A warm North Carolina welcome to the dog days of summer. The picture is of our pooch Abby serving as boat sentinel on a recent float trip. Summertime in the South – there’s nothing like it.

A warm North Carolina welcome to the dog days of summer. The picture is of our pooch Abby serving as boat sentinel on a recent float trip. Summertime in the South – there’s nothing like it.

After reviewing this week’s market activity, we will discuss the current state of earnings going into next Thursday’s AT&T kickoff 2Q 2020 earnings release and call. Then we will dive into the latest regulatory thinking through the examination of the key provisions of recently passed HR2. Finally, we will summarize an excellent study released this week by Altman Solon (in conjunction with municipal broadband advocacy group US Ignite) that broadens infrastructure deployment and management alternatives.

The week that was

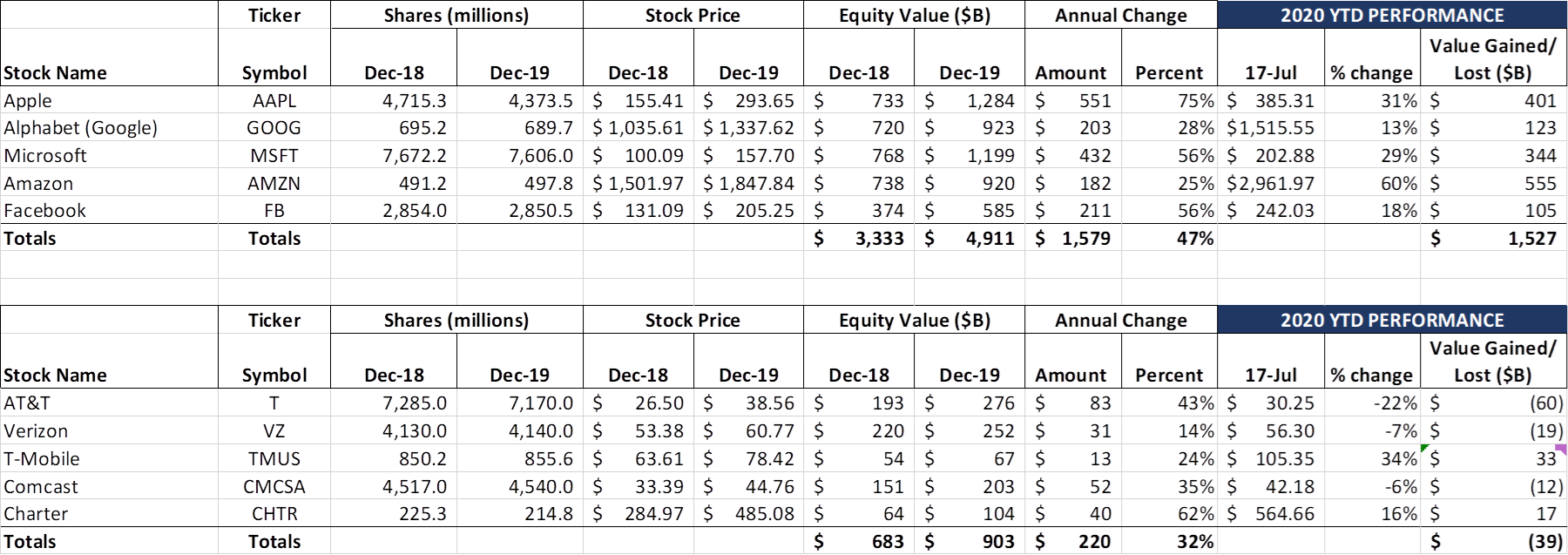

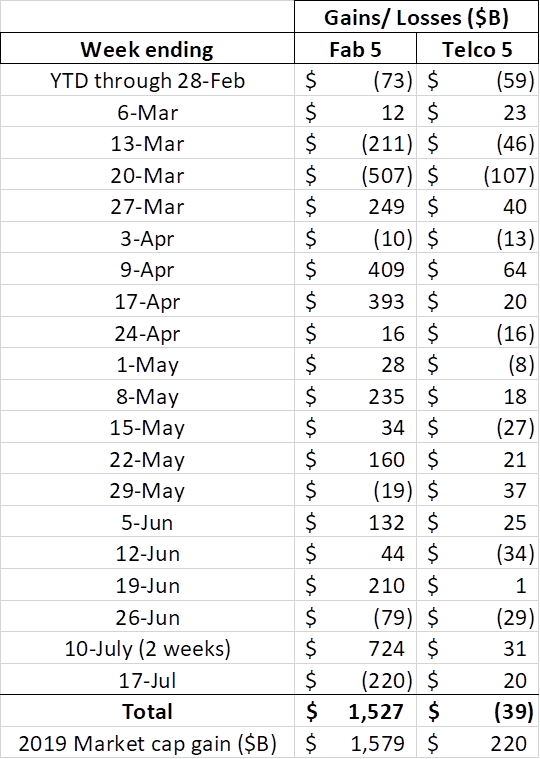

“See – I told you – Telecom is coming back!” read the cheeky memo from one Sunday Brief faithful  reader describing this week’s ever so slight changes in market capitalizations. For the week, the Fab Five lost $220 billion in value (roughly one AT&T) but still has gained nearly as much in the first 6+ months of 2020 as they did in all of 2019. The Telecom Top 5 gained $20 billion this week, helped in large part by Comcast (+$7 billion week/ week; +$12 billion in the last 4 weeks) Verizon (+$7 billion wk/wk; unchanged over the last four weeks) and Charter (+$6 billion wk/wk; $9 billion in last four weeks). Whether this is driven by COVID-19 regional recovery changes, analyst estimate revisions, or investors taking gains from the Fab 5 and shifting into telecom services is anyone’s guess.

reader describing this week’s ever so slight changes in market capitalizations. For the week, the Fab Five lost $220 billion in value (roughly one AT&T) but still has gained nearly as much in the first 6+ months of 2020 as they did in all of 2019. The Telecom Top 5 gained $20 billion this week, helped in large part by Comcast (+$7 billion week/ week; +$12 billion in the last 4 weeks) Verizon (+$7 billion wk/wk; unchanged over the last four weeks) and Charter (+$6 billion wk/wk; $9 billion in last four weeks). Whether this is driven by COVID-19 regional recovery changes, analyst estimate revisions, or investors taking gains from the Fab 5 and shifting into telecom services is anyone’s guess.

