Mid-winter greetings from Atlanta (Truist Field pictured) and Lake Norman, NC. We extend heartfelt prayers and well wishes for all our Texas readership who are learning to cope with the impacts of last week’s storm. This has been a crazy winter for many, but spring (and the baseball season) is coming!

This week’s Brief brings a more expanded commentary on the week’s market events before beginning to explore the consequences of increased Federal infrastructure spending on the telecom landscape. We think that a new administration will have a significant short-term effect on telecom policy, but do believe that infrastructure spending will be used to alter (in some cases, significantly) broadband’s penetration trajectory in rural and underserved territories.

Before the market commentary, we share a link to the Briefer’s appearance on the RCR Wireless podcast “Will 5G Change the World?” Think of this as a 40-minute oral compilation of the last 3-4 Briefs — if you need to get caught up, or need an aural sedative, you now have an answer.

The week that was

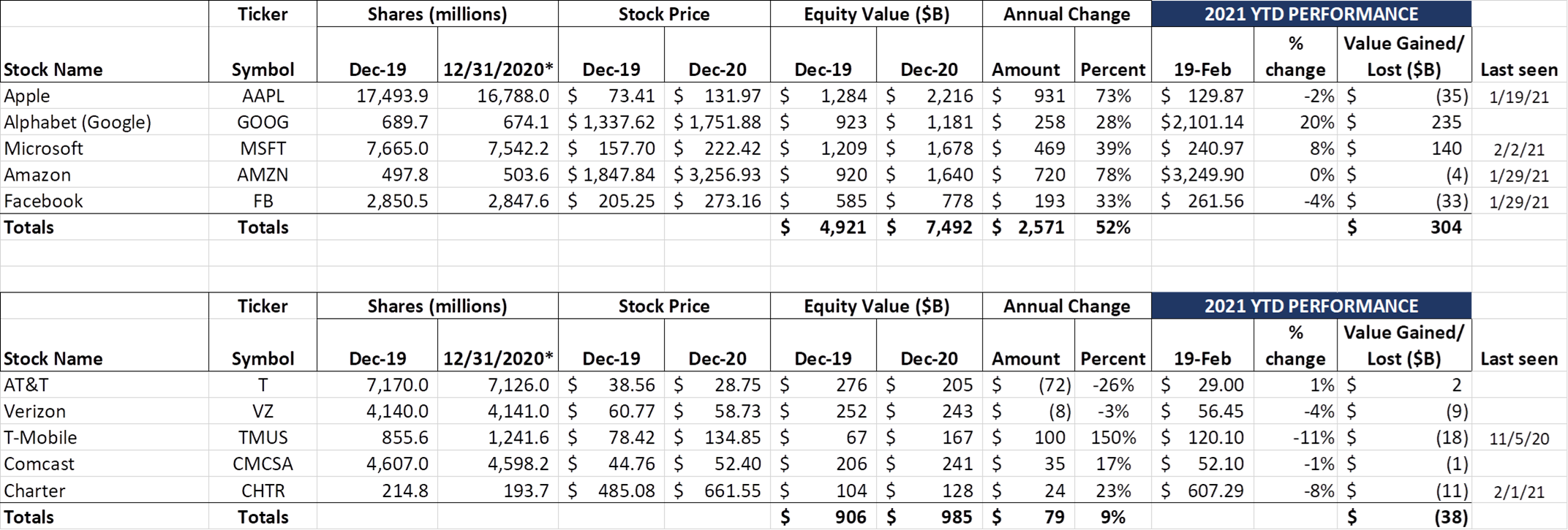

After a crazy 2019 and 2020, the market is deciding to behave more normally: the linear trajectory of the Fab Five is finally beginning to flatten out. Each of the five contributed to the $164 billion total loss in cumulative equity market value, with Apple picking up a majority of the total (-$92 billion week/week or 4.1% of its value). Microsoft also lost $30 billion this week or about 1.6% of its value). Overall, the Fab Five is still on pace to add close to $2 trillion in additional market capitalization, short of last year’s blistering pace but a staggering number nonetheless.

