Hi again from Davidson, where the dog days of summer are continuing. Pictured is our pooch, Abby, stealing some relief from our neighbor’s sprinkler system.

Hi again from Davidson, where the dog days of summer are continuing. Pictured is our pooch, Abby, stealing some relief from our neighbor’s sprinkler system.

This week, we will celebrate the end of Auction 105, also known as the CBRS auction. We will define themes that will shape the second Trump administration if he is reelected, talk briefly about changes to our U-Haul index, and, through the website later this week, post five meaningful summer videos for you to view heading into the Labor Day weekend. We will not have a Sunday Brief on September 6 but will return with a review of events and a look at 3Q trends on September 13.

The week that was

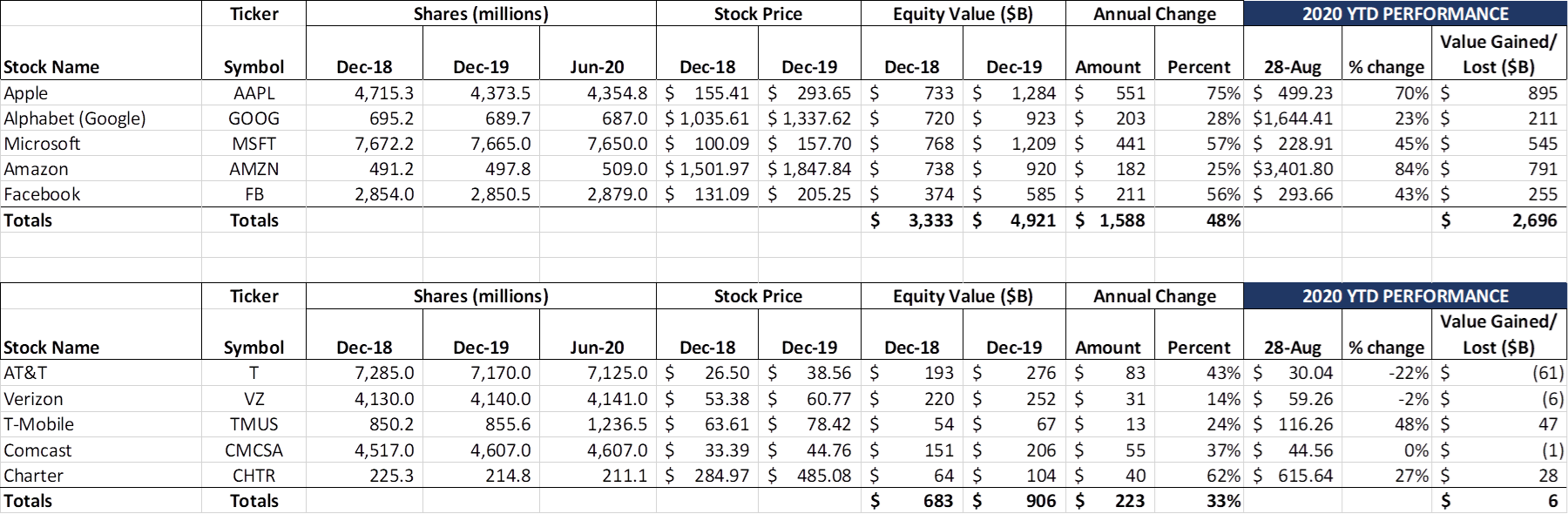

Another week, another $300+ billion of value created for the Fab 5. This time, however, value was not disproportionately created by one Fab 5 stock – everyone but Apple had excellent weekly gains (Alphabet +$44 billion; Microsoft +$122 billion; Facebook +$78 billion; Amazon +$60 billion). Over the past 12 weeks, the Fab 5 has averaged $168 billion in value creation each week. These five stocks have an equity market cap of $7.6 trillion, up from $3.3 trillion at the beginning of 2019 (a mere 21 months ago).

The Telco Top 5 also had a small celebration this week as their year-to-date performance entered positive territory. This represents roughly a $200 billion bounce back from mid-March levels. Comcast had the greatest equity appreciation for the week (+$7 billion) and, with Verizon, are on the verge of entering positive territory for the year. For those of you who are interested in the relative valuation gaps, AT&T is now worth $68 billion more than T-Mobile USA, slightly better than the $70 billion figure a few weeks ago. And Verizon is worth $31 billion more than AT&T as of Friday’s close (Ma Bell was worth $24 billion more than Big Red at the beginning of the year).