The bottom line is that strength remains with cloud infrastructure companies with global growth prospects. The Telco Top 5 is still down $39 billion in 2020, thanks entirely to AT&T and Verizon, and the gap between the Fab 5 gains and the Telco Top 5 losses remains slightly less than $1.5 trillion YTD (roughly 7 AT&Ts) and just over $2.8 trillion since the beginning of 2019 (roughly 13 AT&Ts). If relative size matters (we think it does), the Fab 5 could lose a lot of value and still soundly trounce their telecom peers. My reply to the email above was “and they are only 7 laps behind the leader” – I think that sums up the current value creation gap.

Q2 earnings preview summary: Watch the comments

While examining the first full quarter of COVID-19 influenced earnings is important, the comments made by telecommunications executives on their respective calls could shed more light than normal on their respective outlooks. As we have examined in several previous Sunday Briefs, companies like Comcast will tell a broader story (cord-cutting, broadband, broadcast, MVNO, theme parks, Sky) than someone like T-Mobile (postpaid wireless, prepaid wireless, enterprise IoT, merger synergies). Lumping any two companies together in the telecommunications space (including a direct Verizon vs. T-Mobile comparison, which, at a high level, is close until one examines wireless densification strategies) is dangerous – each has their strategic nuances.

The biggest thing to look for is each company’s take on their respective customers’ economic health. AT&T (Thursday 7/23) will be able to talk about the benefits that they are bringing to first responders because of FirstNet, but probably won’t say a lot about the pinched technology budgets and rapidly shifting priorities facing nearly every municipality. Verizon (Friday July 24) will be able to talk about their robust FiOS platform that kept millions connected during the second quarter but will be mum for now on any 5G Ultra Wideband net additions or the NY Metro small business closures or urban diaspora (impacting FiOS net additions in-region and 5G Ultra Wideband out of region) which may lead to less growth.

