September greetings from Davidson, NC, and Denver Colorado, where the Mile High weather conditions were simply “smoky.” This week’s opening picture shows last Thursday’s Denver skyline against the white backdrop of smoke, adding another reason to wear a mask. The beautiful views of the Rockies were completely hidden. Truly amazing.

September greetings from Davidson, NC, and Denver Colorado, where the Mile High weather conditions were simply “smoky.” This week’s opening picture shows last Thursday’s Denver skyline against the white backdrop of smoke, adding another reason to wear a mask. The beautiful views of the Rockies were completely hidden. Truly amazing.

This week’s Sunday Brief will focus on comments by many telecom executives on the quarter. We will also examine the impact of Verizon’s Tracfone acquisition (announced last Monday) and analyze the first public comments from CBRS license winners.

One editorial note: Next week, we will hand the Sunday Brief pen over to a very well-known guest writer as the Editor and I will be on a weekend getaway. You will not want to miss it.

The week that was

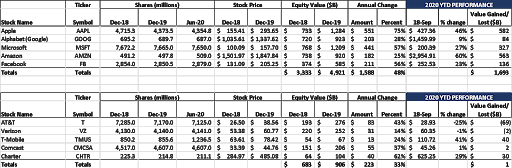

The Fab 5 continued to give back their early summertime gains and have now lost a cumulative $1 trillion over the past three weeks. As we mentioned last week, all but the shortest-term investor is still in great shape, however, with current prices reaching levels not seen since ~July 1 (80 days) in the case of Google, Microsoft, and Amazon and ~Aug 1 (50 days) in the case of Facebook and Apple. The story is the same as last week – stock values got too high in July and August and adjusted in September.

The Fab 5 continued to give back their early summertime gains and have now lost a cumulative $1 trillion over the past three weeks. As we mentioned last week, all but the shortest-term investor is still in great shape, however, with current prices reaching levels not seen since ~July 1 (80 days) in the case of Google, Microsoft, and Amazon and ~Aug 1 (50 days) in the case of Facebook and Apple. The story is the same as last week – stock values got too high in July and August and adjusted in September.

Meanwhile, the Telco Top 5 had a fairly strong week, buoyed in large part by encouraging comments by Comcast CEO Brian Roberts and Charter CEO Tom Rutledge at the 29th Goldman Sachs Communacopia conference. We’ll cover the comments below, but it’s important to note that $7 of the $8 billion week-over-week gain in the Telco Top 5 came from Comcast and Charter.

Apple had another virtual industry event this week that focused on a new Apple Watch Series 6 (which now features blood oxygen monitoring), new iPad (with a more powerful processor), and bundles largely aimed at families (The Verge has a good summary article on the launch here). Apple also introduced a new family configuration called Family Setup (announcement here). While this software update does a lot of things, the most relevant paragraph in Apple’s announcement to the telecommunications industry is here:

“Kids and older family members of the household using Family Setup will have their own phone number through a separate cellular plan, and by using their own Apple ID, they can follow their schedule and family events using Calendar, learn to manage tasks with Reminders, view photo albums synced from a guardian’s iPhone, and more. With the new Apple Cash Family, parents can securely send their kids money to spend on their watch using Apple Pay. Parents can choose to receive notifications when their kids pay, and view their child’s purchases right in Wallet on their own iPhone.”

Wireless carriers are eager for additional phone line additions (particularly for kids), with all three major carriers supporting a $10 monthly price point per connected smartwatch (T-Mobile details here, Verizon details here, and AT&T details here). Also, in what is more of a “sign of the times,” all Apple Watch Series 6 and SE orders had to be placed online – no in-store sales (and, according to our Charlotte-area channel checks, no demo devices for the stores).

Online-only Apple Watch availability appears to have had no impact to Verizon sales – as of Saturday a.m. (Sept 19), there was a minimum 10-day wait for each Series 6 color and an even longer wait (longest a month) for certain colors and sizes. T-Mobile and AT&T had fewer models/colors on backorder during our Saturday lookups. Bottom line: The lack of a 5G iPhone announcement gives the Apple Watch (and Family Setup) more time to shine. Initial sales appear to be exceeding expectations, particularly at Verizon. With no multi-line discount, Family Setup should be a very profitable addition to carrier plans.

