History

Most of the CAPEX required to build a wireless network is related to the RAN segment, reaching as high as 80% of the total network cost. Any reduction in the RAN equipment cost will significantly help the bottom line of wireless operators as they struggle to cope with the challenges of ever-increasing mobile traffic, flat revenues and rising costs to maintain their networks.

Why

Two of the biggest challenges that networks face today is the cost to deploy and maintain networks due to vendor lock-in and network complexity as networks need to support 2G, 3G, 4G and eventually get ready for 5G. These challenges become especially apparent in low ARPU markets, rural areas, or developing markets like Latin America, APAC or Africa. That is why we see Open RAN adoption happening faster in those regions, as OpenRAN innovation gives those operators the ability to choose any RAN vendor thus reducing the deployment cost in those challenging deployment areas.

Open RAN first was deployed in rural areas. Why you might ask? Not only because it was an area where operators could test new and yet unproven technologies, but also from an investment and maintenance standpoint, rural areas are the most challenging ones. If a solution is low-cost enough for rural markets and can economically support the very limited number of users, it will have even better TCO in urban markets. If rural sites can be upgraded remotely with a software push to the edge, maintenance cost will be reduced as well and will make any urban deployments easy to upgrade as well.

Rural Open RAN no more – in the recent investor briefing, Vodafone CEO Nick Read spoke about Open RAN getting ready for urban. “We think we’ll have a rural open RAN ready for 2021 and we are looking to an urban, which is a more complex execution, in 2022, but we need government and we need operators to scale this to improve functionality and efficiency going forward,” he said. This statement highlights the importance of the “village,” or an ecosystem that has been establishing itself for the last few years: from MNOs, vendors, hardware and software, to system integrators, governments and regulators, in every region of the world: from emerging markets all the way to developed markets like Europe and the US.

The main takeaway: after many years of proving 2G 3G 4G Open RAN in rural areas, leading Open RAN innovators like Vodafone are ready to take Open RAN to urban locations.

What

It is important to emphasize here that 2G & 3G networks are not going away anytime soon. Some countries are switching off 2G, some are switching off 3G, but the majority of the world will still have a combination of 2G, 3G, 4G, and 5G networks for years to come. The GSMA mobile economy report 2020 mentioned that 5% of the global population will still use 2G in 2025. That still amounts to over 360 million users. 4G will be still dominating technology in 2025 as well.

In emerging economies, specifically across Africa, parts of Europe and Latin America, many operators still utilize substantial 2G and 3G investments. The migration from legacy to 4G and 5G networks will be a key challenge in those regions since the telecom industries there are still emerging, and an implementation of 4G and 5G could prove very costly because it will require running old legacy non-IP networks and new all IP (4G and 5G) at the same time. In many of the regions across Africa and Latin America, the replacement rate of cellular devices is much lower than in other regions of the world. As mobile phones that are compliant with legacy 2G and 3G tend to be used more in emerging regions, the operators require a solution that can support both 2G and 3G solutions while simultaneously preparing for the deployment of faster 4G and 5G networks. Open RAN solutions that support 2G, 3G, 4G and 5G will cost-effectively enable connectivity in those markets by simplifying installation and providing technological flexibility and sustainability.

For each operator, the landscape of technologies they must support is very heterogeneous; one solution will not fit all scenarios. A sustainable mobile broadband will become widely available with Open RAN, reducing the cost structure and delivering flexibility by design to sustainably evolve and adapt the network to user demand: 2G and 3G today, 4G and 5G in the future.

In developed economies, US mobile operators were looking at Open RAN for rural at first, but current geopolitics around Chinese vendors have created a much bigger opportunity for Open RAN. The Open RAN Policy coalition, formed just a few months ago with many operators as its members, looks to educate the US government on Open RAN as a viable alternative to Chinese vendors. Dish is planning on building their network by 2023, based on Open RAN. And there are smaller US operators like Inland Cellular that are already expanding their 4G networks with Open RAN, proving that it is a strong contender for any RAN replacements.

In Europe, Vodafone is leading the Open RAN pack, considering deploying it all across their European operations.

The main takeaway: Open RAN that supports 2G, 3G, 4G and 5G is an attractive option for global MNOs.

