Greetings from Davidson/ Lake Norman, where it’s still sunny and warm. October is one of our favorite times, and less travel makes the scenery even more enjoyable.

Greetings from Davidson/ Lake Norman, where it’s still sunny and warm. October is one of our favorite times, and less travel makes the scenery even more enjoyable.

We recently used one of the “fall weather transition” days to do some sorting and uncovered one of the topics mentioned in last week’s Brief. Pictured is our Palm Pre on its charging stand. CNET, in their review, concluded that “Palm has developed a solid OS that not only rivals the competition but also sets a new standard in the way smartphones handle tasks and manage information.” Sprint discontinued carrying the Pre 17 months after launch. Palm was sold to HP in 2010 and the trademark was sold in October 14 to a company related to electronics maker TCL. WebOS now powers many LG smart TVs.

This week’s Brief will cover AT&T and Verizon earnings in light of the backdrop of previously discussed expectations. We will summarize the key highlights of each report with a special focus on capital spending.

The week that was

The Fab 5 stocks had a relatively rare 3-2 split this week. Google and Facebook gained (+$38 billion and +$51 billion respectively), while Apple, Microsoft and Amazon all fell. Overall, the Fab 5 lost $78 billion in equity market value this week or about 3.3% of total 2020 gains. Note: The worst Fab 5 performing stock in 2020 (Google) is still up 23% YTD.

Our expectation is that each of the Fab 5 will have some movement this week as Microsoft (Wednesday), Amazon (Thursday), Apple (Thursday), Facebook (Thursday) and Google (Thursday) all announce earnings. We will not lack for content, and fully expect each of these stocks to generate strong cash flows.

The Telco Top 5 started the earnings parade last week with Verizon announcing last Wednesday (10/21) and AT&T following on Thursday (10/22). More details about those announcements are below. Despite surprisingly strong consumer broadband net additions and low wireless churn, both VZ and T moved lower this week. AT&T has now lost $77 billion in value (28%) in 2020, and, as we discussed last week, there seems to be no major catalyst on the horizon for the stock.

This week, Comcast and Charter will announce earnings. Charter took a bit of a hit this week but is still up 22% ($23 billion) this year. Given Comcast’s bullish announcement on consumer broadband net additions (see Sunday Brief here for our analysis of Brian Roberts commentary), it’s likely that Charter will post strong growth, with or without the inclusion of Keep America Connected (KAC) figures.

