Tax Day greetings from the middle of Texas (the iconic Underwood’s Cafeteria sign is pictured – it’s definitely a Texas thing) and from Davidson/ Lake Norman. Feels good to be on the road again.

This week, we will divide our time between first quarter earnings preview for Verizon and AT&T (both scheduled to report this week) and a full market commentary.

Speaking of earnings, many of you indicated that the earnings calendar was a nice touch last January/ February, so here’s a brief summary of upcoming earnings for the ten companies we track each week:

The week that was

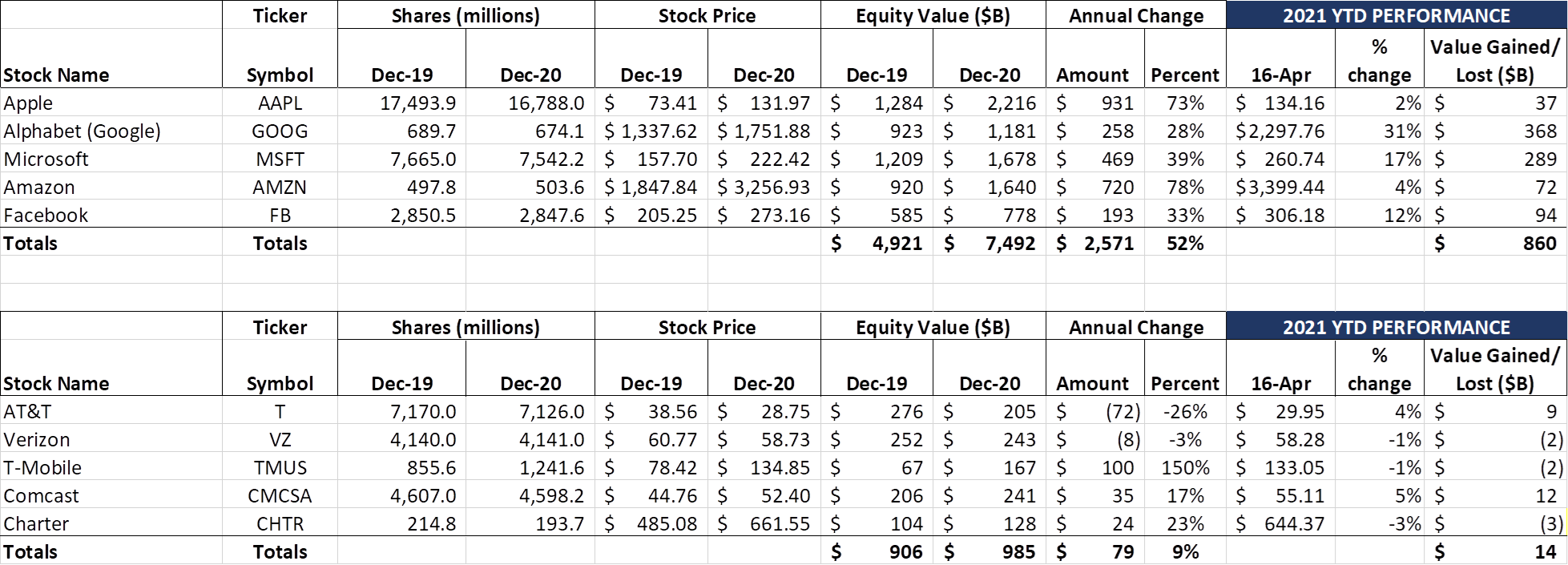

Like the overall market, the ten stocks that we track each week had modest gains. The Fab Five added an additional $61 billion in equity market value this week (YTD total is now $860 billion, most of it coming in the last two weeks), and the Telco Top Five gained $21 billion in value this week, with Comcast leading the pack in terms of YTD value creation and overall market capitalization.

Speaking of Comcast, they announced new plans this week for their MVNO, Xfinity Mobile (announcement here). A lot of attention has rightly been made about four lines for $120 (although, unlike Spectrum, Xfinity Mobile does not include taxes and fees in their base rate), but we were equally surprised at the free phone offer (a Motorola One 5G Ace for any new line added – see nearby picture). This is a big “re-opening” move for Comcast and will place pressure on each of the Big 3 carriers.

