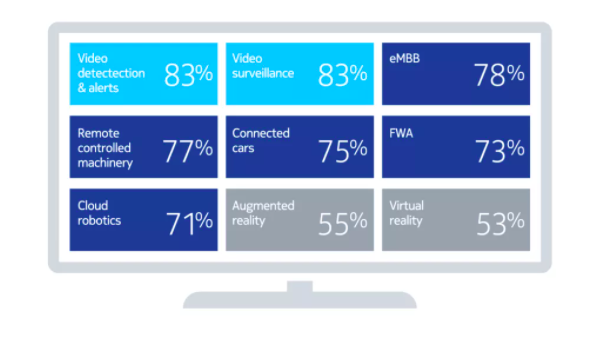

The following list illustrates the five 5G use cases that received the most interest.

Video monitoring and detection

5G-enabled video received the most attention from respondents, with 83% finding it appealing, driven largely by the fact that 75% of the organizations surveyed are already using some form of video monitoring today, and therefore, respondents can readily grasp the additional value that 5G can bring in this category.

The report identified that energy and manufacturing, in particular, are key targets for 5G-enabled video.

“Their video surveillance needs go beyond monitoring,” the report said. “Manufacturing professionals understand how 5G can be leveraged to detect product defects, while energy professionals see the value of drone-mounted cameras to inspect plants and power lines.”

Further, because larger businesses will purchase 5G-enabled video technology as a part of a “wider suite of security services,” the security industry will be an attractive market for CSPs.

Connected machinery and equipment

Over three-quarters (77%) of respondents found the use case of connected equipment and cloud-connected robotics appealing, as they are key enablers of Industry 4.0.

The companies most interested in implementing 5G in this way are those that already use connected equipment because they “are readily able to visualize the benefits of 5G for real-time monitoring and remote control of machines they can’t currently control remotely.”

In fact, 82% of respondents who already use cloud robotics today find the concept of 5G-enabled cloud robotics highly appealing.

Further, Nokia believes that the COVID-19 pandemic may accelerate interest in remote control and robotic automation solutions.

“Enhanced process automation was the key use case cited, with co-ordination of multiple robots ranking second,” said the report. “The automotive industry, with its long history of robotics use, emerges as a key vertical sector that readily understands the additional benefits 5G can provide.

Fixed Wireless Access

73% of SMBs surveyed by Nokia said 5G fixed wireless access (FWA) was appealing as an alternative or back-up to wired broadband, a statistic that also reflects what Nokia discovered about consumer interest in 5G, with 75% of consumer respondents citing it as the most appealing of the use cases.

Nokia also stated that FWA stood out as “a strong near-term opportunity” for CSPs.

“Encouragingly for CSPs, we found that most SMBs would prefer to get FWA from a mobile provider,” the report said. “However, 40% said they’d be open to receiving it from a tech giant like Google or Amazon, with others citing TV, utilities and security systems providers. To compete, CSPs should emphasize strengths like expert support and an existing technical field force. Alternatively, other providers may present MVNO partnership opportunities.”

Connected vehicles

For organization that currently use vehicles as part of their operations, 74% said 5G was appealing. However, the level of appeal varies depending on the way vehicles are used, with a higher interest in 5G present among organizations where the vehicle is being used for safety and security purposes and for transportation of non-employees.

The report indicated that over-the-air updates are a hidden, yet key, opportunity for 5G-enabled vehicles.

“5G connectivity enables in-vehicle systems to be updated remotely throughout the lifecycle of the vehicle, creating a potential new service revenue stream for automakers and dealers,” claimed the report. “CSPs could leverage this opportunity to forge new partnerships in the automotive industry.”

Immersive experiences

55% of those surveyed addressed the appeal of immersive technologies such as VR (virtual reality) and AR (augmented reality), despite the fact that only half that number are currently making use them.

However, the use of this type of technology is likely to increase significantly in the 5G era, especially because 5G can remove the data processing from the equipment, spurring the production of cheaper and more lightweight headsets that can be used anywhere there’s 5G connectivity.

Specific areas of interest for VR/AR solutions include training, safety, quality assurance and retail sales support.

“Companies of all kinds will be able to use immersive technologies to train and supervise employees, while retail businesses can use them to help consumers visualize what their purchases will look like. In the education field, AR and VR can help students to learn more effectively in a remote environment,” stated the report.