We added a column to the stock price chart above a few weeks back showing the “last time we have seen the stock price at this level” if (and only if) that level was not seen in the last two weeks. For example, Apple’s share price is at a level not seen since January 19th, 2021 (before their earnings announcement). We think that the “last seen” column helps to put weekly price changes into perspective. The only stock price that is not within a few weeks of their previous level is T-Mobile, where their price level extends back to November 5, 2020 (slightly more than 100 days ago). And that’s not really surprising given their stock price appreciation in 2020.

Speaking of T-Mobile, the Telco Top Five had a quiet week, with gains in Verizon (+$10 billion wk/wk) offsetting slight losses in T-Mobile, Comcast, and Charter. Verizon’s value accretion was due in large part to Berkshire Hathaway’s SEC 13F filing, which revealed that it purchased $8.6 billion in Verizon shares over 4Q 2020, about 3.5% of the total company. Berkshire also added to their stake in T-Mobile in the quarter and now owns 0.4% of that company. The Oracle of Omaha also trimmed his holdings in Apple shares to ~$118 billion, but Apple is still Berkshire’s single largest stock holding.

Meanwhile, a familiar face returned to AT&T as Elliott Management announced a new stake in the company per their 13F filing last Wednesday (filing here). It’s a small stake (5 million shares – a fraction of the total count), but their return to Ma Bell was more likely greeted with groans than cheers.

Finally, Trian Partners, an investment firm run by Nelson Pelz, added to its stake in Comcast with total holdings now exceeding $1 billion. His investment during the second quarter of 2020 ( ~$35-40/ share) looks very wise right now, and, as we noted in our Brief two weeks ago, a turn in theme parks in 2H 2021 is a likely tailwind for Comcast, with theatrical production cash flow improvements starting later in 2021 and 2022.

Telecom is becoming a focus of the investment community because it has not had the price appreciation of other assets (such as the Fab Five). As networks evolve (to 5G), opportunities to create value emerge. Hence the recent interest.

On the acquisition front, Verizon announced that they were buying Austrian robotics software firm incubed IT last Monday. Incubed IT writes software that enables the autonomous factory (on the floor, between buildings, and pretty much anywhere else). While they don’t have a lot of employees (23 on LinkedIn), it’s not hard to see the low latency application to Verizon’s enterprise 5G ambitions. For an interesting (and recent) demonstration of their capabilities, check out this YouTube video (and nearby picture) featuring Incubed IT’s latest visualization software release. Then think about combining operations software capabilities with Verizon’s other recent 5G-centric purchase, Skyward. Both are very small compared to Verizon Enterprise but give Big Red some low-cost integration cred.

