Despite mid-60s degree temperatures, it’s beginning to look a lot like Christmas in Davidson (pictured are the Giving Trees on the Village Green). They have been a tradition for decades – a highlight of our most unusual Holiday season.

We are going to start looking at large themes as we exit 2020. Thanks to varying business decisions, the impact of each of these trends will be different for each company. We have picked four that we believe have the greatest impact on long-term value. On the heels of Disney’s Investor Day last Thursday and AT&T CEO John Stankey’s appearance at the UBS conference last Monday, examining the role of content competition on the TMT landscape seems like a fitting first trend. We will also include updates on the Facebook and Google anti-trust actions, the C Band auction, and continued shortages of iPhone 12 Pro and Pro Max models (no lack of content).

The week that was

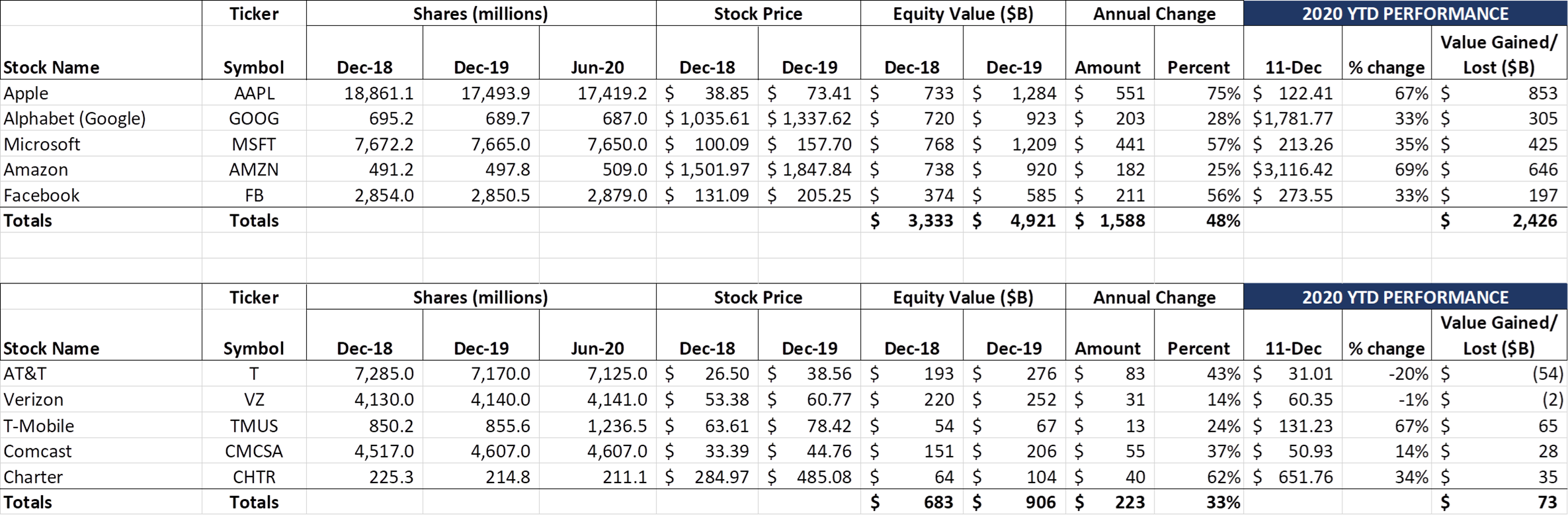

Markets were generally quiet this week as analysts began to assess the impact of continued COVID restrictions. The Fab 5 lost 3.2% of the previous week’s gains, but remain well above $2.4 trillion in added equity market capitalization for the year (+49%). The Telco Top 5 had some shifts between individual stocks this week (AT&T +$10 billion; Verizon -$5 billion; Comcast and Charter each -$4 billion), but the net impact was -$3 billion. They are on track for an 8% gain in 2020 despite AT&T’s value haircut and Verizon’s flatness.