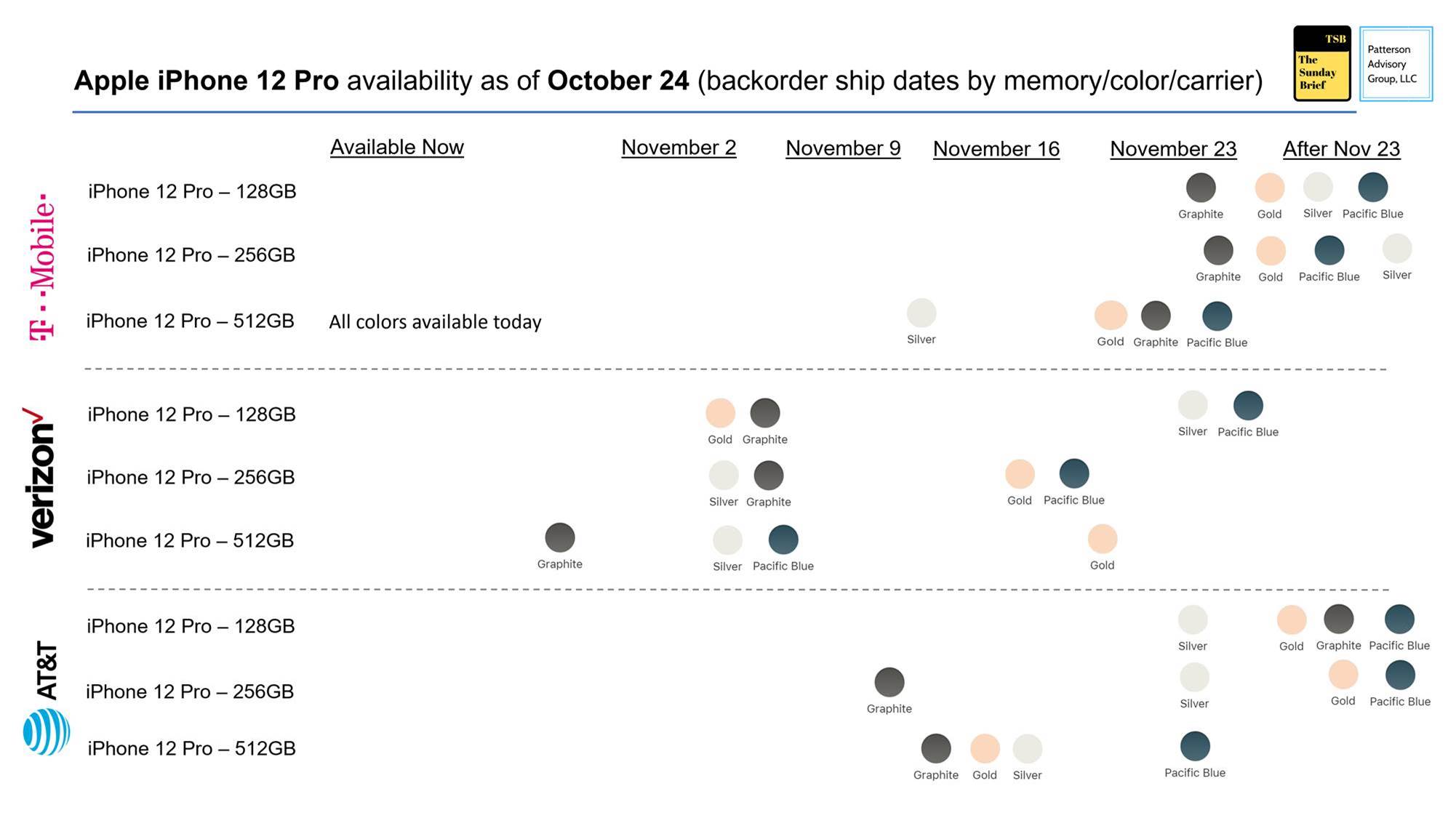

Before diving into AT&T and Verizon earnings, let’s see how the carriers are managing demand for the iPhone 12 Pro and iPhone 12 (the iPhone 12 Mini and Pro Max will be released in November). Here are the backlog statistics for the iPhone 12 Pro (note – PDFs of the iPhone availability and this Sunday Brief are available at the Sunday Brief website):

For those of you new to the Brief, we report backlog as a potential indicator of gross add activity. Since AT&T is providing aggressive trade-in promotions both to existing and new customers, some of their backlog is likely attributable to their slowly upgrading base. T-Mobile and Verizon figures are “ship by” dates, while AT&T figures are “delivery by” dates. We will be tracking changes to these figures through early December or until there does not appear to be a backlog.

iPhone 12 Pro sales are definitely off to a strong start (the Pro Max is available for pre-order on Friday, November 6) with backlogs across all colors, sizes, and wireless carriers. Assuming a 3-day delivery interval for AT&T, it appears that AT&T and T-Mobile are tied for the iPhone 12 Pro backlog prize, with Verizon’s backlog slightly less than their two competitors (note: we saw this same gap with Verizon last year and Big Red still posted very strong figures). AT&T’s promotions are definitely working at the low end (128GB), likely an indicator of existing iPhone customers upgrading to the latest model.

The iPhone 12 backlog shows a fundamentally different picture, with AT&T having the longest backlog for eight of the fifteen possible storage/ color combinations (five are considered ties, and one backlog win for Verizon and T-Mobile respectively). The notable difference for this model likely is attributable to the inclusion of existing customers in the promotion, with a possible secondary effect of some accelerated Android to Apple crossover.