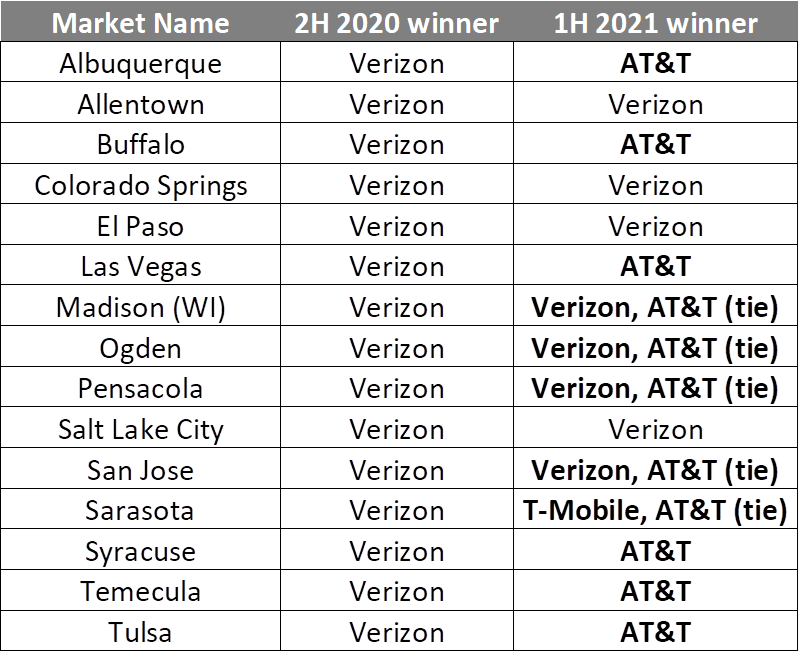

One final telco-related item before we dive into regulatory policy: RootMetrics, a firm we have mentioned many times in previous Briefs, began to publish their 1H 2021 RootScore Reports this week. For those of you who are not familiar with RootMetrics, they publish detail on each carrier’s performance for 125 metropolitan areas (and all 50 states) every six months. Unlike OpenSignal (crowdsourced app-based data), RootMetrics performs their own field testing and uses the same device throughout the test (for 1H 2021 they use the Samsung Galaxy S20 5G for each of the three carriers).

The first half results are shown in the nearby table. It’s important to note that this is only the first 15 markets (12% of 125 total markets), and that the “biggies” such as Los Angeles, New York Tri-State Metro, Chicago, Miami, and Dallas/ Ft Worth have not been posted. For the last 18 months, however, Verizon has been dominating the RootScore Reports. They frequently use their RootMetrics status in their advertising (such as this ad from 2016).

Verizon will still be strong, but no longer dominant, if the latest RootScore trend continues. In the second half of 2020, Verizon won all 15 markets (no ties). In the first half of 2021, Verizon outright won four and tied another four. AT&T was the sole winner of six markets and tied another five (one with T-Mobile). In markets like Temecula and Pensacola, AT&T had not won since 2016. T-Mobile has never won Sarasota. Worst of all, Verizon placed 3rd (no ties) in two of the 15 markets.

There’s a lot more detail in the RootScore link above. Needless to say, we will be hearing more about these changes from AT&T. We will continue to keep you updated as new reports are released

Infrastructure to the rescue (part 1)

One of the most talked about promises in the 2020 election was infrastructure. America’s roads, bridges, airports, ports and government buildings need an upgrade. Energy solutions for a cleaner and more competitive future require a lot of infrastructure investment. And, after the “_____ from home” that encapsulated so much of 2020, increasing the availability of broadband choice (or affordability) is on the agenda for any infrastructure spending.

There are many things to consider with respect to infrastructure reforms, including:

A. Forming and designing solutions for specific policy objectives. For example, having a plan to alleviate the Homework Gap (see last year’s excellent Pew Research Center article here) has to incorporate both wireless and wireline solutions. And, for fiber-based solutions in Multi-Dwelling Units (think of the majority of small apartment complexes with no fiber provider today), providing incentives, including some Universal Service Funds to address aging coax and copper inside wiring, will be required. Articulated, measurable, and unanimously embraced objectives will engender nationwide community support. As the saying goes, policymakers should “measure twice, cut once.”

B. The array of solutions to solve rural policy objectives needs to be local and diverse. The best solution for Empire, Colorado (pictured, population 300) may be fundamentally different from Emporia, Kansas (on the prairie, population 27K+, local fiber provider already established). AT&T’s CEO, John Stankey, penned a powerful article in Politico last September entitled “A Game Plan to – Finally – Connect Every American to Broadband.” In it, he advocates for fixed wireless for rural locations (emphasis added):

“The FCC currently heavily weights subsidies toward gigabit speeds (fiber) over other technologies (such as fixed wireless). It is simply not practical or responsible to assume a fiber broadband service can be delivered to every unserved rural household—the prohibitive cost is part of why connecting many of these households has been uneconomical. Proposed solutions should also support wireless solutions, so long as they can meet defined performance criteria, and satellite may be required to reach the most remote locations. Being overly prescriptive on the technology solution could result in some homes being permanently unserved. Policy, informed by practical engineering, can achieve all the economic and social benefits of gigabit technology at a fraction of the cost—something every taxpayer should want and expect.”