The big news this week was the federal-and-46-state effort to bring antitrust action against Facebook (New York Times article here, copy of lawsuit here). According to the Federal Trade Commission (FTC) website, the suit alleges that “Facebook has engaged in a systematic strategy—including its 2012 acquisition of up-and-coming rival Instagram, its 2014 acquisition of the mobile messaging app WhatsApp, and the imposition of anticompetitive conditions on software developers—to eliminate threats to its monopoly. This course of conduct harms competition, leaves consumers with few choices for personal social networking, and deprives advertisers of the benefits of competition.”

What’s the remedy? “The FTC is seeking a permanent injunction in federal court that could, among other things: require divestitures of assets, including Instagram and WhatsApp; prohibit Facebook from imposing anticompetitive conditions on software developers; and require Facebook to seek prior notice and approval for future mergers and acquisitions.”

We have not read the full complaint (yet), but find it amazing that nearly six years after the acquisition of WhatsApp, both federal and state governments would seek to unravel previously approved transactions. Facebook is a broad-based communications network platform, a “party line” or “bulletin board” of billions of people. They have developed a very popular platform. Unlike state-supported communications platforms of the 1960s and 1970s (AT&T), or the Congressionally-funded Internet tax-free status granted to Amazon and others in the 1990s and 2000s, Facebook received very little government support in their early days.

Subjecting the company to greater regulatory scrutiny is one thing (we have discussed previously why FCC Chairman Pai thinks removing the liability shield, a.k.a. Section 230, might be a good idea here), but undoing transactions implemented roughtly the same time that T-Mobile purchased Metro PCS (2013) and AT&T bought Cricket (2013) could disrupt the industry with unnecessary uncertainty. What does this mean for Charter’s purchase of Brighthouse and Time Warner Cable? Or T-Mobile’s recent purchase of Sprint? Or Verizon’s proposed acquisition of Tracfone?

Commissioners Noah Phillips and Christine Wilson voted against bringing the complaint, and should come forward with their arguments (The Times article linked above reports that this was a 3-2 vote).

For more on antitrust regulation, we would like to point to Steven Levy’s recent article for WIRED (here) and our previous Brief (here). Rather than requote, we’ll let the articles speak for themselves. Bottom line: While popular today, this lawsuit should give the business community pause.

The election is over, and California wants in on the DOJ lawsuit

Meanwhile, California has now asked to join the Department of Justice lawsuit against Google according to this CNBC report, which also states that the Golden State did not request any modifications to the original complaint as a condition of their participation. Per California Attorney General Javier Becerra’s press release:

“Google pays billions of dollars each year to device makers like Apple and Samsung, and to carriers like AT&T, Verizon, and T-Mobile to make Google their default internet search engine. Some of those contracts prohibit similar agreements with competing search engines. Google is the preinstalled default search provider on all Apple devices and on virtually all devices running the Android operating system, among others. On mobile devices, Google’s exclusionary agreements cover more than 80 percent of all U.S. search queries. Even for search queries not covered by Google’s exclusionary contracts, almost half occur on Google-owned search access points, such as Chrome, its browser, or Pixel, its smartphone.”

What will the impact of unraveling carrier default search agreements mean to AT&T, Verizon, and T-Mobile? Will devices using the Android operating system cost more because of their inability to link aggregated and anonymized subscriber activity to potential advertising sources? Will wireless service prices increase as a result?

It’s going to be a busy time for antitrust attorneys. Let’s hope that business can keep up.

Apple iPhone 12 Pro and iPhone 12 Pro Max availability – slowly improving

Last Friday marked seven weeks since pre-orders of the iPhone 12 Pro began. Here’s the availability by color and size for each carrier (PDFs of these charts are available on the Sunday Brief website):

In previous weeks, we lamented that everything seemed to be shifting out with no relief in sight. Thankfully, this week marked the beginning of changes, if you can settle for Graphite. T-Mobile and Verizon have availability of that color (and a few others, depending on storage) available today. If you want a Gold iPhone 12 Pro, be prepared to receive it as a Valentine’s Day gift (except perhaps through Verizon). Based on our tracking of previous models, it feels like the availability logjam is beginning to break. More next week.

