Mid-March greetings from Charlotte/ Lake Norman/ Davidson, where we prematurely celebrated National Poires Belle Helene Day (which is March 15). Like many of you, the COVID-19 pandemic has broadened our culinary skills. We are looking forward to enjoying this and other tasty desserts at our favorite restaurants once vaccines have accelerated.

This week was marked by a triplet of virtual analyst day presentations from Verizon, T-Mobile, and AT&T. There’s a lot to cover from each presentation. We’ll do our best to summarize each one yet adhere to Sunday Brief word limits. As such, our market commentary will be limited.

The bottom line from the three presentations is that while there are similarities in certain strategies (e.g., broadband to the home), each carrier funds its ambitions in very different manners: Verizon through ARPU/ ARPA and new-line

-of-business growth; T-Mobile through merger synergies, Home Internet, and some volume growth; and AT&T through market share gains, HBO Max, and a return to post-COVID trends at the rest of WarnerMedia.

The week that was

Despite a lot of volatility, both the Fab Five (+$50 billion) and Telco Top Five (+12 billion) managed to grow their market capitalizations last week. Contrary to other post-COVID “reopening” themes, the big winner in the Fab Five this week was Amazon (+$45 billion), followed by Microsoft (+$32 billion). Apple, Google, and Facebook offset a portion of their two counterparts’ gains with slight losses.

As we discussed last week, our view is that global earnings, translated back into more dollars (thanks to a weaker dollar), will boost revenues for each of the Fab Five, and that this realization has not been fully baked into earnings estimates for the quarter or for the year. As we saw in 2019 and again in mid-2020, the Fab Five tend to move the most in the weeks leading up to the end of the quarter, and this year should be no different.

Comcast continued its steady rise and now leads the Telco Top Five in both total market capitalization and 2021 gain. We think that the continued emphasis on upgrades (or, in Verizon’s parlance, “price ups”) will result in higher ARPU/ARPA levels across the industry. Offsetting this cash flow will be increased debt levels from the C-Band auction for Verizon and AT&T. As we discuss below, record debt levels are focusing carrier priorities and make the traditionally debt-loving cable industry look almost frugal.

Before moving on to the three analyst conference recaps, it’s worth noting that Tim Wu will be taking a role in the Biden Administration to advise on Technology and Competition Policy for the National Economic Council (see nearby tweet from Tim). This has sparked speculation that Big Tech (and likely telecom) will be under fire for the remainder of President Biden’s term. The Sunday Brief previously reviewed Tim’s book The Master Switch and think that his historical perspective, combined with others, will influence economic policy.

