Greetings from Statesville and Davidson, NC, where vaccinations are in full swing. Pictured is the appointment-only drive thru line at our regional hospital where the elder Pattersons received their first jab Saturday (getting the appointment for Jim’s folks was a definition of “luck of the draw”). It was a smooth, quick, and efficient process. We are very thankful for all of the hospital staff who are working long hours (and in 30-40 degree temperatures!) to get the vaccine dispersed.

We did our best to keep this week’s Brief concise and to the point. There are many insights we had to omit due to space but will include in future issues and online.

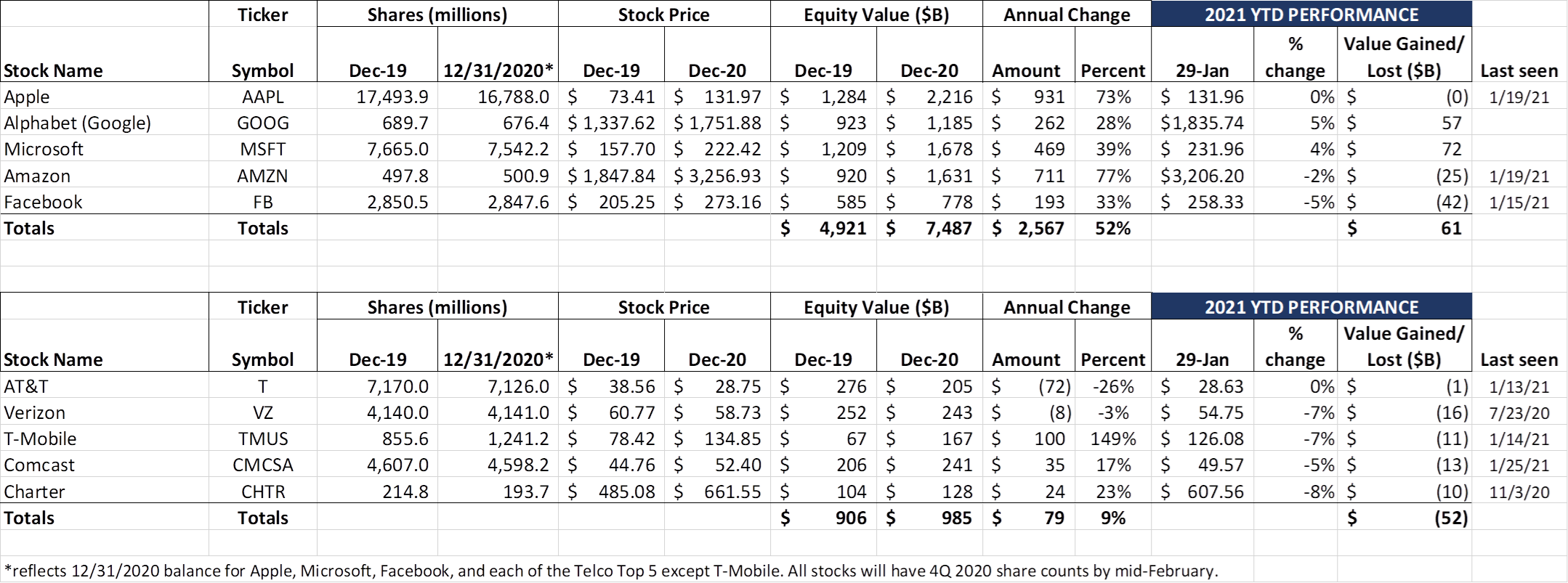

This week, we had earnings from Verizon, Microsoft, AT&T, Apple, Facebook, Comcast and Charter. As a reminder, the remaining earnings calls are scheduled as follows:

- Google Tues, Feb 2 @ 5 ET

- Amazon Tues, Feb 2 @ 5:30 ET

- T-Mobile Thurs, Feb 4 @ 4:30 ET (preannounced subscriber results on Jan 6)

The week that was

“Choppy” is a good way to describe Fab Five activity this week. Apple announced record 4Q 2020 profits and iPhone revenues, yet got pummeled this week (-$121 billion). Don’t worry – Apple has plenty of cash reserves (~$200 billion in short + long-term cash and marketable securities) and operating cash flow (nearly $39 billion in cash flow from operations in the quarter). They used their excess cash to buy back over 4% of their shares during 2020.