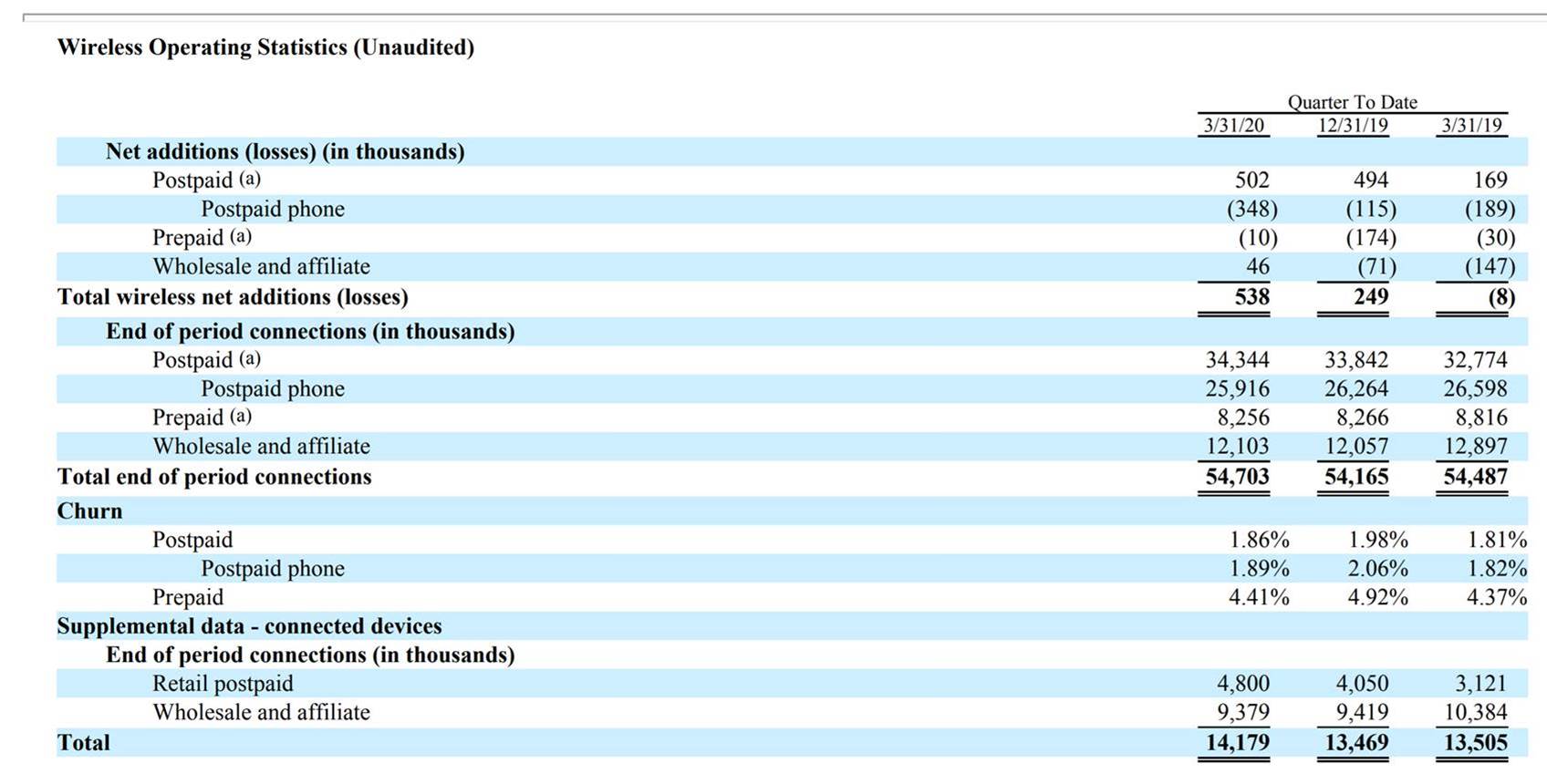

T-Mobile (TBD, likely week of August 3) is where there seems to be the most hand wringing, with many concerned about the credit quality of their customer base (and increased competition from Verizon-backed Tracfone/ Straight Talk and cable MVNOs – more on that on page 25 of their 2Q 2020 earnings release here and earnings transcript here). The bigger metric to watch at Magenta, at least in the short term, is legacy Sprint postpaid phone churn. As we wrote about in “Device Transition from Sprint/ Boost to New T-Mobile (Better than Expected)”, transitioning from Sprint to the new T-Mobile should be fairly straightforward. T-Mobile has opened up every possible band (including 600 MHz – a huge help in the rural areas where Sprint has historically struggled) to provide a better experience, but Verizon and (especially) AT&T smell the vulnerability and are taking aim. As we have explored in our synergy analysis (here), Sprint churn reduction is table stakes. Flat churn in 2Q or 3Q 2020 is not good enough – Sprint needs to improve now (for the last pre-merger Sprint report, see the nearby table from T-Mobile’s May 1, 2020 8K filing).

Cable (Comcast, Altice = July 30, Charter = July 31) will let their respective results speak for themselves. Given what should be even more rapid gains in High Speed Internet (hard to believe, but very likely given in-home moratoriums at Verizon), as well as solid results in their respective MVNOs (margins should be up due to Work From Home/ Shelter in Place Wi-Fi offload), analysts will quickly move to CBRS (which the cable companies can’t discuss) and capital/ adjusted free cash flows (which should be favorable in all respects). The question no one is asking but should is “Given the lessons learned from the launch of Digital Phone, which was only bundled, what are the plans to include wireless in a new bundle? Can wireless “break out” into material market share without being bundled?”

Outside of mentioning the buzzwords on the 2Q Earnings Bingo cards (and we will be posting separate Bingo cards for each carrier the day before they announce earnings), watch how quickly each company’s comments move to 2021. No firm numbers, but general dialogue like “We really aren’t sure how things will pan out after the extra unemployment benefits are removed, and 5G adoption is in its early stages, and equipment revenues are weak (helping quarterly EBITDA), but we are confident that 2021 is going to be better than 2020.” The faster they move to 2021, the more likely that signals weaker 2H 2020 activity.

Bottom line: Words matter, especially in uncertain times. Cable (High Speed Internet dominance + MVNO growth) and T-Mobile (Sprint synergies) have the most to gain in the short term. The telecom industry will continue to have strength, but increased regulation and competition could impact their long-term growth rates.

Infrastructure to the rescue!

