Hazy, hot and humid July greetings from Lake Norman, NC where we recently social distanced with an evening swim/ float. This week, we will be revisiting the fiber thesis developed a year ago (Sunday Brief here and Deeper Brief here). We have been very bullish on fiber for over a decade, and have witnessed value destruction within the local telco provider space because others failed to make the “thousand million” investment ($1,000 per home passed times a million homes = $1 billion of capital required).

Hazy, hot and humid July greetings from Lake Norman, NC where we recently social distanced with an evening swim/ float. This week, we will be revisiting the fiber thesis developed a year ago (Sunday Brief here and Deeper Brief here). We have been very bullish on fiber for over a decade, and have witnessed value destruction within the local telco provider space because others failed to make the “thousand million” investment ($1,000 per home passed times a million homes = $1 billion of capital required).

Before we dive into the fiber thesis, however, a quick look at the weeks that were.

The Fab 5 have not taken a holiday the past two weeks, adding more market capitalization during this period ($724 billion) than they added in the first 4.5 months of the year (another perspective – the Fab 5 generated more value to shareholders in the last two weeks than AT&T, Verizon, and Comcast have in their entire existence excluding dividend payments). The $1.75 trillion of equity market value added by the Fab 5 through the first 27 weeks of the year has already eclipsed 2019’s banner performance.

The Fab 5 have not taken a holiday the past two weeks, adding more market capitalization during this period ($724 billion) than they added in the first 4.5 months of the year (another perspective – the Fab 5 generated more value to shareholders in the last two weeks than AT&T, Verizon, and Comcast have in their entire existence excluding dividend payments). The $1.75 trillion of equity market value added by the Fab 5 through the first 27 weeks of the year has already eclipsed 2019’s banner performance.

Meanwhile, the telecom Top 5 are exactly back where they started prior to the COVID-19 outbreak ($59 billion in market capitalization lost). And each of the Fab 5 (except for Facebook) has a market capitalization greater than AT&T+Verizon+T-Mobile+Comcast+

Needless to say, such success (which is almost entirely through organic growth) is attracting the attention of government regulators in an election year, and Jeff Bezos, Tim Cook, Mark Zuckerberg, and Sundar Pichai will all be on the hotseat when they testify before Congress in a few weeks (and you thought last weekend’s neighborhood fireworks were spectacular). More on the hearing expectations from Politico here.

Before we go into this week’s main topic, two interesting notes. First, in an early morning discussion of the Biden-Sanders task force policy recommendation (to be covered next week’s Sunday Brief – 110-page read here), CNBC’s Squawk Box showed the following screen:

What attracted our attention to this was the third bullet point concerning antitrust review of recent mergers. This became even more interesting when one financial firm with very close ties to the Biden campaign (Signum Global Advisors – more here) said to clients that this review is likely not aimed at the Fab 5. The industries focused on with respect to review are agribusiness, hospitals, pharmaceutical companies, and retail, but later on they recommend reviewing “all mergers and acquisitions since Trump took office and assess those that have created highly concentrated markets, demonstrably caused harm to workers, raised prices, exacerbated racial inequality or reduced competition. Take steps to hold these companies accountable and derive policies to repair the damage done to working people and to reverse the impact on racial inequity.” This got us thinking – might Attorney General Kamala Harris revisit the T-Mobile/ Sprint merger for no other reason than to extract a few billion more from the new T-Mobile?

On the fourth bullet in the picture above, Craig Moffett penned an excellent analysis on what President Biden (only) and a President Biden + Democrat Senate scenarios would mean for Net Neutrality (a terrific read if you are a subscriber). His conclusion:

“The shift in the narrative towards Big Tech, and away from Cable, seems to us to make the regulatory landscape less treacherous, not more. Indeed, even with the prospects of the Democrats rising, the regulatory outlook for Cable looks to us to be less scary than it has in years. What is everyone so worried about?”

We will explore more about Title II, municipal competition, price regulation, and antitrust review in next week’s column.

The second major item this week was a Morning Consult poll showing that most Americans know very little about the Facebook ad boycott (currently in progress), and that the boycott itself has very little impact on their buying decisions. Nearby is a chart from the Morning Consult poll showing that most Americans are unfazed (or unaware) of recent announcements. There’s a lot to digest in the link above, but the conclusions (from Morning Consult) tell the story:

The second major item this week was a Morning Consult poll showing that most Americans know very little about the Facebook ad boycott (currently in progress), and that the boycott itself has very little impact on their buying decisions. Nearby is a chart from the Morning Consult poll showing that most Americans are unfazed (or unaware) of recent announcements. There’s a lot to digest in the link above, but the conclusions (from Morning Consult) tell the story:

“Sixty-one percent of consumers said that brand participation in the boycott would not affect their perception of a company, including 41 percent who said it would have “no impact either way” and 20 percent who offered no opinion. A larger share (70 percent) said the same of their purchasing intent, reporting that participation in the Facebook boycott has no impact on their decisions to buy from one brand or another (49 percent) or provided no answer (21 percent).”