Verizon’s analyst day: Growth

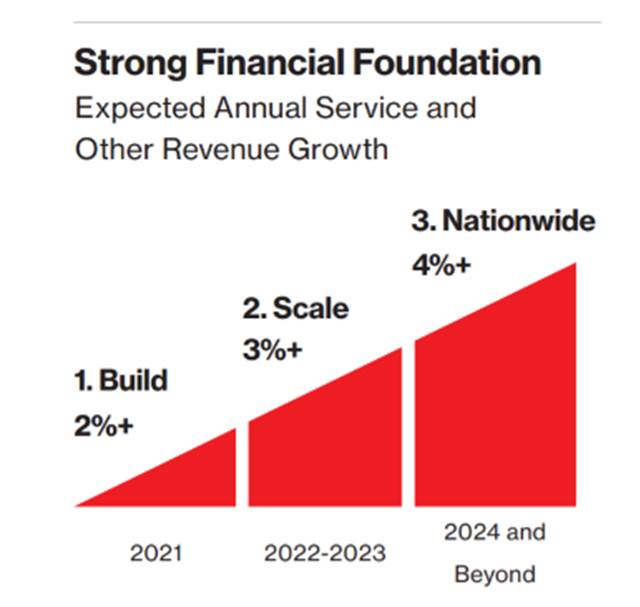

Verizon led off the three-day parade with presentations focused on growth and expansion (YouTube webcast replay here). Of greatest importance (and likely necessity) is their revenue growth targets of 2% in 2021, 3% in 2022, and 4% by 2024. This equates to $2.2 billion of incremental growth in 2021 to $112.1 billion ($28.2 million in monthly growth using the rule of 78s), $3.4 billion in 2022 to $115.4 billion ($43.6 million/month), $3.5 billion in 2023 to $119.0 billion ($44.9 million), and $4.8 billion in 2024 to $123.7 billion ($61.5 million). To provide some context, Verizon’s mobility unit grew 1.6% in 2019 ($1.7 billion). We think that Verizon’s wireless service revenue growth will need to encompass 80% of the requirements above; this implies a growth rate of slightly more than 9% for wireless in 2021.

Here are several ways Verizon plans to achieve their growth targets: Movement from metered to unlimited plans (this includes business customer conversion)

a. Movement from unlimited basic to unlimited premium plans

b. Expansion of wholesale growth opportunities (note: this revenue rose 7% in 2020)

c. Expansion of Ultra Wideband (UWB) customers in both consumer and business markets

d. Increased Multi Edge Compute (MEC) revenues (although they cite the Total Addressable Market, or TAM, for this market is only $1 billion in 2022)

e. Closing the Tracfone acquisition and increasing share of wallet for the prepaid market with wireless and UWB

f. Transforming into a growth company will be a challenge given Verizon’s size and the competitive dynamics (cable upgrades to DOCSIS 4.0, T-Mobile Home Internet described below, AT&T and other LEC fiber deployments in non-Northeast markets). Our view is that Big Red will exceed their 2% growth target in 2021 but 3 and 4% growth is aggressive absent competitors’ execution failures.

c. Given space constraints, we will have to save additional comments on Verizon for next week’s column. We are wary of Verizon’s ability to grow new retail lines of business (including mmWave for home broadband), but think that their strategy of aligning with Disney, Apple, Discovery, and others for content bundles will drive increased ARPU/ARPA.

T-Mobile Virtual Analyst Day: Funded by synergies

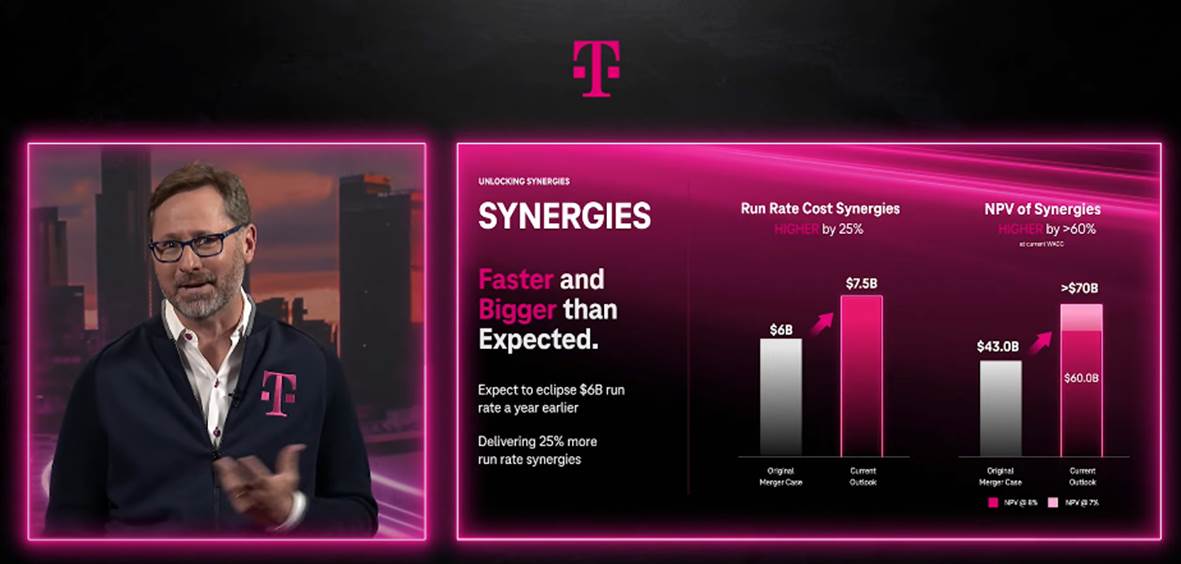

T-Mobile hosted an upbeat 3.5 hour analyst day on Thursday. They covered a lot of data, set quantifiable goals (including teasing a $60 billion stock repurchase opportunity) and fielded many questions. Our key differentiation takeaway was the phrase used by many executives in their presentations: Funded by synergies (or fueled via synergies, or powered by synergies)