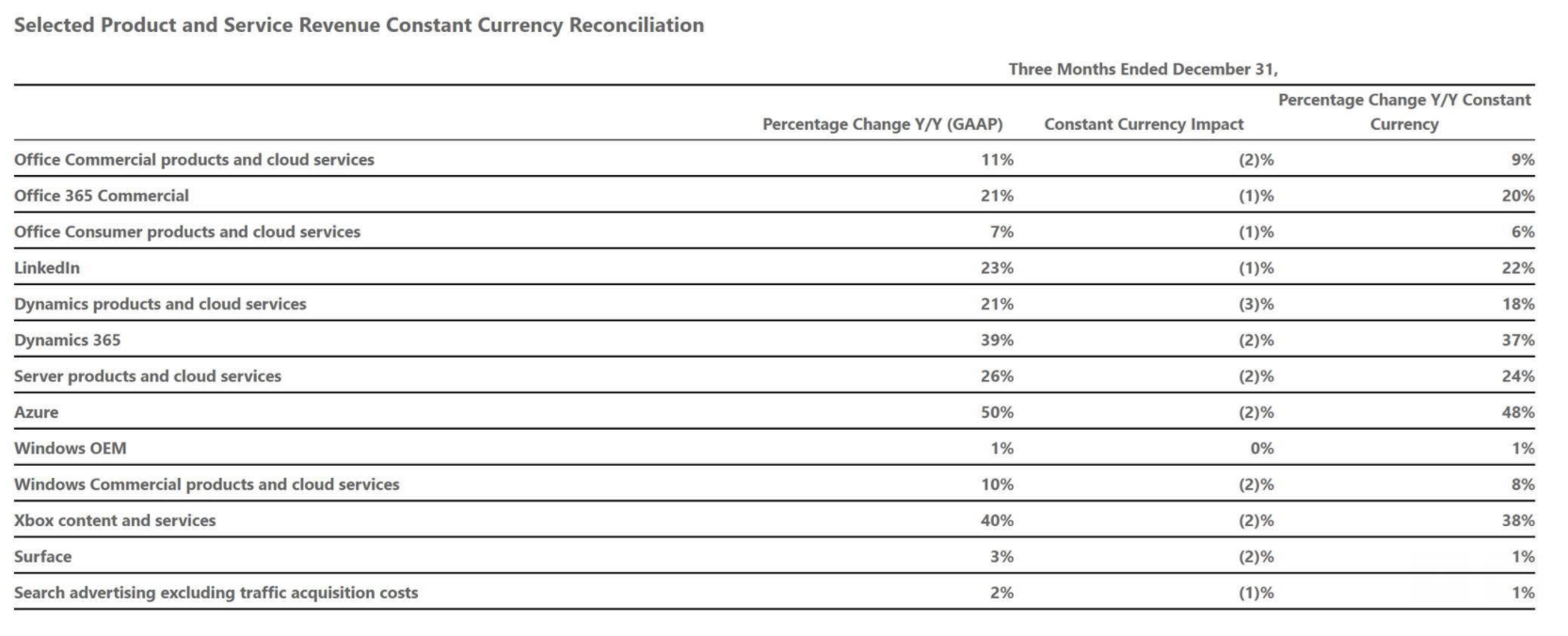

Microsoft reported stellar growth on a large base of revenue, thumbing their nose at “GDP+” growth advocates, and was rewarded (+$35 billion wk/wk) as the stock reached all-time highs. While growth was a common theme across the board for the Redmond software and cloud services giant, Xbox growth was especially hot (+40% annual growth). Here’s the overall revenue growth by product for Microsoft:

Thanks largely to COVID, but also due to the recent release of the latest Xbox S and X consoles, gaming and in-home entertainment are outperforming right now. More on Microsoft in next week’s Brief.