How

In the past, the deployment focus for MNOs was placed on addressing urban issues to increase capacity or spectrum efficiency for densification. Uncertainty in the rural business case on the demand side, and operational complexity on the cost side, and competitive pressure in urban markets resulted in MNOs deprioritizing investment in rural in favor of urban. The rural challenge is now being solved across the globe with Open RAN delivering a new business approach. As Open RAN has proven itself in the most challenging rural locations, now it is getting ready for prime time in urban markets.

Monolithic solutions of the past that provide a single access technology (i.e. 2G) prevent business sustainability as they require additional investments as the demand evolves (3G, 4G). Now, Open RAN can support 2G 3G 4G and 5G, extending the deployment investment.

The main takeaway: As Open RAN proves itself in the most challenging rural locations, now it is getting ready for prime time in urban markets.

When

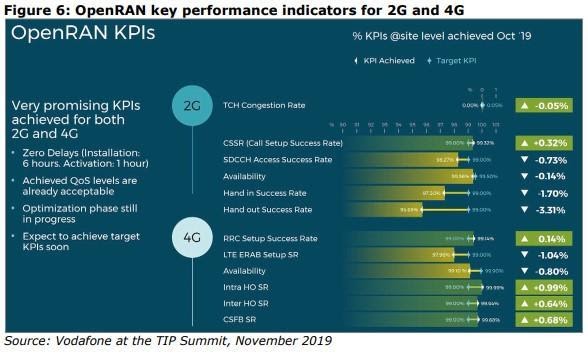

While mobile operators’ interest in open RAN technologies has been growing for a couple of years, Vodafone has been on the journey for over 5 years. Vodafone was the first operator to move the technology out of a lab environment and into a field trial in their emerging markets and rural areas (Turkey and DRC). Vodafone didn’t hold back on its intentions to use Open RAN to help expand its supplier base. CEO Nick Read said at the end of 2019 that the operator was “pleased with trials of OpenRAN and are ready to fast track it into Europe, as we seek to actively expand our vendor ecosystem.” Recently, Yago Tenorio, Vodafone’s head of network strategy, confirmed that “we have had trials taking commercial traffic for about a year now,” and “It is a 2G, 3G and 4G trial and it is live and the KPIs (key performance indicators) are really good and in some cases better than the incumbent.”

Now, Vodafone has set an even more aggressive timeline to use Open RAN for urban.

Africa: The African continent poses a unique commercial and moral challenge for telecom service providers. A large number of the African population is still out of the telecom network – it remains one of the most under-penetrated regions in the world, with the primary 2G network yet to reach over 110 million people (as per the GSMA report). In addition, the Average Revenue Per Unit (ARPU) continues to be extremely low, and the telecom service providers have a tough challenge listing out their priorities. And this is where Open RAN can help and is set to play a vital role in the connectivity race as the regions that are connected are largely dependent on legacy infrastructure, with 2G and 3G, and 4G still in its infancy.

African MNOs need to optimize their previous G investments, especially 4G as those deployments were delayed due to the ability of end users to pay more for 4G services. At the same time, MNOs in Africa are looking to Open RAN for any new 2G or 3G or 4G deployments: vendor choice, lowest TCO, easy upgradability – will help African MNOs to bring connectivity to more end users. In addition, it will help them to realize network ROI much faster– and that is why 4G-based on Open RAN will become a leading technology in Africa in the years to come as more users get access to 4G devices.

An All G OpenRAN solution was attractive to MTN because of easy upgradability to any G, allowing MTN to keep building 2G networks in areas untouched by wireless connectivity, while at the same time continuing to allocate resources and time to expand their 3G or 4G networks with the same investment. MTN is set to deploy 5,000 OpenRAN sites across their 21 operations.

Orange has recently joined the Open RAN movement and is planning on starting its Open RAN journey in Africa with the goal to roll it out across all of their operations.