There are many implications to this phrase. The bottom line: T-Mobile now has options. They include:

a. Grow market share in their core consumer-focused retail business. T-Mobile is the only provider of the three that has minimal dependency on growing ARPU/ ARPA. Nearly all revenue growth is driven by volume, and given their capacity, their cost structure should be better than Verizon and AT&T. Neville Ray, T-Mobile’s President of Technology, estimated that their cost structure would be half of a fully-built C-Band architecture. If this is realized, then their expanded distribution “doors” (2,200 Walmart and 1,000 Best Buy locations) should be even more productive. As stated in the presentations, we think that rural represents the best near-term opportunity (particularly through Walmart).

b. Grow through expansion into adjacent markets. Mike Sievert confirmed what we had discussed (and perhaps only slightly overestimated) in a previous Brief: Over 100,000 customers signed up for the Home Internet pilot, and they had to establish a wait list in some markets (and 35% of Home Internet customers were new to Magenta). T-Mobile indicated they would be announcing their consumer offering later this month (with a new price point of $60/ month, not $50 as was tested in the pilot). With their target of 7-8 million customers, Home Internet represents a $5-6 billion revenue opportunity – and that figure excludes TVision revenues. With their Work From Home (WFX) product priced at $90/ month, there’s room to provide highly secure and profitable service with no contracts.

Mike Katz, who was featured in last week’s analysis of WFX, discussed the enterprise opportunity without overemphasizing mobile edge computing (MEC) or network slicing opportunities. Plenty of opportunities exist within the small and medium segment as well, and T-Mobile’s commitment to staff vertical/ industry experts is a good first step. Doubling market share to 20% will likely happen through a combination of enterprise wins in specific verticals and increased government/educational contracts.

c. Investing in fiber-connected cell sites. Our primary criticism of the T-Mobile plan is that they have not elevated fiber to a strategic priority. If T-Mobile could enable their top 1,500 cell sites by volume with fiber (leases) at the same rate that Dish is paying to enable their network (a truly conservative estimate), they would likely save $60-100 million annually in third-party access costs, and they would have owner’s economics at these sites for their Home Internet and WFX products. Stopping at the base station reduces their certainty of becoming the low-cost leader. T-Mobile can “toe dip” into the fiber experience through Sprint’s legacy relationships (re: Sprint was an early customer of Zayo, DukeNet, Time Warner Telecom, Florida Power & Light/ FPL, and Metromedia Fiber Networks. They also purchased excess conduit/fiber in a few markets during fiber bankruptcies nearly two decades ago).

d. Buy additional spectrum as it becomes available without significant leverage ratio impacts. We think that the 3.45-3.55 GHz block that should be auctioned later in the year is one of many that T-Mobile will be able to evaluate and win at per MHz POP prices that are better than C-Band.

Bottom Line: As we have stated in previous Briefs, we think that purchasing Sprint was a good move, and the improved synergies outlined in both Mike Sievert’s and Peter Osvaldik’s presentations affirm our thesis. We are particularly bullish on the 2-3 person (~6 connected devices) household in rural/ suburban markets, and think T-Mobile’s LTE performance can meet many needs even before 5G is launched. And everything is funded thanks to the Sprint merger synergies.

