Happy Valentine’s Day from Charlotte/ Davidson/ Lake Norman, NC. We have prepared a very special issue this week for both President’s Day and Valentine’s Day holidays. Because it’s a long weekend, we took the liberty to slightly increase the length of this week’s Brief.

A quick shoutout in case you missed it – the Fritzsche Forum is back (link here)! Yes, our good friends at Digital Infrastructure Investor are going to be publishing Jennifer’s column periodically. We recommend adding it to your browser bookmarks. The first edition of the new and improved Forum is focused on edge computing, automobiles, and sports.

The week that was

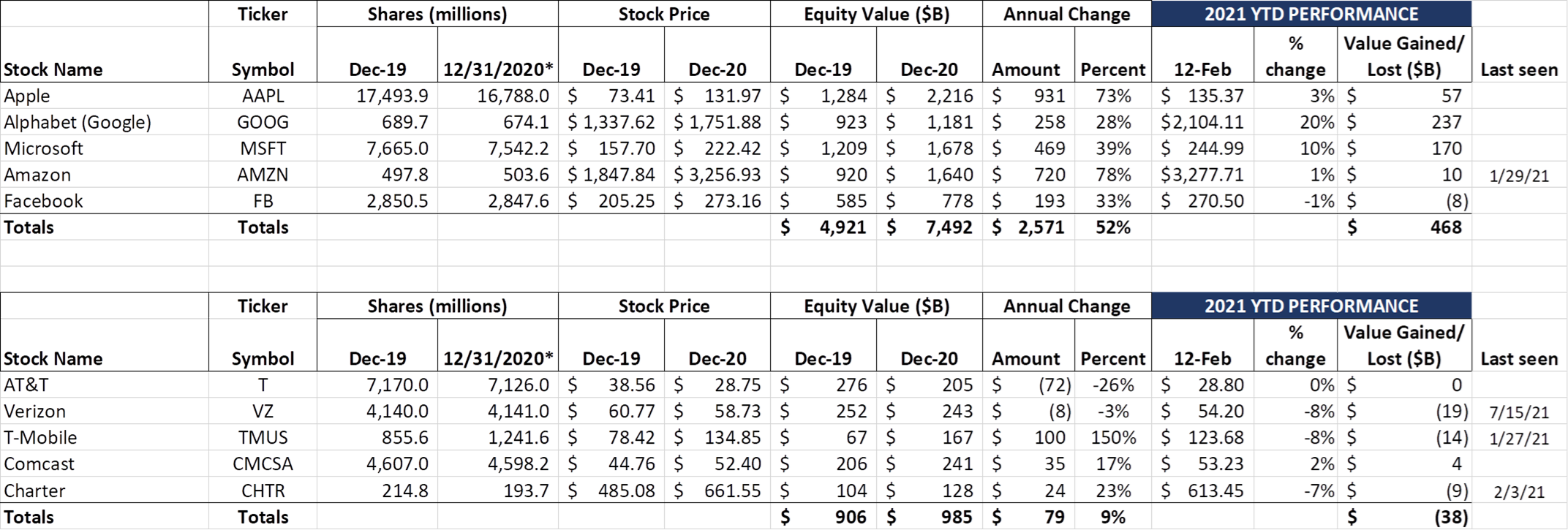

Relatively speaking, this week was a quiet one for both the Fab Five and the Telco Top Five stocks. Apple (-$23 billion) and Amazon (-$38 billion) led Fab Five lower this week (-$28 billion as a group). The Telco Top Five was also basically unchanged with Verizon losing an additional $5 billion in market capitalization and Comcast gaining $10 billion. Overall, the Fab Five have added $468 billion in market value in the first six weeks of 2021, while the Telco Top Five have lost $38 billion, roughly a half trillion swing to start the new year.

As we noted above, it’s been a while since Verizon’s share price has been at this level (mid-July, in fact), and it will likely stay there until the C-Band auction results are announced. Perhaps this is a “sell on the rumor, buy on the news” period for Big Red – there’s no doubt in our minds, however, that Verizon’s historical financial discipline has already kicked in.

