Shipping ports can make money back on key private 5G-based automation systems in less than two years, reckons Ericsson, and make valuable gains (178-percent returns) within five.

The Swedish vendor has worked with Germany-based industrial IoT provider ifm electronic, along with commission management consultancy Arthur D. Little, to investigate the combined impact of five essential Industry 4.0 use cases on a standard (“baseline”) container terminal, running approximately four million TEUs (twenty-foot equivalent units) per year.

The report makes implicit that the initial investment covers deployment of a private 5G network, as well. The five use cases – two for crane automation, one for automated guided vehicles, one for condition monitoring, and one for drone deliveries – will not work with “costly and inflexible legacy technologies”, says Ericsson; private 5G is the only way, the marketing goes.

“Port operators can no longer bridge the gap with… Wi-Fi, Bluetooth, or physical cables… 5G is the key tool to create a smart port and lay the foundation for IoT in industrial automation. Cellular enables mission-critical comms like voice and data capabilities. These help to prevent injury to workers by keeping them physically distant from potential hazards,” it says.

“5G is well optimized for IoT, ensuring low energy usage, increased data security, and the ability to support high connection density. In contrast to legacy networks, 5G provides a complete connectivity solution for licensed and unlicensed spectra, as well as seamless cellular vehicle-to-everything (C-V2X) communication.”

Ericsson’s baseline port, for which the proposed ROI is calculated, generates roughly $400 million in revenue with an operating margin of around 30 percent – enough for it to rank, on paper, among the top 100 container ports in the world (at number 50, in fact). But it has the same issues as all the rest of them, the reports goes on: mainly, higher cargo volumes and a shortage of yard space.

The report quotes data from Finnish cargo-handling machinery maker Cargotec, that compound growth for global container volumes is rising at 3.6 percent per annum, and maritime trade publication Port Technology, that 76 percent of port operators cite operational efficiencies as their primary concern.

All the human and environmental risks that go with this industrial congestion are noted, too. 2018 data from the European Maritime Safety Agency (EMSA) said almost 42 percent of marine casualties or incidents take place in (increasingly busy and congested ) port areas. And, as with every sector knocking at the Industry 4.0 door, you just can’t find the staff.

The shortage of port pilots, generally, means longer waiting times for boats to be unloaded (36 hours at the dock, typically), with their engines idling; McKinsey & Company says 75 percent of operators reckon the skills gap is an issue when it comes to automating port systems. Enter private 5G (duh-duh), and the five automation cases it sets to work.

Ericsson says: “A port can use the same cellular network for all these use cases, plus other tech like sensors, cameras, human-to-human communication, and container tracking… A smart port’s network has to handle large amounts of data generated by cranes, vehicles, equipment, workers… [5G] allows… one backhaul for all services instead of several pieces of network equipment.”

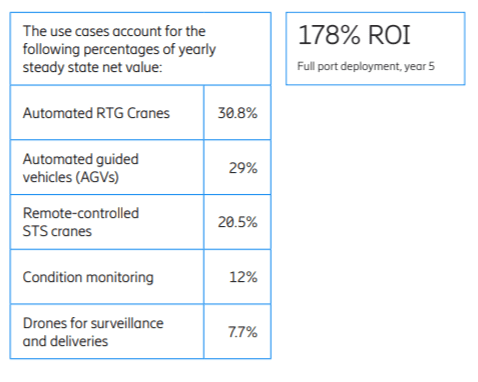

The application / ROI breakdown goes something like this. The financial benefit of remote-controlled ship-to-shore (STS) cranes, for loading and unloading container ships, is equivalent to about 4.9 percent of port revenue (as yearly steady-state net value), and provides payback in two years on the the private 5G deployment – and a 156-percent ROI by year five.

Which sounds almost like the headline saving: payback in less than two years; a 178-percent return within five years. The thing is, says Ericsson, STS automation has to be daisy-chained with a couple of other use cases to work. These are to automate rubber tired gantry (RTG) cranes, stacking containers on the dock, and guided vehicles (AGVs), for the donkey work in between.

In each case, the private 5G network replaces “an unreliable combination of Wi-Fi and fibre”, to enable IoT sensors and positioning devices. The benefit cascades down into reduced maintenance (by 20 percent), requiring fewer spare parts, oils, and other resources – including workers. AGVs, meanwhile, reduce energy costs by 10 percent due to optimized routes.

The financial benefit for automated RTG cranes is about 7.5 percent, as yearly steady-state net value, and 7.1 percent for AGVs. Payback is in less than three years and around two years, respectively; the five-year ROI is put at 98 percent and 149 percent.

The other cases – for condition monitoring and drone deliveries – give a benefit of 2.7 percent and 1.6 percent of the revenue, and break-even in two years in both cases; five-year returns are pegged at 126 percent and 154 percent. The report is available here; a Smart Ports Value Calculator has been published alongside to figure out the ROI for different use cases.

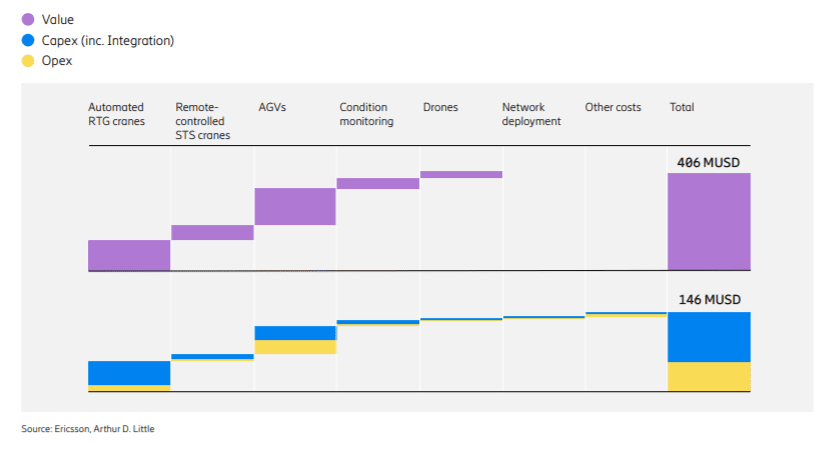

The report explains the maths: “The smart money is on smart ports. Out of all our use cases, the highest value comes from automated RTG cranes, followed by cellular connected AGVs, and then remote-controlled STS cranes. In our baseline port, with all five use cases working together, we reached a payback time of less than two years. The annual steady state net value by year five reaches $101 million, which is 25 percent of the baseline port’s revenue.

“The accumulated net value reaches $260 million in year five – 68 percent of the baseline port’s revenue. This figure includes the full network deployment and the cost and benefits from the five use cases. By year five, the use cases contribute to an accumulated gross value of $406 million. The total, accumulated costs for deploying all use cases is around $146 million by year five, driving a return on investment of 178 percent.”