Mid-month greetings from “move in” weekend at Davidson College. Attached is the “scene” at the College as they grapple with containing outbreaks while maintaining the liberal arts community that makes Davidson special. It’s an experiment that will likely have fits and starts but will ultimately work. More to come.

Mid-month greetings from “move in” weekend at Davidson College. Attached is the “scene” at the College as they grapple with containing outbreaks while maintaining the liberal arts community that makes Davidson special. It’s an experiment that will likely have fits and starts but will ultimately work. More to come.

This week, we will recap three presentations made at two analyst conferences from AT&T, Verizon, and T-Mobile. Because of space constraints, we will hold on the TikTok and Fortnite headlines until next week’s edition (although it might be good to read this WSJ article on TikTok as well as this Reuters analysis on the Fortnite lawsuit). Many thanks to each of you for the comments and suggestions for future Briefs – many great ideas to add to the Sunday Brief whiteboard.

The week that was

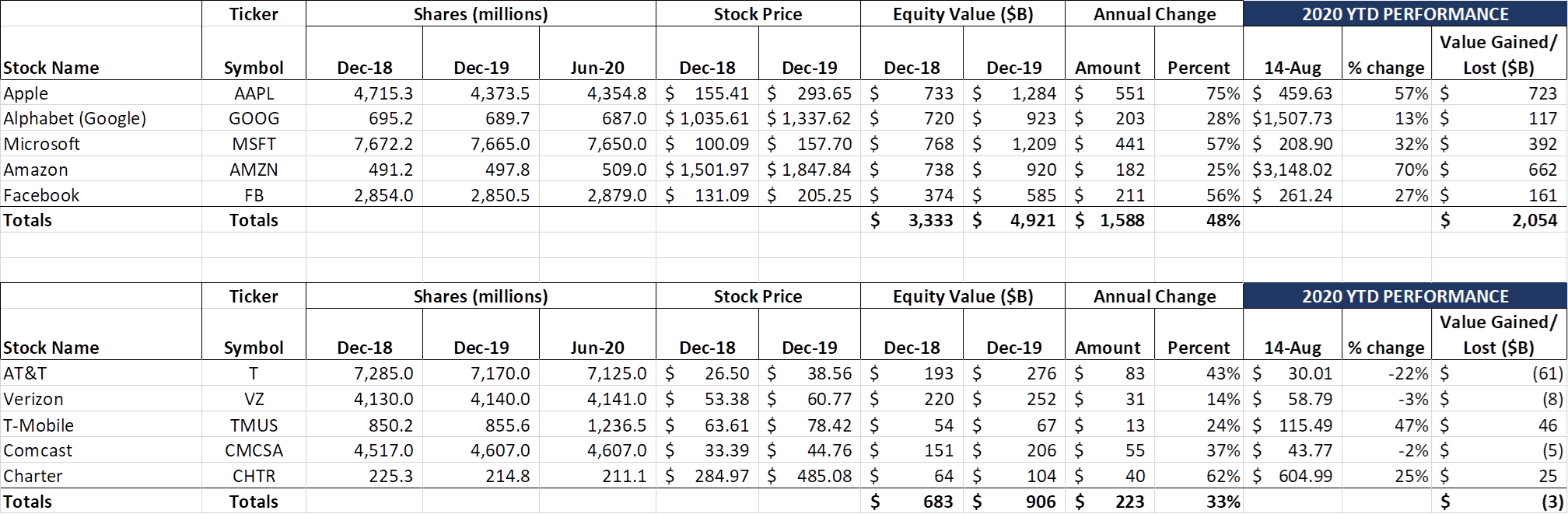

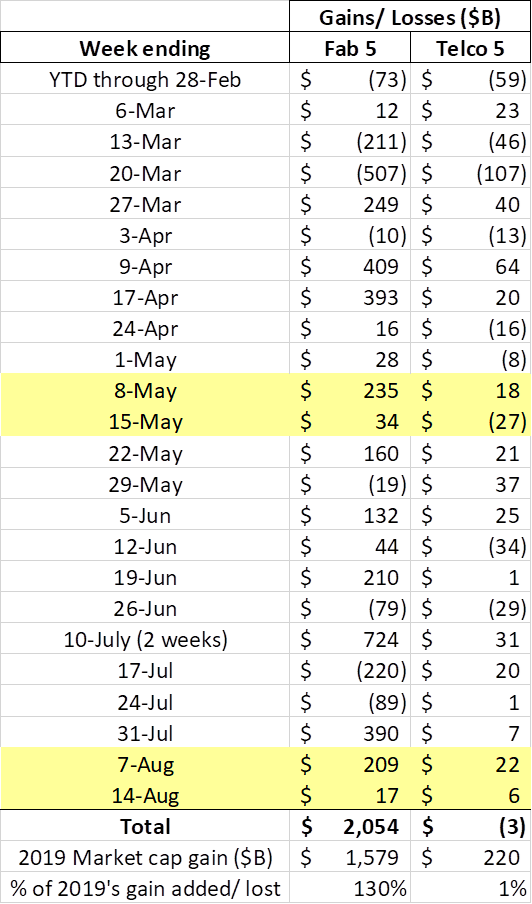

Apple gained over $65 billion this week ($145 billion in the last two) and accounted for more than 100% of the Fab 5 increase, despite concerns that a possible WeChat ban could reduce Chinese iPhone sales. The “up and to the right” slope for most of the Fab 5 has begun to flatten (this may be part of a quarterly trend – look at May’s weekly gains) – holding on to $2 trillion in gains for the year is no small feat.

Apple gained over $65 billion this week ($145 billion in the last two) and accounted for more than 100% of the Fab 5 increase, despite concerns that a possible WeChat ban could reduce Chinese iPhone sales. The “up and to the right” slope for most of the Fab 5 has begun to flatten (this may be part of a quarterly trend – look at May’s weekly gains) – holding on to $2 trillion in gains for the year is no small feat.

The Telco Top 5 continued their steady progress and has nearly recovered as a group the entirety of this year’s losses. Leading that recovery is Comcast, with another $4 billion in gains this week. Hard to believe that during the worst of the pandemic’s volatility, the Philly-HQ media and communications powerhouse had logged over $53 billion in market cap losses in 2020.