When will we know the extent of Verizon’s increased indebtedness? The analysts at Raymond James issued a note Thursday predicting that the assignment phase of the C-Band auction will end on February 17. This means that investors could learn the identities of the largest bidders as early as February 27. We don’t yet know how this impacts the analyst days that each wireless player has committed to have shortly after the announcement, but we will likely get clarity at month end. We predict that Verizon is ~$44 billion of the $81 billion total, with AT&T at $15 billion and T-Mobile at $12 billion.

Also, in case you needed something to celebrate, last Thursday (Feb 11) was the one-year anniversary of Judge Marrero’s announcement that he was going to approve the T-Mobile/ Sprint merger. In case you would like to relive that moment, here’s the recap from Light Reading.

Speaking of merger approvals, there’s a lot of activity afoot in the telecom community to block Verizon’s purchase of their largest MVNO, Tracfone mobile (note: The FTC already approved the merger in November, while the FCC and the DOJ approvals are still pending). On February 5, the Attorneys General of 16 states and the District of Columbia sent a letter to the FCC asking for a “thorough investigation” of the deal. Specifically, the states are asking for additional conditions and protections for Lifeline (government-subsidized plans for low-income families and individuals). A copy of the letter is here.

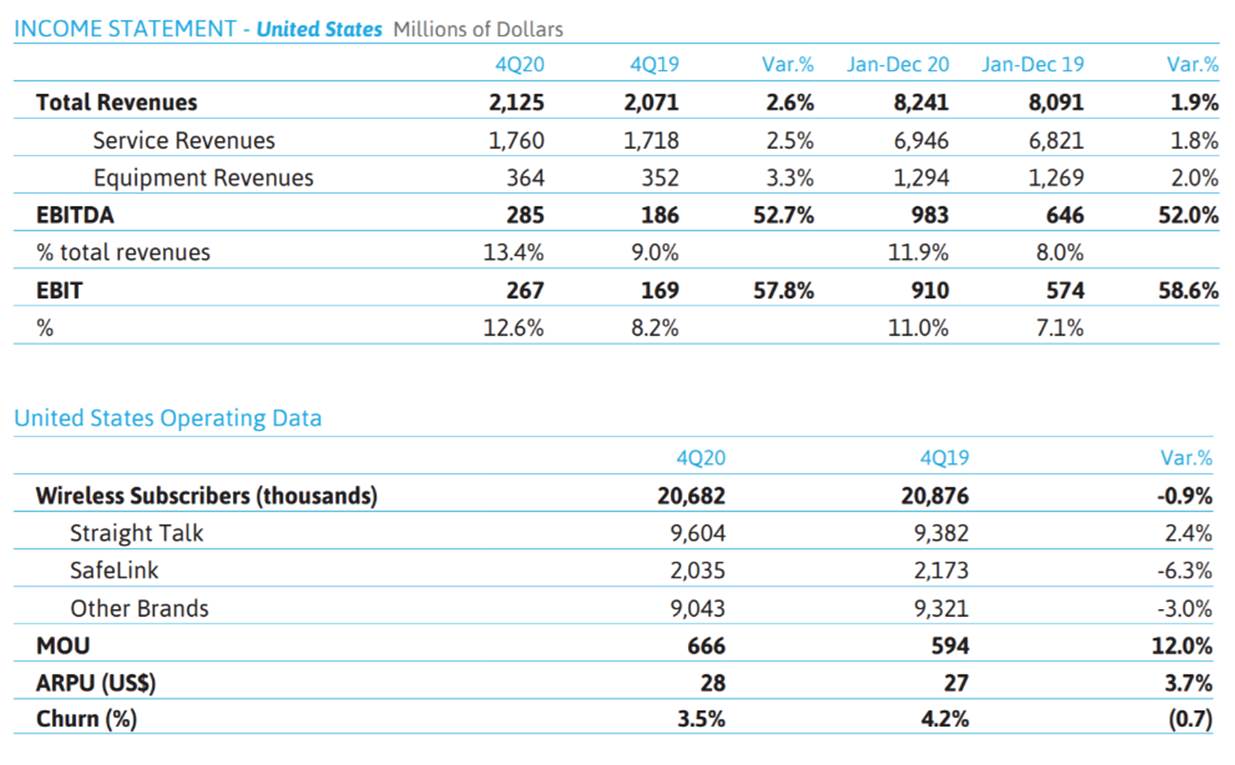

Meanwhile, Tracfone reported earnings last week. Nearby is a summary of their results (note: Tracfone currently uses all of the major carriers as MVNO customers). As expected, they are pulling back on Lifeline customers (down 6.3% on an annual basis), taking actions to lower churn (down 70 basis points to 3.5%), and increase EBITDA (up 440 basis points year/ year). Straight Talk (Walmart) is continuing to be the primary source of growth with subscribers up 2.4%. Due to mix shifts (away from Lifeline), ARPU rose to $28.

