Chilly December greetings from Lake Norman, where “Santa Jim” was busy distributing Christmas treats to the neighborhood dogs. They are certainly an attentive bunch.

Thanks for the many responses to last week’s Brief. As seen below, content/streaming developments seem to occur daily, and we are encouraged by the level of competition that is emerging. Bundling with wireless is definitely a key theme for 2021, and the jury is out on who the ultimate winners and losers will be.

This week, we continue with another dividing trend – the long-term viability of fixed wireless as a replacement for wired Internet services. Although many companies have an interest in this space, we will focus our efforts on home broadband replacement efforts at Verizon, T-Mobile and AT&T. Before we dive into this topic, we’ll recap a few significant events of the week and analyze (hopefully one last time) the Apple iPhone 12 Pro (and now Pro Max) backlog.

An editorial note – we will not publish a Brief next Sunday (December 27), but will publish a couple of memorable 2020 interviews on the website. Our next Brief will be on January 2, 2021.

The week that was

This week’s most impactful headline came from Tuesday’s Nikkei Asia: “Apple Plans 30% boost in iPhone production for the first half of 2021.” This prompted a $74 billion increase in Apple’s equity market value for the week (now closing in on $2.2 trillion). Regular Sunday Brief readers are not surprised that Apple is increasing production, and, as we will see below, iPhone 12 Pro and iPhone 12 Pro Max supplies cannot come soon enough.

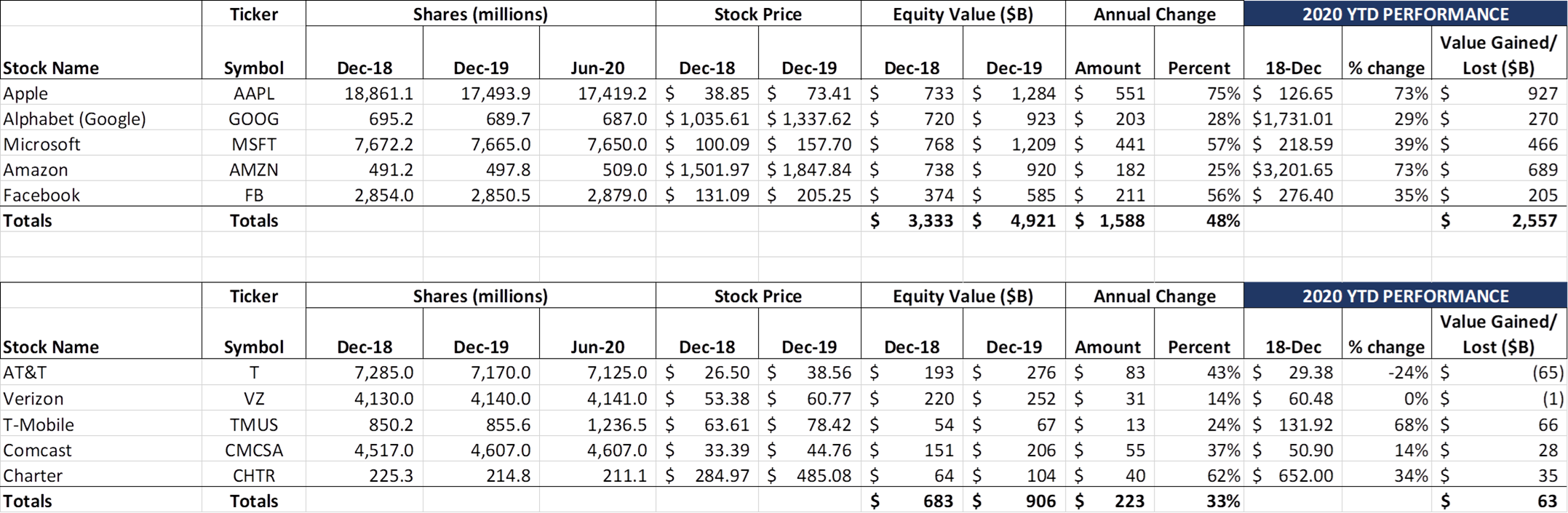

Apple drove over half of the Fab Five equity value gains for the week ($131 billion in total), as the markets think about the impact of recovering global economies in 2021. The Telco Top 5 gains for the year dropped $10 billion this week, with nearly all of the movement attributable to AT&T’s return to a sub-$30 stock price. It appears likely that the Fab 5 will finish the year with $2.5-$2.6 trillion in equity market value increase for 2020, and approximately $4 trillion in value creation over the last 24 months. For every dollar of equity market capitalization created by the Fab 5 over the past two years, the Telco Top 5 have created just under 7 cents. Influence follows value, and the Telco Top 5 are rapidly losing clout compared to their Fab Five peers.