AT&T’s Analyst & Investor Day: Fiber for most, free lunch for none

Having to follow Verizon and T-Mobile is not an easy task, but AT&T did a good job of reiterating themes and delivering new news in their 2-hour session on Friday (materials here). For regular readers of The Sunday Brief, the main themes were unsurprising:

- Fiber deployments (now 3 million new homes passed in 2021) with as much cross-business unit leverage as possible

- Continuing wireless churn reduction efforts through matching offers to new and existing customers (no change to this policy)

- HBO Max deployment with specific growth targets of 41 million subscribers by the end of 2022 and 120-150 million by the end of 2025, thanks to the introduction of advertising-supported (AVOD) and international versions

- No dividend changes (management’s language conveyed “flatness”) and focused deleveraging of the business

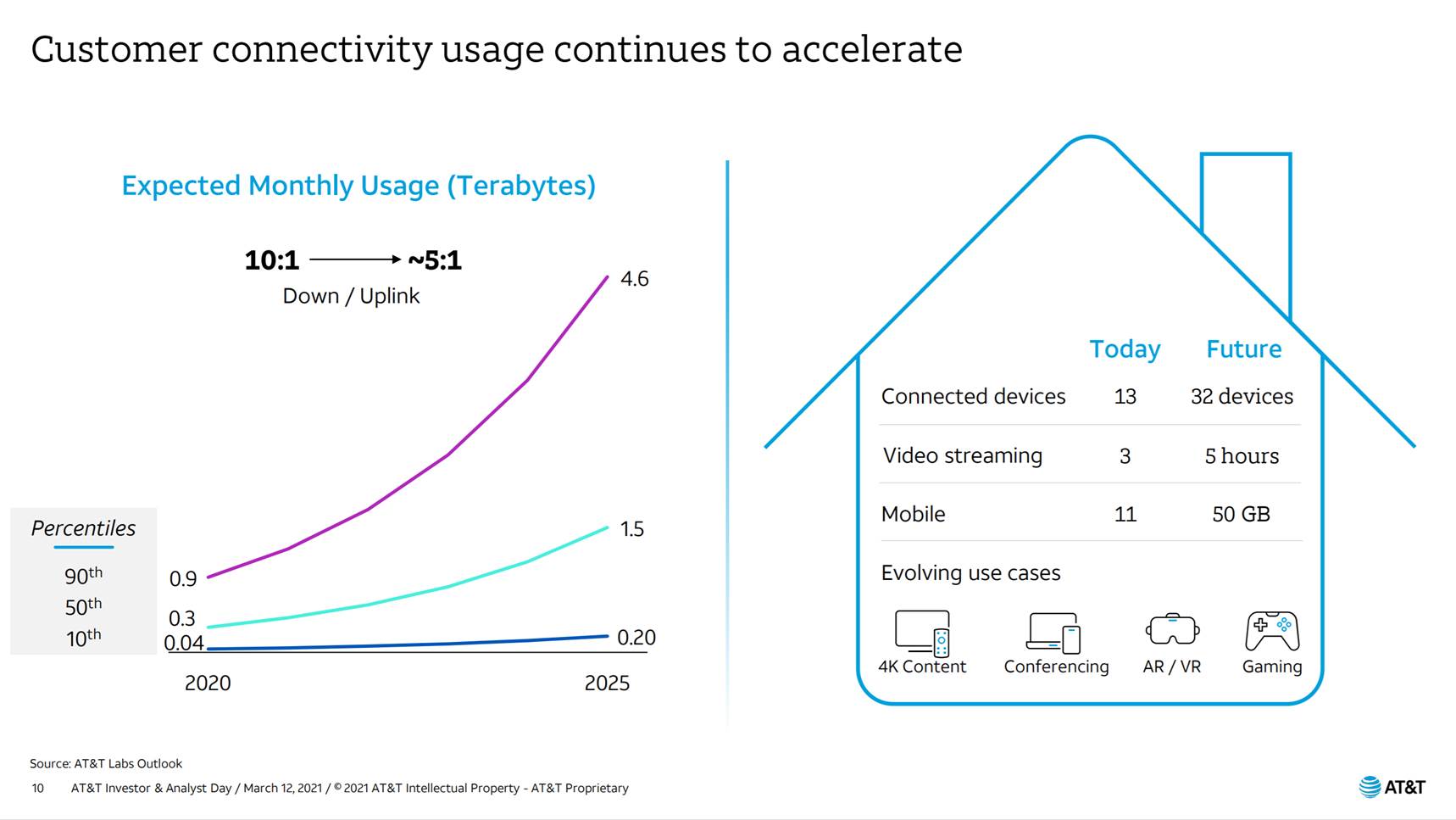

There were two elements of the presentation that were surprising. First, after outlining the historical growth rate of wired broadband (38%), led by growth of uplink tonnage, Jeff McElfresh presented a projection of data growth using the following slide:

Here is the corresponding commentary (full transcript here):

“… we expect the demand for high-quality broadband will continue to increase upwards to 5x in the next 5 years, where the majority of customers are expected to consume up to 4.6 terabytes of data as seen represented on the chart on the left. Factors driving this increasing bandwidth consumption and the emphasis being placed on uplink demand include a multitude of things, like the number of connected devices in a home increasing to 32. Mobile consumption will continue to grow to nearly 50 gigabytes and shifts in our video content format from high-definition to 4K and, of course, the rise [of] … streaming services and the time that we spend watching them, the prevalence of video conferencing and many other high bandwidth applications such as augmented reality, virtual reality and, of course, gaming.”

AT&T went on to make the case that the only way to satisfy this insatiable demand is through increased fiber deployments. As we have discussed (and as Jeff McElfresh reiterated in the Q&A), AT&T currently serves 14 million customers with fiber (fiber passed homes). Five million have signed up for AT&T (36%). The 14 million will grow to 17 million in 2021, or about 45-50% of AT&T’s total homes passed.