As we have discussed previously, Verizon will reclassify Tracfone’s current (wholesale) revenues as retail prepaid service revenues once the merger is complete. With 666 minutes per average customer (the average cost of which is ~$2.75 assuming the traffic is VoLTE), and the fact that Tracfone customers receive deprioritized data if there’s congestion, there’s plenty of room for Verizon to compromise with the FCC and DOJ.

Before diving into our discussion on wireless, three noteworthy follow-ups. Under the theme of “The Great American Move,” if any of your friends are looking to relocate, the city of Natchez, Mississippi, wants to welcome them (Brandon Hall, one of the stately homes of yesteryear, is currently for sale for a cool $3.85 million). The Shift South program will pay new residents who stay a year (purchasing a home valued at $150,000 or more – there are 117 single family homes currently meeting this criteria at realtor.com) up to $6,100 in relocation expenses, consisting of $2,500 up front and $300 per month for 12 months. Besides the requirement of a home purchase, the applicant must “be employed by an employer outside the Natchez region and have the ability to work remotely.”

According to Broadbandnow.com, Natchez is served by AT&T Fiber (26% of the homes passed), AT&T DSL (91.2% of the population), and Sparklight (formerly known as Cable One, with 81.2% coverage). Business coverage is even worse, with AT&T touting fixed wireless (no more DSL) and Sparklight coverage at a measly 40%. C-Spire to the rescue?

Also of note, under the theme of “Google – Times They Are a-Changin”, we have an article and podcast from CNET about the developments down under (see link later in this paragraph). For those of you who have not been following, Google is threatening to pull its search engine from the country of nearly 26 million over a recent bill working its way through the national legislature. The News Media Bargaining Code bill would require Google to pay news outlets for the news links that are produced from search results. According to this CNET article published Friday, legislators from Canada and the European Union are also considering introducing similar legislation. It’s a good background article. While losing Australia might not dent Google’s revenues (2.5% of total sales came from Canberra), Canada and Europe are a completely different matter.

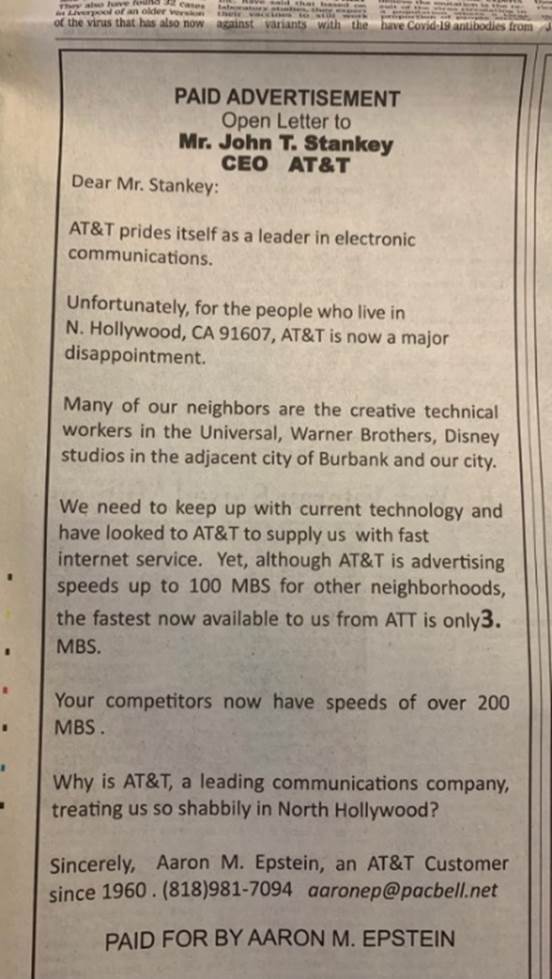

Finally, under the theme of “Wake Up, AT&T!”, consider the 90-year old who took out a quarter-page advertisement in The Wall Street Journal earlier this month (see copy of ad nearby). Ars Technica made Mr. Epstein a superstar, and the ad was featured on Stephen Colbert’s Late Show.

