1 | FedEx + BLE – for tracking vaccine shipments

FedEx has introduced a new Bluetooth based asset tracking system in time for anticipated shipping of COVID-19 vaccines, as well as for other emergency pharmaceuticals and medical supplies. Customers in the aerospace and retail sectors will also be able to access location data from the new tracking system, from initial launch in the US.

Its new SenseAware ID solution uses a compact lightweight sensor to transmit location data every two seconds over a Bluetooth Low Energy (BLE) connection. The signal is received by BLE beacons in the FedEx Express network in the US, and transmitted to the cloud via Wi-Fi access points, or other wired or wireless gateway devices.

SenseAware ID sensors are tracked hundreds of times, versus dozens of times with traditional package scanning protocols, said FedEx. As well as positioning data, the company suggested other environmental data will also be available, such as for temperature, humidity, and vibration. Customers will be able to “proactively” monitor and protect shipments, including cold-chain storage, thermal blankets, and temperature controlled containers, it said.

It is unclear whether the solution also relies upon GPS and / or cellular positioning for outdoor connectivity, when out of range of BLE beacons and Wi-Fi hotspots.

The initial roll-out will see SenseAware ID sensors applied to next-day (First Overnight) FedEx Express shipments in the US. Customers in the healthcare, aerospace, and retail industries will receive access to the new location data from November 2020. Access will be expanded through the first half of 2021, and offered eventually with a range of premium delivery services.

2 | Michelin + Sigfox – for tracking container shipments

French tire manufacturer Michelin has implemented a solution for tracking sea-freight containers, based on compatriot connectivity firm Sigfox’s narrowband IoT network. The new tracking solution provides freighters with a geolocation fix on their containers, going from their point of departure to their final point of call.

It also offers alerts about delays, and is being integrated with temperature and tamper monitoring, as well as geo-fencing. The set up includes IoT trackers, low-power networking, plus the analytics platform to gather and interpret data. Sigfox said that the new offering can be used with high numbers of containers.

The duo claim international container shipments can involve more than 200 interactions and more than 25 entities, including freight-forwarding, in-land transportation, port handling, customs, and shipping. Real-time visibility of container assets has been difficult to achieve, so far, they said, leading to inefficient supply chains and, ultimately, to failing customer service.

They suggest their ‘real-time’ tracking solution will improve container scheduling by a margin of up to 40 percent, and reduce “inventory ruptures”, knocking deliveries off course, by up to 25 percent. Michelin is offering the solution, which it co-developed with Sigfox and Argon Consulting over 12 months, to third parties, as well.

Sigfox has busily pursued asset tracking deals in the automotive, pharmaceuticals, luxury goods, aerospace sectors.

3 | Nafta Frigo + NB-IoT – for monitoring cold-chain storage

Mexico-based logistics firm Nafta Frigo specializes in cold chain warehousing and distribution. It has worked with California-based tracking provider Roambee to deliver reliable ‘real-time’ cold chain temperature monitoring for long-haul shipments, including new storage and transport monitoring in ‘deep freeze’ conditions.

The company’s success with cold-chain warehousing and short-haul logistics had seen demand among customers spike for longer-haul deliveries, and its offering to expand from frozen food shipments to deep freeze products. Its rising demand and widening remit forced it to engage with third-party transport and warehousing providers, as well.

Roambee provided a cellular-based tracker and temperature logger for the company to record and send GPS location data and ambient temperature data over either a 2G or an NB-IoT network. The solution dovetails with BLE and Wi-Fi indoors, as well. The point was to enable a live feed, via cellular, to detect spikes in temperature in transit.

The alternative, to download data from sensor devices on arrival, is not an option; the information about spoilage comes too late, and products are discarded, as they would be without any monitoring at all. The Roambee solution also established an automated analytics system to issue live alerts about temperature ‘excursions’, as well as off-track deliveries in case of theft.

In both cases, it has enabled Nafta Frigo to take immediate action to secure and preserve frozen foods, pharmaceuticals, and other temperature-controlled products. Roambee’s cellular-based tracking solution is well deployed in mobile operator channels, including with US carrier AT&T, Canadian operator Rogers Communications, and German outfit Deutsche Telekom.

