Greetings from North Carolina, where it is seasonally hot and humid. Fortunately, our COVID-19 “stay at home” garden is yielding fantastic results. Zucchini, anyone?

Greetings from North Carolina, where it is seasonally hot and humid. Fortunately, our COVID-19 “stay at home” garden is yielding fantastic results. Zucchini, anyone?

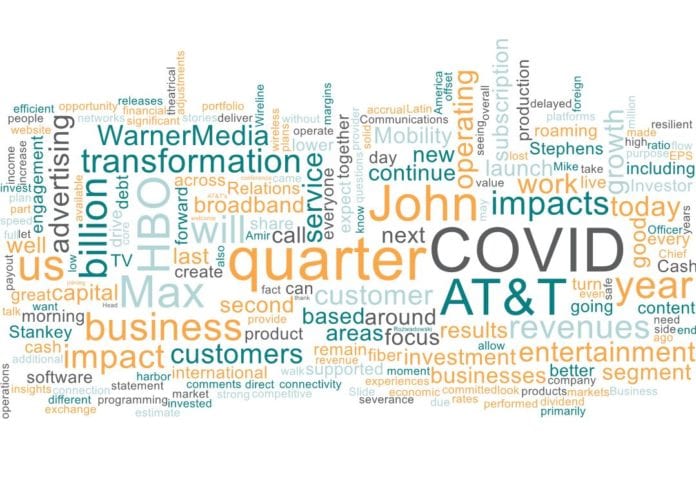

The earnings season started this week with AT&T, Verizon, and Microsoft reporting earnings. As we predicted, there’re a lot of positives and negatives in these announcements, leading us to this week’s title. We will sift through the telco side of the house in detail this week, with a focus on wireless (cable earnings results will help us better understand the full broadband and small/medium business picture).

We had nearly 500 views of the AT&T and Verizon earnings bingo card posts (admittedly, I missed including “roaming” on the AT&T Bingo card – hard to imagine this super-high margin component’s contribution to earnings – until it evaporates). Many of you sent in your cards and time to achieve Bingo status. We will continue to improve with the next week’s cards (as a reminder, we have Facebook this coming Wednesday (7/29), Amazon, Apple, Comcast and Google/ Alphabet on Thursday (7/30), and Charter on Friday (7/31). Our cards will be on the website the evening prior to the earnings release, and, as always, we welcome your inputs and completed cards).

We will conclude this week’s Brief with a short update on the CBRS auction, which blew by the aggregate reserve requirements after Friday’s bidding (a very encouraging sign for the wireless industry).

