A so-called 5G+ combination of edge computing, data analytics, and private networking will drive the global economy upwards by seven percent, potentially, or $8 trillion, in 2030. So says a comprehensive-looking new study by Nokia and Nokia Bell Labs, which also reckons spending on private 5G will outrun investment in traditional ‘public’ 5G cellular in the period.

The report, available here, says this 5G+ ecosystem will spur the digital transformation of ‘physical industries’ in the next decade, transforming them into “augmented physical industries” — and putting their innovation drive, at last, on a par with already-mature digital industries. For ‘physical industry’ read: the broad Industry 4.0 movement, effectively, plus a loosely-termed smart city landscape, capturing the public sector, transportation, and healthcare.

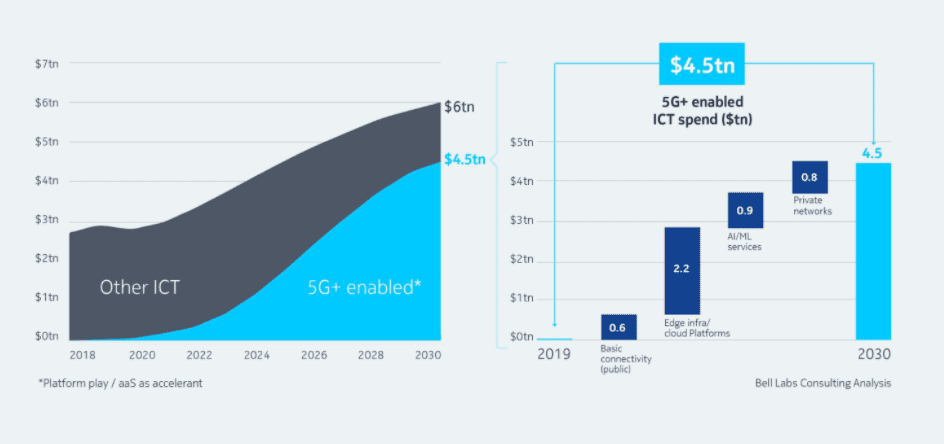

These incoming technologies — essentially, IoT sensing and AI sense-making tools, powered by edge and cloud infrastructure, and glued together by industrial-grade private 5G networks in most cases — will spark the “lion’s share” of ICT spending in physical industries, the study claims. Annual global ICT consumption is forecast to increase from $2.8 trillion in 2020 to $6 trillion by 2030.

5G+ technologies, applications, and services will contribute 75 percent of this figure, or $4.5 trillion. Of this, edge and cloud hardware and platforms will have the largest share, at 49 percent ($2.2 trillion), and private networks and AI (and machine learning) services will run practically neck-and-neck, contributing 18 percent and 20 percent ($800 billion and $900 billion) of investment, respectively.

Basic connectivity — which includes wide-area mobile-and fixed-network services, and ‘unified communications’– comprises $600 billion, or a little over 13 percent of the total spend — significant on its own, but a relatively minor sum considering the total 2030 investment, as well as its historical significance in the digital economy.

Nokia Bell Labs said this ‘fourth industrial revolution’ will spark a “big value inversion”, realized in safety, productivity, efficiency, and resiliency gains, as well as in new jobs, higher wages, and a richer public sector. “5G+ is the new enterprise ICT and industrial operations technology (OT) infrastructure, designed to revive latent demands and trigger a new phase of growth across our physical industries,” it said.