The biggest economic event of the week was Fed Chairman Powell’s speech, in which their dual mandates of full employment and low inflation were redefined (transcript here). Of greatest note was the Chairman Powell’s take on the role of inflation and their overall adherence to a 2% average. While lengthy, here’s the inflation recommendation:

“We have also made important changes with regard to the price-stability side of our mandate. Our longer-run goal continues to be an inflation rate of 2 percent. Our statement emphasizes that our actions to achieve both sides of our dual mandate will be most effective if longer-term inflation expectations remain well anchored at 2 percent. However, if inflation runs below 2 percent following economic downturns but never moves above 2 percent even when the economy is strong, then, over time, inflation will average less than 2 percent. Households and businesses will come to expect this result, meaning that inflation expectations would tend to move below our inflation goal and pull realized inflation down. To prevent this outcome and the adverse dynamics that could ensue, our new statement indicates that we will seek to achieve inflation that averages 2 percent over time. Therefore, following periods when inflation has been running below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”

This seems subtle, but it appears from this statement that during economic recoveries, the Federal Reserve will be less likely to pull the tight monetary policy lever. This opens up the door for a lot of value creation opportunities in asset-intensive industries like telecom.

For example, it was only a few years ago that the telecom industry was navigating the perfect storm of unlimited pricing plans, net neutrality regulation (which included throttling) and the advent of phone installment pricing (vs device subsidies). During this time, ARPUs plummeted (see nearby chart from this 2017 Wall Street Journal article). Over the 3-yr period from the beginning of 2015 to the end of 2017, the wireless services index fell by over 20% (source: St. Louis Federal Reserve index here).

Could a bit of inflation, even if it is manifested through price stability as opposed to increases, impact valuations in the telecom industry? Could the relative value of debt (versus large cash balances) be a good thing? Could pension obligations (still a meaningful balance sheet item for AT&T and Verizon) actually diminish because of higher nominal returns?

None in the industry is holding its breath on higher prices. But the thought that a $35/ line rate could go to $38 or $40 because of increased prices across other economic goods and services is intriguing to say the least for a capital-intensive industry like telecom. Since nearly all of us (including yours truly) can’t remember when the CPI was last above 5% (answer here from the Bureau of Labor Statistics – July 2008), it’s hard to think about managing businesses in an age of higher inflation. Time to bone up on inflation, because Chairman Powell just gave higher prices a green(er) light.

Auction 105 ends – the era of sharing begins – who cares?

Auction 105 ends – the era of sharing begins – who cares?

After just over a month of bidding, the CBRS auction came to a close last Tuesday. Nearby are the final stats after the 76th round as provided by Sasha Javid (website here). Just under $4.6 billion in winning bids were placed. Final winners should be announced next week.

Most readers of The Sunday Brief are familiar with this license band (LTE Band 48) and have seen it implemented on many new devices including the iPhone 11, iPhone SE and high-end Samsung models. As a result, to some this is just another mid-band capacity augment using a global band.

To others, CBRS represents an opportunity to pioneer private networking. Given sub-leasing rights for PAL licenses (discussed extensively here by Federated Wireless’ Iyad Tarazi), companies could run secure on-prem IoT and other applications without having T-Mobile, Verizon, and AT&T as their primary vendor. If the PAL winners are companies like Dish, Google, Deere, or Chevron, private networks could be in the future. If those companies or others are relegated to GAA (best efforts access available for everyone) because Verizon and cable companies won the vast majority of Priority Access Licenses, then momentum could be muted.

We see a third opportunity with the auction results which is universally terrific for the industry as a whole – shared spectrum usage. As we outlined in a Brief a year ago (here), having multiple wireless carriers sharing spectrum creates a more competitive environment, prevents spectrum squatting, and saves cash for other things like improved coverage. The telecom industry shares common conduits (a sub-duct for each provider), towers, and construction crews – why not share the actual spectrum itself?

One last note: While we will look at winners and losers in the September 13 brief, conventional wisdom is that Verizon emerged as an overall winner. What’s intriguing to us is the lack of affordable devices equipped with LTE Band 48. We searched through the Verizon online device catalogue and, with the very notable exception of the newly released iPhone SE ($400 MSRP), found no devices below $500 enabled with CBRS. Perhaps CBRS will be used by Verizon as a fast lane, but we see this as a gap.

Nationalism, spectrum, and presidential preference – telecom policy under Trump

Last week, we looked at the Democratic Party platform (though the Biden-Sanders task force recommendations) and concluded that there will be a lot of continuities between the last four years and those of a new administration. Outside of more union labor driving up overall costs, and the obligatory threat to move the entire industry to Title II regulation if they throttle or block traffic, there weren’t a lot of “sharp turns” expected to rock the industry.