The week that was

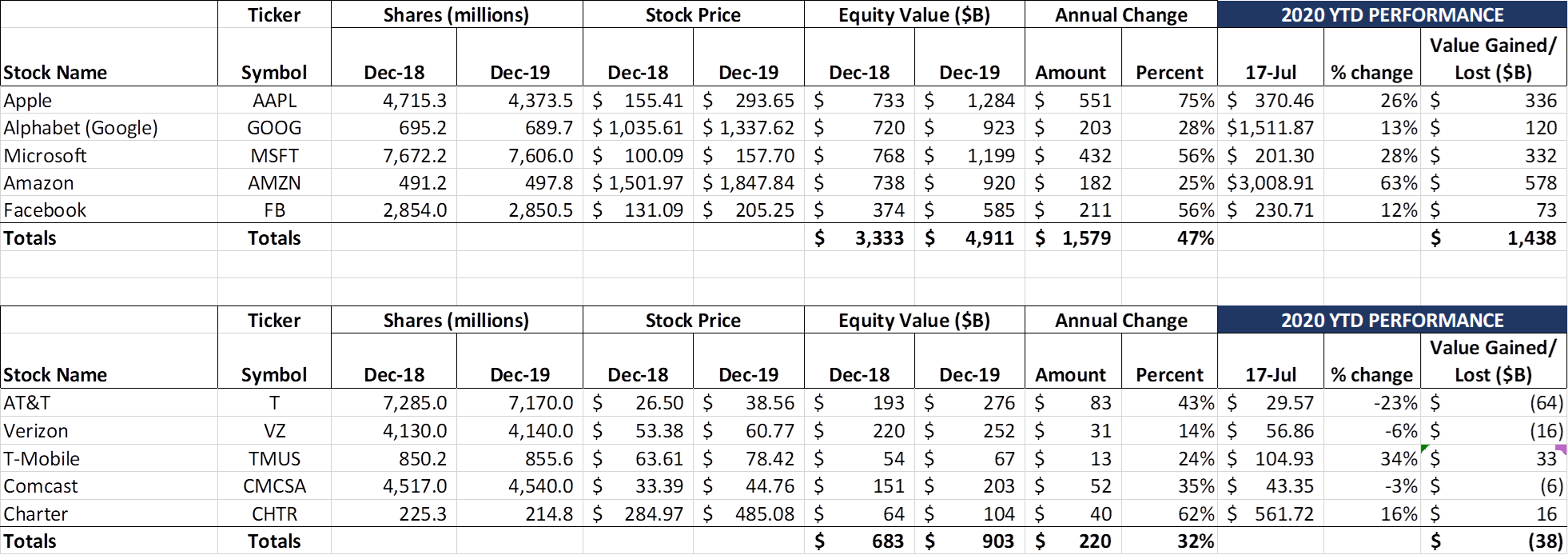

All told, this was a week about two stocks: Facebook ($32 billion in lost market cap this week) and Apple ($65 billion in lost market cap). We have documented the advertising boycott in previous Sunday Briefs (Disney disclosed this week that they joined – more here) and the Cupertino tech giant’s expectations for timing and quantities for a 5G device have begun to be trimmed. More on the Apple situation from Business Insider here.

All told, this was a week about two stocks: Facebook ($32 billion in lost market cap this week) and Apple ($65 billion in lost market cap). We have documented the advertising boycott in previous Sunday Briefs (Disney disclosed this week that they joined – more here) and the Cupertino tech giant’s expectations for timing and quantities for a 5G device have begun to be trimmed. More on the Apple situation from Business Insider here.

Meanwhile, Comcast continued its recovery, gaining another $6 billion in market cap this week as earnings expectations continue to grow ahead of Thursday’s call (as we will see below, AT&T and Verizon’s lackluster broadband numbers signal strong gains for all of cable). Verizon also continued to gain (incrementally with a $3 billion increase on Friday). Analysts continue to be neutral to negative on AT&T even though they posted a solid quarter (more below) and signs that new CEO John Stankey will be decisive in executing AT&T’s vision.

Bottom line: We saw a massive increase in the Fab 5 over the two weeks surrounding July 4th. It’s natural to see some pullback. What’s particularly impressive is that Microsoft (who announced strong revenue growth and excellent earnings) basically held its ground in the two trading days following their earnings announcement (less than 1% loss in market capitalization).