Last year (when the upgrades were more modest), T-Mobile (pre-Sprint) had significant inventory issues with the iPhone 11 through mid-December (more details in last year’s post). AT&T and Verizon’s availability depended on color.

Bottom line: We are still very early in the cycle, but model upgrade themes are similar to last year (perhaps slightly less constrained due to 5G network availability and the pending 5G Pro line introduction) with one notable exception: AT&T is definitely constrained at the low end (64GB and 128 GB storage models) across the board. This will likely continue through the first weeks of November.

Verizon’s earnings: Growth on the horizon?

Verizon reported earnings on Wednesday (link to materials here). Here are the headlines:

- Wireless equipment revenues down $1 billion (20%) versus 3Q 2019. Wireless equipment costs were down $1.1 billion, so slightly accretive to earnings. This is attributable to all stores not being open the entire quarter (largely remedied by Labor Day) and a delayed iPhone 12 launch.

- Verizon’s provision for credit losses (cash impact) is $1.1 billion in the first 9 months of 2020 compared to $1.07 billion for the same period in 2019. COVID-19 impact on bad debt has been no worse than non-COVID 2019. Verizon reported on the call that of the 1.2 million accounts covered through their Keep America Connected pledge, 90% had made payments. They also guided to slightly higher involuntary churn in the fourth quarter, presumably to cover the remaining 10%.

- Verizon’s Consumer division “other” revenue stream rose slightly vs 3Q 2019 (+$62 million or 3%). Without cable’s growth, it’s likely that the Consumer division’s gross margin (75.6% with cable included) would have been lower, both in absolute numbers and as a percentage of revenue. CEO Hans Vestberg indicated on the earnings call that cable is taking a share in the consumer marketplace.

- As we predicted, Fiber (FiOS) subscribers grew but revenue fell, driven by cord-cutting of video and voice services. Verizon’s broadband growth (+113K subscribers) was particularly strong, with DSL declines holding to recent patterns and fiber connections rapidly improving. FiOS’ 9-month growth is double where it was in 2019, and

management attributes the 3Q surge to both pricing changes (Mix and Match 3.0) and COVID-19 related demand.

- Verizon’s Business division appears to be the hardest hit by the pandemic. Small and medium business revenue grew $141 million sequentially, but were still $157 million below 3Q 2019 levels (see nearby chart). Verizon still has a large component of regionally-based commercial revenues and the Northeast appears to be the slowest area to open. Public sector revenues were on fire (+$167 million vs 3Q 2009) and management had very bullish comments on first responder (surprising given AT&T’s FirstNet rollout). It does not appear that Verizon has been able to turn One Fiber into a profit engine with cost of service continuing to rise for business customers even with increased fiber deployments (to or near buildings). The wireless upgrade rate for business customers (the prime beneficiary of 5G services) was 3.3% (vs 4.5% in 3Q 2019). This will likely grow with the Apple iPhone launch.

- Capital expenditures for the first nine months of 2020 are 15% ($1.84 billion) higher than the first nine months of 2019. Verizon guided to $18.5 billion in total capital expenditures for the year, which would be $500+ million higher than 2019. This places less pressure on fourth quarter deployments and will likely lead to a faster start to capital deployments in 2021.

- Total Debt (secured and unsecured) is up $4 billion since the beginning of 2020. Unsecured debt coverage is 2.1x, slightly above Verizon’s 2.0x high-end target. Like AT&T, Verizon has been actively restructuring its debt to deliver lower interest expense and longer repayment terms.

- On the Monday preceding the earnings call, Verizon announced that they would be acquiring Bluegrass Cellular for an undisclosed amount. This will build their presence in Eastern Kentucky.

