The European Commission has published a major review of funding for 5G-based and 5G-related industrial transformation, including €10 billion of new public-private partnership (PPP) funding to drive the region’s digital and green agendas, and a series of “ambitious” recommendations to raise venture funding in home-gown 5G networks and 5G-based IoT applications.

The commission has proposed 10 new ‘institutionalised European partnerships’, some building on existing projects, between the European Union (EU) and either member states or industry players. The EU will provide €10 billion of funding, which will be matched by member states or industry partners. The combined contribution will mobilise further investments, it said.

The 10 new partnerships, detailed at the bottom, are geared variously to help Europe’s “preparedness and response” to future Covid-scenarios (“infectious diseases”), and to develop smarter transport (ow-carbon aircraft, “radical transformation of the rail sector”), and cleaner energy systems (clean hydrogen, renewable bio-based raw materials).

A major theme, within the broader thrust of green-focused industrial change, is about new-generation cellular networks, including both 5G and 6G, to drive home-grown infrastructure and services (under the banner ‘digital sovereignty’, in the shadow of the Huawei fallout in western markets), and support digital transformation of the region’s industrial sector.

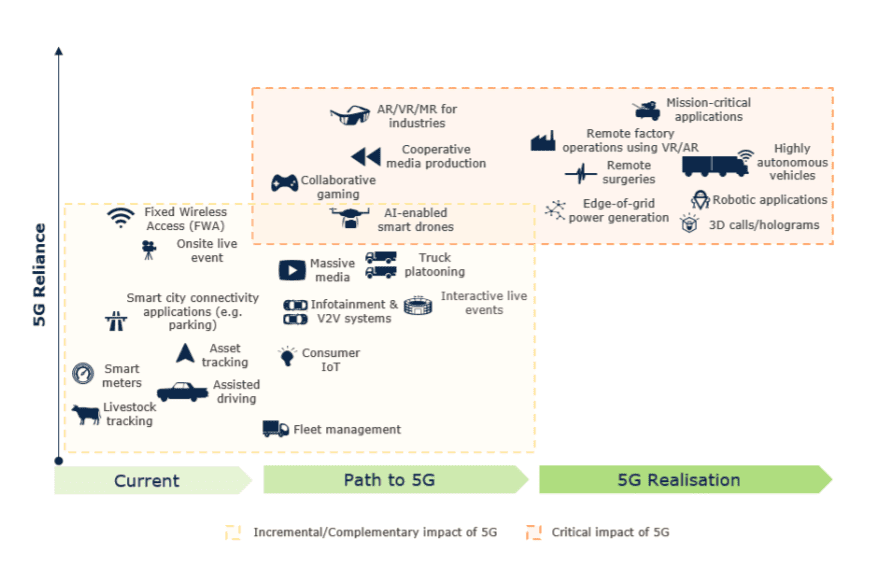

5G – deployment timeline and industrial impact

One of the new partnerships (#9, detailed below) addresses ‘smart networks and services’, specifically, and has been earmarked for €900 million of public funding (€1.8 billion of PPP funding in total), over the new 2021-2027 budget period. Funds will be drawn from 5G projects in the Connecting Europe Facility and 6G projects in the scope of the Horizon Europe fund.

A successor to the old 5G-PPP programme, the ‘networks and services’ package will introduce a new governance model that puts European industry alongside the commission and member states “in the driving seat together”, the commission said. The idea is to enable new business and industrial services, and lay a foundation for the introduction of 6G in Europe.

In Europe, a first set of 6G projects worth €60 million was launched last month under the 5G-PPP initiative, with the Hexa-X flagship proposing a first 6G system concept. 6G, bringing new terabit capacities and sub-millisecond response times, on paper at least, will enable “real-time automation, extended reality”, and a whole new ‘internet-of-senses’ (IoS), the commission said.

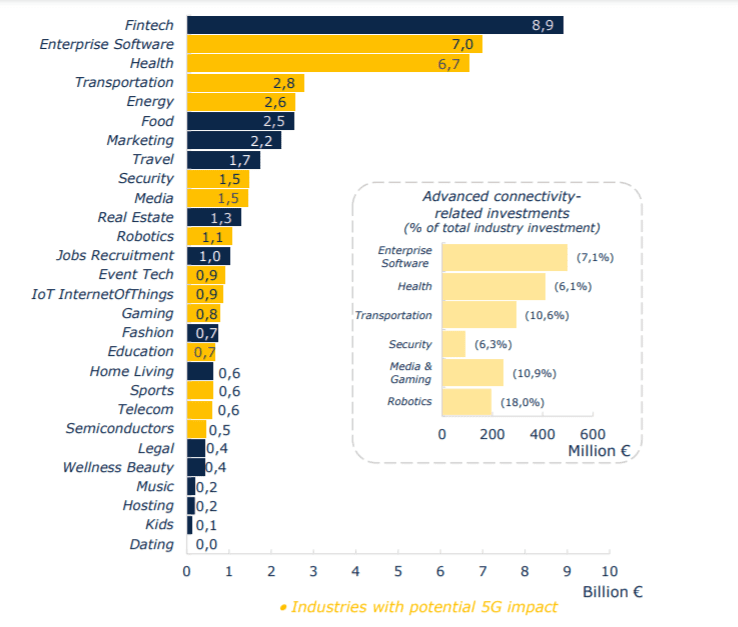

Separately, the European Investment Bank (EIB) has issued a report to urge a major funding increase in order to finance the “large-scale technological, industrial, and innovation transition arising from 5G”. It calculates a “significant” funding gap between 5G-oriented venture capital in Europe and the US, of between €4.6 billion and €6.6 billion annually.