There has been a lot of talk about government infrastructure spending over the last several weeks. The House passed a “statement” bill that largely passed along party lines (233 yea, 188 nay, 10 not voting – full roll call here) which will not come up for a vote in the Senate in this session (Majority Leader McConnell’s comments here).

HR 2 largely deals with roads, but there are several sections that impact the telecom industry (picture is of Chairman of the House Committee on Transportation and Infrastructure Peter DeFazio):

- The bill establishes an Office of Internet Connectivity and Growth, which, in consultation with

the FCC and Rural Utility Service of the Department of Agriculture, will “conduct a study to assess the extent to which Federal funds for broadband internet access services, including the Universal Service Fund programs and other Federal broadband service support programs, have expanded access to and adoption of broadband internet access service by socially disadvantaged individuals as compared to individuals who are not socially disadvantaged individuals.” This report would also identify ways to spend Universal Service Fund receipts to improve the reach and effectiveness of Internet connectivity for socially disadvantaged individuals;

the FCC and Rural Utility Service of the Department of Agriculture, will “conduct a study to assess the extent to which Federal funds for broadband internet access services, including the Universal Service Fund programs and other Federal broadband service support programs, have expanded access to and adoption of broadband internet access service by socially disadvantaged individuals as compared to individuals who are not socially disadvantaged individuals.” This report would also identify ways to spend Universal Service Fund receipts to improve the reach and effectiveness of Internet connectivity for socially disadvantaged individuals; - The bill also establishes a State Digital Equity Capacity Grant Program whose purpose is to “promote the achievement of digital equity, support digital inclusion activities, and build capacity for efforts by States relating to the adoption of broadband service by residents of those States.”

- The bill establishes the basis for a “Lifeline” equivalent service for home broadband. The administrative tools would be similar to those used for the current wireless program (derivation of a “broadband benefit” which enables subsidized service; the reimbursement of such benefit to the broadband supplier, etc.);

- The bill requires the formation of a national pricing database listing all service rates by speed by carrier, and be updated every 90 days;

- The bill requires the periodic evaluation of broadband speed thresholds (the new minimum Internet threshold defined as 100 Mbps up/ 100 Mbps down);

- There are increased funds in the bill to study ways to improve broadband growth and availability to Federally-backed housing.