Disappointing, however, is that Xfinity Mobile minimizes streaming service NBC Peacock in their plans and marketing. While it’s true that Xfinity Internet customers have NBC Peacock Premium included in nearly all service plans, they still pay more for Peacock Premium Plus (the only service tier that includes some offline downloading capabilities to mobile devices). Ironically, more offloading over Wi-Fi would reduce tonnage/costs on Verizon’s (Xfinity’s partner) network. While including Peacock Premium Plus with all new family plans is small, it would remove AT&T’s “ace” – HBO Max.

Speaking of HBO Max, the release of Godzilla vs. Kong (discussed in last week’s Brief) on both mobile and in theaters appears to have had less impact on the box office side than originally anticipated. Bloomberg ran a story Friday that predicted that the WarnerMedia movie would rake in an additional $7-8 million domestically this weekend, bringing the US total to just shy of $80 million (total revenues including international should approach $350 million by Monday). AT&T provides a big benefit to HBO Max customers and also takes advantage of a content-starved box office – very good move for Ma Bell. As the Bloomberg article indicates, another WarnerMedia movie, Mortal Kombat, will be released next Friday (April 23) and is expected to yield even greater returns.

The big news of the week for the Fab Five (besides Steven Levy’s article in WIRED, where he makes the case for greater regulation of the Fab Five, including using a former Sunday Brief characterization of Microsoft as the fifth “Horseman”) is Microsoft’s acquisition of Nuance for $16 billion in cash ($20 billion including debt – announcement here). While Nuance’s success in healthcare has been strong (~60% of 2020 revenues per their latest 10-Q; 70% of US Hospitals are Nuance customers), they also claim 85% of the Fortune 500 as customers and hold a very broad range of patents (2,350+ generated by an R&D staff of 1,600). This represents the largest acquisition for Microsoft since LinkedIn. At first blush, looks like they got a reasonable deal for an iconic asset. How Tim Wu (antitrust advisor to President Biden) views this transaction will be interesting to see.

Finally, it’s worth noting that Amazon founder and CEO, Jeff Bezos, has written his last letter to shareholders (here). There’s more than the normal level of nostalgia in the letter (including an attempt to assess how much value Amazon added to the lives of consumers, AWS customers, and others in 2020), but he ends it with a serious note to Amazonians about resisting the inertia to maintain the status quo of a large company:

“In what ways does the world pull at you in an attempt to make you normal? How much work does it take to maintain your distinctiveness? To keep alive the thing or things that make you special?… We all know that distinctiveness – originality – is valuable. We are all taught to “be yourself.” What I’m really asking you to do is to embrace and be realistic about how much energy it takes to maintain that distinctiveness. The world wants you to be typical – in a thousand ways, it pulls at you. Don’t let it happen. You have to pay a price for your distinctiveness, and it’s worth it. The fairy tale version of “be yourself” is that all the pain stops as soon as you allow your distinctiveness to shine. That version is misleading. Being yourself is worth it, but don’t expect it to be easy or free. You’ll have to put energy into it continuously. The world will always try to make Amazon more typical – to bring us into equilibrium with our environment. It will take continuous effort, but we can and must be better than that.”

No doubt that Jeff will be fighting that inertia for some time to come. Amazon is a grand experiment of perpetual, sustained originality (or a less kind word, disruption). Each CEO will shape his or her company differently, but these parting words from the founder are important to the future of what is now a $1.7 trillion behemoth.