After taking out the $10,000 ad, Mr. Epstein got quick results. Per Ars:

“AT&T CEO John Stankey called Epstein personally today [Feb 12], Epstein told us. Stankey told Epstein that he saw his WSJ ad in a packet of press clippings given to him by staff. Stankey also apparently gave Epstein a different answer than the one we got from AT&T’s public-relations team about when the rest of his neighborhood will get fiber. “He said that the way things are, my neighborhood should have it within 12 months,” Epstein told us, shortly after getting off the phone with AT&T’s CEO. By contrast, AT&T’s spokesperson told us it has “completed” the expansion in his neighborhood, which appears to be incorrect based on what Stankey and other AT&T employees told Epstein.”

Within a week of placing the ad, Mr. Epstein had 300 Mbps symmetric service. The squeaky wheel got the grease. As for AT&T (besides our inquisition over press clippings – makes us wonder if Mike Sievert at T-Mobile and Mr. Vestberg at Verizon receive similar press clipping “packets”), they only have 1,999,999 homes left to go to achieve their 2021 fibered homes goal.

Telecom love is in the air (not on the ground)

The remainder of today’s sweetheart Brief reflects on last quarter’s Altice and Lumen earnings. Simply put, telecom investor love appears to be directed skyward (wireless) and not in underground connectivity, at least for now. This adoration is misguided, in our opinion, as the fair hair of wireless is firmly attached to the head of in-home/ on-prem Wi-Fi (which still originates the vast majority of mobile data (75% or more by nearly every estimate)) and the body of metro and regional fiber. Without the body and a head, wireless growth would be non-existent.

As proof points, one need look no further than the earnings of Altice USA and Lumen (formerly known as CenturyLink). While Altice has some MVNO customers through its T-Mobile MVNO relationship, and CenturyLink is providing a limited amount of fixed wireless services, they are essentially wireline providers.

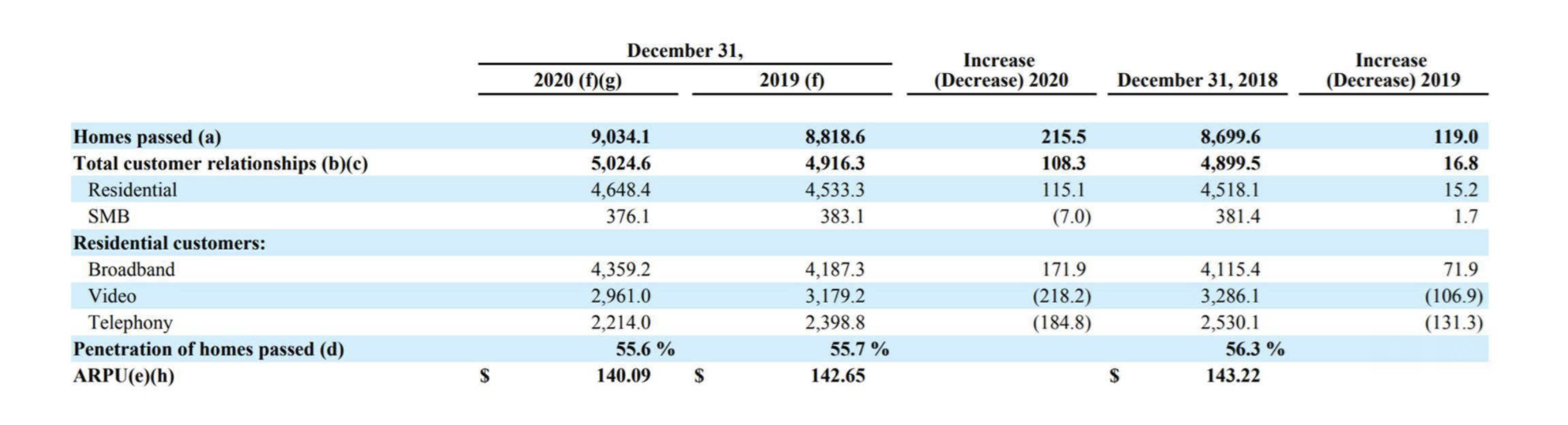

Altice announced earnings this week and released their Annual Report (form 10-K). Their customer snapshot is as follows:

Altice passes just over 9 million homes or just less than 7.5% of the total country. The majority of its territory is in the New York metropolitan area (Long Island, suburban Connecticut and suburban New Jersey), but, due to their merger with Suddenlink in 2015, the company has additional (primarily rural) customers in 17 other states.