Meanwhile, AT&T and Verizon reported earnings and their stocks moved modestly (AT&T -$2 billion wk/wk, Verizon -$11 billion). Comcast increased capitalization $4 billion on broad earnings strength, and Charter had modest losses on decent earnings. As we will discuss below, the market is having difficulty understanding the dynamics of residential broadband growth.

While earnings analysis prevents us from going into great detail, it is worth noting that Apple CEO Tim Cook made a speech to the 2021 Computers, Privacy, and Data Protection conference held virtually this week (comments are the first 15 min here). While there has been reporting on the rebuke, we thought it would be worth detailing Mr. Cooks short yet sharp remarks with two extended excerpts:

“The fact is that interconnected ecosystems of companies and data brokers, of purveyors of fake news, or peddlers of division, of trackers and hucksters just looking to make a quick buck, is more present in our lives than it has ever been. And it has never been so clear how it degrades our fundamental right to privacy first, and our social fabric by consequence…. If we accept as normal and unavoidable that everything in our lives can be aggregated and sold, then we lose so much more than data – we lose the freedom to be human.”

“Technology does not need vast troves of personal data, stitched together across dozens of websites and apps in order to succeed. Advertising existed and thrived for decades without it… If a business is built on misleading users, on data exploitation, on choices that are no choices at all, then it does not deserve our praise – it deserves reform…. At a moment of rampant disinformation and conspiracy theories juiced by algorithms, we can no longer turn a blind eye to a theory of technology that says ‘all engagement is good engagement, the longer the better’ with a goal of collecting as much data as possible. Too many are still asking the question ‘How much can we get away with?’ when they need to be asking ‘What are the consequences?’”

While not mentioning Facebook by name, it’s clear that his comments were directed at the social media giant. For more on Apple’s views on privacy, here’s a link to the “A Day in the Life of Your Data” paper referred to in the video, and also Tim’s comments at the October 2018 CPDP conference. The gloves are coming off, there’s a new Administration in town, and things are about to get interesting.

Earnings recap part #1 – two truths and a lie

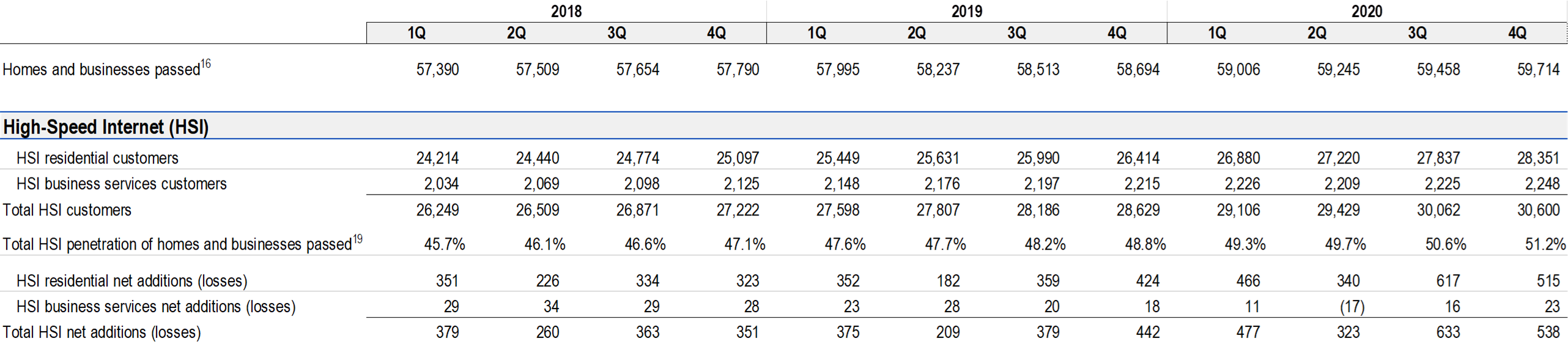

Truth #1: Despite all of the bluster about AT&T’s fiber ambitions (and deployed fiber success), Comcast and Charter continued to take residential High Speed Internet (HSI) market share in 4Q 2020 (Comcast earnings here and Charter here). The two largest US cable providers accelerated their market share gains, as the below chart for Comcast shows:

Passings increased by 1.6% in 2019 and 1.7% in 2020. Residential HSI customers increased even faster – 5.3% in 2019 and 7.3% in 2020. Business customer growth was less than residential (4.2% in 2019 and 1.5% in 2020), for many COVID and non-COVID related reasons. Overall, Comcast grew 1.23 million net residential customers in 2018, 1.32 million customers in 2019 and 1.94 million in 2020 – 4.5 million new customer relationships in three years. Charter’s net residential HSI additions are 1.11 million in 2018, 1.28 million in 2019, and 2.12 million in 2020 – slightly more than Comcast. Both grew their subscriber count far faster than homes passed, and both increased their cash flows as a result of increased neighborhood scale.

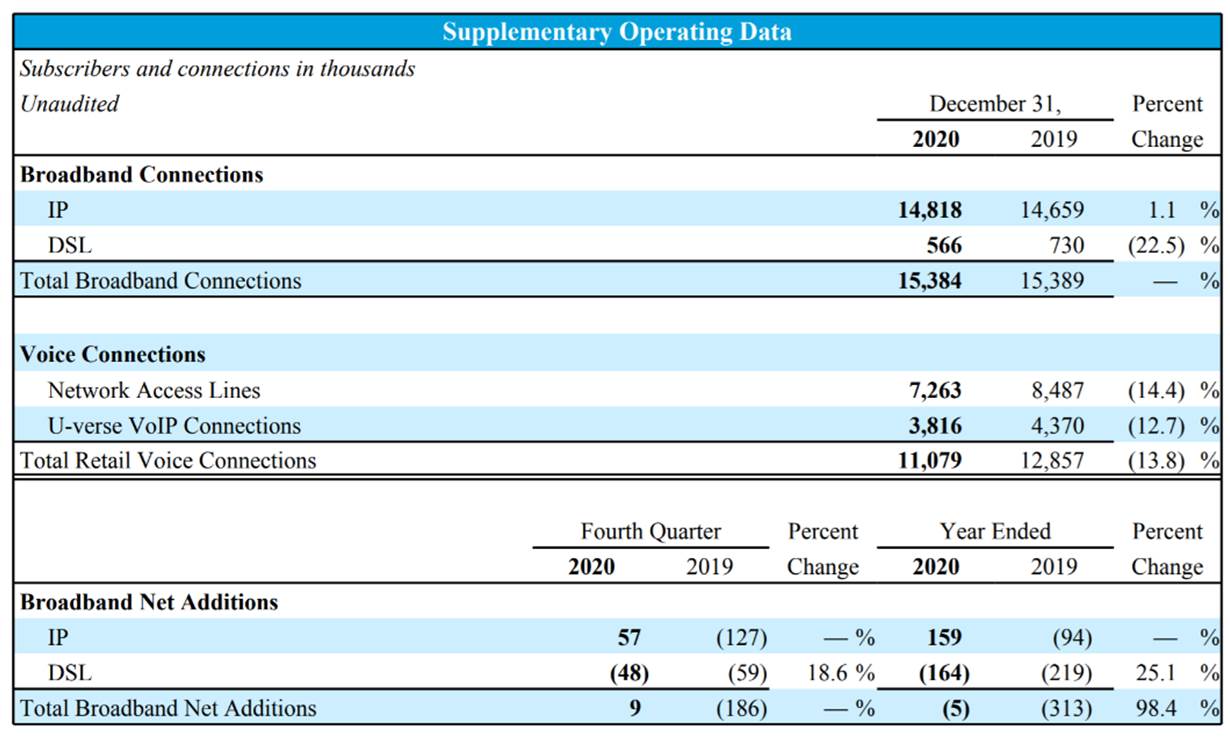

Let’s compare that growth to AT&T using their Q4 results (shown left, full earnings package here). After years of losses, 2020 proved to be a break-even year for AT&T. Even with this improvement, however, they managed to lose market share (Dallas, Austin, Atlanta, Nashville, Miami, Jacksonville, Charlotte, and other fast-growing locations are all in the AT&T footprint).

