Opening the C Band for 5G networks frees up spectrum for a number of years and represents a major opportunity for mobile operators. At 280 megahertz, the C Band is the largest chunk of mid-band spectrum the Federal Communications Commission (FCC) has made available to date in the United States. To utilize the C Band spectrum, 5G network deployments will require new infrastructure. Specifically, analysts estimate that each U.S. operator building a nationwide network with C Band spectrum will need to spend between $3 billion and $3.6 billion for the wireless equipment necessary to broadcast 5G signals in the band. In this article, we’ll discuss how opening the C Band will help accelerate 5G network deployments across the United States.

Allocating the C Band spectrum for 5G

The recent FCC decision to auction 280 megahertz of mid-band spectrum (C-band) for flexible use, including 5G, wasn’t made in isolation. Indeed, the FCC recently concluded the CBRS PAL auction, while the U.S. Department of Defense (DoD) announced it was making 100 megahertz of contiguous mid-band spectrum in the 3450-3550 MHz band available for 5G. Taken together, these spectrum allocation activities have significant implications for 5G, both in the short and long term.

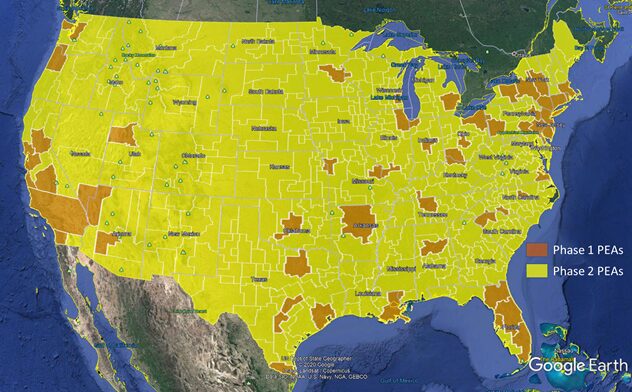

More specifically, the 3450-3550 MHz band (3450 band) and the C Band represent 380 megahertz of valuable mid-band spectrum, which should become available at approximately the same time, albeit with certain caveats. In the short term, Phase 1 will have 46 of the top 50 market areas (partial economic areas or PEAs) available for the C Band by the end of 2021 after existing incumbents are relocated. Phase 2 will see the remaining PEAs available no later than the end of 2023. The figure below depicts the Phase 1 and Phase 2 PEAs. As the 3450 band remains in the formative rulemaking stage, the telecommunications industry is still in the process of determining when the full 100 megahertz will be available.

Both of the above-mentioned bands are capable of supporting high-power macro-cellular operation – with CBRS in the middle adding another 150 megahertz of spectrum, 70 megahertz of which is licensed, albeit at lower maximum power. The 380 megahertz of spectrum will help to support the wealth of 5G use cases expected for the mid-band, with a wide range of associated coverage possibilities enabled by high-power operation.

Leveraging the C Band spectrum for 5G

The first use of C Band is slated to begin in late 2021 in the 46 PEAs. For the rest of the country, C Band won’t be accessible for users until December 2023. The additional spectrum provided by C Band will benefit mobile subscribers in urban areas, suburban locales and rural areas with minimal existing coverage. Although the first 46 PEAs are part of the 2021 phase, there is still a fair amount of suburban and rural areas associated with the above-mentioned markets which could see deployments during this time frame.

As noted above, the newly cleared C Band should enable 280 megahertz of spectrum for 5G services, including both mobile and fixed applications. In fact, this band is likely to be exclusively used for 5G. It will enable mobile network operators to provide a differentiated 5G network experience across a broad coverage area as part of a macro 5G network overlay to existing LTE networks, and it will be complementary to extremely high capacity millimeter-wave nodes that are being deployed primarily in dense urban areas. In addition, the flexible use nature of the band will enable fixed multipoint operations, some of which can even support certain backhaul needs.

Managing the spectrum: A new role for SAS?