AT&T’s second quarter earnings: Uncertain recovery = uncertain results

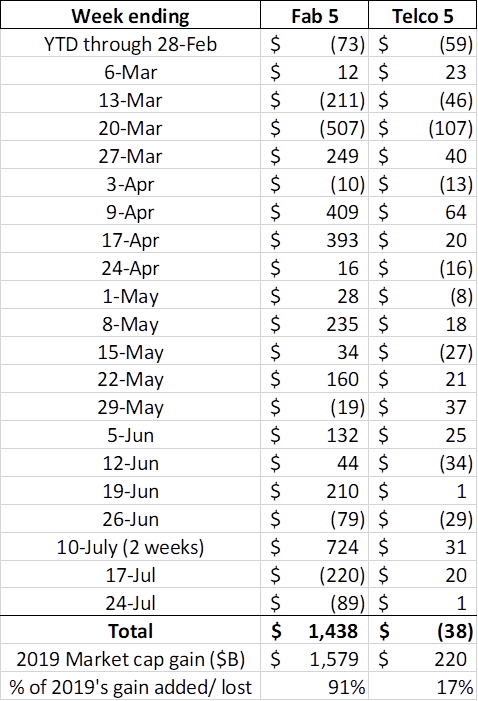

We started last week’s column with a warning to “watch the comments” with particular focus on how AT&T and Verizon handle the topic of economic recovery, bad debt, and pinched technology budgets, particularly with municipalities who are delaying many capital initiatives and refocusing spending on public safety/ disinfection/ school reopening efforts. Here is the overall “word cloud” from the AT&T earnings call:

Taking out the traditional finance jargon that you would expect in an earnings call, four things stuck out:

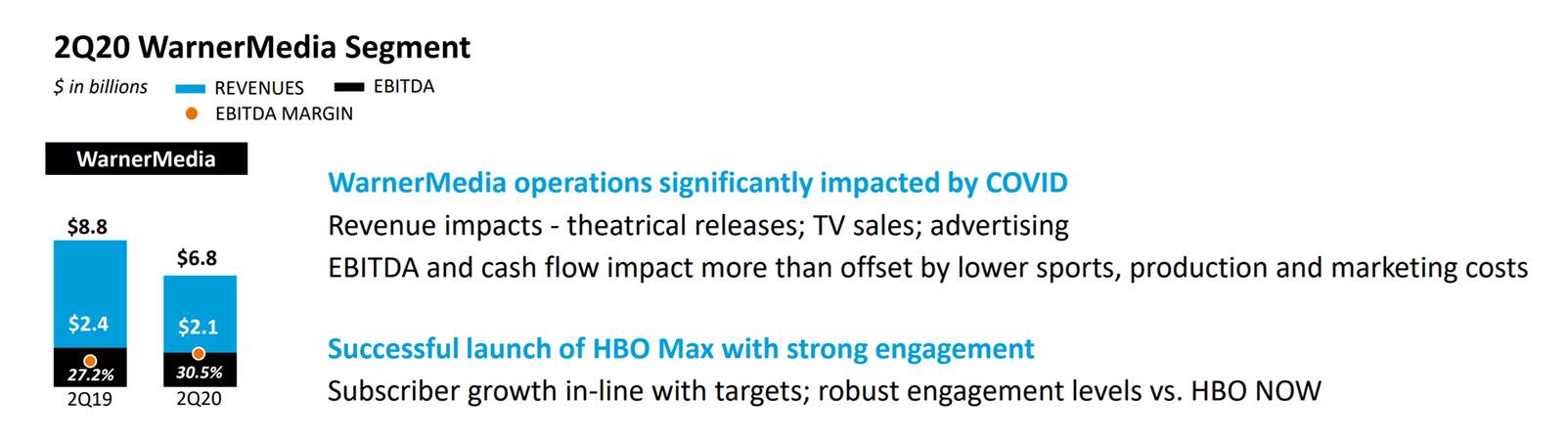

1. There is a lot of uncertainty in AT&T’s business, particularly with WarnerMedia advertising. The slide in their earnings presentation tells the story:

Simply put, work (including movie/ content production) stopped. Advertising plummeted. EBITDA ($$, not %) followed to just over $2 billion in the quarter, down from $2.4 billion in 2Q 2019. There will not be a cold start of WarnerMedia, although sports are coming back (particularly the NBA). Given the relatively low capital intensity in this segment (at least compared to Communications), EBITDA decreases cannot be easily made up by reducing cash capex. It’s clear from the comments on the call that WarnerMedia’s COVID-19 recovery timing and velocity is a (the?) primary headwind facing the company.

