End of February greetings from Charlotte/ Davidson/ Lake Norman, where spring is in the air. Featured is our dog Abby, sporting her brand new T-Mobile pet bandana (free through their T-Mobile Tuesdays app). Our household is an easy target for free stuff, and T-Mobile’s app offers us Popeye’s chicken sandwiches, Dunkin’ Donuts and Starbucks coffees, or even Domino’s pizza.

As the title implies, we are going to comment on the recently completed “big block” auction and the FCC’s announcement of another 100 MHz spectrum coming up for bid later this year. We will also detail AT&T’s announcement of their linear TV carveout (a.k.a. the New DIRECTV).

Each of the Big 3 wireless carriers will be holding virtual investor days in the coming weeks to outline their network deployment and business strategies. Verizon is scheduled for 6 p.m. on Wednesday, March 10; T-Mobile on Thursday the 11th at 2 p.m.; and AT&T on Friday the 12th at 10 a.m (all times EST). Also, Morgan Stanley is holding their telecom investor conference this Thursday and AT&T will be speaking at the event. Expect the March 14 Brief to be packed.

The week that was

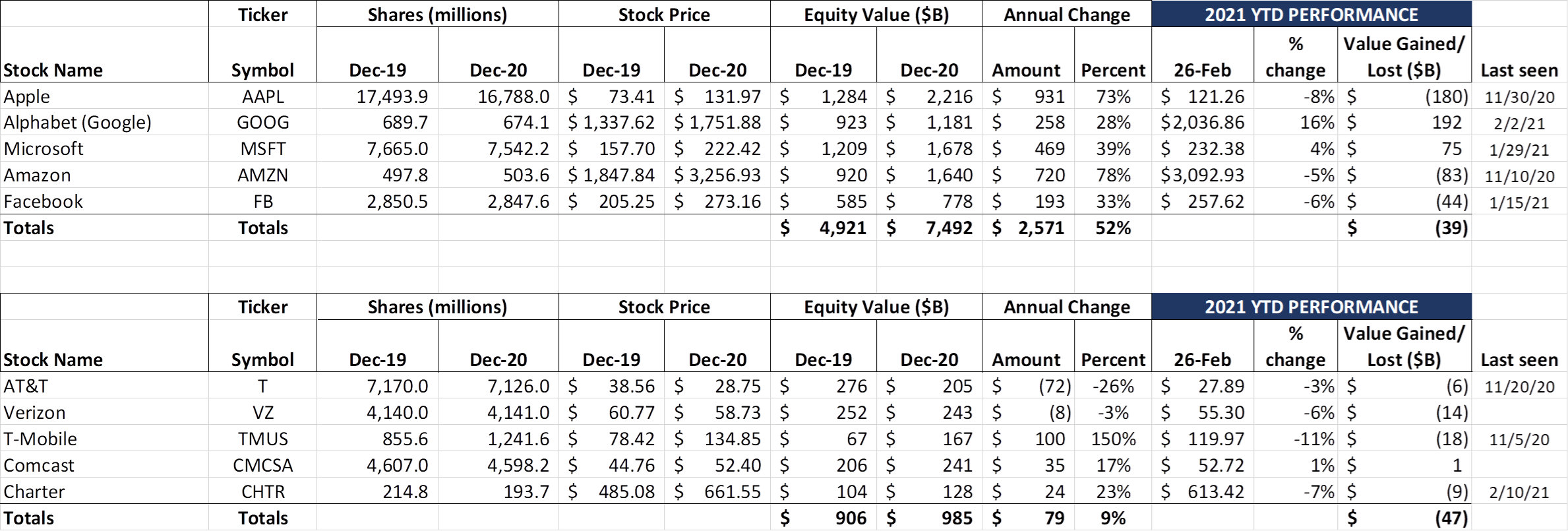

“Not as bad as it could have been” was the summary of the week according to one Sunday Brief reader. The Fab Five slipped into a net equity loss for the year of $39 billion (recall this time last year, as COVID-19 worries were developing, the Fab Five were down $73 billion, but ended the year up $2.5 trillion). To put this into context, the Fab Five have now lost 2% of 2020’s unprecedented gain, while the Telco Top Five have erased 57% of last year’s meager increase.

To add additional relief, we have updated the “We haven’t seen ______’s share price this low since” column for each stock (if the field is blank, it’s because the stock is higher than levels seen in the past two weeks). For Apple, who dropped $145 billion in value or roughly one T-Mobile this week, the share price is back to beginning of December levels. That story is similar for Amazon (Nov 10). For the other three, however, it’s hardly worth mentioning the “Last seen” column. Time to take that deep breath and recognize that what goes up, might come down.

