Swedish network vendor Ericsson is offering trial kits of private industrial 5G networks to enterprises via its mobile operator customers. It has confirmed Deutsche Telekom in Germany as its first operator partner to resell the test networks to local industry.

Ericsson and Deutsche Telekom already claim a ‘strategic’ partnership on private and campus-based cellular networks for industrial customers in Germany, and have collaborated to provide private LTE and 5G using privately licensed spectrum and dedicated channels in its own public network for the likes of car maker BMW, lighting company OSRAM, and car parts maker ZF Group.

The pair also pointed to their work to turn on a dedicated 5G standalone (SA) network with Ericsson’s cloud-based plug-and-play Industry Connect solution at the Centre for Connected Industry (CCI) at Rheinisch-Westfälische Technische Hochschule (RWTH) at Aachen University.

Ericsson said it is offering 5G SA trial kits to enterprises via communications service providers on selected low and mid-band spectrum. The kits include hardware and software to support a network to enable enterprises to test how 5G can enhance their productivity, efficiency, safety, and security.

Enterprises will also have access to business development and technical support. Ericsson’s portfolio of dedicated networks consists of two offerings; Ericsson Industry Connect, a pre-packaged product, and Ericsson Private Networks, a modular solution.

The first solution, like Nokia’s Digital Automation Cloud, seeks to simplify the deployment and management of private LTE and 5G networks for industrial enterprises with no prior experience of cellular network operations. The second is for enterprises seeking to take full charge of their own industrial connectivity; it is equivalent to Nokia’s own modular private wireless (MPW) micro-core network solution.

The main difference between the approaches of Ericsson and Nokia to the Industry 4.0 market is in their tone, ultimately, where Nokia has been open about going directly to enterprises when traditional mobile operators are not in contention, and Ericsson has sought to defer to operators as the primary channel for the sale of private networks. It might be noted, Ericsson is equally pragmatic, actually, and will go to enterprises directly if operators are not part of the discussion.

Deutsche Telekom expects, in most cases, to manage private networks for enterprises, even if they are deployed in privately-owned spectrum, which is not licensed directly by the operator itself.

Ericsson quoted forecasts from analyst house ABI Research that more than 4.3 billion wireless modules will be deployed in smart manufacturing by 2020 to enable more than $1 trillion in production value. ABI Research claims a wireless factory can be reconfigure for a new model of car in two months, compared to a year for a wired factory.

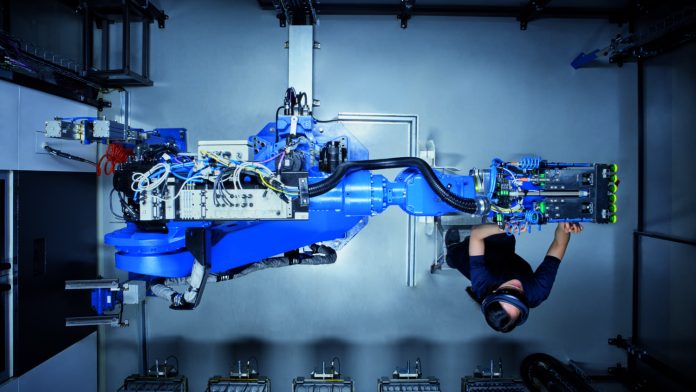

Ericsson cited the role of 5G in data-heavy industrial use cases, notably around augmented reality (AR) and video-based applications. Potential benefits include remote inspection, training, monitoring, and surveillance as well as use cases that require low latency such as remote control of machinery and collision avoidance, it said.

Thomas Norén, head of dedicated networks at Ericsson, said: “By taking full advantage of the 5G SA dedicated networks trial kits, industrial customers can gain competitive advantage by accelerating their move to 5G. As they develop and test industrial applications, they can build optimised and innovative smart factories, warehouses, mines, ports, and more.”

Antje Williams, senior vice president for 5G campus networks at Deutsche Telekom, said: “Our industrial customers demand secure, reliable, high-performance network solutions and applications tailored to their specific needs. In partnership with Ericsson, we can bring the benefits of 5G standalone architecture to enterprises to accelerate their production automation journey.”