The 5G smartphone market is now outperforming its predecessor generations, including Long Term Evolution (LTE) smartphones, on nearly every metric, including the number of mobile devices, subscribers, and networks available at launch. However, 5G brings with it a whole raft of technical challenges, features, and functionalities, as well as new radio elements for supporting new radio bands and combinations, all of which can lead to substantial changes in the design of mobile devices.

This level of complexity is not just limited to the high end, as the availability of 5G smartphone models will become more diverse, brought to market quickly at a wide variety of price points, democratizing the 5G experience. Many leading Original Equipment Manufacturers (OEMs) are expected to push deeper into the lower-priced 5G smartphone segment, so mid-range smartphones will be the main driver for accelerating adoption in 2021 and beyond, aided by the continual introduction of lower-tier 5G chipset platforms. According to ABI Research, and despite the impacts of the U.S.-China trade war and the global COVID-19 pandemic, shipments of 5G smartphones will grow globally by over 1,200% in 2020 to reach between 170 million and 200 million units worldwide, accounting for over 15% of total smartphones sales. The market is then set to grow at a rapid pace as 5G smartphones become available across all tiers, globally.

Solving the design burden that Radio Frequency Front End (RFFE) complexity is putting on mobile devices is becoming paramount for the leading OEMs. While 5G is a massive opportunity, across sub-6 Gigahertz (GHz) and mmWave, they will need to manage their smartphone designs in an intelligent way to help complement the Stock-Keeping Unit (SKU) count across all price tiers, which will manifest in a number of different ways, chiefly:

- Handling the increasing numbers of RFFE components brought about by myriad 5G frequency bands and configurations, as well as by new features necessary for 5G functionality.

- Ensuring integration with 3G/4G RFFE components to provide optimized configurations and offer better support for new functionalities, such as Dynamic Spectrum Sharing (DSS), 4G-5G Carrier Aggregation (CA), global 5G/4G band support, and global multi-Subscriber Identity Modules (SIMs).

- Addressing the complex and costly sourcing processes associated with RF components, involving collaborations with multiple suppliers, which could lengthen the overall products development and their time to market.

- Addressing additional layers of complexity brought by signs of a growing mmWave ecosystem.

These elements are equally valid for fixed wireless access Customer Premises Equipment (CPE) OEMs who have no experience dealing with radio system design and so will also have to delegate to RFFE specialists.

There is growing evidence in the smartphone market that OEMs are increasing their adoption of

integrated designs from modem-to-antenna and for 5G and 3G/4G systems. Such a strategic approach has been considered by few component suppliers in the market, thus far, with Qualcomm taking first-mover market advantage, but this is one that has been well-received by a number of OEMs, whether for support of 5G in sub-6 GHz, mmWave, or both. It is worth mentioning here that the leadership by Qualcomm in radio system design did not come out of the blue, but it is a strategy that the company has been building for years.