Q1 earnings preview – setting expectations

AT&T and Verizon kick off the earnings season this week. Unlike 2020, investors will be acutely interested in both companies’ earnings guidance for the full year. There are two common themes we think apply to both companies:

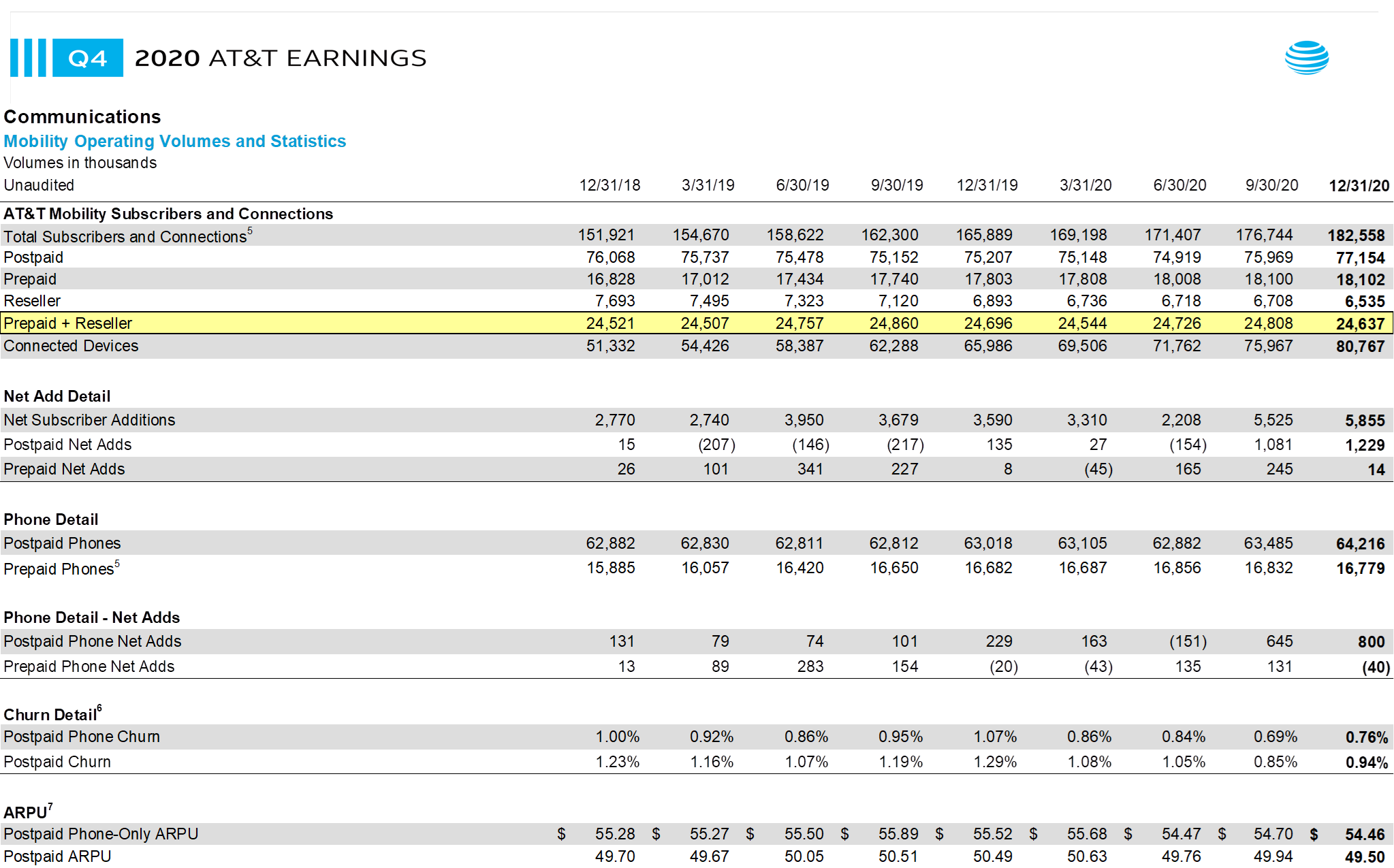

- Ability to grow wireless ARPU. They may not engage in the same manner and yield the same EBITDA, but stagnant guidance will not be received well. Here is the snapshot of AT&T from their 4Q earnings release (highlighted row, the sum of retail prepaid and reseller subscribers, was added):

The post-COVID recovery process began early for AT&T due to a) HBO Max bundling, b) promotions that include existing customers, and c) improved network performance – over 2.3 million postpaid net adds over the last two quarters, including 1.45 million postpaid phone net adds. The fourth quarter monthly postpaid churn (0.76%) was an important contributing factor to last quarter’s subscriber gains – the 4Q 2019 to 4Q 2020 churn improvement is worth 225-235K net additions or about 18-19% of the total gains in the quarter.