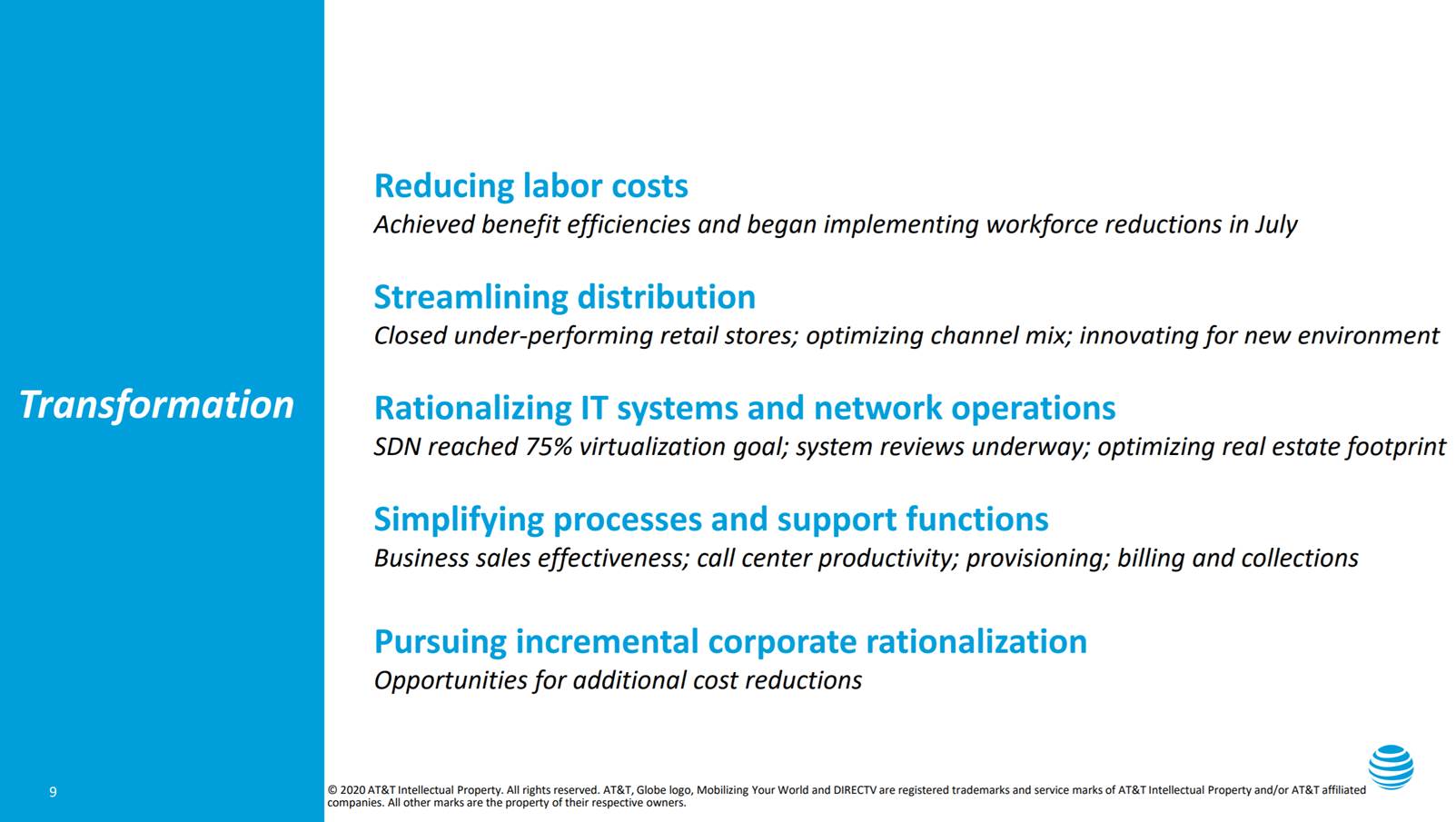

2. There are 60 workstreams underway to transform AT&T’ business process and direction. The speed and precision with which these workstreams correctly identify opportunities, implement plans, and improve profitability and customer experience drive the short-term future of the company.