On the Telco Top Five, it’s worth noting that Comcast is the only stock with gains in 2021. None of the other stocks are suffering, but Comcast is the closest thing to a “COVID recovery” stock play in telecom. We will dive into the remaining telcos below in our C-Band discussion.

The only major wireless plan news centered around T-Mobile, who replaced their Magenta Plus plan with Magenta Max. Besides significantly upgrading their Netflix bundle (one Standard Definition subscription available now with the first line; 2 screens of 4K streaming included with two-or-more-line plans), they eliminated any data caps and also increased the Hotspot allotment to 40 GB. With the pre-existing GoGo wireless benefit (unlimited GoGo Wi-Fi on planes), it probably should be called the “road warrior” plan. While it’s hard to see entire families upgrading to Magenta Max, it’s good to know there’s a truly unlimited plan.

On a separate note, we were encouraged to see CNET’s review of the T-Mobile Hotspot. For those of you who are not aware, T-Mobile offers a wireless home internet service that primarily uses LTE today (although the device will pick up 5G signal when available). We have been testing this service at headquarters since October and made it our sole home broadband service in December. Our Zoom calls are better than our cable modem, and our HD streaming is no worse than our previous provider experience. CNET’s conclusion parallels ours: “After more than a week of business as usual — working online during the day, streaming video at night, FaceTime calls to parents and so on — I’ve encountered scarcely a blip in connectivity.” More details on the service are available in the link above.

