New IBM hybrid cloud offering geared toward enterprise adoption of 5G and edge computing

For operators investing billions in building 5G networks, the real revenue opportunity is not in selling enhanced services to consumers but, rather, in standing up differentiated service offerings geared toward the various digital transformation strategies of enterprise. But given the variability in use cases and needs 5G for enterprise can support, it’s going to take a village. To that end, IBM, in launching a new telco-focused hybrid cloud architecture, has assembled a group of 35 ecosystem partners focused on “accelerating business transformation, enhancing digital client engagement and improving agility as they modernize their enterprise applications and infrastructure to unlock the power of 5G and edge,” according to the company.

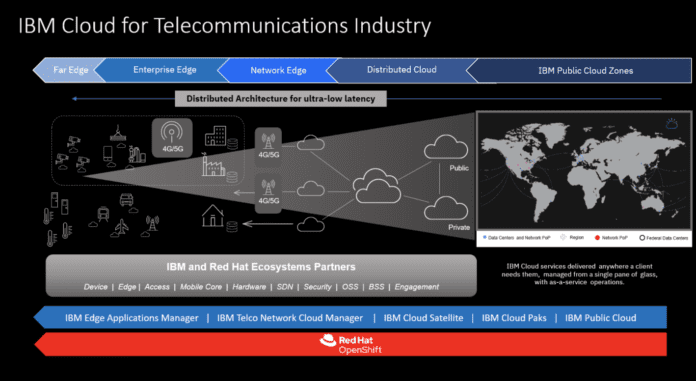

Distributing 5G network infrastructure and cloud computing functionality is seen as part and parcel of delivering on the promise of 5G for enterprise which moves beyond enhanced mobile broadband to also include massive machine-type communication (IoT) and ultra-reliable, low latency communications. On one hand, operators need to put 5G radios, baseband and core equipment in locations that flexibly serve the needs of whatever an enterprise might try to do—regional data centers won’t be of much use when an AR-type factory application needs sub-5 millisecond latencies. Simultaneously, in a world where everything is connected and data is generated in terabytes and zetabytes, the cloud needs to become pervasive, extending from regional facilities right out to the enterprise edge.

According to IBM execs Howard Boville and Steve Canepa, “The holistic hybrid cloud offering will be complemented by our ecosystem partners’ software and technology, and enable mission critical workloads to be managed consistently from the network core to the edge to position telecom providers to extract more value from their data while they drive innovation for their customers.”

IBM’s initial ecosystem partners are: ADVA Optical Networking, Affirmed Networks, Altiostar, Altran, Assima, Cisco, Dell Technologies, Dubber’s, Enghouse Networks, Equinix, F5 Networks, HPE, Intel, Juniper Networks, Kaloom, Lenovo, Linux Foundation Networking, MATRIXX Software, Mavenir, Metaswitch, Movius, NetApp, NETSCOUT Systems, Nokia, Nuance Communications, the O-RAN Alliance, Palo Alto Networks, Portworx, Red Hat, Robin.io, Samsung, SevOne, Sinefa, Spirent, THALES, TM Forum, Travelping, Turbonomic, and Zerto.

IBM Cloud for Telecommunications incorporates IBM Cloud Satellite and Red Hat OpenShift for flexible cloud-based service delivery, and integrates IBM’s Edge Application Manager and Telco Network Cloud Manager.

In terms of how enterprises will consume 5G, there are three primary options. First, operators could deliver a slice of their public network that’s tuned to the specific SLA or SLAs required by the enterprise. This assumes the operator is able to deliver a network slice which is predicated by a standalone core and end-to-end virtualized network infrastructure. The second option would be a private network wherein an operator, vendor, system integrator or combination thereof sells a turnkey network to the user. This assumes the enterprise can access spectrum which is becoming increasingly liberalized with things like the CBRS band in the U.S. or the 3.6 GHz set aside in Germany. The third option would be a combination of one and two where, for instance, an enterprise could have its own RAN and edge compute infrastructure that’s connected back to a public network.

Nokia has gone hard on private networks for enterprise and, at the end of April, tallied well over 100 private network customers in a range of verticals. Since then, Nokia has continued to notch customer wins with Toyota, for instance, which engaged the Finnish firm to build a 5G-upgradable private network at its manufacturing design center in Fukuoka, Japan, with an eye on support for IoT devices and “equipment digitization and visualization.”

Discussing their collaboration with IBM, Nokia’s Head of Edge Cloud Jane Rygaard said in a statement, “We are happy to team up with IBM to develop 5G solutions at the telecom edge, with Red Hat OpenShift. We believe that our service provider customers will benefit greatly from having an additional choice to quickly and efficiently deploy private 5G networks. The transition to 5G will be a key step for industries to deliver on their digital transformation plans. Having multiple options of cloud-based solutions will help our industry build this path forward.”

Canepa, IBM’s Global GM & Managing Director, Communications Sector, in a Q&A called out three “fundamental shifts” shaping the telecoms industry: the ongoing deployment of 5G; the change in the network “to become a…hybrid cloud platform;” and mobile edge computing.

As to how IBM’s Cloud for Telecommunications addresses these the three trends, he said, “As 5G and edge grow, telcos are transforming their networks into flexible platforms that can scale to support growing volumes of complex data. That’s why we’re delivering an open, hybrid cloud platform that gives them the flexibility to choose where they build and deploy services…We’ve also infused advanced automation and AI to speed efficiencies in deployment while reducing costs.”

On the operator side, IBM is working with AT&T and specifically called out enterprise 5G/edge support for banking and finance, manufacturing, retail and healthcare. The telco hybrid cloud solution “draws heavily on IBM’s 2019 commitment to retool its software platform around Red Hat OpenShift,” according to a blog from Boville, IBM’s SVP of hybrid cloud. “For telcos, this open approach is critical…By making it easier for businesses to manage open hybrid cloud computing in a low-latency, private cellular network edge environment like AT&T Multi-access Edge Computing, IBM and AT&T are helping businesses across all industries…to quickly and securely build applications using regional or on-premises edge computing.”