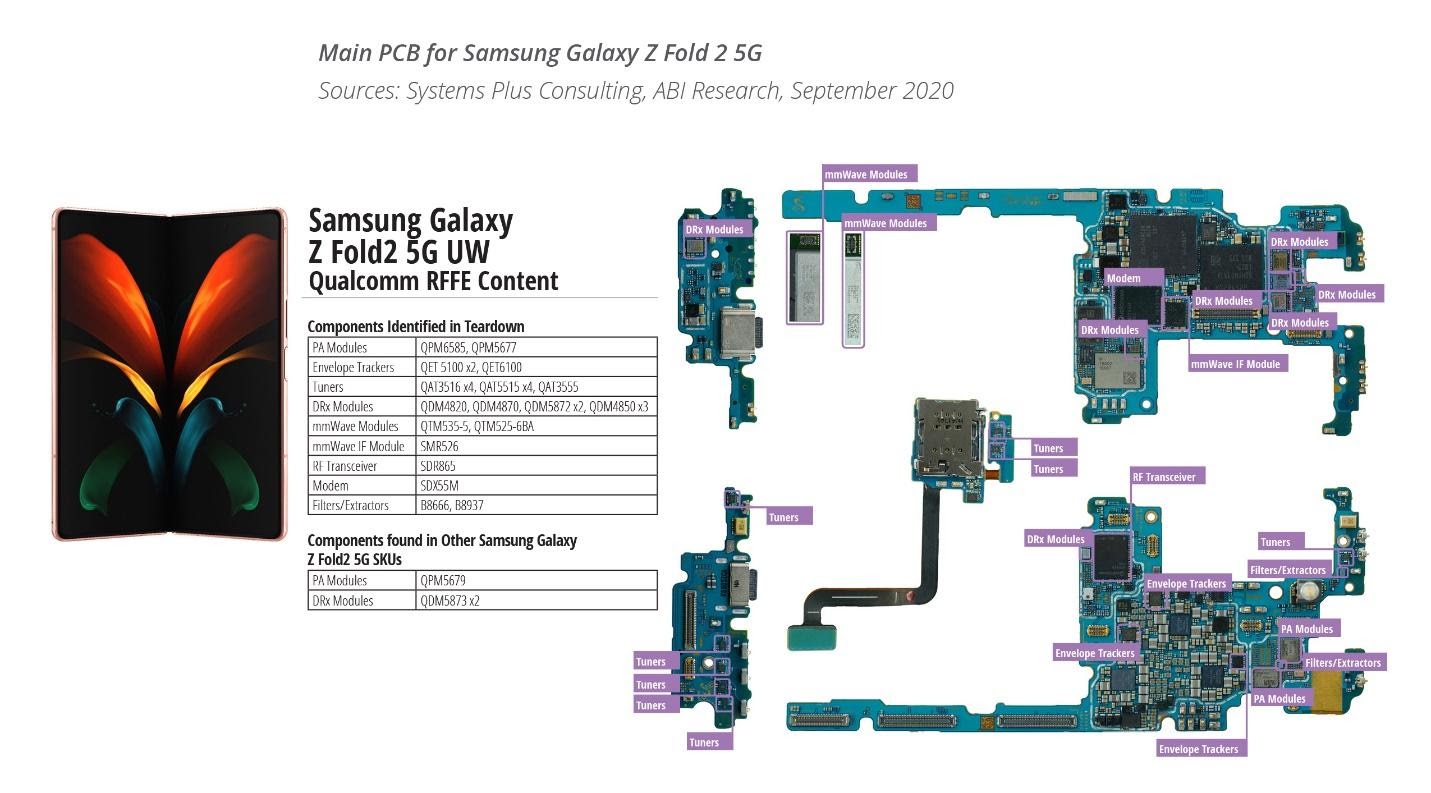

Figure 1: Main PCB for Samsung Galaxy Z Fold 2 5G

As the entire RFFE, not just with respect to 5G, is becoming one of the key drivers of revenue growth in the components industry, it will become a fertile landscape. The vendor landscape will change rapidly in 2021, as lead suppliers jostle to seize market share. Layered on top of this complexity is the industry’s move toward the use of 5G mmWave. The technology was once derided as being too challenging to be of practical use in mobile devices, mainly due to limited coverage and being overtly costly to implement. However, over the past 18 months, these technology barriers have been overcome and 5G mmWave is now a commercial reality in smartphones. Significantly, support for mmWave was given a definitive boost as it has been included in SKUs for the entire Apple iPhone 12 line-up.

Much of the mmWave RF design complexities have been resolved through a system approach, which continues to evolve to provide a reduced form factor, as well as improved performance, latency, reliability, and efficiency. Leading the industry’s drive to mmWave has been its key advocates—Qualcomm, Verizon, and Ericsson—with Qualcomm introducing a fully integrated mmWave RF module design, which is used in a multi-antenna configuration (often two or three) to mitigate the impact of signal blockage. Thanks to these efforts, the companies recently reached a milestone when they demonstrated 5G peak speeds of 5.06 Gigabits per Second (Gbps) using mmWave spectrum with CA. Moreover, Verizon has stated plans to bring mmWave to 60 cities in the United States during 2020.

The rapid miniaturization and continual iterative enhancement of mmWave modules has also helped bring it to compact smartphone industrial designs. As a result, Qualcomm has already commercialized its third-generation mmWave module (QTM535), which is now in use several months ahead of schedule and included in the Samsung smartphones featured in this report. Compared to its predecessor, the QTM525, the new QTM535 is narrower by 16.7%, has a 13.8% smaller footprint, and is 10% lower in volume. As the QTM535 is only 3.5 Millimeters (mm) wide, it helps enable mmWave in very thin devices, such as foldable smartphones.

After a slow start, mainly limited to the U.S. market, ecosystem momentum for mobile mmWave continues to build as several regions are targeting deployments, expanding across North America, Europe, and Asia, led by operators in the countries of Japan, Russia, Italy, South Korea, and Australia. Implementing the technology in tight combination with 5G New Radio (NR) sub-6 GHz and dual connectivity with LTE, mmWave is starting to gain momentum in keeping its promise of providing new business opportunities and enhanced mobile and fixed wireless experiences, while supporting advanced mobility features, such as beamforming and beam tracking.

For more information on this subject, check out ABI Research’s whitepaper Teardowns of New 5G Smartphones Confirm Benefits of Integrated Radio System Design.