Why did Verizon acquire Tracfone?

In a week that featured several blockbuster acquisitions (including Softbank’s proposed sale of Arm Holdings to Nvidia for $40 billion and an announcement that Softbank will also divest of most of its holdings in money-losing wireless logistics company Brightstar, Verizon’s Tracfone acquisition almost got lost.

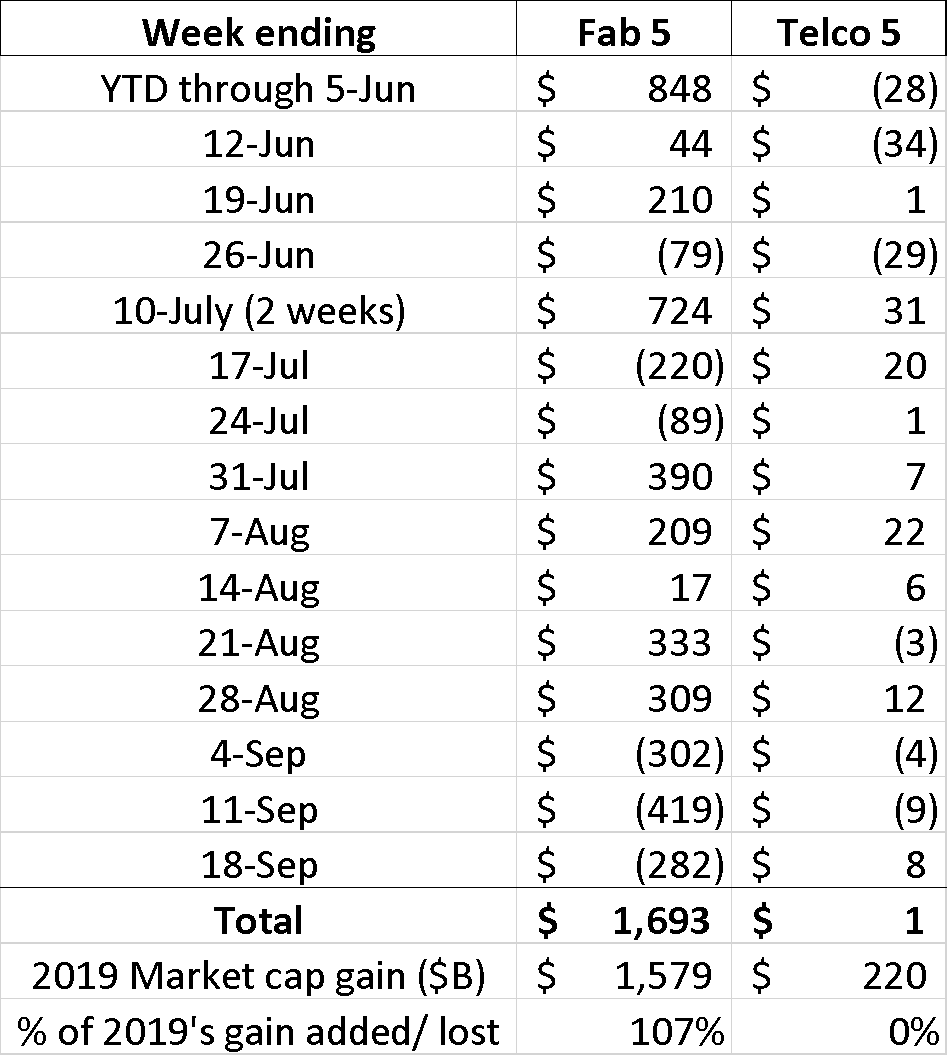

For those of you who missed Monday’s announcement, it’s here. The numbers are telling: Verizon is acquiring an MVNO (Mobile Virtual Network Operator) that already uses Verizon for 62% of their customers (13 out of 21 million). From this perspective, the acquisition preserves a highly profitable revenue base and also allows the wholesale base to grow an additional 8 million subscribers (which, assuming cost of sales at $18 for the $28 ARPU, would represent about $1.7 billion per year in wholesale revenue value). Here’s a snapshot of the Tracfone’s US performance per America Movil’s second quarter earnings report:

While second quarter earnings trends are more indicative of pandemic retail closures than they are of economic trends, it’s important to note that Straight Talk (distributed through Walmart) is growing at over 4% year/year while all of the other MVNO brands (excluding SafeLink, their lifeline brand) are shrinking by nearly the same amount. ARPU also continues to grow as customers increasingly are selecting unlimited plans (Straight Talk plans are here). With lots of distributor changes, however (e.g., T-Mobile’s Metro dealer disputes, Boost Mobile’s sale to Dish), Verizon inherits a new, large, struggling, high-maintenance channel.