One other interesting note which adds credence to the “now #2” claim by T-Mobile: In the first 7.5 months of 2020, the equity market value gap between AT&T and T-Mobile (even with the Sprint merger and the subsequent Softbank secondary offering changes) has shrunk by $107 billion. If that trend holds, T-Mobile USA will overtake AT&T in equity market capitalization by the end of this year (there’s ~$70 billion gap today). While we are making no predictions due to merger synergy uncertainties, it is interesting to note just how quickly T-Mobile has closed that gap. If HBO Max’s appeal fails to expand beyond their current base, then we could see AT&T’s equity market value eclipsed by their Bellevue-based competitor.

As we discussed last week (with respect to Google), simply because each of the Fab 5 has negative net debt does not mean that they are not willing to sell additional bonds. This week, Bloomberg reported that Apple sold $5.5 billion in debt at an average yield of 118 basis points above treasuries (with the 10 yr note trading at 70 basis points, this would imply a yield of around 2.8-2.9% on a 10-yr note). Bloomberg also reported that Apple sold a portion of the debt at 40-year rates with “favorable yields.” While unnamed sources indicated that the proceeds will largely be used to repurchase shares (the entire $5.5 billion would equate to 0.3% of Apple’s current net worth), it’s interesting to note how little coverage this COVID-initiated share buyback boom is receiving.

In other Fab 5 (and Telco Top 5) related news, Microsoft and AT&T launched the long-awaited “don’t call it a phone” Microsoft Duo this week for $1400. Lots of media attention piqued our interest, until we looked at the specs (here). No 5G (which runs contrary to AT&T’s business sales messaging), no Wi-Fi 6, a relatively low battery level (for 2 screens), and no Band 48 (CBRS) or Band 71 (T-Mobile’s 600 MHz band – perhaps this was by design), which significantly limits it’s ability to be marketed by T-Mobile. We aren’t quite sure where launching an LTE device for enterprises in a 5G-centric world ranks – but it’s somewhere in between the Easter Sunday (no joke) launch of the Microsoft Lumia 900 (announcement here) which had a terrific camera, and the delayed launch (until the Z10 release in 2013 including this very confusing and forgettable Super Bowl ad) of any Blackberry that had LTE enabled.