Local decision-making breeds better solutions and consensus formation because it considers the existing infrastructure (including cell towers) as well as prospects to stimulate growth. Better local coordination keeps articles like this one from the New York Times (cited frequently by our column) from having to be written. While dispersing control is difficult, every town’s 2021 infrastructure is in a different place.

C. Metro-area solutions need to begin (but not necessarily end) with fiber. The consulting side of PAG (Patterson Advisory Group) spends a lot of time with companies that have made fiber investments, mostly in urban areas. We have seen many waves of (mostly venture-backed) infrastructure investment over the last 20+ years, and, for the most part (see exceptions from these Briefs here and here) they have covered their capital costs if they were well planned and operated.

There are many in the telecom community that believe the case for fiber in lower-income urban communities is untenable and that the only way these communities can be served is through government subsidy. We disagree with that premise for several reasons:

- Population density tends to be greater in underserved, urban areas. Internet needs are generally as great as if not greater than nearby single-family homes;

- Most analyses fail to consider urban expansion and gentrification over the upcoming useful life of the asset. Broadband availability has risen in a post-COVID world to one of the top home needs. We are an 8K TV upgrade cycle away from needing something more than a 50 Mbps connection. No one deploying fiber 20 years ago thought about the impact small cells might play in local neighborhoods – those who deployed then now have both a time-to-market and cost advantage;

- In nearly every case, the fiber does pay off, but it’s outside of “normal thresholds.” Again, from John Stankey’s Politico article:

“Market forces and private companies can’t do it alone because of the lack of return on the significant investment necessary to reach all Americans. But it is in society’s interest for our government to financially incentivize the investments necessary to ensure that all children can learn, and all workers can do their jobs. Through a mix of public subsidies for low income households and smart policies that encourage new infrastructure investment in unserved areas, we can finally close this gap.”

While the above statement is true, it’s important to realize just how close AT&T is to helping their customers achieve a better fiber future. Here’s an example using three adjoining zip codes – 64113 (gentrified mostly single-family homes in Kansas City, a.k.a. Country Club District), 64110 (the lower-income neighborhood to the east, a.k.a. Troost Avenue), and 64130 (a combination of low and middle-income homes, a.k.a. Swope Park):

Note: We have included a PDF for those of you who want to examine the data. Our broadband percentages come from Broadband Now (here, here, and here). All population and household data comes from www.zip-codes.com.

This is a good case study on long-lived asset deployment. Spectrum and Google Fiber are nearly 100% deployed across the three zip codes with Gigabit speeds. They have a different view of the value of a broadband franchise than AT&T, who has dramatically different fiber penetrations across the territory, from 86% in the Country Club district to 24% in Swope Park. From the west side of 64113 (the Kansas State line) to the east side of 64130 (the Kansas City Zoo) is slightly less than four miles. That’s how quickly the fiber picture changes for AT&T (but not the other providers).

Many questions emerge from this analysis, namely for AT&T (and perhaps Google):

- How can Google and Spectrum justify this investment but not AT&T?

- What timeline would AT&T require to justify an equivalent fiber deployment?

- How can AT&T justify deploying fiber to 86% of the households with two broadband competitors present yet not be able to justify the other two zip codes?

Perhaps in AT&T’s fixed wireless architecture, the equation is more palatable. And, perhaps with Google Fiber and Spectrum are already deployed to nearly 100% of the zip codes above, they find the situation too competitive to justify building. It appears, however, that either a) Spectrum and Google Fiber are losing their shirts, which is highly unlikely, or b) AT&T got caught flat-footed in Kansas City. We think that their payback time horizon was (and is) far less than the thirty year useful life of most metro fiber.

Bottom line: Broadband infrastructure policies need to be debated and challenged. They need to be flexible and local. And, in the metro, they need to begin with fiber (and adjusted as payback horizons dictate). Broadband is a long-lived asset with significant societal implications. Take the time to get it right.

That’s it for this week. Next week, we will continue the infrastructure discussion. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Have a great week and Go Davidson Wildcats – beat the Bonnies!