This is not a study of flight operations, but of business operations. Copper maintenance, Class 5 (local voice) and DSL switch maintenance, redesigning how wireless systems and networks connect to local operations are just a few of the areas where deep cuts are needed. In both business and consumer, legacy products have tumbled. They are not going to return. This does not necessarily mean that the underlying copper is useless, but it does mean that the support model should be rightsized for a lower base.

In IT, it means making a lot of tradeoffs (e.g., less IT but more procedural latitude) and doing as little development as possible in the first release of a product (but also reserving additional capital as products succeed). It also means a lot fewer stores – perhaps 50% fewer company-owned stores – in every metro area.

Because of the dramatic change it can cause to organizations, there’s a natural level of resistance. But the Johns and Bill Morrow all have very strong backbones and will likely cut more rather than less. This presents a lot of opportunities for companies to support AT&T with their transformation (e.g., construction crew outsourcing as 5G networks are built).

3. There is an ambition, but not necessarily a result, to re-instill common fiber planning and ownership (and the opportunity is very big). John Stankey wants to build out more network in a coordinated manner, while others (including investors) would prefer the more certain outcome of resumed stock buybacks.

While John Stankey’s poke at 5G millimeter wave builds got a lot of headlines, the earlier part of his response is even more insightful:

“I have an appetite to build fiber that serves a combination of our needs in the consumer space, what we need to do to deploy 5G and what can help our business segment. And really, the unique position we’re in as a business is we have lines of business in all those areas, and that should give us leverage in fiber deployment that I think others that are either only a fixed line provider and reselling wireless services or those that are only wireless providers and trying to deploy more fiber-intensive 5G networks don’t enjoy. And my investment thesis and my point of view on our company is that if we do our engineering correctly, and we think about our planning properly, we should be getting yields off of every millennial foot of fiber we put in that nobody else can achieve. And so as I think about this, and as we’re working them through from a planning perspective right now, it’s how we get the leverage across all 3 segments, not just the homes that we pass. Although, ideally, the net effect of that will be there will be communities that we build.”

This is a terrific articulation Verizon’s OneFiber program (which, we have noted, is a re-articulation of the November 2012 strategy laid out by AT&T at their Investor Day). The question here becomes “What has AT&T learned in the past eight years from their original “One Fiber” strategy, and why did it fail to be institutionalized?” AT&T cites a very large opportunity in their Investor Briefing (8.5 million business locations within 1,000 feet of existing fiber), which begs the question “Why now (and not then)?”

AT&T has the enterprise might today to delay some fiber builds, but others (Comcast, Spectrum, Zayo, a rejuvenated Crown Castle Fiber, others) are catching up. No one is waiting for AT&T anymore, and an infrastructure-hungry Congress is going to ensure that there is plenty of capital available for future fiber builds.

4. AT&T’s TV offering, coupled with AT&T Fiber, is a major test of the overall “premium content demands premium networks” vision. One of the best quotes of the call is from John Stankey: “to the extent the reason comes back for people to engage on pay TV, such as sports returning, where there’s some feeling of something that they’re missing, if that doesn’t recover, it’s going to continue to pressure throughout the balance of this year… I really need to see some reason for a customer to want to get into the pay TV product, and that’s going to probably correlate to what we see on the sports portfolio.”

This is more than simply saying “We are really screwed if there’s no NFL Sunday Ticket (although it would really hurt).” This is saying “Pay TV is probably dead if there’s no live sports content to attract customers back to the new AT&T TV.” And, as the executives discussed on the call, AT&T TV and fiber come more often than not as a bundle.

There are several questions in our mind that remain unanswered:

- What is the impact of tightening municipal budgets on FirstNet adoption?

- What is the financial impact of no NFL Sunday Ticket programming?

- What is AT&T’s edge computing strategy and what progress has been made?

- What is the “re-start” process of entertainment production?

- Can others market AT&T’s embedded copper footprint better than AT&T?

- How does AT&T mend fences with Amazon (across many fronts, but especially HBO Max distribution)?

- How does AT&T regain its competitiveness in Mexico (over 1.1 million net subscriber losses on a 19 million Q1 2020 ending subscriber base)?