Bottom line: We know that it’s very hard to break through the Apple/ Samsung duopoly, but Microsoft falls short until they address each of the shortcomings described above.

Summer analyst conference roundup: AT&T’s post-COVID mantra – WarnerMedia and DirecTV recoveries

This week, there were two distinct telecommunications-focused conferences, Cowen’s Communications Infrastructure Summit and Oppenheimer’s Technology, Internet & Communications Conference. Both were virtual.

AT&T CFO John Stephens kicked off the Oppenheimer conference (video here), reiterating many of the themes voiced during their earnings call:

- Broadband and wireless are forming the foundation for AT&T’s cash flows

- Cost transformation is not slowing down a bit during the COVID-19 crisis

- FirstNet continues to be a gift that keeps on giving, not only allowing them to expand the definition of “first responder” to hospital staff and utilities workers, but also providing the funds to make systems improvements that have improved AT&T’s operational efficiencies (and resulted in lower churn)

- AT&T continues to generate a lot of cash

- The company continues to take advantage of very low interest rates (re: commentary in last week’s Sunday Brief surrounding T-Mobile’s cost savings)

- The dividend (with current yields approaching 7%) is still safe

- The post-COVID environment, particularly with respect to WarnerMedia, remains uncertain

There are very good quotes for each of the points above, but the most interesting point to us was Mr. Stephens’ comments on cable as a competitor (around 28:40 in the video):

Tim Horan: (part of a multi-part competitor question)… Do you think the cable companies will build out wireless capabilities?

Tim Horan: (part of a multi-part competitor question)… Do you think the cable companies will build out wireless capabilities?

John Stephens: Cable is really continuing to focus on the bundling aspect with their broadband and their video – that’s what we’ve seen. The geographic footprint of having the ability to cover a nation – people want the whole country – they want to be able to roam, they want to be able to use the network wherever – and cable footprints aren’t set up that way. So when you get into those roaming costs… Are they competing? Yes. Have they established customers? Yes. Are they hitting the industry marks on margins and profitability? No, I don’t think they are. So I think it’s more of a defensive measure for them. We’ll see their participation in activities to further their footprint or not – so far we have not seen any of that. We pay attention to cable but they are not the #1 competitor out there.

While many in the telecommunications industry (including AT&T) aren’t quite sure what to make of Dish’s wireless initiatives (no one is taking their eye off of Dish), it’s very interesting to hear an almost dismissive tone with respect to cable simply because they do not own and operate a licensed spectrum network today.