As for the iPhone 12 Pro Max, we posited last week that perhaps iPhone owners would upgrade to the ultra-premium model using the argument that “they needed something under the Christmas Tree.” We concluded that iPhone 12 Pro shortages would leak into the Pro Max as a result. That thinking might have worked in 2019, but given upended Holiday schedules, the iPhone 12 Pro Max availability actually improved over last week (significantly, depending on the carrier):

With 9 out of 12 combinations available today on T-Mobile (last week = 4), 6 of 12 on Verizon (last week also 4), and 5 of 12 available today on AT&T (last week there were no Pro Max models immediately available), and with both of the latter carriers avoiding January backlogs on any Pro Max model, our thesis has so far been disproven. We will continue to monitor availability for both models next week, and continue to be impressed by what is turning out to be more of a “super [upgrade] cycle” than many analysts thought. Good news for Cupertino, and, if the iPhone 12 Pro supply issues can be alleviated, good Q4 2020 news for the carriers.

Content competition intensifies – implications for wireless and cable

In last week’s Brief, we started to discuss streaming and its importance to wireless companies. Verizon has a multi-pronged approach, providing both FiOS and YouTube TV options. AT&T took a different route and purchased WarnerMedia to develop and distribute programming. T-Mobile has launched TVision, which includes Live (more like cable) and Vibe (more like Hulu) services.

Cable companies, particularly Comcast, have been active as well. On top of developing their Xfinity X1 and Flex solutions, Comcast has launched Peacock, which streams broadcast content on a delayed (mostly next day) basis, and also owns NBC Universal. Cox Communications and other providers have licensed Comcast’s X1 and Flex platforms, creating incremental scale and attempting to create a uniform standard for the cable community (Charter has not joined the X1 or Flex party, and, as the market capitalization chart above shows, is not seeing any value impact for their decision).

As we discussed last week, Verizon and T-Mobile have teamed up with streaming companies (T-Mobile with Netflix and Apple+; Verizon with Disney+, discovery+, and Apple Music) to increase [family plan] wireless offer attractiveness. This is a good deal for both the content provider (low cost per added subscriber) and for wireless carriers (value of a wireless family plan bundle with Netflix/ Disney+ included with higher ARPU plans). These content “moats” are usually exclusive, keeping cable MVNOs from duplicating content bundling offers.

On top of this are non-affiliated platforms such as Amazon Prime video (although Metro by T-Mobile’s high-end plan includes Amazon Prime), YouTube Premium (which now includes YouTube Music), Spotify (no longer included as an option for AT&T premium plans), Tidal (not offered with new T-Mobile plans), Sirius XM/ Pandora, Fubo, DAZN and others. We are assuming that Peacock Premium and Premium Plus will be marketed as a part of a larger bundling effort with Xfinity Mobile once CBRS offload capacity has been deployed. (Maybe one of the biggest things we realized in preparing this Brief is how many changes have occurred in the past year).

Content association matters, and not just to the wireless companies. Disney+ and Verizon bring together two top-shelf names. Netflix and T-Mobile represent mainstream, broad-based value (one could argue that even on a premium plan, Amazon Prime + Metro by T-Mobile helps the latter). Even though they are owned by the same parent, HBO Max gains from their AT&T bundle association, as does Peacock and Comcast.

Wireless companies like more bundling because it preserves service average revenue per user (ARPU), and, to a lesser extent, reduces churn. More services mean steadier ARPU. In the case of T-Mobile and AT&T, it drives content loyal customers to purchase more expensive plans (Unlimited Elite for AT&T; multi-line Magenta Plus for T-Mobile to get Netflix in HD). Wireless companies pay a fraction of the retail price to include these plans provided they achieve certain subscriber thresholds. Everybody wins.