TPG invests in DirecTV: Implications to AT&T

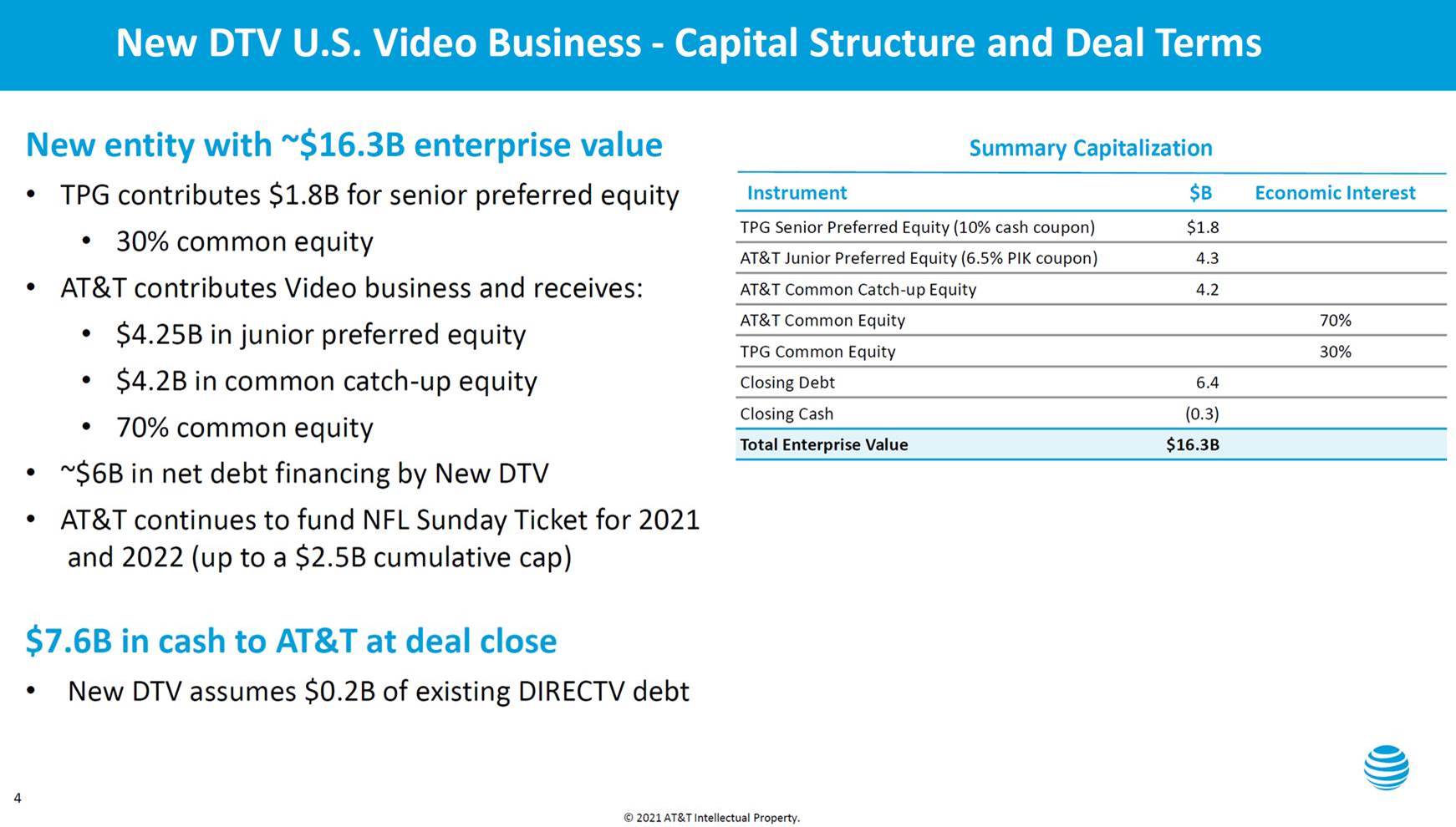

On Thursday, AT&T announced that they would be restructuring their linear content distribution and forming a new entity (called New DIRECTV or DTV) with private equity giant TPG. The following slide from AT&T’s conference call outlines the basic structure of the transaction:

The most important part of the transaction is that TPG sits senior to AT&T on the preferred scale and receives a 10% cash coupon for their $1.8 billion investment. The other critical point in this slide is that AT&T will continue to fund the NFL Sunday Ticket cost through 2022 (the end of the contract term). This amounts to a $2-2.5 billion additional value block that is not directly reflected in the enterprise value of the company (this liability will not transfer from AT&T).

The New DIRECTV will include the satellite operation as well as AT&T TV and legacy U-Verse video services. There are many ways that the new company can unlock value. First, it can (and should) eliminate the requirement that AT&T TV can only be purchased in conjunction with an AT&T Internet plan. While the connection might make sense in AT&T Fiber areas (which AT&T has committed to grow by 2 million homes this year), foisting a “less than” experience on customers is ridiculous. The new company will have less interest in supporting the aging copper infrastructure and should take steps (leveraging DIRECTV or other branding) to provide video services nationally.

Second, the new company should include HBO Max with all plans (currently, it’s one year for free). This would create substantial differentiation versus YouTube TV and other competitive offerings. Third, it should include unlimited cloud storage. Including a measly 20 hours forces customers to actively manage their recordings. By the time they add unlimited cloud storage ($10/mo) to their offer, however, the base package (with one equipment rental charge) rises to $85/mo. The pricing of AT&T TV’s services (particularly in comparison to T-Mobile’s new service, TVision) is out of line.

One of the great mysteries of the DIRECTV and WarnerMedia transactions is the lack of inclusive TV bundling. Wireless includes HBO Max in the core product offer, yet DIRECTV doesn’t (beyond a few free months). We are sure there’s a rational explanation for this (systems, compensation, MFN, anti-trust issues… the list goes on), but AT&T missed a fundamental opportunity to bolster its position with a product that has minimal (external) incremental costs. A real headscratcher for shareholders.

There are many questions remaining to be answered about how this entity will interface with the rest of AT&T. Without a doubt, it makes their bundling/ joint marketing prospects more difficult. Distribution (incenting AT&T store representatives vs outbound marketing vs DIRECTV online efforts) is going to change. Customer service could change. The news release states:

“New DIRECTV will have a commercial agreement with AT&T to continue to offer bundled pay-TV service for AT&T’s wireless and internet customers. Additionally, AT&T and New DIRECTV will have commercial agreements in place that will give New DIRECTV video subscribers continued access to HBO Max; allow both companies to serve customers through multiple distribution channels, including retail, online, call centers and indirect sellers; and share revenues for ad inventory management and ad sales.”

How those commercial agreements are structured determines the cash flow trajectory. If I were TVision, Dish, cable or any fiber-based broadband challenger, I would be licking my chops through the transition. Even though AT&T retains 70% of common stock ownership, the new entity has its own management team and Board. DIRECTV is no longer a division of AT&T, it’s a “below the line” consolidated holding.

Bottom line: Assuming AT&T has to pay $2.5 billion in NFL Sunday Ticket fees on behalf of the new entity, Ma Bell will net just over $5 billion from this transaction to pay down debt. They will retain 70% of common equity in an entity designed to pay out $180 million per year to an external shareholder into perpetuity (which could render the common equity useless by the end of this decade). Without a turnaround, the only winners from this transaction are T-Mobile, Dish, and cable.