With all of these puts and takes, why did Verizon acquire Tracfone? Verizon’s CEO, Hans Vestberg, addressed this at the Goldman Sachs conference this week (full transcript here):

“As a — part of the Network-as-a-Service strategy was, of course, to broaden out and see that we’re using the network in the best way. We think we have a unique sort of competence in running networks and customer innovation. We have been #1 in the premium segment. We now are going to be the #1 in the value segment. We think we can scale everything in the back office in order to make this even a better experience for our customers, everything from our network, to our innovation, to the distribution and all of that. And that’s why we think this is a good fit.”

Simply put, in Verizon’s view, it’s a base that they believe they can manage better than Tracfone. Eight million additional customers will add nationwide scale, and, even with integration costs, it should be accretive to Verizon shareholders within a year (we think sooner than that if the $18/ subscriber revenue opportunity is accurate).

There is little doubt that the cash outlay for the deal can be easily recouped (America Movil’s payment is $3.125 billion in cash and another $3.125 billion in Verizon stock), but MVNO cash flow preservation is, in our view, a small part of the overall value to Verizon. First, Big Red needed a vehicle to test various value propositions without writing down their current retail base. Visible and Yahoo! Mobile were not going to be able to gain broad-based appeal without a price war. Tracfone brings local distribution to the table, which allows Verizon to target specific products and offers.

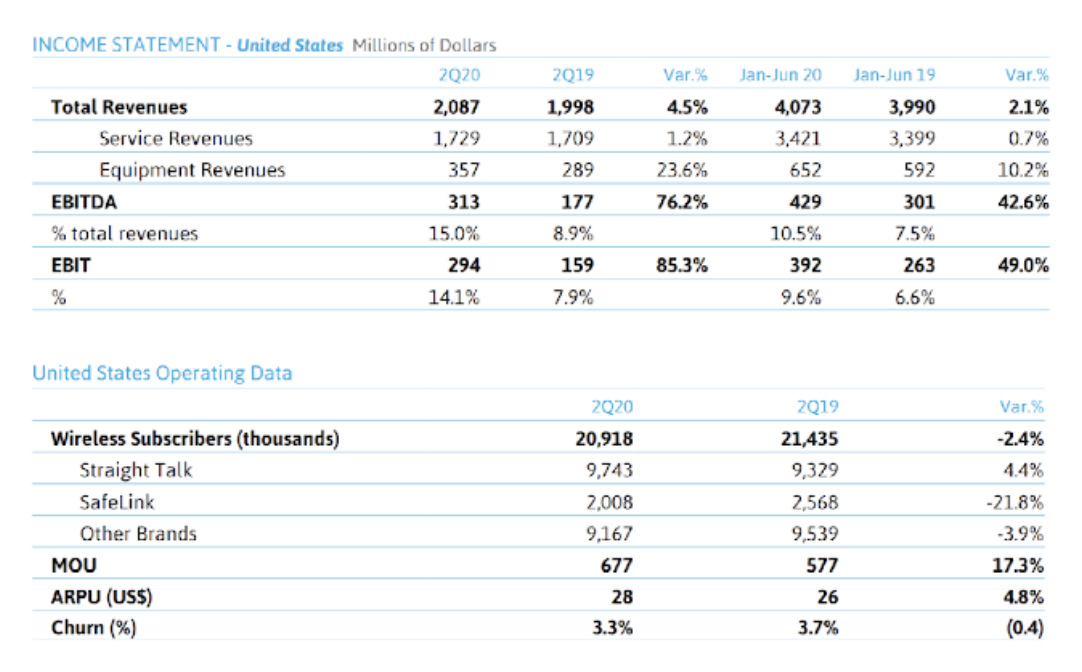

Specifically, we think that Tracfone’s distribution could help Verizon’s 5G fixed wireless efforts. For those of you who are unaware of their buildout progress, city maps can be found here. One of the city buildouts is in the Corktown (mostly industrial) neighborhood in Detroit. Here’s the Verizon 5G map (left) and the Zillow Home Value Index (ZHVI) for zip code 48216:

This is not a high-end housing network deployment, but rather a middle-class neighborhood. The nearest Verizon store is in downtown Detroit (1.1 miles away). But there are three independent wireless dealers in this zip code, each of whom would be very interested in helping Verizon grow their fixed wireless access (FWA) base. Verizon did not need distribution synergies to justify the Tracfone deal, but Page Plus Internet could be coming to Corktown very soon.

On top of this, the Tracfone transaction boosts Verizon’s relationship with Walmart. In late May, Light Reading ran an article (here) outlining the growing relationship between the two companies as Walmart looked to deploy localized data centers, remote telehealth solutions, and in-store cameras. With the Tracfone transaction, Verizon “owns” part of the electronics department. Could “store within a store” be far behind (using one of the Tracfone brands), combining one of the biggest winners from the COVID-19 pandemic with one of the strongest brands in prepaid wireless (Straight Talk)? And, with Walmart still in the running to be a minority owner of the TikTok US subsidiary, could we see Verizon bundles featuring either the Walmart app or TikTok or even Walmart Plus?

Bottom line: Verizon shareholders should be very happy with the stated reasons for the TracFone deal and should be even happier when they realize that Tracfone’s distribution enhances Verizon’s FWA distribution efforts and increases the ties with America’s largest retailer. This is a transaction with a lot of upside.

What pandemic? Telecom 3Q earnings preview (Part 1)

This week, Goldman Sachs held their 29th Communacopia conference and telecom was well represented (Hans Vestberg, Brian Roberts, Mike Sievert/ Neville Ray/ Peter Osvaldik, Tom Rutledge, and John Stankey all attended virtually). We will split our analysis across several Briefs, but here are the themes that were emphasized from their presentations:

- Even as COVID-19 lockdowns abate, home connectivity continues to be paramount. Broadband volumes will grow, and ARPUs will also grow. This overachievement will help cable and AT&T/ Verizon offset SMB softness and company-specific issues (Cord cutting, WarnerMedia, NBC Universal, and theme parks). Everyone’s boat rises, but cable’s yacht will rise even more than expected.

- Every company is rethinking the role of distribution, and the percentage of permanently closed stores will be larger than expected. Along with decreased advertising, this will be the common 2H 2020 project across every company (with less cost opportunity for cable). AT&T and T-Mobile appear to have the largest opportunities.

- Consumer High Speed Internet self-install is here to stay, and its impact will drive meaningful EBITDA improvement for cable and, to a lesser extent, Verizon and AT&T.

- The cable companies are serious about deploying Citizens Band Radio Spectrum (CBRS) to offload increasing amounts of traffic from Verizon. Companies who deploy Priority Access Licenses will also take advantage of the 80-150 MHz of Generally Available Access (GAA).

- As we have seen in our Telco Top 5 stock price performance analysis, AT&T will likely perform differently than the rest of the market. Many factors, including a substantial reduction in workforce that occurred throughout the summer as well as languishing satellite and WarnerMedia metrics, will drive their relative underperformance. We also believe that HBO Max launch statistics (specifically net new revenues to HBO from the product) will be weaker than most expect (especially when compared to Comcast’s Peacock launch).

- Political advertising cash flows represent a significant tailwind for both cable and AT&T (Verizon to a smaller extent based on the most competitive races).