While subscriber gains are terrific, ARPU gains on the entire base are even better. It appears that the incremental ARPU AT&T is gaining is not offsetting base changes (likely from “bucket” to unlimited family plans) – overall postpaid ARPU continues to fall (down 0.40% for phone-only and 0.88% for overall postpaid ARPU). Postpaid gains likely added $175-185 million to AT&T’s monthly revenues starting in 2021 (1.229 million*$48 incremental ARPU). If AT&T were able to extract $1.95/ mo. in additional ARPU from the base, this would effectively double their monthly revenue gains (77.15 million customers * $1.95 = $150 million monthly revenue increase).

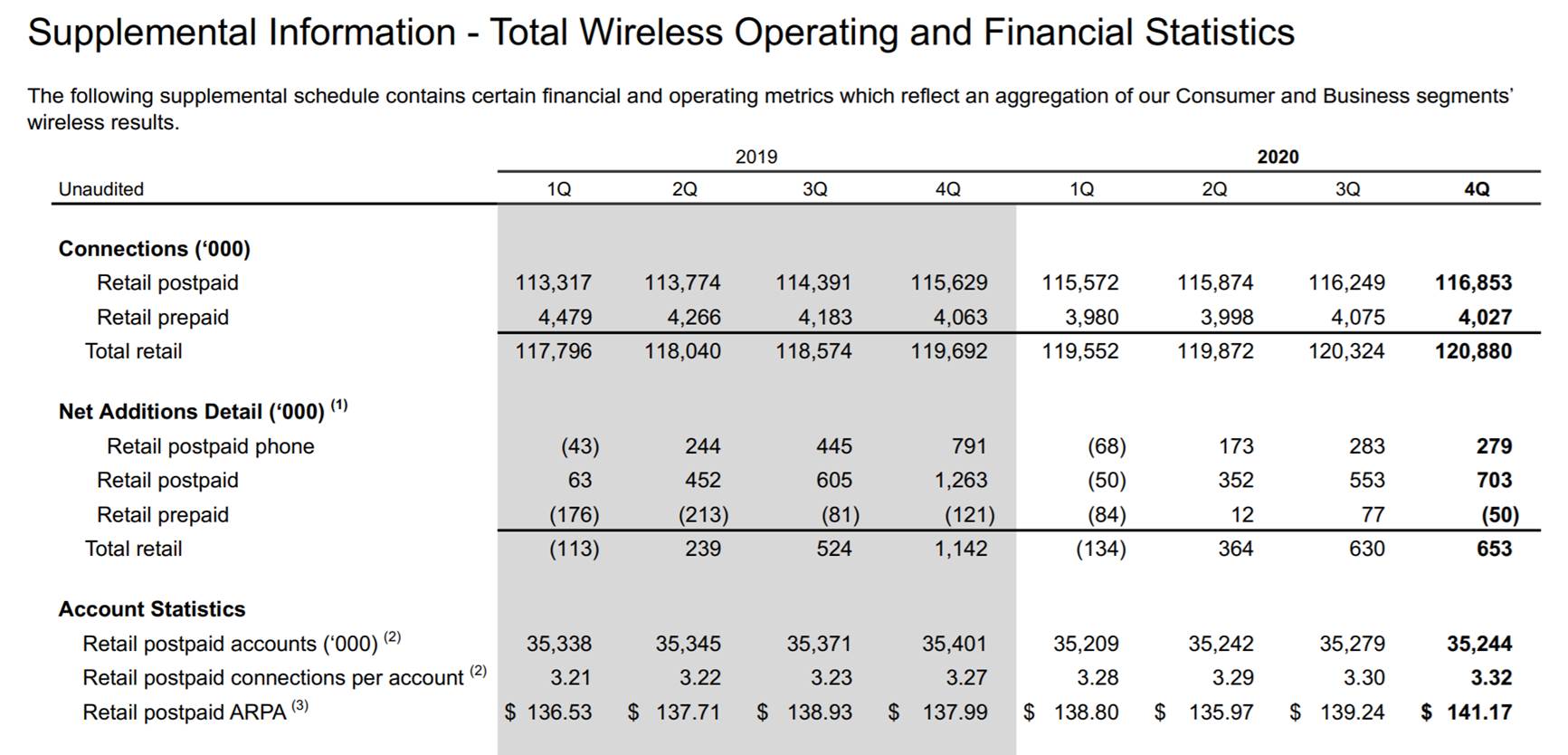

As important as it is for AT&T, ARPU may be the single most important success metric for Verizon. Here is the analog chart for Big Red:

Dividing connections per account into Average Revenue Per Account (ARPA) yields similar figures and trends as we saw with AT&T. ARPU rose slightly from $42.20 in Q4 2019 to $42.52 in Q4 2020 (+0.8%). Q3 2019 was $42.19 so the quarterly sequential and quarterly annual measures are similar. Starting in 4Q 2020, Verizon began to reap the benefits of improved ARPU. They appear to have done this, however, without the Apple device release net additions bump.