I like big blocks and I cannot lie …

The FCC announced the “winners” of Auction 107 (a.k.a., the C-Band auction) on Wednesday. Four bidders accounted for the vast majority of the winnings: Verizon, AT&T, US Cellular, and T-Mobile. After active participation in the CBRS license auctions last summer, both Dish and cable declined to join the bidding frenzy. No one leaves this auction feeling victorious.

There is a lot of terrific commentary on the auction and implications. For those of you who receive Craig Moffett’s analysis, he does an amazingly good job of constructing post-auction pro forma leverage for each of the Big 3 wireless carriers. There’s also a lengthy but insightful article published by Mike Dano in Light Reading here.

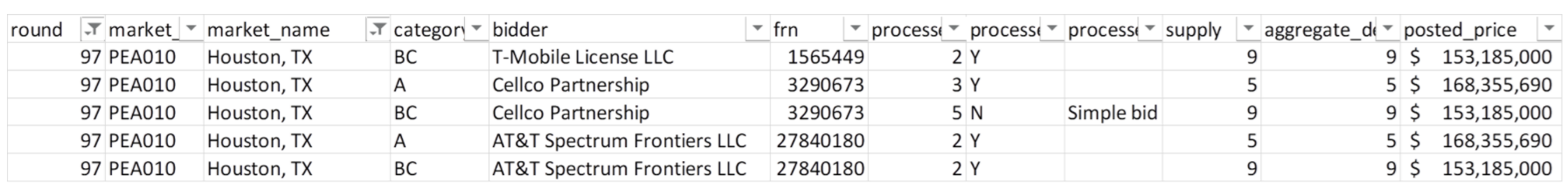

A quick recap for new Brief readers who are not familiar with the C-Band auction: There were three major blocks of spectrum up for bid: A Block (100 MHz; 3.7–3.8 GHz; mostly avail later this year), B Block (also 100 MHz; 3.8-3.9 GHz; available by December 2023) and C Block (80 MHz; 3.9-3.98 GHz; also available by December 2023). In most metropolitan areas, bids were separated into A and BC categories (outside of the metros, bidders placed one “ABC” bid). This is rarely a “winner take all” scenario, as this example of the Houston Partial Economic Area shows (from the FCC results database):