- How is AT&T addressing fiber injustice (deploying in wealthier areas and minimizing deployment in poorer sections of a city)? How is that factored into the planning process described above?

Verizon’s second quarter earnings: Uncertain recovery = uncertain results

Verizon announced earnings on Friday with the benefit of going after AT&T. Their earnings results were more upbeat (“resilient” was a term used to describe their employees) than AT&T’s but were also couched with the same “We’re not quite sure how the second half is going to turn out” caveats. They offered terrific details on the call (and in their release) about key metrics, revenue and earnings drivers. The earnings call went a little longer than normal which was very welcome.

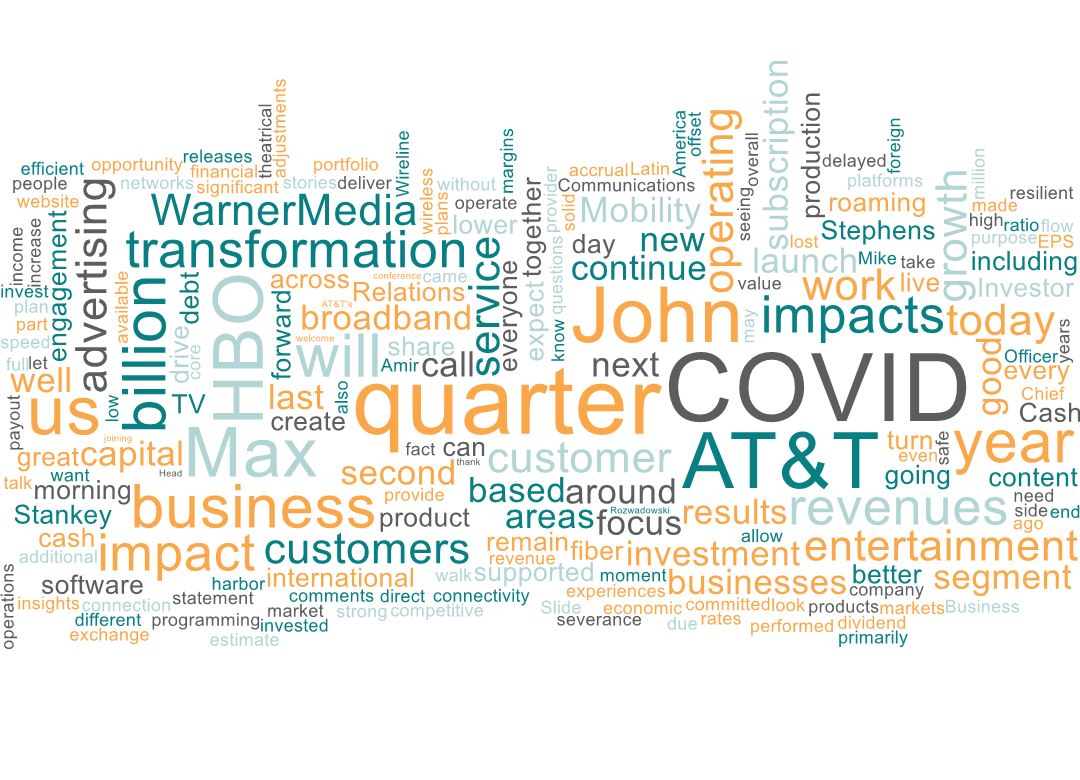

Here’s the word cloud for Verizon:

Verizon’s message was very focused: We will recover. New York City, Verizon’s HQ, has been through a lot over the past several months. No one who has remained in the City would categorize operations as “business as usual.” Verizon managed, however, to continue to execute their nationwide 5G buildout through the chaos. Here’s the wireless supplemental page for Verizon from their earnings package:

What’s important to note in these details is that retail postpaid phone accounts grew in the quarter (but total postpaid net additions were down ~ 20% from 2Q 2020). This came directly as a result of dramatically lower monthly churn (down 24 basis points) and reasonably strong ARPA (down 2% sequentially and 1% vs 2Q 2020 with much of this coming from lower roaming revenues).