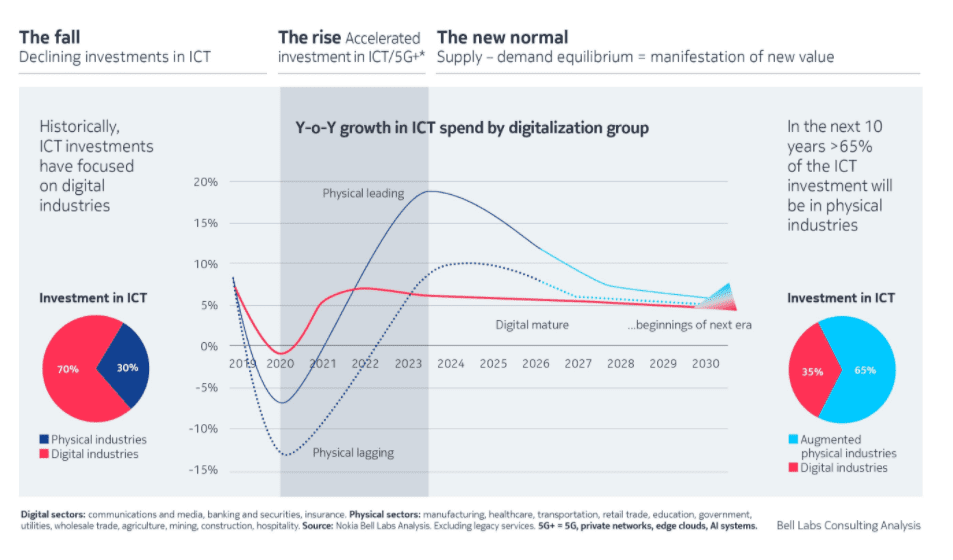

Digital industries have outspent physical industries at a rate of 70:30 in recent years, the story goes, despite having only 25 percent of the workforce and contributing only 30 percent of GDP. While overall ICT spending is projected to grow 6.5 percent annually over the next decade, the rate of investment will be 40 percent greater in physical industries compared to digital industries, said the report.

Importantly, the COVID-19 pandemic is considered to be a turning point for physical industries to drive digital change. Digitally ‘mature’ digital industries coped better during lockdown, by comparison. The rate of ICT spending will shift to a 35:65 ratio, from here, restoring parity with the relative GDP contribution of the two sectors, said Nokia Bell Labs. The firm has charted the investment period, post COVID-19 (outbreak) in three phases: the fall, the rise and the ‘new normal’.

It said: “The first of these reflects the near-term decline in investment as enterprises and industries reacted to the economic challenges of the pandemic; the second, a period of accelerated investment expected in the next three years as enterprises seek to expedite digitalization; and the third, a new, steady-state equilibrium.”

It added: “That $4.5 trillion investment in 5G+ technologies will trigger a concomitant $8 trillion growth in global GDP in 2030, or a seven percent increase in overall GDP, measured in terms of workers’ wage growth, enterprise profitability growth, and government revenue growth.”

Through this 5G+ period, cellular 5G — and private 5G in most cases — will become a “general purpose technology” at the heart of the “innovation ecosystem”. Nokia Bell Labs commented: “It will transform all industries… This will have two fundamental effects: parity will be achieved between the ICT investment and GDP contribution of industries, and value creation will be catalyzed across industries and, ultimately, throughout the global economy.”

Meanwhile, the market analysis goes with a new poll by Nokia into the state of the industrial 5G market, which quizzed 1,628 “purchasing decision makers” in six industrial sectors, across six (mostly advanced) economies. It took feedback from respondents in the energy and utilities (208 responses), mining (119), manufacturing (455), public sector (271), healthcare (445), and transportation (130) sectors; and companies based in Australia, Finland, Germany, Japan, Saudi Arabia, South Korea, the UK, and the US (with responses split roughly evenly between).

It found companies at an “advanced level of 5G adoption” — classified as either in ‘expansion’ or ‘implementation’ mode — were the only group to experience a net increase in productivity (of over 10 percent) following COVID-19, and the only group able to maintain or increase customer engagement during the pandemic.

In total, 49 percent of organisations in ‘expansion’ with 5G and 37 percent in ‘implementation’ achieved “rapid growth” in their businesses in 2019; this compares with 20 percent claiming “rapid growth” in the ‘planning phase’, 11 percent in the ‘discovery’ phase, and just five percent with ‘passive’ interest in 5G.

Apparently (despite the novelty of 5G, still, and the fact its more game-changing industrial-grade capabilities remain a couple of years off), 50 percent of companies are at the midway level on 5G readiness, between initial planning, trials and deployment, compared to just seven that are classed as 5G mature — in implementation or expansion. Almost three quarters (72 percent) of large companies in advanced economies will invest in 5G over the next five years.

Perhaps surprisingly, the markets with the highest proportion of “5G mature” companies was Saudi Arabia, in country terms, and the healthcare sector, in industry terms. These also had the largest share of growing companies in each case (83 percent and 80 percent respectively, compared to an overall average of 73 percent). Geographic variations were notable; 13 percent of organizations in Saudi Arabia and 12 percent in the US rated as mature, compared to four percent, three percent, and two percent in the UK, Germany, and Finland, respectively.

Raghav Sahgal, president at Nokia’s enterprise division, said: “While many companies see 5G as a technology for the near future, deployment varies by organization, industry and geography. Most organisations are at the implementation stage – for most, this means trials, pilots or early stage deployments, for example, in mining applications to improve the safety of workers, in power utilities remote control of physical assets to avoid wildfire ignition, or in manufacturing supply chain resilience.

“Yet, we still have to realise the true breadth, depth and potential of 5G. Organisations [don’t] have to wait to reap the benefits. Those who have prioritised and begun deployment of private [LTE] within their business appear to be deriving clear operational benefits today. We believe this demonstrates the importance of linking 5G as a technology to broader business outcomes. If an organisation aims to capture revenue growth at some point, it needs to reinvent itself and look for new business and operational models, because an old one can only grow so far.”