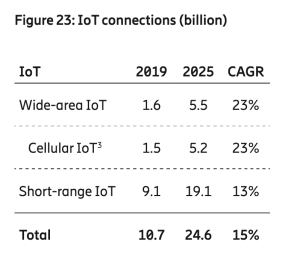

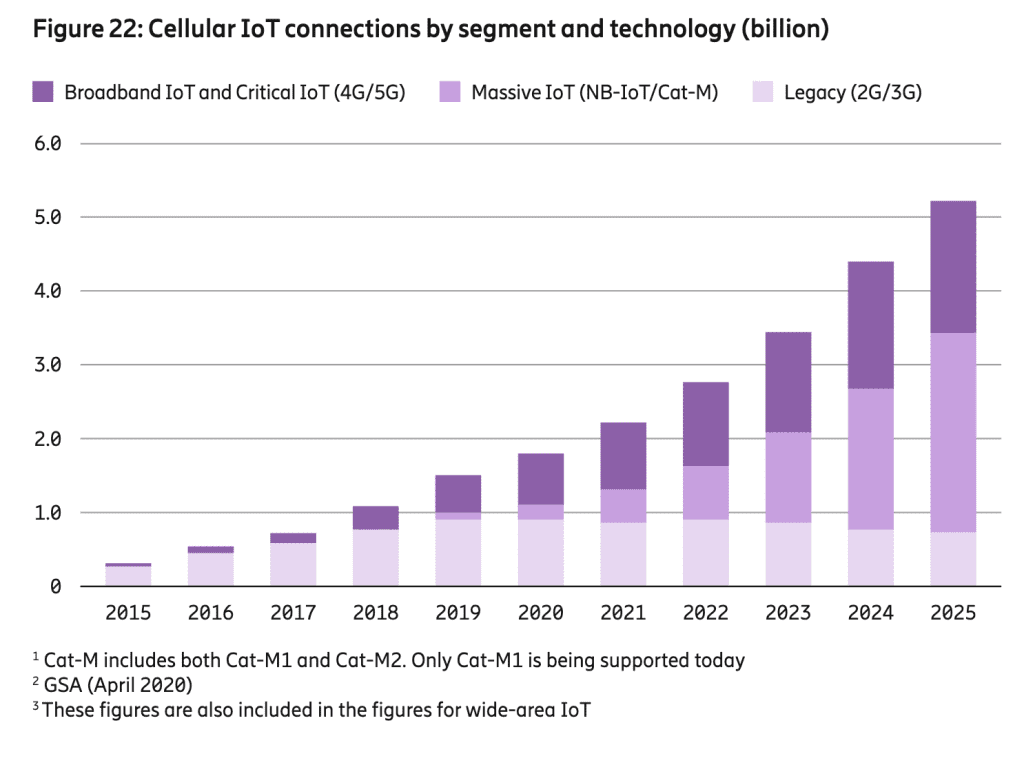

Momentum for NB-IoT and LTE-M will slow in 2020 with the coronavirus (Covid-19) pandemic, but not enough to knock mid-term projections for the cellular IoT sector. The Swedish telecoms vendor has even revised up its six-monthly market forecast, with cellular IoT to top 5.2 billion connections by 2025 – and NB-IoT and LTE-M to contribute over half.

The figure is an advance on its parallel 2025-end forecast from the last edition of its Ericsson Mobility Report from late last year, when cellular IoT was slated to hit five billion connections in the period at a compound growth rate (CAGR) of 25 percent per annum. Ericsson’s five-year CAGR projection has been fallen, slightly, to 23 percent, from a higher starting base.

The total number of cellular IoT connections for 2019 was higher in the end, at 1.5 billion, compared to the 1.3 billion that had ear-marked six months ago. The number of massive IoT connections – mostly of NB-IoT and LTE-M – increased by a factor of three during 2019, reaching close to 100 million. In total, 123 operators have launched either NB-IoT or LTE-M networks, Ericsson said, of which a 25 percent are running dual-mode NB-IoT and LTE-M networks.

The rest of the 1.5 billion cellular IoT connections are on 2G, 3G, plus some LTE-based IoT for applications requiring wider bandwidth. At the end of 2025, NB-IoT and Cat-M are projected to account for 52 percent of all cellular IoT connections, said Ericsson; the percentage figure is the same as six months ago.

