Ericsson using 4G/5G private networks to enable the Miner 4.0; Smart Mining Value Calculator pins TCO to return on five mining use cases

In its Connected Mining report, published in December 2020, and an accompanying deep dive webinar hosted earlier this year, Ericsson explored the value 4G and 5G private networks can bring to the mining vertical. Panelists from AT&T, Ambra Solutions and mining productivity specialist Epiroc discussed the careful balance mine operators need to strike between the benefits mission critical networking can bring to their businesses with risk aversion in an always-on production environment.

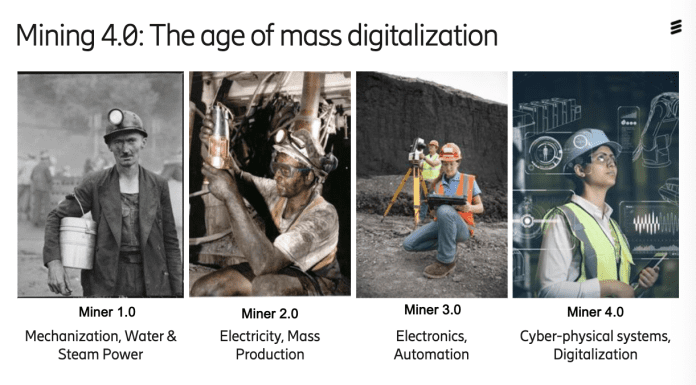

In the age of smart mining, meet Miner 4.0

Ericsson’s Filip Mestanov, an industry and ecosystem manager who specializes in the mining vertical, traced the overlap between previous industrial revolutions and how miners go about their jobs. Miner 1.0 used mechanization and water and steam power; Miner 2.0 took advantage of electricity and mass production capabilities; Miner 3.0 tapped electronics and automation; and Miner 4.0, he said, will use cyber-physical systems and broad digitalization.

“We envisage this cyber physical systems where we have mass digitalization so all kinds of different assets get connected to the network, and then information gets exposed to the digital domain, processes get revamped and redone in order to increase productivity, efficiency but, of course, also reduce environmental impact and improve safety of the workers working in those mines,” Mestanov explained.

He laid out Ericsson’s private network solution which includes indoor and outdoor 4G/5G RAN equipment, on- or off-premise core, local management, group and/or VoLTE communications, and access to global cloud centers for apps, management and as-a-service add-ons.

Smart mining use cases

Working with customers and technology partners, Ericsson has identified five key smart mining use cases that can be enabled with 4G and 5G:

- Autonomous vehicles for haulage and load-haul dump (LHD)

- Remote operations for remote control of drill rigs and other mobile implements

- Monitoring and tracking for real-time condition monitoring

- Enhanced video services for unmanned drone inspections

- Hazard and maintenance sensing for smart ventilation control

With the use cases identified, Mestanov said the next step was to build business cases around those use cases and break out end-to-end costs, both capital and ongoing operating spend. Ericsson developed a Smart Mining Value Calculator that considers variables like site size, production capacity, and number of machines, lets a potential buyer input desired use cases, and produces a TCO figure. In a polling question during the webinar, attendees identified real-time condition monitoring and autonomous LHD as the use cases they see as bring the most business value.

Perspective from the mines

Tim Ledbetter, vice president of automation R&D for Epiroc’s Surface Divison, drove home the need for absolute reliability giving the mission critical nature of mining use cases that would ride on a cellular network. He shared an anecdote based on a conversation with a mining operator where the operator told him that mining IT teams should have KPIs based on production outcomes like tons hauled rather than purely focused on technology implementations.

He said modern mines are loaded with sensors measuring ground movement, vibration and a host of other environmental factors. “The technology is accelerating and we see the same thing with our mining partners. It’s really the internet of things approach.”

Ledbetter continued: “If you get into the next phase, into automation…the term ‘mission critical network,;” becomes vital. “Dark spots in the network and high latencies, they just won’t be tolerated by the state of the art automation systems.” High bandwidth, low latency and strong quality of service “are huge factors for doing autonomous haulage of autonomous load haul dump.”

Eric L’Heureux, CEO of Ambra Solutions, pointed out that, “A mine works 24/7. Having access to equipment, bringing in new technology, it’s pretty limited the time we can stop production.” Given that any new technology implementation brings with it new risks, he said, “Everyone wants to be second.” But, at this point, initial deployments have been done and the technology has been proven out in the field.

Canadian-based Ambra is a specialized telecom engineering firm with a focus on design and manufacture of systems and products for rugged and remote areas. The company has delivered networks for mining, oil and gas, and utility firms, among other verticals.

L’Heureux said the biggest challenge for cellular-based smart mining is around the challenging RF environment in both open pit and underground mines. “That mission critical network must be reliable, redundant and provide enough throughput and, of course, low latency. He also noted that the prevalence of cameras streaming video from various implements in a mine mean that “most of the traffic will be on the upstream.”