At their Analyst Day, Verizon disclosed that 20% of their postpaid phone account base subscribed to premium unlimited plans, and expected this to grow to 30% by the end of 2020. Using the chart above, that means that 3.52 million accounts are going to upgrade. Did discovery+ drive upgrades, or did 5G? Our hunch is that there will be a gap to make up in the second half of 2021.

Bottom line: In the absence of new sources of subscriber growth, AT&T and Verizon need to find ways to grow ARPU. Both companies are suffering from ARPU flatness, although Verizon appears to be breaking from the stagnation cycle. Accelerated adoption of unlimited plans by existing customers and improved upselling of content bundles appear to be the best means to grow ARPU.

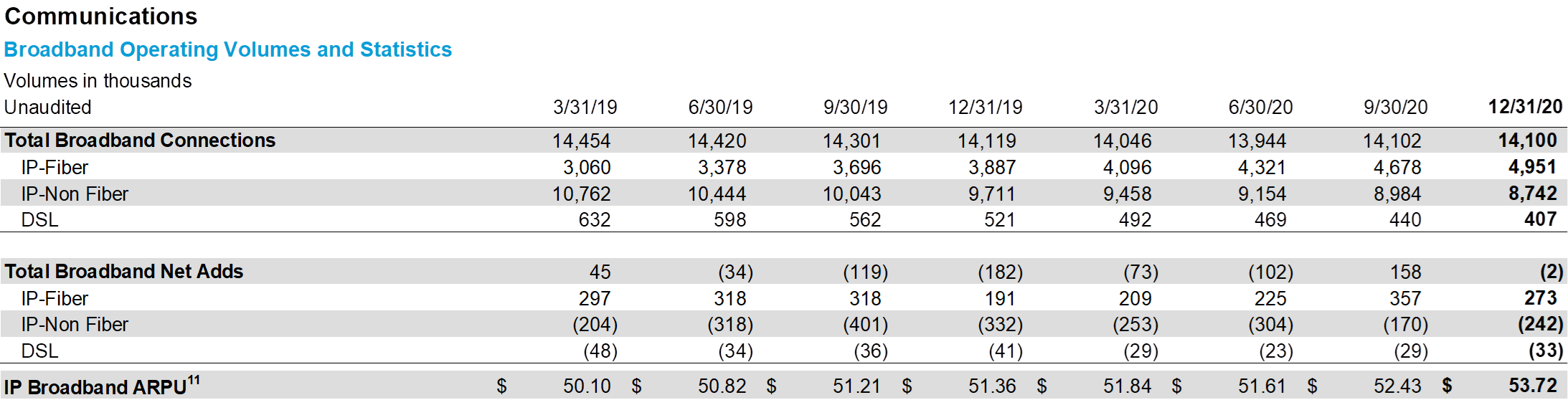

- Residential broadband growth. The other product on the “high adoption/ high incremental profitability” quadrant for both AT&T and Verizon is residential High Speed Internet (broadband). This could take two forms for Verizon (in region = FiOS; out of region = 5G Ultra Wideband) and involves chiefly fiber growth for AT&T.