“Stable” is the best verb to describe Verizon’s third quarter. The question we continue to ask is “Where is the next $1 billion in new growth coming from?” It appears that the company has big plans for fixed wireless as a cable replacement. Asked about the prospects for the product, CEO Hans Vestberg indicated:

“We have said we’re going to address 30 million households over the 5 to 8 years. That’s where we — what we’re addressing. And hopefully — not hopefully, our ambition is to take a fair market share of that one as we have done with the Fios. So that’s what we’re pushing for. And our team is always geared to do better than the expectations. So of course, we are pushing them hard. And as we are releasing more and more sites and more and more homes for sale, we’re going to start reporting it.”

Assuming a $55 ARPU for High Speed Internet, Verizon sees this as a $19-20 billion addressable market. Depending on what “fair” market share assumptions are made, the company appears to be setting an expectation for $6-9 billion of annual revenues within 5-8 years. Given the ability to leverage common fiber infrastructure, this could be a meaningful driver of earnings in the next several years (and present a challenge to their cable MVNO partners).

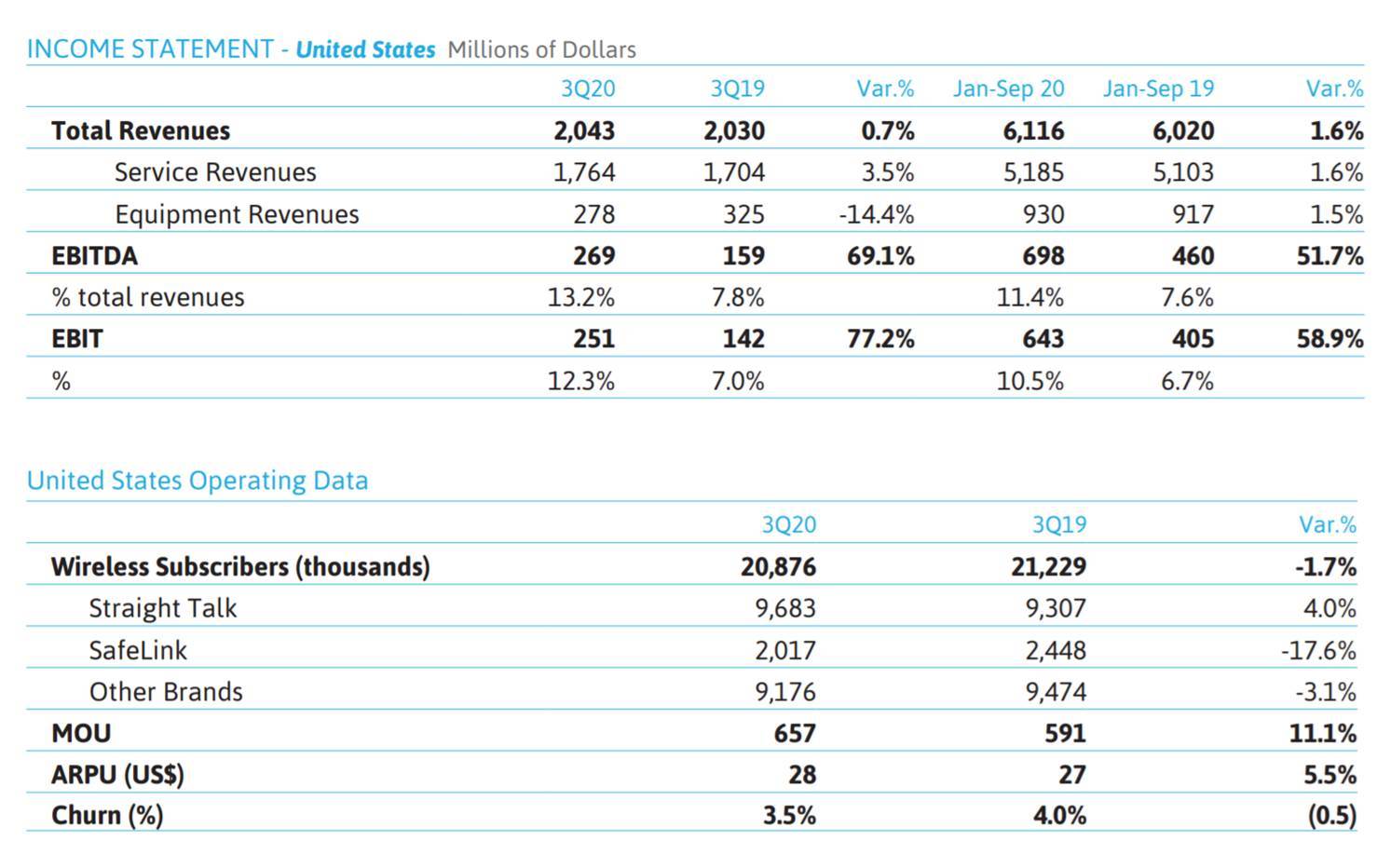

Another key driver of growth comes with the expansion of Tracfone after Verizon completes their acquisition in the second half of 2021. Here’s their latest report:

Excluding SafeLink (Lifeline) results, the “Other Brands” losses are more than offset by Straight Talk gains. To build an incremental $1 billion in annualized revenues, Verizon would need to grow an additional 3 million net additions at a $28 ARPU. As we discussed in a previous Brief here, leveraging and cultivating Tracfone’s brands (especially a Straight Talk Internet product) could yield enormous results.

Verizon’s largest opportunity, however, lies with 5G business applications. Their recent partnership announcement with Microsoft (Amazon’s announcement was last December) cements Verizon as the edge applications enabler. Coupling fiber deployments with the existing base and edge presence gives Verizon the opportunity to lead the industry (along with AT&T) in industrial automation. The opportunity range for 5G business applications is very wide.

Bottom line (from Hans Vestberg on the earnings call): “So now it’s up to our sales team to sell. I mean it’s Ronan, it’s Tami, it’s Guru, the 3 CEOs that now needs to get out with a sales force to sell on it. Because, Kyle, which is running the technology, has bumped this network up to something that we have never seen before. So that’s how I see it. So it’s really execute right now.” We could not have said it any better ourselves. More proof 5G is valuable to business = higher stock price.

AT&T: Capital slowdown – 5G growth implications

On Thursday, AT&T announced earnings which were remarkably downbeat except for mobility and consumer broadband (full package here). There were some bright spots, however:

On Thursday, AT&T announced earnings which were remarkably downbeat except for mobility and consumer broadband (full package here). There were some bright spots, however:

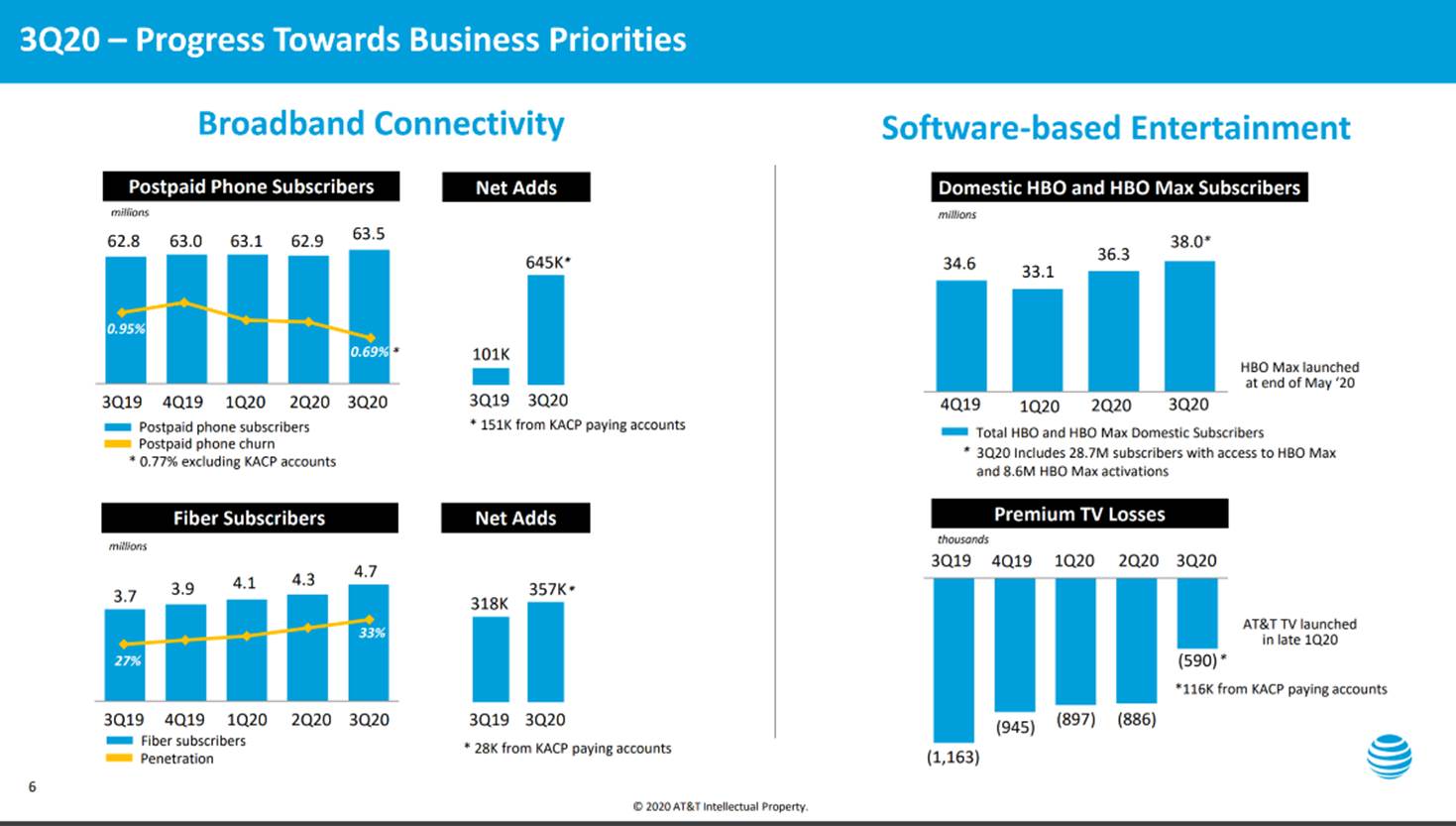

- Low postpaid monthly phone churn of 0.69% drove increased EBITDA in mobility. Prepaid churn was below 3%, and CFO John Stephens indicated that Cricket prepaid churn was even lower than that. Even excluding the Keep America Connected plans, postpaid phone subscribers still grew at a healthy pace (~500K).

- Broadband growth was strong, although not the “pop” that Verizon showed. In fact, as shown in the nearby chart, If the KAC paying customers were excluded, net adds would be only slightly higher than in 3Q 2019.

- HBO spent a lot of money launching their Max product line, and the incremental benefit to the combined HBO customer count was relatively minimal (+1.7 million qtr/qtr customer additions while spending $600 million). Most of these came from wireless bundles (a plus for bundling, but potentially at a lower profit margin than a standalone customer). Also, programming costs for HBO (related to Max) were up 55% or $344 million versus 3Q 2019.

- Theaters are only slowly beginning to open. WarnerMedia’s dependence on theatrical releases was on display with the division’s revenues lower by $922 million (27%) on a year/year basis. AT&T was able to cut $733 million in operating (presumably production) costs in the quarter, but this has many asking “What’s the cost to restart production?”

- AT&T’s aggressive iPhone moves (see charts above) are a part of a carefully calculated retention strategy. John Stankey addressed this in the earnings call (answering another question):

“We have an incredibly valuable customer base. It’s our most important asset for us to focus on. And when we go in and we look at the data and we understand why that base elects not to stay with us, it’s not because of customer service or it’s not because they don’t like the network. It’s because more often than not, they see some enticement to go somewhere else. And that’s usually a device offer or a belief that they can’t fine-tune their plan to meet their economic construct that they want.

