5G+ is the network along with edge cloud, AI/ML, private networks, sensors and robotics

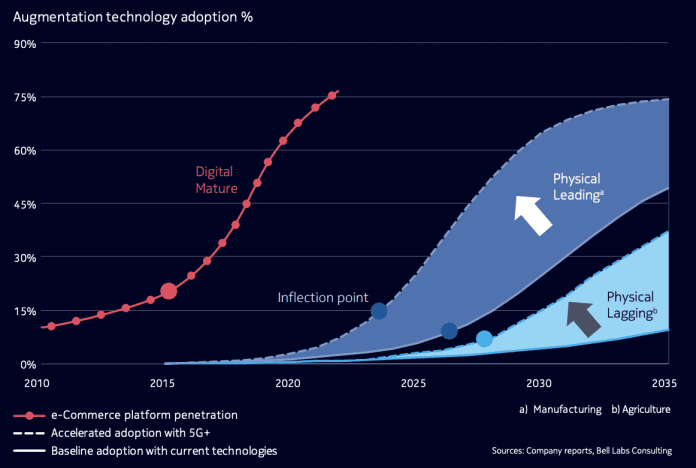

Sectors such as media, financial services, and e-commerce were able to more quickly pivot as the COVID-19 pandemic reshaped the ebb and flow of global commerce because they were farther along in embracing digital transformation as compared to legacy, physical industries like mining, agriculture, transportation and logistics. Now it’s time for those physical industries to catch up by leveraging the technology set Nokia calls 5G+—that’s the 5G network plus edge cloud computing, artificial intelligence, machine learning, private networks, sensors and robotics.

Speaking today in a panel discussion at Nokia’s virtual event, The Rise of Digitalization in the Americas, Nokia Bell Labs Senior Partner Fuad Siddiqui said previous industrial revolutions delivered massive productivity increases that lifted up physical industries, economies and society with productivity growth in the U.S. peaking in the 1950s and 1960s.

When COVID-19 hit, the concentration of ICT investments, 70% of the total, in certain industries allowed them to more readily maintain business continuity while addressing growing demand, latent demand and new demand. This pivot was more difficult for physical industries that had not historically invested as much in ICT; “Now is the time to invert that paradigm,” Siddiqui said.

In a whitepaper authored by Siddiqui, Bell Labs Consulting research sees investment by physical industries in 5G+ technologies growing to $4.5 trillion in 2030, effectively shifting the 70%/30% ratio to 65%/35% in favor of physical industries. According to the paper, “We estimate that increased wages, profits and tax revenues will induce an increase in global GDP of up to $8 trillion…We predict that we are approaching a ‘big inversion’ in ICT investment in physical and digital industries, driven by this emerging set of 5G+ technologies. This inversion will restore the parity in ICT investment between the amount these industries invest in ICT and their respective contributions to overall global GDP and workforce employment. When this inversion is complete, industries will be optimized to create and capture new value.”

In terms of the private network portion of the 5G+ technology set, Nokia has been at the forefront of deployment. Company CSO and CTO Nishant Batra said the firm tallies 156 private 4G/5G networks in 32 countries. He also noted that concurrent evolutions of technology and business cases are necessary to drive broad value from critical and private networks.

“We see the compute moving closer to the use cases and we see this is now enabled by network-as-a-service,” Batra said. “In five to seven years, we will stop thinking of the network as an entity that provides SLAs; it will be outcomes…This will be a revolution during the rest of the decade.”

He said trends around critical and “hyper-local” private networks for industries “will not take off until software agility is there and until as-a-service business models are adopted.”