Even with that mix, Altice has at least one relationship with 55.6% of their homes passed, even though they have battled Verizon’s FiOS High Speed Internet product for over a decade. 94% of their residential relationships involve broadband connectivity to the home (up from 91% in 2018). Thankfully, cable-only (or cable + phone) relationships are few and far between. Altice is currently in the last stages of overbuilding their coax with fiber and completed the New York City metro area fiber build in 2020. Nearly 8% of their entire base subscribes to their fastest 1 Gbps broadband speed tier (usually priced at $55 for the first year). Where Altice has overbuilt with fiber, new customers are taking the 1 Gbps (symmetric) speed 67% of the time.

Even with these ambitious fiber build plans, Altice is only spending about 11 cents per dollar of revenue on capital (fiber overbuilds account for around 2 cents or 20% of their total capital). Given their strong and growing cash flow performance (combined with low debt financing), it was not surprising to see Altice make a move for Canadian-based Cogeco (to obtain their American-based subsidiary Atlantic Broadband. More on their failed advances in this Light Reading article). After they were spurned, Altice bought back $2.33 billion in shares (64.6 million) through a tender offer last December. Despite strong performance and aggressive share buybacks in 2020, Altice has struggled to grow their overall equity market capitalization. Where’s the market love?

Bottom line: Altice is a classic example of a company making the right investments (fiber to the home), growing share (over deployed fiber or upgraded DOCSIS), and expanding inorganically as opportunities become available. Given a small and shrinking number of eligible merger partners, the key to unlocking more shareholder value may lie in expanding Suddenlink even more rapidly through the use of CBRS or other wireless spectrum.

Lumen (formerly CenturyLink) also announced earnings this week and received a cold response. Unlike Altice, however, they are underinvested in fiber across their footprint and unable to feed the mouths of both fiber and dividends. Since the beginning of 2019 (so slightly more than a 2-year view), Lumen has significantly lagged wireline champ Charter, wireless champ T-Mobile, and the overall S&P 500 Index:

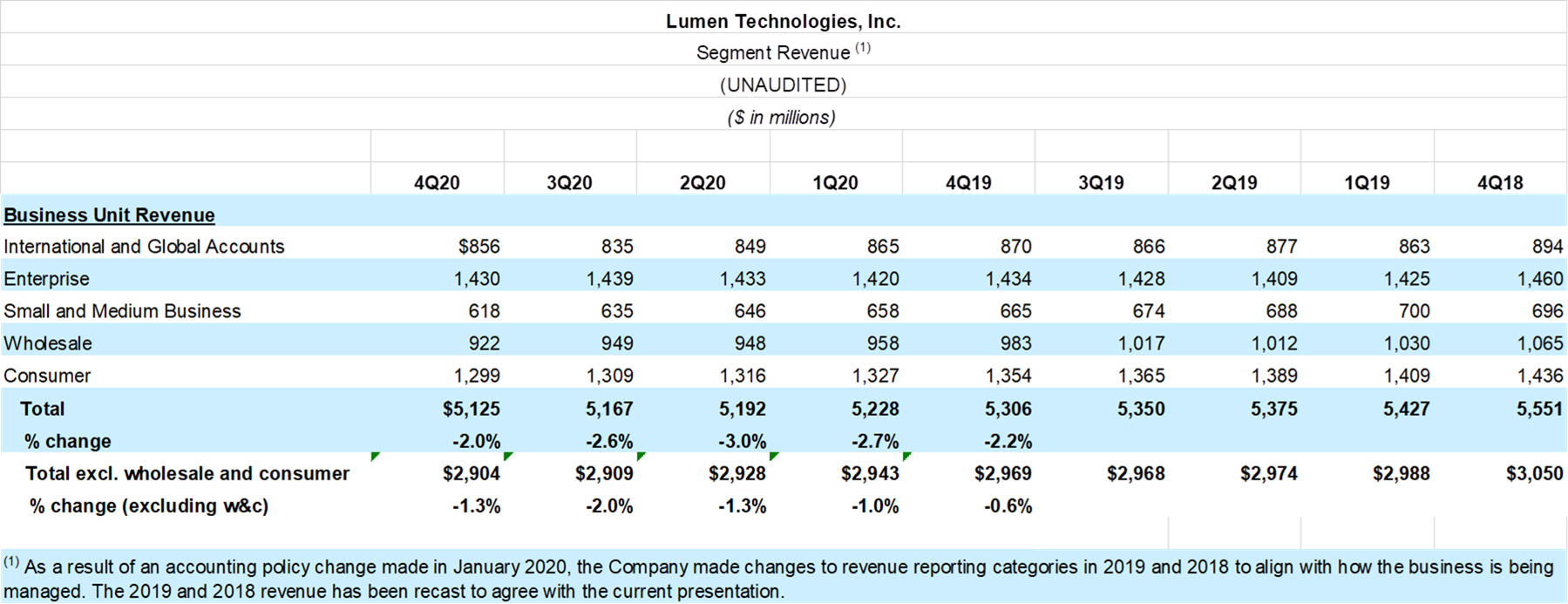

Over the last 2+ years, Lumen has lost 23% of its equity value while Charter has more than doubled and T-Mobile is up 83%. Where did things go wrong? Here’s Lumen’s revenue by segment:

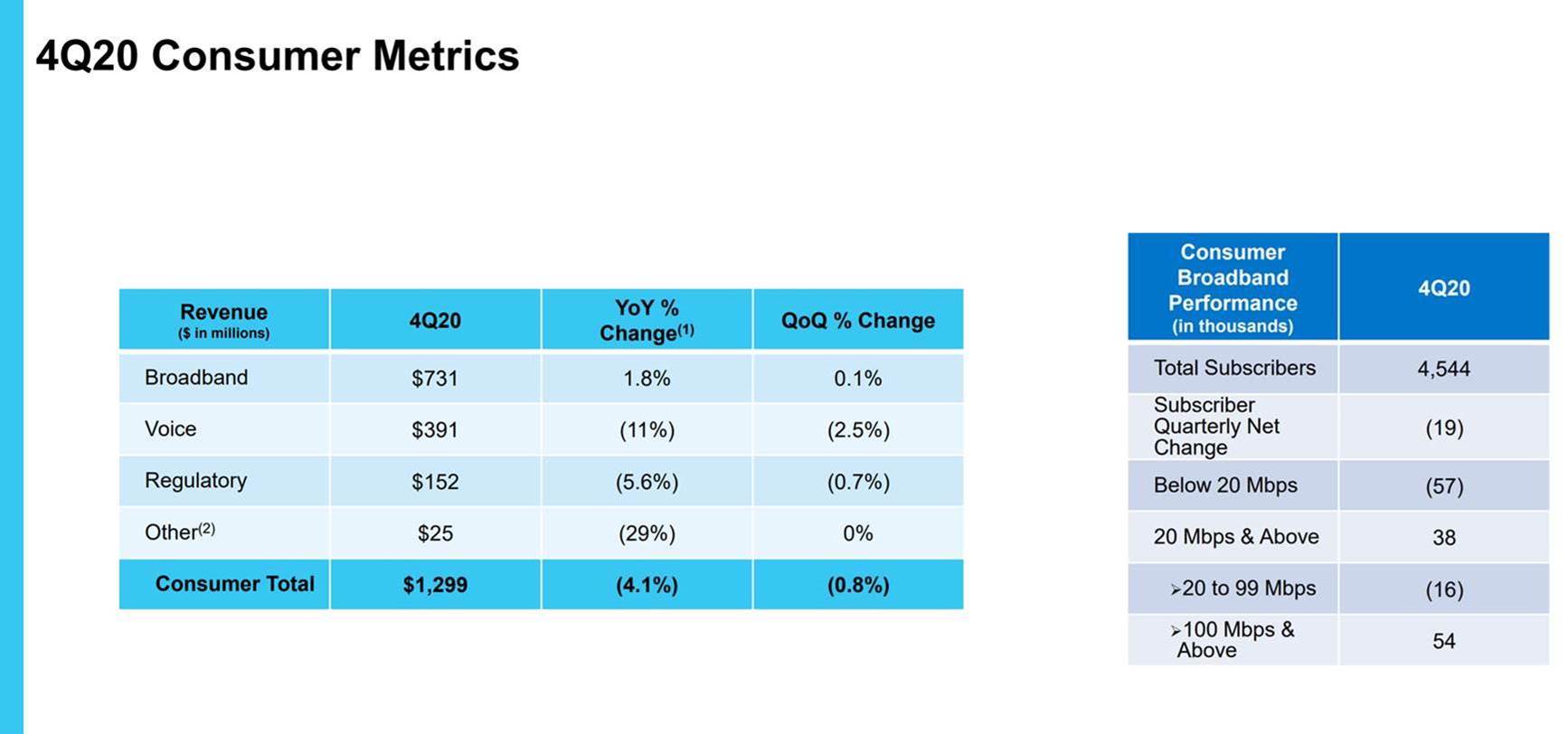

Lumen added 400,000 fiber homes to their footprint in 2020, ending the year at 2.4 million. Using 1.1 access lines per home passed and CenturyLink’s 2011 ending number of access lines (14.584 million), we estimate that the homes passed denominator for the company is approximately 12.5 million. While increasing 400,000 homes is great, it likely only bumped their fiber penetration by three or four percent. And overall, the homes passed with fiber likely stands at less than 20%. Compare this to the Altice figures above and you see why Lumen struggles against Comcast in markets like Seattle, Boise, Minneapolis, Denver, Salt Lake City, and Portland. As a result, as shown below, Lumen shrank their overall broadband base in 4Q 2020 (and barely grew revenue even with speed upgrades):

Each time we have written about CenturyLink (or Lumen), our thesis returns to the same question: Can the company transform from a collection of local and global infrastructure assets into a premier enabler of tomorrow’s on-net infrastructure? And each time we approach that question, we return to the trajectory of in and out-of-territory fiber upgrades and compare that to their in-territory and national homes and businesses passed footprint. Then we examine that asset through a cable (and soon Rural Development Opportunity Fund competitor and cable) lens to determine how Lumen can create sustainable competitive advantage.

What we are left with are two struggles:

- The internal competition for capital between local and global infrastructure needs. Absent an investment in a building that supports the Lumen platform, we see minimal improvements in secondary and tertiary markets. The result: New York City buildings get fiber – Johnson City (TN) and Jefferson City (MO) buildings don’t. Yet the costs to operate Johnson City and Jefferson City remain. We fail to understand why CenturyLink does not divest significant portions of their legacy local exchange territory now and focus the proceeds on strengthening and expanding the Lumen platform. Feeding half a meal to both results in two undernourished businesses (and hangry shareholders).

- The struggle to move from retail enterprise to a (pseudo) wholesale business model. It’s clear that the Lumen platform provides a needed service for many Managed Service Providers, but it’s a component of a much larger (and geographically broader) network need. It’s a low-cost enabler that’s likely going to be well received by the market, but it’s still one quilt on a very large bed. Reorganizing into mass market and business units (wholesale largely within business) was not done by accident – Lumen needs to show that they can manage carrier relationships and scale the Lumen platform rapidly.

Bottom line: The balance sheet has been restructured, the global economy appears to be recovering, and Lumen has maintained credibility as both the world’s largest IP backbone and one of the world’s most expansive enterprise networks. They lack out-of-region fiber footprint depth in several markets (especially in metro areas like Atlanta, Boston, Chicago, Los Angeles, and San Francisco), and need to find one or more tightly integrated partners to complete the footprint. They need several years of profitable growth, and then they will be ready for a “knight in shining armor” – Amazon, Apple, Oracle or Google. It remains to be seen how Lumen can successfully behave like a growth company while paying an 8-9% dividend.

Investment attention and devotion has shifted recently to wireless spectrum. But, as we have discovered through many Briefs, it takes a lot of towers (and more than a few small cells) to equip a market with C-Band spectrum. That increases investor passion for denser bandwidth which can only come from fiber.

That’s it for this week. Next week, our focus turns to government infrastructure and stimulus. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Have a great week and Go Davidson Wildcats!