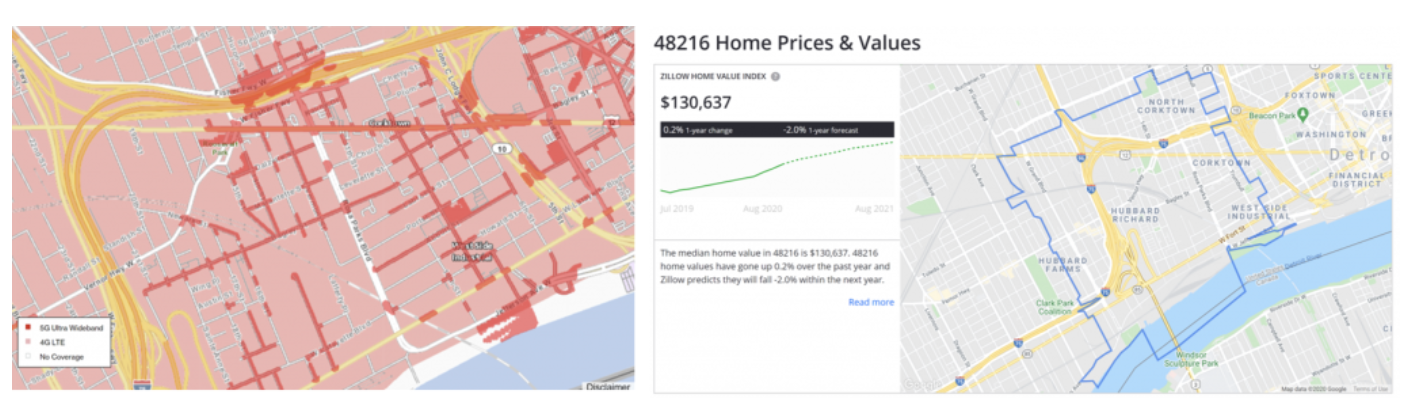

With respect to broadband, Comcast CEO Brian Roberts surprised everyone at the Goldman Sachs conference with the following proclamation (Brett Feldman of Goldman Sachs asked a follow up question about the performance of Comcast’s portfolio):

“I think I have some good news in that regard. Broadband is doing much better than I thought, we thought, and frankly perhaps everyone thought. If you look back to the first quarter of 2008, the single biggest quarter of net adds was 492,000 in that quarter. I am pleased to say that we are going to beat that this quarter. We are already looking at over 500,000.”

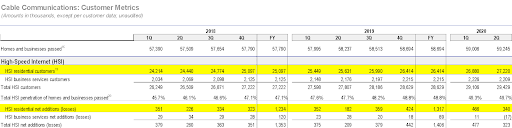

Here’s the current trend line for Comcast broadband net additions for the last several quarters:

Adding 520,000 or 530,000 customers would represent a 35-40% acceleration in net additions (first three quarters of the year) versus 2019 when the economy was strong (first three quarters of 2019 was 4% lower than 2018 but a super-strong 4Q helped put them ahead on a full year basis). Double-digit net addition growth (e.g., 15%) would have been great, but 35-40% is phenomenal. Internet is a high gross margin product as well, and, as Brian articulated in his opening comments, helps to set the stage for the other two legs of the consumer platform: aggregation (think Apple TV and Roku competitor sold as X1 or SkyQ) and streaming (Peacock). Accelerating profits in broadband fuel faster growth in aggregation and streaming.

What if you had all of this growth but did not have the overhang of theme parks, entertainment production, and broadcast channels? Then you would have Charter. Tom Rutledge also spoke at Communacopia, and, while not sharing specific numbers, reiterated Brian Roberts’ broadband comments with the simple statement “So far, so good.” Tom also spoke to lower broadband churn (driven in part by less moving, which is interesting given news reports to the contrary, specifically out of New York City), and then made this comment about satellite as a broadband growth source:

“The continued decline of satellite video actually helps us in the marketplace in the sense that a lot of video customers who kept DirecTV or Dish didn’t subscribe to our broadband, and as they become loose from their satellite relationships, they are reevaluating their broadband connections. That’s affecting us in a positive way.”

So as Hulu, YouTube TV or Amazon Prime grow as a replacement for satellite TV, so does cable’s ability to disproportionately grow their High Speed Internet base. This seems intuitive, but, as we see the DirecTV base crumble, there’s a potential secondary impact to AT&T – fewer broadband connections. This reinforces the fifth theme above and could be one reason why Ma Bell has not unloaded DirecTV yet. We will devote much of the October 4th Brief to John Stankey’s comments at the Goldman Sachs conference, but Tom’s insights really help square the circle.

We could write a lot more, but that’s it for this week’s Brief. Look for our special guest columnist next week!

Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe, keep your social distance, and Go Chiefs!