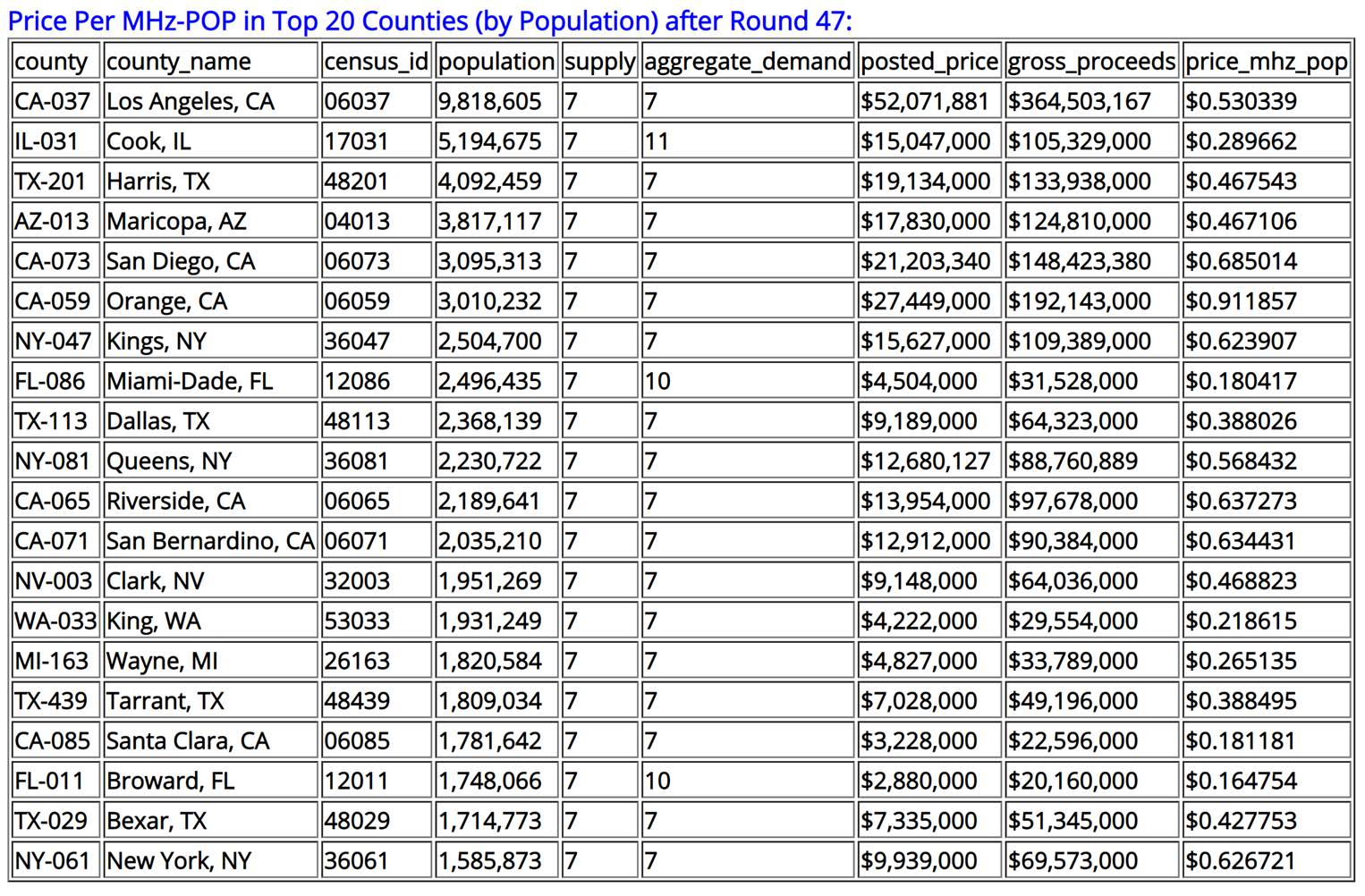

For some idea of what cable might be up to, let’s see what’s going on with the CBRS auction after Round 47. Here’s the latest large market data from Sasha Javid (site here):

Last week, there were considerably more markets with more demand than supply (12 out of 20). That number is now down to three, with market activity being focused on the Miami and Chicago areas (both Comcast). It’s important to note that in the case of Miami, the price per MHz POP is still considerably lower than their metropolitan counterparts (even lower than Detroit) and that when final bidding has stopped, prices may be higher.

It’s very hard for us to see a situation where cable was not extensively involved in the CBRS process. They have long fought to have the band included in each of their devices (see Xfinity selection here – the first 10 devices all carry Band 48). They have a lot of “pole” experience in their local markets, albeit not as much with CBRS-based small cells. And, best of all, this is not an “all or nothing experience” – like their outdoor Wi-Fi deployments (under the CableWiFi SSID), they have the ability to use information gathered from their millions of customers to pinpoint where offload makes the most sense. It also is completely feasible that cable and Verizon might partner to make the CBRS deployment process faster (re: Priority Access Licenses apply to spectrum that has already been deployed. This is a multi-quarter as opposed to a multi-year rollout).

Bottom line: AT&T dismisses cable’s consistent 500-600K quarterly net additions at their own risk. To use telecom parlance, Comcast and Charter (and Cox) might have figured out the right “Least Cost Route” formula with Verizon that allows them to make money in wireless and deploy/expand a wireless network overlay on their own terms. We will learn more about cable’s “sneak attack” in just a few weeks. The real tipping point comes when cable’s marginal cost to grow enables them to come close to (or match) a “Four for $XXX” promotion. Once cable eats into family plan net additions, Mr. Stephens’ focus will intensify. A smartly deployed CBRS footprint and a cooperative MNO partner like Verizon might get them there.

Summer analyst conference roundup: Verizon’s fiber ambitions

Verizon’ Senior Vice President of Network Strategy & Planning, Adam Koeppe (picture nearby), gave an excellent interview at the Cowen Communications conference (Colby Synesael led the interview).