It’s highly likely that a Biden administration would continue to expand spectrum auctions (perhaps with a union construction requirement), take a soft touch on the Fab 5, and steer clear of price controls (including mandated symmetric bandwidth requirements for cable and fiber providers). And, even with the increasing potential of a Blue Wave, sweeping telecom legislation would be low on the priority list. These are a few of the reasons why we titled last week’s column after a line from The Who classic “Won’t Get Fooled Again” – Meet the new boss… same as the old boss.

Predicting telecom policy under a second Trump term (assuming a split legislative branch) is very difficult because of the current administration’s individualized take on each of the companies. To the president, AT&T is the owner of “fake news CNN” and “Concast” is a part of the “NBC fake news family.” And who could forget the 2015 Tweet fight between Trump and John Legere detailed here. With Amazon’s CEO Jeff “Bozo” Bezos now owning The Washington Post, there are plenty of tweets to describe the current President’s feelings (a history is here).

On the other hand, there seems to be a more diplomatic co-existence between President Trump and CEOs like Tim Cook of Apple (Tweet history here) and Satya Nadella (history here). We could find no history of Tweets between either Lowell McAdam or Hans Vestberg (the last two CEOs of Verizon), and our understanding is that there’s a “friendly”relationship between Tom Rutledge and President Trump (see pic nearby – Mr. Rutledge is to the right of the President in the picture – as well as this YouTube video).

On the other hand, there seems to be a more diplomatic co-existence between President Trump and CEOs like Tim Cook of Apple (Tweet history here) and Satya Nadella (history here). We could find no history of Tweets between either Lowell McAdam or Hans Vestberg (the last two CEOs of Verizon), and our understanding is that there’s a “friendly”relationship between Tom Rutledge and President Trump (see pic nearby – Mr. Rutledge is to the right of the President in the picture – as well as this YouTube video).

With these numerous presidential CEO “preferences,” what could Trump do to further telecom policy? At the top of the administration’s list is 5G and American business productivity. They are committed to having more communications network development and reducing barriers to deployment (less permitting resonates with Trump’s commercial real estate background). In a perfect world, all of the 5G software developed for 5G networks deployed in the US would be owned and managed by American companies (we could not find where this had been explicitly stated, but here’s a Wall Street Journal article that gets close).

Improving America’s manufacturing and supply chain capabilities is an important priority for a second Trump term. The administration’s focus will be on recovering from COVID-induced job losses while resupplying hospitals and other areas with materials and infrastructure. How successful a second term will be in this particular area depends on Trump’s relationships with governors and the business community alike. For more on the administration’s efforts, click here for the March 2020 National Strategy to Secure 5G.