This increased influence has not gone unnoticed – just ask Google, who became the latest target of two new antitrust lawsuits this week. On Wednesday, a group of ten Republican attorneys general alleged that Google and Facebook schemed to manipulate online advertising auctions using a Star Wars character as their code name (full Bloomberg summary is here and Wall Street Journal summary is here. This CNBC article also contains a Scribd copy of the complaint). Google quickly characterized the lawsuit as “meritless.”

Then came Thursday, when 38 attorneys general filed an additional lawsuit alleging that Google maintained monopoly power over the internet-search market using anticompetitive tactics and conduct (Wall Street Journal summary article is here). The attorneys general indicated that they expect to combine their lawsuit with the DOJ action initiated in October (which California joined last week).

It’s important to note that while these lawsuits were filed in close proximity to one another, they deal with two very different concerns. The first (DOJ + California + 38 AGs) is whether Google’s search agreements and practices created an anticompetitive monopoly, while the second (10 AGs led by Texas) focused on specific practices related to the ad placement process/ ad exchange operation.

The closest telecom comparison would be if Verizon were also the Number Porting Administrator (NPA or NPAC), seeing who was moving between carriers, and then using that information as a wireless carrier to instantly change their competitive/winback offerings. If no other carrier had access to that information, and hence the ability to respond, then the NPA + Carrier status would present an unfair advantage. Admittedly, this is not a perfect analogy, but the bottom line is that those who own exchanges (Google purchased DoubleClick in for $3.1 billion in 2008) oftentimes have more control over outcomes.

The Apple backlog saga – it got worse this week

Just when you thought it could not get any worse… the backlog for most iPhone 12 Pro and iPhone 12 Pro Max models increased this week. As shown in the chart below, 7 of 12 at T-Mobile, 6 of 12 at Verizon, and 8 of 12 of AT&T’s color/ memory combinations are delayed by at least four weeks. This for a device that debuted eight weeks ago:

The lack of availability of the iPhone Pro at AT&T is particularly acute, with the earliest delivery of any color/ memory delivery (via online channels) delayed into January. And, as the article above describes, there are shortages of key parts plaguing the supply chain.

As we surmised last week, the pressured quest to “have something under the tree” has driven many iPhone 12 Pro customers to the most expensive Pro Max. The next chart shows iPhone 12 Pro supply constraints among certain color/ memory combinations (this is not a golden opportunity to purchase an iPhone 12 Pro):

While the 512 GB backlog at Verizon and now T-Mobile appears to have seen the greatest changes, last week’s relative safe supply at Verizon (6 color/ size combinations of the Pro Max available last week) of any Pro has evaporated to two available colors for the 128 GB memory size. A similar depletion has occurred at AT&T. Interestingly, no real shortages of the basic iPhone 12 (or iPhone 12 Mini) have been seen for the last several weeks.

It’s difficult (particularly in the case of AT&T, who expanded iPhone 12 offers to include their current customers) to determine the gross/ net additions impact of the chronic backlog. Expect to hear more from the carriers in their earnings announcements, however, about “what could have been” had inventories been plentiful. Great news for 5G adoption and also for Apple, but potential “switcher” delays for T-Mobile.

AT&T lands Roku just in time for WW1984

As a follow on to last week’s Brief, AT&T announced that HBO Max will be distributed through Roku just in time for the debut of WW1984 (full announcement here). As indicated in this Bloomberg article, this likely doubles the addressable market for HBO Max at a critical time. Big news for both companies.

Fixed wireless – implications for wireless and cable

There have been a lot of discussion recently about the “next big thing” in wireless, and many analysts believe it will be home and small business Internet substitution. Verizon continues to expand their 5G Home Internet network (as of the end of October reaching 12 markets – announcement here) with Amazon Bundles, Verizon Stream boxes, a free month of YouTube TV, and a $100 gift card to sweeten the pot. Expected speeds are ~ 300 Mbps, with peak speeds approaching 1 Gbps. Verizon’s new modem (pictured nearby), developed in conjunction with Original Device Manufacturer Wistron, is designed for self-installation (although about 30% of customers request professional installation, which is provided through Asurion). While the footprint is small, early adopters have generally had positive comments on Reddit and Verizon Community threads. For $50/ month (inclusive of taxes and fees for existing Verizon customers on autopay), it’s very competitive with cable offerings.

In addition to this, Verizon has also expanded their 4G LTE Home Internet product on October 1, which is now available in 189 markets in 48 states (specific zip codes where this product is available can be accessed through a link in the article). The LTE variant is $10 less per month for existing Verizon customers but there is a $10/ month modem charge. When properly installed (also through Asurion), the user experience has been positive, but neither product has been a cable killer.

Not to be outdone, T-Mobile launched their LTE Home Internet product on October 8 to 20 million homes or about 17% of the US population (original announcement here and November expansion announcement here). T-Mobile is very explicit about their coverage ambitions in their news release: “With additional capacity unlocked by the merger with Sprint, T-Mobile is preparing to launch 5G Home Internet commercially nationwide, covering more than 50% of U.S. households within six years and providing a badly needed alternative to incumbent cable and telco ISPs.” 60-70 million households is a very large initial addressable market.