But what if your next “mix and match” combination with Verizon or T-Mobile now includes a bundle of premium content (as we discussed last week, TVision with Vibe included)? Will bundles now include something other than a wireless subscriber line (a big concept)? T-Mobile has started to move in that direction with their Essentials plan – for $160, customers can now purchase four lines of service and receive 60+ channels of programming. There is no discount – yet, but having those products bundled in the same account allows for further promotional opportunities, such as Showtime or Starz throughout 2021 for all new customers purchasing a family line bundle. Comcast could certainly offer Olympics content to Xfinity Mobile customers as a switching incentive, and AT&T… well, they are just getting started with HBO Max if John Stankey’s interview this week is any indicator.

Mr. Stankey said a lot about content in his discussion with John Hodulik at UBS (transcript here), and it’s worth reading all of his comments on HBO Max. His deepest insights, however, came about midway through the interview (minute 31 in the webcast) where he discusses why AT&T views content so strategically:

“…over time, what we’ve learned is being able to manage and have some of your own content is important. If you step back and you look at — let’s look at distribution for the MVPD (cable) business. It was an attractive business to distribute the pay TV bundle when there were fewer distributors in the market, when there was maybe 2 in the market. And at that point in time, a distributor could make money by aggregating content, and there was a margin stacking dynamic that occurred.

“I think the reality of where we are in distribution right now and what’s changed in these platform economics is when there’s multiple places that somebody can go to get content, if you’re just using your platform to distribute somebody else’s IP, at the end of the day, it’s going to be really difficult to ultimately make money on just being an aggregator of content that you don’t own or not having the opportunity to have a direct engagement with the customer where those hours allow you to do things like have insights to the customer, data with the customer that you can monetize other products and services on top of.

“And so I think it’s really important in this distribution world that we’re in today, in the drive to vertical integration that we think about the fact that you’re going to have to have some relationship with the customer and probably some core IP, and just running and distributing others is ultimately going to put you in a position where it’s the owner of that IP and that content or the owner of the distribution platform that will probably have the rents that accrue to them.”

In this response (about 300 words), he lays out why HBO Max content is critical to AT&T: a) platforms are proliferating with profits (“rents”) being split between content owners and distributors, and b) firsthand customer behavior, the driver of advertising and other insights, cannot be easily and effectively obtained without some degree of vertical integration. Basically, he says Comcast Xfinity Flex suboptimizes overall economics, and Verizon’s gross additions and churn losses can only extend so far.

Where does this leave someone like Charter, who has live sports content, but nothing like HBO Max or Peacock? It could leave them with a less profitable HBO distribution model, offsetting gains made in overall programming purchasing power from their Time Warner Cable/ Brighthouse merger. Does it change their earnings trajectory? Not until AT&T steps up to the plate with broad-based fiber solutions in Los Angeles and Dallas/ Ft. Worth. The lifetime value of one new broadband customer in those markets ($1600-2000) leaves plenty of room to fight off AT&T’s challenge.

Bottom line: Until HBO Max becomes an exclusive component of AT&T’s wireless and fiber offerings (years away, if ever, in our view), there will be room for Verizon, T-Mobile, and cable to distribute third party content while also being an effective traditional broadband or wireless competitor. While we think that AT&T could become a content juggernaut in a post-COVID world, their love of uniqueness and proprietary relationships could also be their downfall. Verizon’s approach with Disney+ and discovery+ is more valuable to customers and shareholders for the next several years. With more content acquisitions, however, Ma Bell could gain a dominant position and exercise considerable leverage. It’s more likely that new content competition emerges that places pressure on the AT&T content catalogue.

That’s it for this Brief. Next week, we will take up our next big trend – wireless as a broadband alternative. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Stay safe, keep your social distance, and Go Chiefs!