The rest of the 1.5 billion cellular IoT connections are on 2G, 3G, plus some LTE-based IoT for applications requiring wider bandwidth. At the end of 2025, NB-IoT and Cat-M are projected to account for 52 percent of all cellular IoT connections, said Ericsson; the percentage figure is the same as six months ago.

In the broader 5G space, Ericsson expects the global number of 5G subscriptions to top 190 million by the end of 2020 and 2.8 billion by the end of 2025.

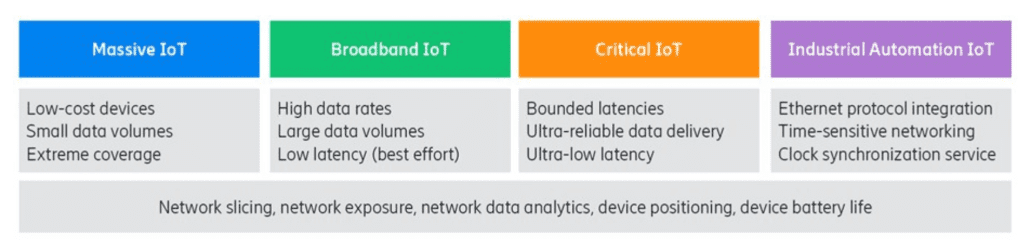

For IoT, the company has divided the cellular industry’s networking of it into four tiers: massive IoT, covering low-cost low-power sensors connected by 5G-ready NB-IoT and LTE-M networks; broadband IoT and critical IoT, using LTE and 5G with varying prioritisation and reliability; and industrial IoT, using the incoming ultra-reliable URLLC-strand of 5G networks.

Broadband IoT mainly includes wide-area use cases that require higher throughput, lower latency and larger data volumes than massive IoT technologies can support. LTE is already supporting many use cases in this segment. 5G will be introduced in this category, as well, but most will remain on LTE. By the end of 2025, it said 34 percent of cellular IoT connections will be broadband IoT.

Deployment of the first modules supporting critical IoT use cases is expected in 2021. Typical use cases include cloud-based AR/VR, cloud robotics, autonomous vehicles, advanced cloud gaming, and real-time coordination and control of machines and processes. North East Asia is leading in terms of the number of cellular IoT connections.

Deployment of the first modules supporting critical IoT use cases is expected in 2021. Typical use cases include cloud-based AR/VR, cloud robotics, autonomous vehicles, advanced cloud gaming, and real-time coordination and control of machines and processes. North East Asia is leading in terms of the number of cellular IoT connections.

At the end of 2019, North East Asia accounted for 54 percent of all cellular IoT connections, a figure set to increase to 67 percent by 2025. The first 5G NR-capable IoT platforms have recently been released. Modules from several vendors are available, as well as tailored platforms for PCs and advanced wearables.

In the second half of 2020 and during 2021, this is expected to expand to include use cases involving personal and commercial vehicles, cameras, industry routers, and gaming, said Ericsson. Devices will initially support mobile broadband capabilities, but performance is expected to evolve towards time-critical communication capabilities via software upgrades on devices and networks.

Ericsson said that despite a 5G slowdown in some markets, as a result of the Covid-19 pandemic, growth in others markets has outpaced this, prompting Ericsson to raise its year-end 2020 forecast for global 5G subscriptions.

Ericsson said that despite a 5G slowdown in some markets, as a result of the Covid-19 pandemic, growth in others markets has outpaced this, prompting Ericsson to raise its year-end 2020 forecast for global 5G subscriptions.

Fredrik Jejdling, executive vice president and head of networks at Ericsson, said: “Covid-19 has affected everyone around the world. Social distancing and keeping millions at home has placed significant demands on infrastructure. Systems supporting healthcare, education and businesses of all types are under stress. Today, connectivity is key and so far, telecom networks have stood up to the task.

“The success of 5G cannot be measured in subscriptions alone. The value 5G brings will be determined by the success of new use cases and applications for consumers and businesses… 5G was made for innovation and, as the value of the digital infrastructure has been further evidenced during these recent times, 5G investments can play a significant role in restarting economies.”