And we’re now in a position where we can address that. And this offer is going to attack that very point. It’s going to ensure that our very best customers, who many have been very loyal to us, these are original iPhone subscribers that have been around a long time, are treated just like a new customer coming into our business. And that they can avail themselves of that opportunity and recommit to us for a very, very long period of time.”

It’s important to remember that to take full advantage of the AT&T aggressive trade-in promotion, customers will need to upgrade to an unlimited plan (which makes sense but has not been widely reported – full terms available on AT&T’s website) and, for new customers, that plan will need to be at least $75 ARPU (Unlimited Extra plan) prior to any discounts.

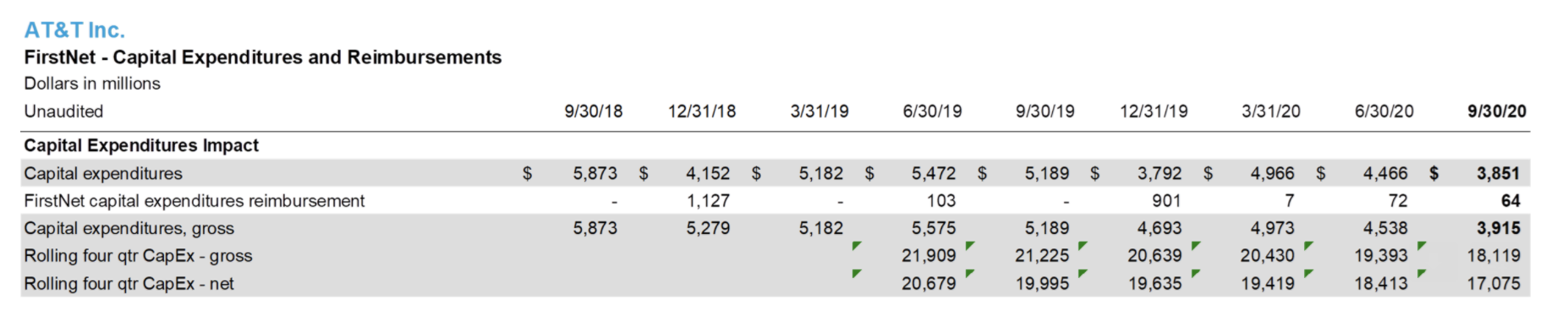

Besides DirecTV losses (down 3.3 million subscribers over the last 12 months) and HBO sluggish growth, the most remarkable trend that was not discussed on the call was AT&T’s capital conservation (vs. Verizon’s push to deploy more capital, particularly out of their local region). Here’re AT&T’s gross capital expenditures for the last several quarters (rolling 4-qtr view added):

With or without reimbursements, the capital trend is down – at least $3.6 billion annually – at a time when more fiber investment (particularly for 5G, both in and out of their local operating territories) is needed.

Finally, there were a lot of questions about fiber deployment on the call. John Stankey stated that his end of 2021 goal was to “exit next year in a construct where we are gaining subscribers, gaining share and growing the broadband business. And our footprint will be engineered to allow that to happen.” We look forward to seeing more clarification of the value proposition, with or without AT&T TV.

Bottom Line: Absent a severe economic contraction, this was probably the pandemic-driven low water point for the company. This does not mean they are out of the woods yet, and increasing the dividend (even fractionally) while pushing the brakes on capital spending seems to us a surefire way to suboptimize shareholder returns. Either AT&T believes in fiber (at the expense of dividend increases) or it doesn’t (which contradicts John Stankey’s comments). And they have, especially out of region, some catching up to do.

There’s more we could say, but will leave additional commentary to comparisons against Comcast and Spectrum in next week’s Brief. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe, keep your social distance, and Go Chiefs!