Verizon performed slightly better, with 19K broadband net additions in 2018, 7K in 2019, and 191K in 2020. Fiber beats coax every time? Not in the Northeast. Comcast’s 4Q net additions, which include markets potentially impacted by COVID moves (Chicago, Philadelphia, New Jersey, San Francisco, Seattle, Boston, Hartford, etc.) grew faster than AT&T and Verizon did for the past twelve quarters.

To their credit, AT&T disclosed a 34% market share for fibered neighborhoods and CEO John Stankey disclosed on the earnings call that they would be (conservatively) targeting 2 million additional homes passed in their 2020 rollout (assuming $700 per home passed, which considers a lot of fiber already deployed to the neighborhood node), that’s ~$1.4 billion or about 8% of their total capital budget.

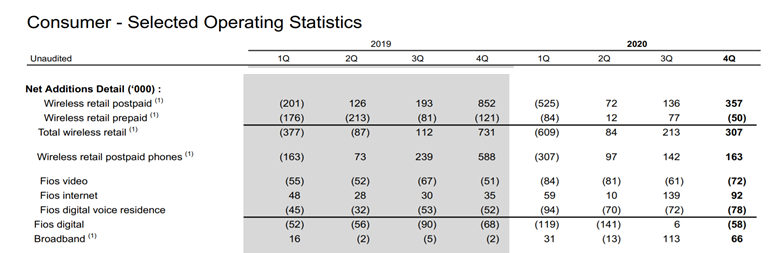

The question on many minds is “What’s happening to the Consumer 5G Ultra Wideband growth?” Verizon reports a 5G Ultra Wideband customer as a postpaid “other” or non-phone net addition. Here’s how that line item has performed over the last eight quarters (Verizon’s full 4Q earnings release is here):

To get to “other” growth, the phone net additions detail needs to be subtracted from the wireless retail postpaid line. This yields, for example, 194K non-phone postpaid retail growth in 4Q 2020. Some of that growth came from 5G Ultra Wideband. While there might be some Hotspot or accessory growth in this figure, however, it’s still lower than the 264K non-phone postpaid retail growth in 4Q 2019.

For 2020, Verizon grew their total consumer wireless retail postpaid base by 40K customers, down about 930K customers from 2019. The non-phone figures are 193K for 2019 (21% of total growth came from non-phone sources in 2019) but 95K customers for 2020 (more than 100% of total wireless retail postpaid growth came from phones in 2020). Non-phone wireless retail revenue generating units fell in 2020, even as Verizon added twelve 5G Ultra Wideband markets. In 2021, they stated that they will add an additional 20+ markets. Verizon’s fixed wireless data offerings are not materially growing the base and may be covering up some decreases in certain products/ devices (tablets, watches, etc.).

It will be interesting to compare these figures to T-Mobile’s release this Thursday – we anticipate that Magenta had an excellent launch of their LTE-based Home Internet product and have already announced that they will have a 5G version ready for tens of millions of homes and small businesses by the end of 2021.

Bottom line: AT&T’s new fiber plans will take time to materialize in 2021. Verizon’s Ultra Wideband will also take time to gain a foothold in dense urban markets (especially where they already compete against AT&T fiber). Comcast and Charter are watching, but, like the rest of us, they are waiting for their competitors get their collective act together.

Truth #2: AT&T’s existing base stuck around because of attractive iPhone and Galaxy offers. As we mentioned above, Verizon’s net phone additions were significantly lower than 4Q 2019. Part of this is due to COVID-related retail slowdowns, but much (most?) of it is likely driven by AT&T’s aggressive retention offer.