While the odds of Senate passage of HR2 are slim, there is a Senate version of the infrastructure bill that deals primarily with the construction and maintenance of roads. Most of the Senate version is expected to pass both chambers this year.

But HR2 gives us an idea of what’s on the mind of some in Washington when it comes to Internet policy. The focus of HR2 is not based on population density (underserved peoples can exist, as we have seen before, in the urban core), and the standard is now a 100 Mbps symmetrical speed. On top of this, the trend is for greater government oversight of all service providers – pricing, service availability, net neutrality, M&A – the list broadens daily.

The concepts in HR2 only deal with the wireline divide – wireless inequities are handled through other Commission and legislative initiatives and tend to be focused on low population densities. We will discuss what appear to be overlapping initiatives from the Commission and Congress in an upcoming Sunday Brief.

Bottom line: Wired residential broadband Internet access is a social priority that has been exasperated by the COVID-19 pandemic. While there is understandable disagreement on the level of subsidy needed to enable widespread Internet availability (and whether wireless makes more sense as an alternative for certain Multi-Dwelling Units in metropolitan areas), there is an immediate need to enable learning, work, and commerce through upgraded infrastructure.

The Altman-Solon-US Ignite study: Is there a “third (or fourth) way” for municipal broadband deployment?

We have spent some Sunday Briefs (including this one) analyzing different approaches to solving broadband availability and performance issues. Last week, the newly merged firm of Altman Solon published a study (here) done in collaboration with US Ignite (a non-profit that facilitates public-private partnerships).

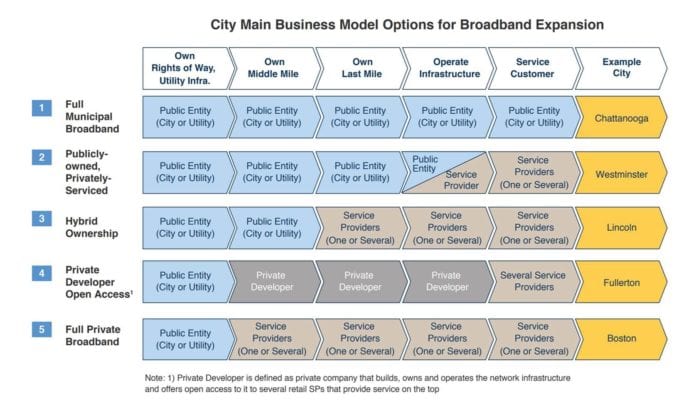

Historically, when municipal funding has been evaluated, most analyses take a binary focus: Either the municipality enables a service provider (usually regulated) to utilize existing rights of way to provide a private service (the current standard for most municipalities), or they decide to self-fund the build and service customers through a new entity (likely 100% funded by taxpayers).