The EIB, in a study for the commission, said Europe “runs the risk of being left behind in the race for 5G leadership”. It recommends increasing investments in both early- and growth-stage digital startups. It said Europe should allocate sufficient public capital through both national budgets and EU programmes, in order to catalyse additional private sector investment.

The report focuses on small and mid-sized firms (SMEs) as a source of innovation, to drive change in the telecoms sector and in the wider economy. The EIB said venture funding has stalled higher-up the tech stack, on “well-understood” industrial IoT apps, rather than in the underlying tech, such as in NB-IoT and LTE-M, as IoT-geared subsets of the 5G standard.

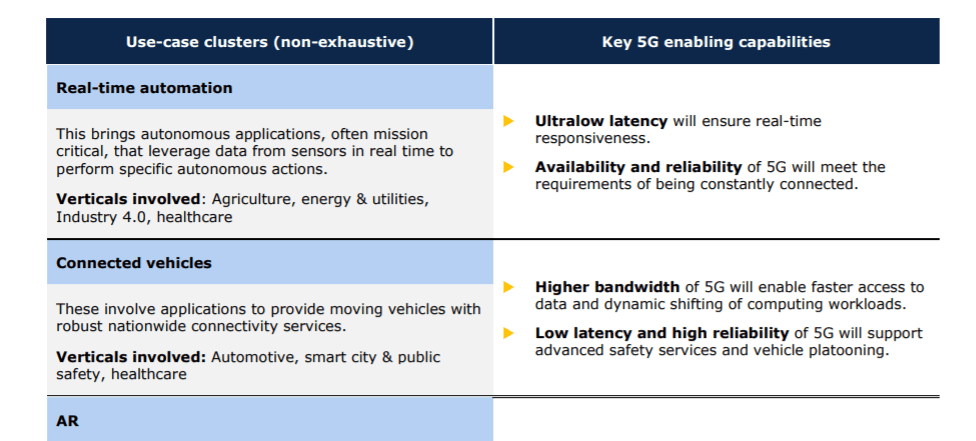

5G – use case clusters and capabilities

A statement said: “5G can make European supply chains and industrial ecosystems more efficient and resilient. It can be deployed not only by traditional operators but also by industrial players, for example to cover specific industrial sites. This could offer new possibilities to support industrial processes, adding efficiency and unlocking new ways of doing business.”

As well as the industrial upside of 5G (and 6G), the rush of funding announcements from the European Commission put a major focus on the ‘sovereignty’ of home-grown cellular networks and services, in the context of 5G investments and advancements, and the broader economic power of the likes of the US and China.

“Maintaining a strong position in [the 5G] market will be key to ensuring a diversity of choice for telecom operators deploying 5G, thus supporting Europe’s autonomy and role in the sector… Where other world regions have seized the opportunities brought by this technology, it is critical to ensure a rapid transition to 5G to further the EU’s economic strength,” said the EIB.

The funding will also go to sponsor new European telco entrants, as cellular networks are opened up, virtualised, and disaggregated. The EIB stated: “These evolutions are expected to open the market to new players, in contrast to the current domination of the sector by traditional players of the telecommunications industry, such as network operators and technology providers.”

At the same time, it will go to shore up the positions of Nokia and Ericsson, as the trading bloc’s leading cellular kit suppliers, which have taken R&D loans of €500 million and €250 million from the EIB, respectively. The commission said the pair have a 40 percent share of the kit market, and over 50 percent of the intellectual property rights (IPR) held by the four major global suppliers.

It said: “Our trading partners are heavily engaged in 6G, including the US and Japan, with focus on software-based networks, and China aiming to build on its strong technology and IPR. There will be opportunities and challenges concerning new business models and players through… Open RAN and convergence in edge computing, AI, and components and devices.”

It added: “Europe needs to position itself to ensure the best outcome both for the digital economy at large, but also for the technology capabilities of our existing and emerging industrial leaders. This calls for a strategic partnership with a solid R&I roadmap set out and followed by a critical mass of European actors.”

5G – impact by ‘vertical’ industry

The 10 new partnership projects, detailed underneath, will be discussed by member states in the council with a planned launch in autumn. Margrethe Vestager, executive vice president for a Europe fit for the Digital Age, said: “We are at our best in Europe when we work together. This is particularly important when it comes to mastering the challenges of digital transformation.”