Here are the takeaways from the discussion (full transcript here):

Here are the takeaways from the discussion (full transcript here):

- Network architecture and corporate strategy are tightly intertwined

- Traffic balance remains below normal in the urban core, and above average in suburban and rural areas

- Enterprise order activity is up, led by VPN and collaboration demand

- Edge compute needs are directly correlated to latency requirements

- Verizon’s MEC relationship with Amazon, while not exclusive and still embryonic, is a lot deeper than most people recognize

- The value of the Amazon relationship directly correlates to Verizon’s ability to simplify the developer experience.

- IBM adds a meaningful application layer to Verizon’s 5G network for enterprises

Adam also does a very good job of discussing public versus private clouds in the interview (which was punctuated by Verizon’s Bayer AG global network announcement two days later). The most interesting part of the interview, however, came what Colby asked about capital spending after fiber (emphasis added in Adam’s response):

Colby Synesael: Don’t you get to a point though where like you’ve blanketed enough of the U.S. with fiber? And it’s no longer about building the fiber and the strategy does kind of transition to other areas of the build-out, maybe it’s MECs, for example?

Adam Koeppe: So if you think — I mean we had 60-plus markets that are in some phase of fiber build-out, right? But the goal is in every square foot of the country. So it is very targeted to the more dense areas, our hottest markets, if you will, for 4G and 5G growth. That’s where — that’s the sweet spot for where we’re putting our fiber resources. That’s — there’s still 2 to 3 years left in that build program for those core markets. So each year, though, we have an aggressive capital management process that looks at projects that have a greater need versus ones that don’t and shift resources accordingly. But right now, we are full steam ahead on the fiber build and pairing that with our 4G and 5G node deployments and it’s been going exceptionally well.

I think this is Adam’s way of saying “Fiber is Verizon’s foundation for growth. What you see in Phase 1 (60 markets) is exactly that – the first phase. Our goal is to cover a metropolitan area economically with an owned and operated fiber network.” We think this is a correct paraphrase and are greatly encouraged to see them make this statement. Bottom line: Verizon is going to fiber up beyond the 60 markets, and, like wireless network expenditures, new fiber deployments will be a $2-3 billion annual expenditure for the company in perpetuity. If they increase their One Fiber accountability (“sell where you have fiber/ don’t sell where you don’t have fiber”), Verizon could create disproportionate value in the next decade.

Summer analyst conference roundup: T-Mobile’s network deployment

The last discussion for this Brief will be Tim Horan’s interview of three of the key T-Mobile management team members: CFO Peter Osvaldik, CMO Matt Staneff, and President of Technology Neville Ray (pictured above and full video interview here). Many of the points were made in last week’ Brief, but there are several key additional insights:

- T-Mobile’s site upgrade capacity target is 800 units per week (40,000 per year). This capacity covers both the 600 MHz and the 2.5 GHz projects. June averaged 600 per week, and July 700

- Currently, the focus is on completing the 600 MHz rollout but Neville anticipates that T-Mobile will roll out “multi-thousands” of 2.5 GHz site upgrades as well as largely complete the 600 MHz rollout

- It takes approximately 5-10 business days to upgrade a site

- Each 2.5 GHz site rollout has a two-part benefit: a) Significantly improves the 5G experience (to 300 Mbps initially and substantially more than that with an extra 20 MHz of 2.5 GHz deployment), and b) Sprint synergies as the future network is instituted and site consolidation can occur on a single network platform

- Fixed wireless is a rural-focused project (creating a distinction with Verizon’s 5G Ultra Wideband offering which is urban-focused). Matt reported that the selective Grand Rapids trial results were very encouraging from both a network performance as well as an NPS perspective. T-Mobile believes that the addressable market for their home broadband service could be as much as 50% of the US Households (which means all of rural and part of the suburban/ rural mix. More on that segmentation from Bloomberg here)

The quote of the interview was from Neville who commented (to Tim Horan) “I can’t have a bad day anymore, Tim. I wake up every morning and there’s a smile on my face because I finally got a great set of spectrum assets.” That pretty much summarizes the tasks ahead for T-Mobile: a) come together; b) build the best network possible; c) win together.

That’s it for this edition of The Sunday Brief. Next week, we will turn our analysis to telecom’s future in a Biden administration (which makes the TikTok and Fornite stores more relevant). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!