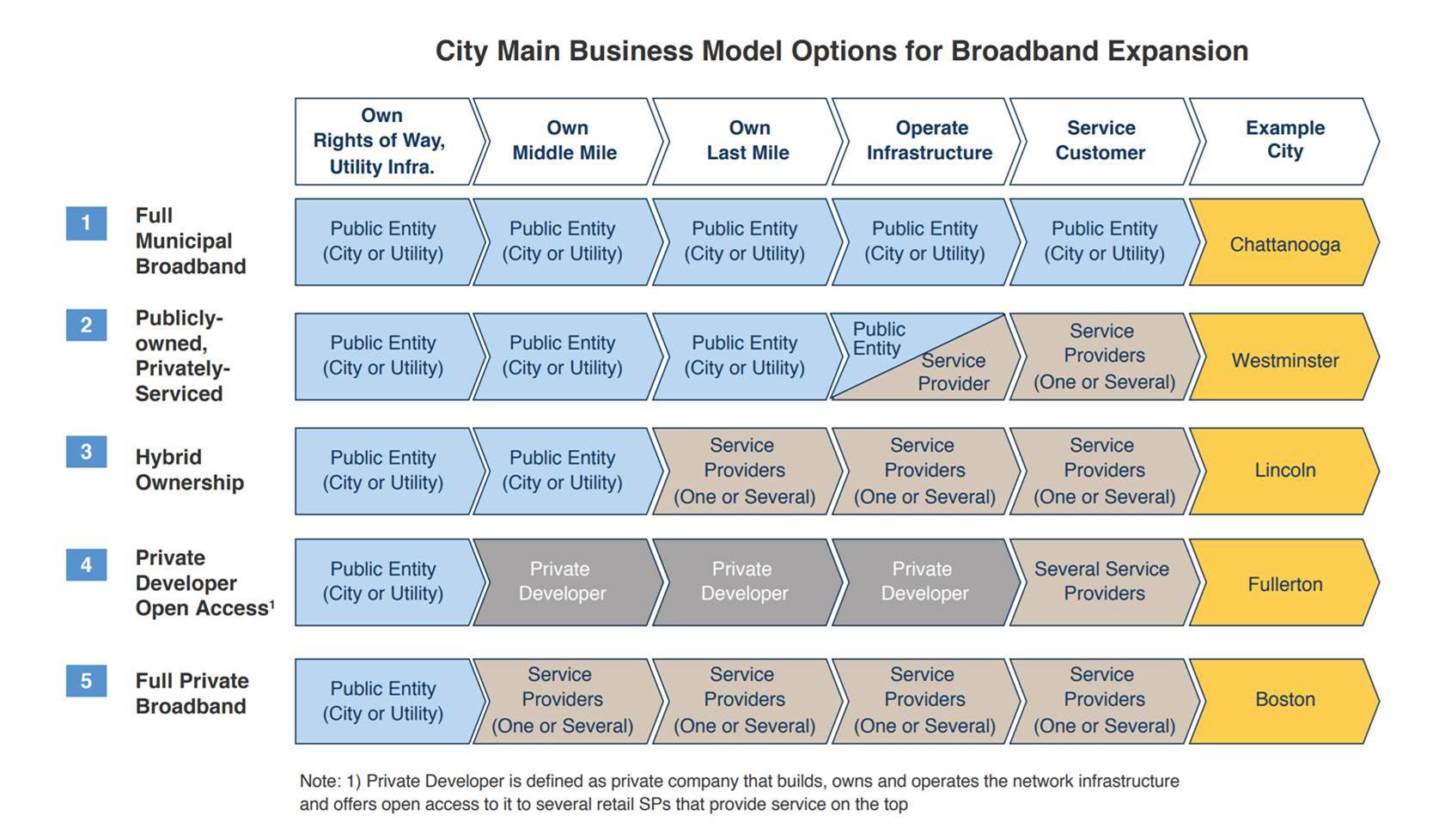

The Altman/ Solon/ US Ignite study presents additional alternatives to these models as follows (note that the binary alternatives are Models 1 and 5 below):

The study creates a new line between infrastructure owner and retail service provider. For those of you who live in highly deregulated energy markets, you have a decent proxy. That’s the model currently used in Westminster, Maryland, today (Ting Internet is the service provider, along with Verizon DSL and Comcast’s Xfinity service. More on the Ting experience with Westminster in their blog post here).

Then there are less used options which involve private construction (e.g., a REIT focused on small town development) and varying demarcation points. These might seem unusual today, but are entirely feasible (and probably economical) with a CBRS auction winner (that might be what Charter has in mind as they applied for Rural Development Opportunity Funds (RDOF) last month).

Bottom Line: This study is a deep read, but one that makes a lot of sense in a mmWave/ CBRS/ broadband needy world. (There’s even one additional complexity for many in the underserved community: Multi-Dwelling Unit coax upgrades. Bring the fiber to the curb in spades, but if the wiring into the apartment is 25+ years old, service performance will suffer).

That’s it for this week. Next week, we will recap what was said (and what was not) on the Verizon, Microsoft and AT&T earnings calls. In the interim, we have started a new online-only post called “Ten second quarter interviews to watch.” Admittedly, there are only two posted at the moment, but we will have more coming as companies announce.

Thanks again for the subscriber referrals – we signed up close to fifty new readers this week. Please keep the comments and suggestions coming. And if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!