After the C Band auction closes, licenses will be awarded, and channels assigned. It should be noted that earth stations may require slight modifications (e.g., antenna upgrades or filtering) to support new channel assignments and add protection from mobile operator adjacent band interference before they are relocated to allow for early deployments. Following the C Band auction, the next spectrum bands under consideration are likely to be 3100-3450 MHz. For the 3450 MHz band, the rulemaking process – which describes areas that require long-term sharing – is still ongoing. Nevertheless, it is clear that spectrum managers will have to work around the DoD systems that are remaining in the band. Although certain relocations or modifications of operations for the DoD systems are anticipated, we expect no impact to CBRS.

The telecommunications industry is working with regulators and the DoD to study the full 3100-3550 MHz band for sharing and relocation. In the interim, some of the relocations from the 3450 MHz band could potentially shift into the 3100-3450 MHz portion of this spectrum. In addition, the 7/8 GHz band (7125-8500 MHz) may be under study soon, although it is far too early to speculate on how it would be made available.

The above-mentioned spectrum clearing and sharing activities have had a noticeable impact on spectrum management efforts. For example, one fairly new tool in the spectrum management toolkit is the Spectrum Access System (SAS) which is required for CBRS deployments. The SAS concept could potentially apply to the 3450 MHz band by supporting transitional sharing during relocations or longer-term sharing for the areas where relocation isn’t feasible. However, whether the SAS is used or not, spectrum managers will still have to manage adjacent-band issues for CBRS, especially considering the high-power neighbors located above and below. The ability to effectively manage the spectrum across the full 3100-3900 MHz bands will be one of the keys to successful deployment of new 5G and even 6G systems.

Deploying C-Band infrastructure

In parallel with clearing the C-band for mobile operators, new 5G infrastructure will be required to take advantage of the newly available spectrum. According to Omdia analyst Daryl Schoolar, each U.S. operator that builds a nationwide network with C-band spectrum will need to spend between $3 billion and $3.6 billion for the wireless equipment necessary to broadcast 5G signals in the band.

The above-mentioned spend assumes three-sector cell sites that use either 64T64R or 32T32R active MIMO antenna units, as well as a baseband module. Cables, power, shelter, tower and construction expenses are not included in this estimate. The industry is poised to heavily invest in 5G deployments within the C Band, which will likely comprise over 10% of total 5G infrastructure for those operators who deploy C-band nationally.

Existing 5G networks use a combination of shared radio and baseband assets for low band coverage. To deploy C Band 5G networks, operators will need to add a new set of RU equipment in each sector, plus additional baseband capacity, power and fiber. It should be noted that C-band capable RUs are typically more expensive than the legacy 4T4R radios (using dynamic spectrum sharing) that are in place today for LTE/5G.

From our perspective, there are a number of innovations, technologies and techniques that can be implemented when rolling out 5G infrastructure for C Band. For example, active antennas already support massive MIMO, which is a key technology for 5G. In addition, the industry is evolving to adopt cloud-native architectures, with a portion of the baseband running in the cloud. Varying levels of automation are also being developed in the orchestration layer to more easily spin up network slices.

Potential differences in C Band equipment (BSA) deployments in urban, suburban and or rural locales are likely. For example, different RU configurations may be used in different morphologies – 8T8R in suburban and rural, and 64T64R in dense urban locales – to optimize network CAPEX and OPEX. Looking beyond 5G, it is likely too early determine how the new C Band infrastructure can potentially accommodate future equipment upgrades to support next generation mobile networks. However, 6G may be capable of simultaneously transmitting and receiving on the same frequency channel. It is important to emphasize that this capability will require industry evolution and innovation spanning multiple key areas, including antennas.

In conclusion, the upcoming auction of 280 megahertz of mid-band spectrum (C Band) closely follows the recently concluded CBRS PAL auction, as well as a DoD decision to make 100 megahertz of contiguous mid-band spectrum in the 3450-3550 MHz band available. The newly cleared C Band should enable 280 megahertz of spectrum for 5G services, including both mobile and fixed applications. Indeed, this band is likely to be exclusively allocated for 5G. To be sure, the industry is poised to heavily invest in 5G deployments within the C Band, which will likely comprise over 10% of total 5G infrastructure for those operators who deploy C Band nationally.