The EIB recommendations, published by its InnovFin ‘finance-for-innovators initiative, launched with the European Commission as part of Horizon 2020, will underpin future EIB financing, in a bid to drive venture capital interest in 5G in the region.

Teresa Czerwińska, vice president at the EIB, said: “The rollout of 5G has become a key battleground in a broader struggle for control over the industries of the future. At the same time, the race to build 5G networks and reap the significant benefits that they offer to all economic actors has gained urgency in light to the intensified digitalisation triggered by the global Covid-19 pandemic. Europe, however, is in danger of falling behind its global competitors.

“We need to tap into the agility and creativity of smaller ventures, to make sure Europe doesn’t miss out on the vast possibilities and new growth pathways 5G has to offer. As the international financial institution with the largest digitalisation portfolio, the EIB Group stands ready to work closely with all stakeholders to provide the capital and advice needed to help the EU realise the full potential of 5G innovations.”

She added: “As few 5G consumer devices are currently available and many 5G industrial applications are still on the drawing board, it is essential that the EIB positions itself now on what is the defining digital challenge of the next decade… This study… seeks to address the risks and opportunities of this emerging technology. I look forward to seeing the fruits… as Europe reclaims its leadership.”

The EU’s 10 Institutionalised European Partnerships

1 | Global Health EDCTP3

“This partnership will deliver new solutions for reducing the burden of infectious diseases in sub-Saharan Africa, and strengthen research capacities to prepare and respond to re-emerging infectious diseases in sub-Saharan Africa and across the world. By 2030, it aims to develop and deploy at least two new technologies tackling infectious diseases, and support at least 100 research institutes in 30 countries to develop additional health technologies against re-emerging epidemics.”

2 | Innovative Health Initiative

“This initiative will help create an EU-wide health research and innovation ecosystem that facilitates the translation of scientific knowledge into tangible innovations. It will cover prevention, diagnostics, treatment and disease management. The initiative will contribute to reaching the objectives of Europe’s Beating Cancer Plan, the new Industrial Strategy for Europe and the Pharmaceutical Strategy for Europe.”

3 | Key Digital Technologies

“They encompass electronic components, their design, manufacture and integration in systems and the software that defines how they work. The overarching objective of this partnership is to support the digital transformation of all economic and societal sectors and the European Green Deal, as well as support research and innovation towards the next generation of microprocessors. Together with the Declaration on a European Initiative on processors and semiconductor technologies signed by 20 Member States, an upcoming Alliance on microelectronics, and a possible new Important Project of Common European Interest under discussion by Member States to foster breakthrough innovation, this new partnership will help boost competitiveness and Europe’s technological sovereignty.”

4 | Circular Bio-based Europe

“This partnership will contribute significantly to the 2030 climate targets, paving the way for climate neutrality by 2050, and will increase the sustainability and circularity of production and consumption systems, in line with the European Green Deal. It aims to develop and expand the sustainable sourcing and conversion of biomass into bio-based products as well as to support the deployment of bio-based innovation at regional level with the active involvement of local actors and with a view to reviving rural, coastal and peripheral regions.”

5 | Clean Hydrogen

“This partnership will accelerate the development and deployment of a European value chain for clean hydrogen technologies, contributing to sustainable, decarbonised and fully integrated energy systems. Together with the Hydrogen Alliance, it will contribute to the achievement of the Union’s objectives put forward in the EU hydrogen strategy for a climate-neutral Europe. It will focus on producing, distributing and storing clean hydrogen and, on supplying sectors that are hard to decarbonise, such as heavy industries and heavy-duty transport applications.”

6 | Clean Aviation

“This partnership puts aviation en route to climate neutrality, by accelerating the development and deployment of disruptive research and innovation solutions. It aims to develop the next generation of ultra-efficient low-carbon aircraft, with novel power sources, engines, and systems, improving competitiveness and employment in the aviation sector that will be especially important for the recovery.”

7 | Europe’s Rail

“This partnership will speed up the development and deployment of innovative technologies, especially digital and automation ones, to achieve the radical transformation of the rail system and deliver on the European Green Deal objectives. By improving competitiveness, it will support European technological leadership in rail.”

8 | Single European Sky ATM Research 3

“The initiative aims to accelerate the technological transformation of air traffic management in Europe, aligning it to the digital age, to make the European airspace the most efficient and environmentally friendly sky to fly in the world and to support the competitiveness and recovery of Europe’s aviation sector following the coronavirus crisis.”

9 | Smart Networks and Services

“This partnership will support technological sovereignty for smart networks and services in line with the new industrial strategy for Europe, the new EU Cybersecurity Strategy and the 5G Toolbox. It aims to help resolve societal challenges and to enable the digital and green transition, as well as support technologies that will contribute to the economic recovery. It will also enable European players to develop the technology capacities for 6G systems as a basis for future digital services towards 2030.”

10 | Metrology

“This partnership aims to accelerate Europe’s global lead in metrology research, establishing self-sustaining European metrology networks aimed at supporting and stimulating new innovative products, responding to societal challenges and enabling effective design and implementation of regulation and standards underpinning public policies.”