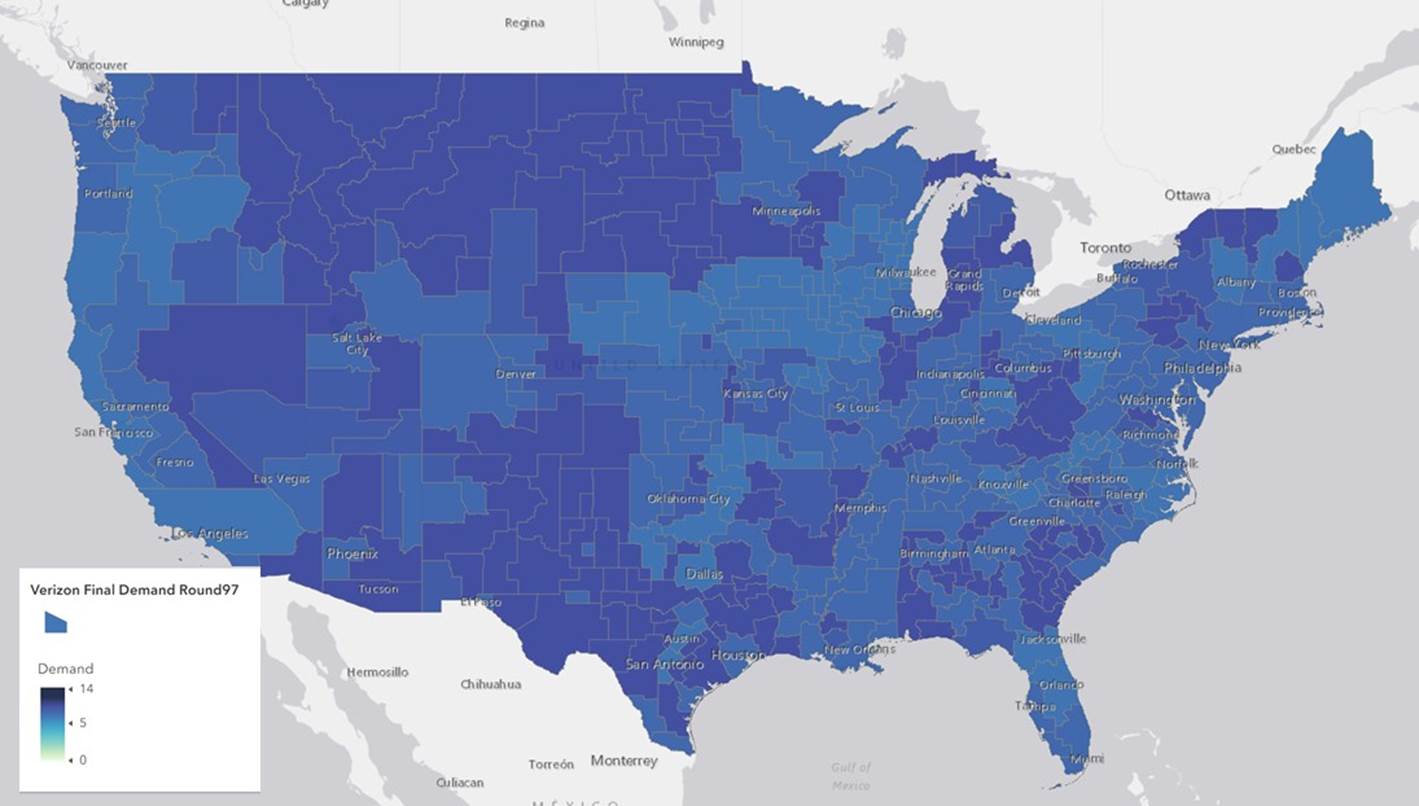

Verizon (d.b.a, Cellco Partnership) won three of the five A Block 10 MHz license pairs (60 of the total 100 MHz), and also won five of the nine BC Block 10 MHz license pairs (Verizon’s overall winnings map is shown nearby and can also be accessed through Sasha Javid’s auction tracker website here). This resulted in a total of 160 MHz of new spectrum Verizon can put to use in Houston – 60 MHz starting the end of this year, and the remainder by the end of 2023. They paid just over $1.27 billion for their share of this spectrum excluding relocation costs (roughly an additional 12% or $150 million). The Houston PEA has a population of 5.891 million according to the FCC website leaving a price per MHz POP of $1.43 for the A Block and $1.30 for the BC block.

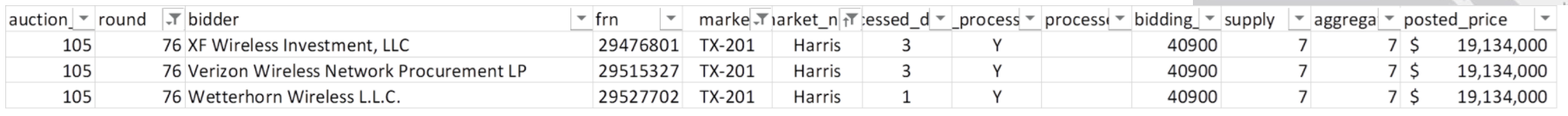

Contrast that to what Verizon paid for 30 MHz of CBRS Priority Access Licenses just a few months ago (results also from the FCC database link above – note that these results are for Harris County only which is about 75-80% of the PEA population. Verizon did not have the winning bid on any surrounding counties in the Houston area):

In this auction, Verizon netted 30 MHz of adjacent spectrum for $57.4 million (Harris County has a population of 4.71 million so 41 cents per MHz POP).

To recap, in July, Verizon paid 41 cents per MHz POP for 30 MHz of spectrum and six months later paid between $1.30 and $1.43 per MHz POP for 160 MHz of spectrum. The “big block” value is roughly 3-3.5x for Houston.

We scratched our heads on this sizeable difference for adjoining spectrum bands in January (Brief here). And many of you touted the value of having a large block of contiguous spectrum. Is a “big block” worth 4x? Why? What’s that use case, even for a vibrant market like Houston?

To make matters worse, this spectrum band will require additional clearing costs and more towers than lower frequencies. Tower providers in denser areas (and the fiber providers that connect to them) should get ready for more business. It’s going to cost a lot more to deploy C-Band, which leaves less capital for existing spectrum capacity augments and other competing capital priorities (like in-building 5G and fiber to the home).

Bottom line: Verizon and AT&T overpaid for the C-Band (Verizon in particular with their winning bids for 200 MHz of spectrum in Helena, MT, and Lewiston, ID). Their “big block” infatuation is puzzling. T-Mobile’s acquisition of Sprint is going to look like one of the smartest deals in telecom history when this is all over. And cable might be the biggest winner of all by lying low and possibly waiting for the next 100 MHz spectrum auction (more to come on that in future Briefs).

That’s it for this week. Next week, we will continue the infrastructure discussion and discuss the results of AT&T’s appearance at the Morgan Stanley conference. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Have a great week and Go Davidson Wildcats!