As we analyzed in a previous Brief (here), CEO John Stankey thinks AT&T can serve ~2/3rds of the fiber market economically (without additional government assistance). That would equate to roughly 26-27 million homes passed. While every million helps, it will take an additional three years of 2021 deployment pace to reach the 2/3rds goal (Jeff McElfresh, in the Q&A, stated that AT&T might accelerate beyond 3 million homes passed in 2022, but that depended on 2021 schedules and initial success). Including 2021 spending, we estimate the capital plan for fiber is likely $9-11 billion to go from 14 million to 27 million homes (there are a lot of factors to consider in these estimates, including the actual number of fiber feet from the Network Interface Device or the NID to the home, but the $9-11 billion equates to $700-$850 per home passed).

How AT&T will address the remaining third of their homes that do not meet their economic threshold was not clearly answered. At one point, Jeff McElfresh described using wireless spectrum (including C-Band) as an “edge out” to deliver broadband services (John Stankey discussed this in a September 2020 Politico article), but it’s not hard to imagine that AT&T is lobbying hard to include fiber funding in the upcoming infrastructure bill.

It’s also interesting to point out in the goals and objectives that management is treating fiber deployment as a growth engine – revenue and share gains are the objectives, and profitability is secondary. If the Broadband unit retains a market share focus, cable will face broad-based competition.

The other item which struck us was Jason Kilar’s presentation on characteristics of the HBO Max AVOD product scheduled to launch in June (see nearby “Takeaways” slide). Specifically, unlike NBC’s Peacock streaming product, there will not be a free version launched. When Jason described the AVOD product, however, this makes more sense (HBO Max AVOD will not have “day and date” theatrical movie releases, but other than that, it’ll be the same as the current HBO Max product). To some extent, charging even a nominal amount (e.g., $39.95/ yr) would allow AT&T to cover any advertising/ marketing costs.

Bottom line: AT&T’s presentation was polished, and they were confident that they could retake market share in wireless and broadband. The primary question for AT&T is “Can they grow their customer base and EBITDA simultaneously?” Their presentation quelled some fears, but their answer to the previous question was not completely convincing. Specifically, new content costs could prove to be more expensive than forecasted.

Next week, we will continue our analyst day evaluation and address which topics were not discussed by the Big Three wireless carriers. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Have a great week and Go Davidson Wildcats!