And although there are capabilities to deploy 5G, Africa-based operators will require the ability to run 5G alongside their existing 2G, 3G and 4G networks. At present, that can only be solved with either erecting new infrastructure or deploying Open RAN, which can run alongside existing infrastructure. It’s a no brainer really …

Latin America is a large geographical region with many areas that are extremely difficult to be reached and concentration of infrastructure and population in large metropolitan areas. During spectrum actions, the government puts expectations on MNOs to cover the majority of geographical areas, not just by population. It presents a challenge to regional MNOs to cover entire countries as the cost of installation and maintenance of traditional RANs is high. Couple it with the need to support a variety of technologies to support 2G 3G 4G and 5G in the future, and no wonder Open RAN is catching on like fire throughout the region.

Telefonica’s initiative Internet para Todos (IpT) aims to connect the approximately 100 million unconnected in the LATAM region to enable economic inclusion. And they are embracing Open RAN to achieve this ambitious goal.

IpT was formed in early 2019 with the mission to bring faster internet access and its benefits to everyone — giving more people a voice, strengthening communities, and creating new economic opportunities. IpT has deployed 650 sites since May 2019, covering over 450,000 customers) with a 3G and 4G rollout in rural Peru. IpT is developing a new business model by establishing a wholesale model and enabling partnerships with local communities. Open RAN technologies allow IpT to reduce the cost of deployment in areas where current technologies are cost prohibitive. These include cloud-like Open RAN architecture, automated network planning, and a combination of optimized fiber and microwave networks.

As of today, IpT Peru has deployed hundreds of new sites in Peru and is the largest Open RAN deployment in the world.

The technology brings much more flexibility and agility to the deployment and management of a telco access network. The Open RAN architecture creates a multi-vendor, multi-operator, open ecosystem of interoperable components for the various RAN elements and from different vendors.

However, openness and virtualization also come with incremental levels of complexity that must be managed to capture the value and not create new problems for operators. With this objective, IpT Perú, Telefónica and their Open RAN vendors have implemented an operating model built on the principles of the data center with continuous integration and continuous delivery (CI/CD) – bringing even more data center native principles in the network. That enterprise embraced model of CD/CI, which we will cover in our next installment, helped accelerate taking new functionalities to the market faster, in an easy and automated way. This approach has helped to establish a new operating model to reduce IpT Perú’s OPEX, to be able to manage much faster product lifecycles and to speed up the deployment of new applications for coverage and capacity scenarios.

The initiative makes use of new approaches to network deployment, using Open RAN and RAN sharing technologies. “We have to operate our network more efficiently and at a lower cost than traditional operators,” commented Renan Ruiz, IpT’s CTO at TIP Summit 2019. “We need low cost, scalable and disruptive technology that allows us to overcome the challenges we are facing in the rural areas of Peru.”

The partnership demonstrated that infrastructure projects based on Open RAN, combined with new business models, can connect communities and serve as a model for other areas of the world.

IpT: the world’s largest Open RAN deployment, Source: Parallel Wireless

As part of the new partnership, IpT Peru will connect rural communities throughout Peru by enabling any mobile network operator to use its 3G and 4G infrastructure to deliver high quality retail mobile communication services, said the partners, who are hoping the success of the venture in Peru will pave the way to replicate this type of business model in other countries in Latin America and the Caribbean region.

In APAC, we see Open RAN gaining momentum for greenfield deployment with Rakuten. Smartfren, Ooredo among others plan on using Open RAN under TIP umbrella for brownfield as well. These operators are using deployment learnings from TIP, Vodafone and plan to use Open RAN in variety of scenarios.

In the US, regional provider Inland Cellular has been in the news lately for pioneering the use of Open RAN technology that might give the United States an advantage in its battle against Huawei. Asked by The Lewiston Tribune, Richard Jackson, Vice president of network operations, explained why open RAN: “It drops the cost of each cell site by about 40 percent. That’s important because we need more sites per square mile to serve our region than in companies that operate where the terrain is flatter. It was price and features. Before, we were locked in. We had to pay what our suppliers asked if we wanted to expand our network or add services. They were driving the network, not us.”

With smaller US operators, required to remove Huawei from their networks in a few years, the last thing they want is to be locked in into another RAN supplier that will be “driving their networks.” This echoes the sentiment that started the Open RAN movement.

The main takeaway: More and more operators see Open RAN as the only alternative to get them into the driver’s seat to deploy and manage their networks.