Regardless of one’s view of any boycott’s effectiveness, it is interesting to note that since June 1, Facebook has created over $55 billion in incremental value for shareholders, nearly half of the $114 billion it has created in 2020. The news of the boycott seems to have buoyed the stock price, and when Facebook announces earnings in a few weeks, the results will be through June (pre-boycott).

Fiber always wins (until it doesn’t) – 2020 edition

When we resumed the Sunday Brief in June 2019, one of the first topics to go on the “idea board” became the title of our August 11 edition. Prevailing wisdom among those purporting to be value experts was that “fiber always wins.” In the article (link above), we accept the premise that fiber is a better medium than copper (and wireless), but note that it’s not a guarantee of increased value, especially if you are the second or third provider to a home or small business (Google is a good example) or, in the case of Frontier Communications, you pay top dollar per subscriber and fail to execute.

The “Fiber Always Wins (Until it Doesn’t)” theme returned to the front lines in 2020 with several new developments:

- Verizon continues to deploy fiber in support of densification efforts (primarily to support mmWave but also for reduction in 3rd party access expense). We have written extensively about this, citing the 1,500 route miles per month being deployed across the 60+ cities where Verizon is rolling out their 5G Ultra Wideband network.

With 150K more consumer broadband connections added in the 12 months ending March 31 (on a ~16 million homes passed base), FiOS market share is growing a tepid 1%. Even with great improvements in customer satisfaction (see the recently posted ACSI results here which show a 3 point improvement for FiOS), net additions are elusive and, using the 16 million homes passed figure, Verizon’s market share is still mired in the upper 30s%. Why?

- AT&T has spent a lot of time talking about the transformative effects of fiber. Here’s current CEO John Stankey talking about the impact of fiber on their business at a virtual analyst conference in May (full transcript here):

“I believe there’s a tremendous business case for AT&T to continue to take the great success we’ve had with fiber, thus far, and push it further and faster. I think it helps our wireless business from a density perspective and a performance perspective. I think it helps our enterprise business in getting more endpoints, as we can walk up to customers and talk to them about being fiber [ready] and I know it helps our consumer business. And so any asset that I look at and say, further that objective and allow us to deploy capital against that and then drive return into that space, for me, is a win right now in our company.”

Yet AT&T has been far less aggressive as an overbuilder than Verizon outside of their region (one of my consulting colleagues estimates AT&T will spend less than $1 billion in 2020 growing their fiber network outside of their incumbent footprint). And, while 209,000 net fiber additions in the first quarter is a strong figure, it merely makes up for the abysmal performance in Q3 and Q4 (see chart below). There’s no indication that a post-COVID environment will place anything but pressure on incremental market share gains. Here is the chart of AT&T’s pre-COVID IP and DSL performance through December 2019:

The bottom line for AT&T (at least for consumer fiber customers) is that they appear to be trading technology share amongst their existing base (1.932 million fiber subscriber growth from Q1 2018 to Q4 2019, and 18K loss in the IP Broadband customer base during that time). Ambitions to grow to 50% market share are exactly that – with 14-15 million homes passed their current market share, while growing, remains right at 30%. An opportunity, perhaps, when bundled with AT&T TV and HBO Max, but not the competitive threat to cable that was originally envisioned.

- CenturyLink has been very vocal about the value of their global fiber connectivity, including this presentation by CEO Jeff Storey at a Wells Fargo virtual conference in late June. They have gone so far as to suggest that analysts should be valuing CenturyLink at $25-39/ share as opposed to their current $10 (see slide below):

They go on in the presentation to discuss that if the Level3 asset (a proxy for out-of-region profitability) were valued at an 11x EBITDA multiple (which would be low to average for cloud providers), then the remainder of CenturyLink (including consumer fiber) would carry an implied valuation of 2x EBITDA.

What this valuation does not consider is just how weak the in-region consumer franchise has become. Here is an example using BroadbandNow. We looked at two suburban zip codes in Denver, one of CenturyLink’s largest and fastest growing markets (80012 and 80014 – the Aurora area and East Cherry Creek areas). We selected a multi-device, multi-member household that watched a lot of video on-line and discovered the following results (versus Comcast):

Like AT&T (and, generally, unlike Verizon), CenturyLink seems content to provide as little fiber to homes as possible, even in fast growing, middle-class neighborhoods like those shown (both 80012 and 80014 have grown high single digit populations since 2010 and have Zillow average home index values above $300,000). CenturyLink’s has an economy of scale issue – it’s hard to get traction and to build a reputable brand when fiber penetration is 10.5% in one suburb and 16.8% in another, especially when your competition is 99% available even through they have data caps, higher prices and slower speeds.

Start with fiber in the suburbs or invite Verizon 5G Ultra Broadband in to help scale the business (Verizon is actively building out just East of 80012 in the Stapleton neighborhood). There’s a lot of value in Level3, but the question is how much (if any) remains with the legacy CenturyLink operation – without fiber, should a terminal value be assigned to the business after 2025?