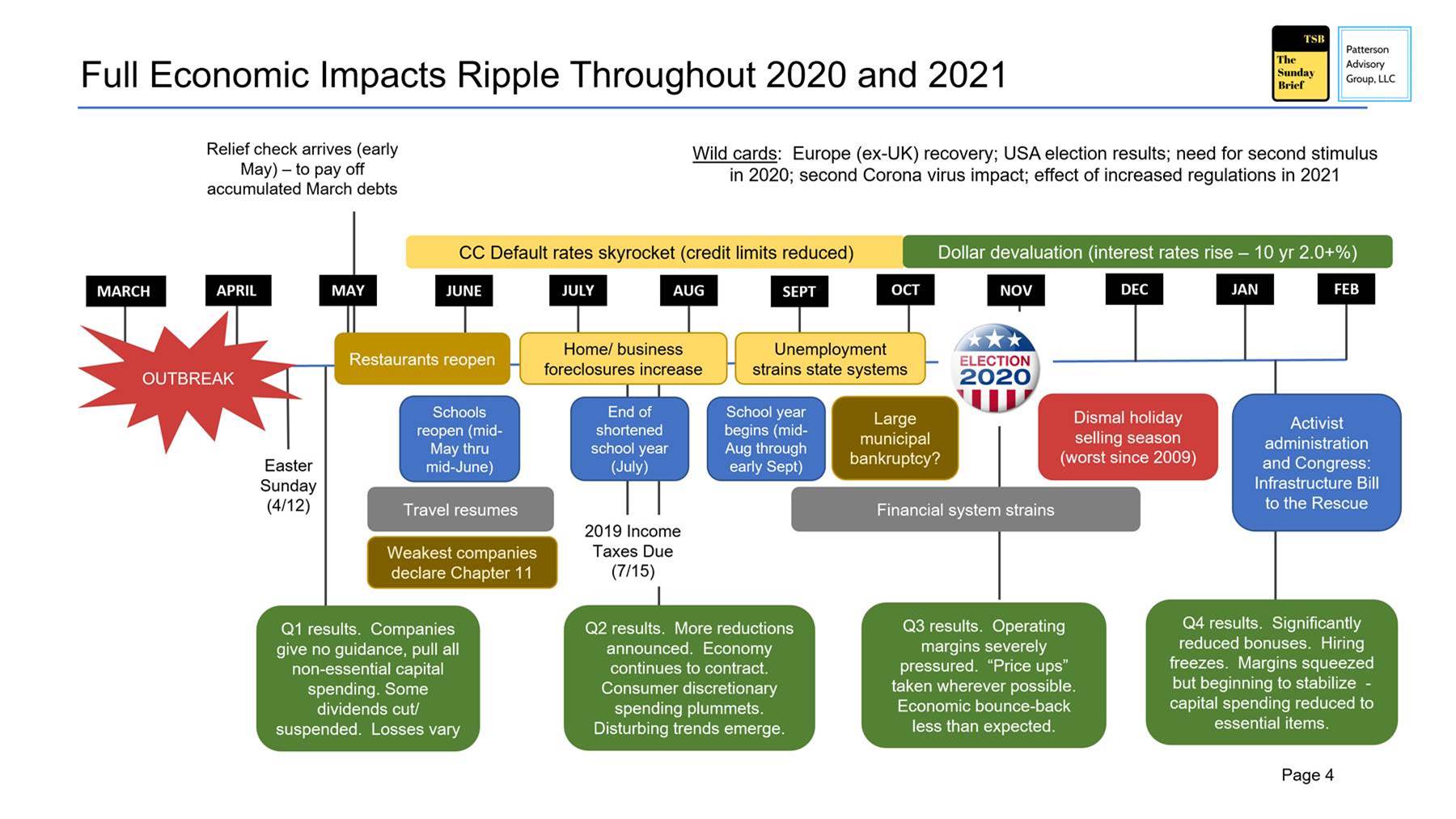

Many of you have asked us over the summer when we thought an infrastructure bill would transpire. As a reminder, when we discussed The Essential Economy during several Sunday Briefs, we developed the following timeline:

Our view is that infrastructure spending (which may or may not include telecom) is going to pass after the election, with the earliest possible date of February 2021. While parts of this timeline (developed mid-March) have changed (see here for the recent credit limit reduction news and here for the dollar devaluation trends), we think that there’s too little time for Congress to do much more than pass a budget and increase unemployment benefits in September.

We would not be surprised to see a second-term Trump administration make roads, bridges, and major airports a priority. We would also not be surprised to see more spectrum readied for auction, with less union construction requirements attached to winning bids than a Biden administration. Presidents as a whole are less inhibited during their second term as thoughts turn to legacy. We are not sure if the President views his second term through this lens, but a more mellow tone is likely not in the cards.

Bottom line: 5G and American productivity is critical second term Trump administration priority. Likely more spectrum auctions (many bands possible) with focus on sharing capacity between carriers. The M&A environment will be very friendly for smaller mergers, but don’t expect anything larger than a Cox-sized merger to make it through the approval process (divestitures, like the DirecTV rumors that began circulating late Friday, are an entirely different matter).

Updating the U-Haul Index: Is the great American move off for now?