In 4Q, Verizon added 279K postpaid phone lines. T-Mobile preannounced that they added 824K postpaid phone subscribers in Q4. Cable (Comcast + Charter) added 561K total wireless subscribers – we assume that ~90% of these were phones or about 500K for the quarter. AT&T added 800K postpaid phone subscribers. The industry grew ~2.4 million postpaid phone subscribers in the fourth quarter, with AT&T representing a third of that total and Verizon around 12%. Cable’s MVNO growth was 2x their network supplier. This was definitely a tough “hold the fort” quarter for Big Red, and their stock sold off to levels not seen since July 2020 because of their near-term financial discipline.

One key metric to measure existing customer retention is the device upgrade percentage (6.5% of the base for AT&T, and only 5.6% for Verizon). The logic to this metric is explained in the quote below. The most important key metric for AT&T, however, was the postpaid phone monthly churn decline, which was down an impressive 31 basis points from 4Q 2019 (1.07% to 0.76%). Given AT&T’s continuation of the offer into 2021, it’s likely we will continue to see 1-2% upgrade differences per quarter and even lower postpaid phone churn. It is widely thought that AT&T will also cut back on other promotional costs (e.g., advertising) to keep overall Cost Per Gross Add (CPGA) as low as possible. If T-Mobile and cable are going to continue to grow, they are going to need to target Verizon first and AT&T second.

Here’s how AT&T CEO John Stankey explained their existing customer promotions on their earnings call:

“[We will be] the industry leader in churn this quarter, I think we called it right. We said that we don’t have customers that are upset about our network. They like it. We don’t have customers that are upset about our service. They’re satisfied with our service.

“We have customers who are interested in finding new devices. We shared with you that we had a little bit more aging population on device longevity than the rest of the industry. We’ve been targeting how we do that. I think getting the new 30-year lease on life — the 30-month lease on life with these customers — I wish it was 30 years, it’s in a very appropriate exchange [sic] for the franchise right now given everything we have in front of us.”

Bottom line: AT&T wins the postpaid phone churn award (and likely the upgrade % award) this quarter. The ARPU gains that they saw were offset by increased trade-in allowances and other iPhone promotions. Competitors will be forced to offer increased buyouts to woo gross adds away from Ma Bell. Let the wooing begin.

The Lie: “This is a unique opportunity that will redefine the video entertainment industry and create a company able to offer new bundles and deliver content to consumers across multiple screens – mobile devices, TVs, laptops, cars and even airplanes. At the same time, it creates immediate and long-term value for our shareholders” – from AT&T’s May 2014 announcement to purchase DirecTV for $67.1 billion ($48.5 billion for equity + $18.6 billion in assumed debt). Nearby picture is of Michael White, DirecTV CEO and Randall Stephenson, CEO of AT&T at the time of the merger.

It was to be all about bundling and scale. DirecTV was going to bring AT&T the scale (and associated lower broadcasting costs) it needed to reinvigorate their fledgling U-Verse TV business. AT&T customers were finally going to get the opportunity to receive bundled products and services. And… AT&T scored the vaunted NFL Sunday Ticket. To quote Stephenson in The New York Times: “The more we peeled the onion back, frankly the better we felt about this.”

That was 2014. By 2020, everything had changed – just look at the newly recast video segment (page 8) here. Whether the former US President or Colin Kaepernick (or consistent price increases) were to blame did not matter – The Sunday Ticket had lost its mojo. For many reasons, the value of DirecTV (including debt) has plummeted to ~$15 billion if the stories of a possible sale are to be believed. This forced a non-cash write down of $15.5 billion of goodwill in 4Q, the largest in the telecom industry since Sprint/ Nextel ($29+ billion charge taken against 4Q 2007 earnings). Stephenson and White were long gone, but the debt from the transaction wasn’t. Stephenson’s legacy will be tarnished by this debacle.

Bottom line: AT&T made a fundamental mistake when they purchased DirecTV. They have now placed all of their 2021 chips on HBO Max. While we think they will succeed with infusing HBO Max into every part of wireless and fiber, will that be enough to justify the $85+ billion purchase price? Only time will tell. One thing is certain – AT&T’s debt will certainly be downgraded to junk status if WarnerMedia does not quickly recover.

Next week, we will continue our earnings analysis with a “Super” wireless focus. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Stay safe, keep your social distance, and Go Chiefs!