4. Elliott Management’s memo and plan to recapture the value at Crown Castle.

Elliott Management, famous for their aggressive confrontation of AT&T’s management nearly a year ago, is back on the scene, this time in the form of a Board memo and a 60-page presentation chock full of Crown Castle analysis (one of you commented that the presentation was the title page + 59 pages of ‘Fiber – Bad Decision’).

While they are generally complimentary of Crown’s management of their tower business, they are critical of the value destruction caused by a series of fiber investments. Here’s the key portion of Elliott’s memo to the Board:

“While we admire Crown Castle’s investments in the wireless tower industry, we believe that the Company’s expansion away from its core and into fiber infrastructure has detracted from shareholder returns and will continue to detract from shareholder returns unless significant changes are made. Fiber infrastructure businesses can be attractive investments, but it is our considered view that Crown Castle’s fiber strategy has not been successful and that the return on these investments has significantly underperformed.

Fortunately, we are confident that these problems can be remedied, and that the solution includes a refined fiber investment strategy with greater investment returns and higher cash flow. The result would be a better Crown Castle with enhanced strategic flexibility.”

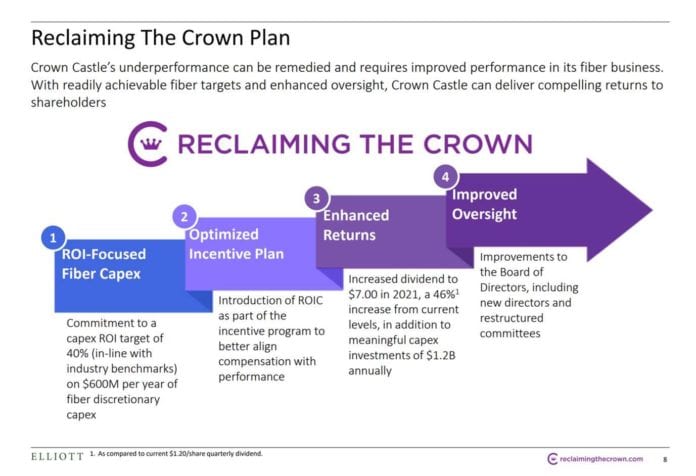

Elliot’s plan is summarized early on in their presentation:

In case ROI-Focused Fiber Capex is confusing, here’s specifically how Elliott would change the ROI equation:

There’re a lot of really good slides in the presentation outlining the poor acquisition strategy (overpayment for assets vs. Zayo), but more importantly the failure to obtain an acceptable return on those assets. Like we saw in their assault on AT&T a year ago, Elliott is mostly right. Crown could do more to ensure that fiber assets retain their value. Unfortunately, adding value to the current assets means a) growing the tenure and expertise of the Fiber sales force to add buildings that can generate immediate returns (buy more talent – now); b) partnering with other providers, e.g. Verizon out of their local footprint, to fill in footprint (in-metro buildings, segment or regional) gaps, something Crown has historically eschewed; and c) selling (or swapping) impaired assets now to existing fiber providers.

Crown Castle’s argument that fiber is essential to small cell deployment is true. If there are multiple fiber providers in the market, however, where does Crown create leverage? And, if more fiber is being deployed by local fiber providers during a time when Crown is reducing their discretionary spending, how does the asset create long-term value?

The question Elliott fails to ask is “How does Crown Castle create more revenues on their existing plant to feed the market’s insatiable appetite for fiber?” The answer to that question requires many more data centers, commercial office buildings, and salespeople (either directly or through partnerships) than are currently being contemplated. It also requires a competitive differentiation beyond their tower presence.

Bottom line: Elliott Management raises some good questions but stops short of the most critical question, which is growing the addressable market for fiber quickly beyond small cells and towers. Recapturing the crown is a lot easier than fixing AT&T.

That’s it for this week. Before we sign off, a quick congratulatory note to Jennifer Fritzsche, who ended her 25-year career with Wells Fargo this week. We will miss her wit and laughter (although none of us doubt she will be back on the telecom scene in some fashion very soon). Our best wishes to one of the finest persons in our industry.

That’s it for this week. Before we sign off, a quick congratulatory note to Jennifer Fritzsche, who ended her 25-year career with Wells Fargo this week. We will miss her wit and laughter (although none of us doubt she will be back on the telecom scene in some fashion very soon). Our best wishes to one of the finest persons in our industry.

Next week, we are back to discussing Apple’s iOS changes and the pending infrastructure bill (and some other pre-earnings newsbytes). In the interim, please check out our blog post on “Ten Interesting Reads/ Listens/ Views for your Fourth of July Holiday” here – it’s grown to more than ten but we had quite a few interesting additions.

Thanks again for the subscriber referrals – we signed up several dozen new readers this week. Please keep the comments and suggestions coming. And if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!