For the last two months, the TSB offices have solely been using T-Mobile Home Internet and our speed ranges mirror those described by T-Mobile in their marketing material. We routinely experience 70 Mbps download/ 30 Mbps upload. Our Zoom Conferencing connections do not drop, and our speed variance is less than we experienced with Spectrum (our section of Lake Norman still has AT&T DSL which has limited market share – COVID bolstered Spectrum’s market share and created a lot of Internet node congestion). We routinely run two HD video streaming services (YouTube TV, MLB channel, Amazon Prime Video, others) on top of work-from-home Internet needs most days. Best of all, our monthly cost dropped from $93 with Spectrum to $50 with T-Mobile (no upfront or recurring modem fee).

While T-Mobile’s current LTE product is not perfect (we eagerly await a 5G version), it is very consistent. Combined with TVision (which we see as an equally compelling product currently starting at $40/ month for 67 channels), it could be a meaningful competitor to cable.

AT&T is less aggressive about fixed wireless in the residential space. At the Oppenheimer 5G Summit conference this week, Igal Elbaz, SVP of Wireless Technology, addressed Ma Bell’s differing approach to millimeter wave fixed wireless access as follows (transcript here and photo of Igal and Tim Horan nearby):

“Now I believe that some of our competitors… [are] building millimeter wave for broadband and building this as a stand-alone network. We [have] never seen the economics of building a stand-alone millimeter wave for broadband. When we think about broadband, we think about a set of solutions that help us to serve our customers the way they need it.”

Igal then went on to discuss the differences between customer satisfaction on deployed fiber versus millimeter wave, and to ascribe millimeter wave to small cell Cloud RAN (C-RAN) deployments. The bottom line is that AT&T is not thinking about deploying fixed wireless access over millimeter wave as a residential access solution (particularly where they are the incumbent broadband provider) anytime soon. They will remain focused on fiber deployments.

What AT&T’s comments indicate, however, is that they do not have an out-of-region fixed wireless “challenger strategy” for residential or small business customers. This creates an armor chink in markets like Boston, Philadelphia, Washington DC and New York City where millions of AT&T wireless subscribers will soon be hit with bundled discounts from cable. As we have mentioned several times this year, the question for cable is not “if” but “when” they will build out CBRS and C-Band capacity to improve their overall family plan economics. Once those deployments are near completion, $100-120/ month, four-line unlimited family plans will not be far behind for Xfinity and Spectrum Internet customers.

Here are developments to watch in 2021:

- When T-Mobile has successfully deployed 150 million POPs on the new 2.5 GHz + 600 MHz 5G architecture, look for a shift in their product portfolio from residential DSL replacement to “all access forms” replacement. Also, once that is complete (they may experiment in an early deployment market like Philadelphia), look for T-Mobile to do even more bundling, perhaps working more closely with Netflix and others to place content servers as close to T-Mobile customers as possible. When 4Q results are announced, we would not be surprised to see the early results of the T-Mobile Home Internet expansion announced and exceed expectations.

- Verizon will continue to stick to their 5G Ultra Wideband plan, expanding it to more aggressively address small business access. In some cases, this will improve their current P&L by reducing third-party (AT&T and Lumen) access costs. Wholesale access has historically been a high-margin product for both telcos and cable companies, and the impact to the incumbent providers will be directly dependent on Verizon’s commitment to self-source the last mile. While we think they have the discipline to do this, we also think that the multi-line residential economics cable will achieve from spectrum deployments will also apply to most small businesses.

- We think AT&T will stick to deploying more fiber in their incumbent region next year. This focus will help shore up the value of their broadband franchise in areas like Los Angeles, Dallas/ Ft. Worth, Houston, Atlanta, and Miami. At the same time, they will continue to extend handset and trade-in promotions to existing customers to shore up wireless contract quality in the Northeast and West.

- We firmly believe that Comcast will lead the way in deploying even more aggressive fiber solutions to residential customers, whether they reside in single family homes or in Multi-Dwelling Units (MDUs). Cable will be very choosy with their investments, and Comcast has the most to gain with Xfinity Flex and Peacock success directly tied to a high-octane Internet experience.

Can fixed wireless be successful? In rural areas where copper is the primary alternative, the answer is “with the right target marketing, installation and service model – yes.” In metro areas and in fiber-fed MDUs, the answer is a definite “maybe.” As discussed above, bundled discounts will be important. If cable challengers can market and deliver bundled features (content) and savings with the same attractiveness that Time Warner Cable, Brighthouse, Comcast, and Cablevision did with the “Triple Play” fifteen years ago, they could erode cable’s broadband market share. Unlike the relatively unresponsive telcos of the past, it’s hard to see cable ceding share losses without a fight.

That’s it for this year’s Brief. Next week, we will take a break and then begin 2021 talking about our last big trend – enterprise 5G. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Stay safe, keep your social distance, and Go Chiefs!