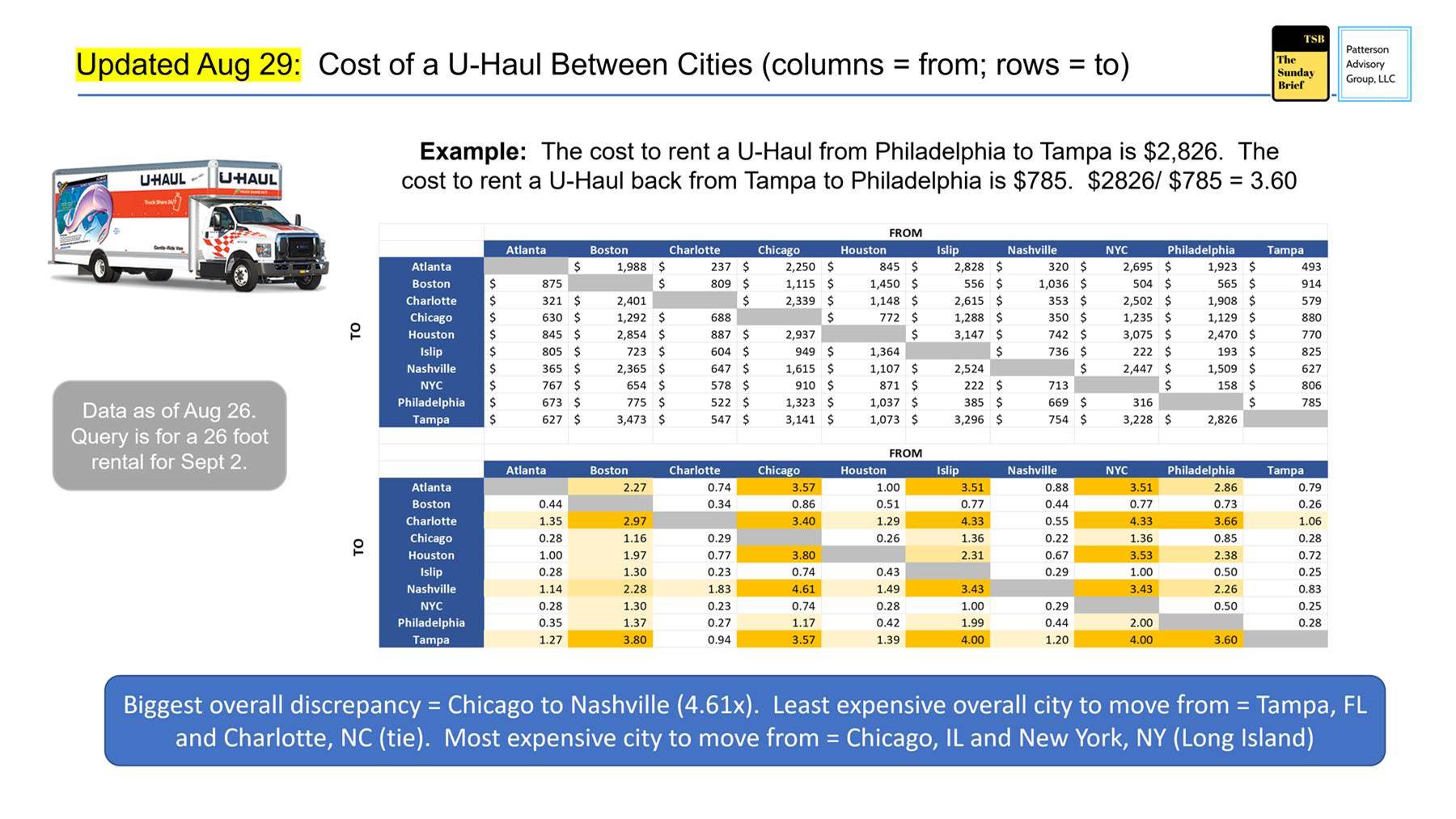

During the worst of the pandemic, we devoted a portion of the May 10 Sunday Brief to the acceleration of moving activities from the North (Central and East) to the South (excluding California). That study looked at the cost to rent a 26 foot U-Haul truck between 10 pairs of cities. Here’re the results from the latest survey:

As we had suspected when we put this together back in May, there were still some lingering COVID-19 health concerns driving extreme figures (in May, it was 7.44x more expensive to rent a U-Haul from New York to Nashville than to rent the return trip; that figure today is 4.61x which is still high, but lower).

Notable changes from the May survey are as follows:

- Boston became more expensive to move from to every market. In the May survey, Boston had a ratio > 1.0 to four of the nine markets. In August, that turned to nine out of nine (although their ratios to Tampa and Charlotte came down slightly). This is surprising as Massachusetts handled the virus very well and has not seen a lot of civil unrest/ looting/ demonstrations in recent months.

- In Charlotte and Tampa, the move from/ move to gap shrank in 17 out of 18 markets. Still large ratios moving from any of the other large Northeast markets to Charlotte or Tampa, but they are dropping.

- Chicago and New York remain the cities with the greatest supply/ demand imbalance (and to the same markets). NYC to Atlanta, Charlotte, Houston, Nashville, or Tampa is at least 3.4x more moving from the Big Apple than to it.

The bigger story appears to be the diaspora to the suburbs and exurbs than across the country (Apple’s latest data is here – try Ashe County, NC (the mountains) or Horry County (South Carolina beaches) to see the dramatic changes since the pandemic), but there’s plenty of evidence to show that the “move from” vs “move to” ratio is favoring certain markets over others.

Bottom line: There’s more reality to the Great American Move than most people think. With less “in office” required time, if Internet infrastructure is robust (a big condition), then many temporary getaways will turn into permanent relocations.

That’s it for this edition of The Sunday Brief. Next week we will take a Labor Day break, then come back on September 13th with CBRS Auction 105 winners and losers. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!