Retail prepaid also managed to gain subscribers, a 96K qtr/qtr turnaround. Wireless service revenues were down 2.5% qtr/qtr (1.7% yr/yr) with much of the difference also attributable to lower roaming.

This remarkable stability occurred while the City was under assault, first by an asymptomatic pandemic, and then by rioters and looters. That Verizon was able to emerge relatively unscathed is the miracle here.

Many analysts quickly pounced on Verizon’s less conservative bad debt treatment. Here’s how Matt Ellis, Verizon’s CFO, described the situation:

“We continue to monitor payment trends and will reassess as needed. We are working with affected customers and have a long and successful track record in this area. These customers value the communication services that are vital to their everyday lives, and we value the longevity of these relationships. To that end, we have enrolled many impacted customers in a repayment program beginning in July, providing extended terms for past due service and device payments. We believe the vast majority of these accounts can be cured over time but it will heavily depend on the macroeconomic environment.”

Later on, in the Q&A, Ellis offered additional details:

“We ended at around 1.5 million [Keep Americans Connected] accounts. It was right in line with our expectations 90 days ago. I’d tell you what’s most encouraging though is what we’re seeing in terms of payment patterns from the customers. We have approximately 1/3 of the customers are current as of the end of June. I said in the comments that the vast majority have made some payments during that time period. I mean it’s more than 80% of those customers — those wireless customers who took the pledge have been making payments. So I am very, very encouraged by what we’ve seen, and my expectation is the vast majority of these customers will be customers of ours a year from now.”

Assuming the 1.5 million refers strictly to wireless accounts, and using the information in the table above, about 4.25% of the total postpaid wireless account base is in this category. And 33% of that number (or about 1.42%) are current. That leaves about 2.8% of the postpaid base in potential trouble. Many of those were undoubtedly headed to collections given a softening economy (particularly in the Northeast) in January and February. And, even if these customers disconnect, how they are treated through this economic pain likely drives whether they return to Big Red. Our prediction is that the 1.5 million quickly becomes half of that figure as the economy continues to rebound and that Verizon successfully manages these very choppy waters.

We are much less bullish on Verizon’s millimeter wave prospects, however, and believe that more frequent updates (including customer testimonials or 5G Ultra Wideband) are needed. While Verizon will undoubtedly execute their network deployment, it’s unclear whether they will be able to deliver a superior product to coax (or already deployed fiber). Hans’ response, which broadened the benefits to include small business access, created even more confusion (although he is correct – this could be a very effective and secure solution for SD-WAN customers).

Worst of all, there was very little discussion of how Verizon has successfully executed their One Fiber strategy. It would be as simple as reporting all of the 3rd party access expenses they have been able to displace as a result of One Fiber builds. Even if the number is small today, tracking this additional benefit shows that One Fiber is a critically important strategy for the company.

Bottom line: Verizon will weather this storm because it’s focused on network deployment. They will leverage a desperate entertainment community to their advantage. For this reason (and many others), they will outperform their largest counterpart over the next several years.

CBRS auction off to a great start

We would be remiss if we did not report the latest CBRS auction results. After Day 1 of bidding (Thursday), the FCC reported over $357 million in opening bids from 271 qualified bidders. This more than met the aggregate reserve. We would strongly recommend that you read Sasha Javid’s post here on the auction process for additional details.

That’s it for this week. Next week, we will have a very full earnings analysis with our focus on broadband growth. We think it’s going to be a banner earnings season for both Charter and Comcast. We will also be posting several new links in the online-only post called “Ten second quarter interviews to watch” by Monday evening. Please check back on the on-line site this week as well for Comcast and Charter 2Q Earnings Bingo cards.

Thanks again for the subscriber referrals – we signed up many new readers this week. Please keep the comments and suggestions coming. And if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!