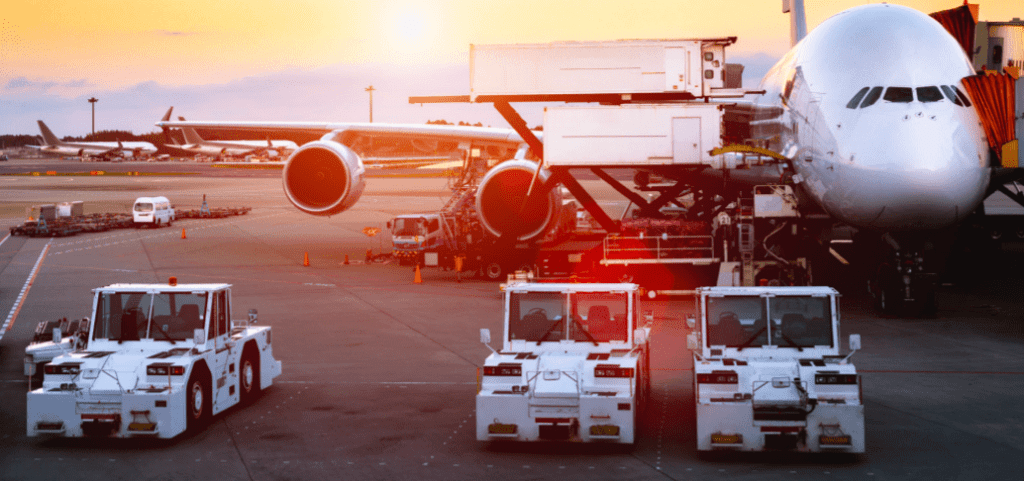

4 | Istanbul Airport + LoRaWAN – for tracking airport assets

Turkish provider Skysens Teknoloji (Skysens) has deployed a LoRa-based solution for GPS-free tracking of vehicles, personnel, and luggage at the new Istanbul Airport. The solution comprised a LoRaWAN network and 3,000 LoRa-based sensors, initially; the plan was to increase the sensor-count to 10,000 by the time the site opened, earlier this year (2020),

Istanbul Airport has an area of 76.5 million square metres, and serves about 100 million passengers a year; it is projected to expand capacity to cope with double that number. The airport’s supervisory control and data acquisition (SCADA) systems monitor infrastructure, but offer no way to track or monitor assets, to check their position, status, or condition.

Skysens has deployed a LoRaWAN network across the site; LoRa-based sensors have been attached to fixed infrastructure, as well as mobile assets, to help with predictive maintenance, asset monitoring, and to enhance the efficiency of airport operations — and to make the airport ‘smart’.

The network provides indoor and outdoor connectivity and positioning; the position of trackers attached to vehicles, personnel and luggage is triangulated by bouncing signals off the LoRa base stations in the LoRaWAN network. All data monitoring and analysis runs through Skysens’ cloud-based IoT platform. The setup is available to other airport tenants and airline companies.

5 | Morita + BLE – for tracking manufacturing assets

Japanese fire truck manufacturer Morita Group has deployed a Bluetooth-based IoT solution at a 57,000-square metre factory in Osaka, in Japan, to track the location and status of trucks as they are being built.

The solution, by Japanese firm Kokusai Kogyo, utilises Bluetooth Low Energy (BLE) tags and locators from Finnish outfit Quuppa. These are fitted to the vehicles and the inside of the factory, respectively, to monitor location and progress as the trucks make their way between production bays.

The challenge for Morita Group is to manage the simultaneous production of several hundreds of customised fire trucks between manufacturing zones at the site, in Sanda City, in Japan’s Hyogo Prefecture, north of Osaka. The plant produces 700 fire trucks each year, and has around 300 in production at any time.

The BLE solution gives the location of the fire trucks to within about one metre – “even in challenging environments with high ceilings and metal structures”. Kokusai Kogyo installed around 70 BLE antennas (‘locators’) at the plant, suspended inside from ceilings and mounted outside on walls.

A BLE beacon is fixed to the dashboard of each truck at the start of production. A traffic light system shows the progress of each vehicle against schedule on display screens in the facility. Morita, which sells its fire trucks to customers in Asia, Europe, and North America, is looking to integrate on-site tracking for workers, as well as between its factories, and even with suppliers.