AT&T’s eight quarter broadband trend is shown above. As we have stated in previous Briefs, they are not gaining customer share, but are substituting higher value/ lower churn risk customers for the legacy IP non-Fiber base. Incremental revenue per customer is meaningfully higher than disconnect revenue, a welcome offset to declining legacy voice and equipment products (in 4Q 2020, AT&T grew sequential revenues by 2%, its first positive quarterly growth result since 2Q 2019). Was the 4Q voice and equipment revenue result a false positive? The answer in the upcoming earnings release will reveal how much AT&T will grow their residential business.

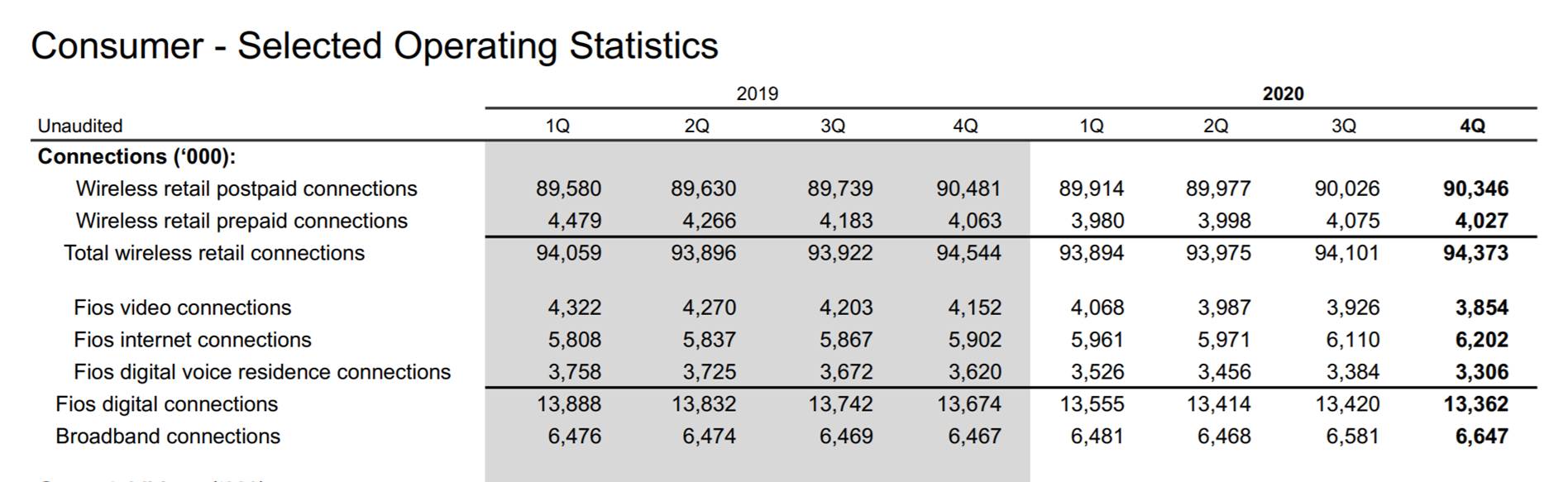

Verizon has a better story with FiOS but will continue to need to reiterate the 5G Ultra Wide Broadband consumer story. Here is Verizon’s FiOS trend:

2020 growth in FiOS Internet connections was 300K and were bolstered by broadband connections growth of 197K. Traditionally, as AT&T’s results demonstrated, telco fiber gains are usually offset by DSL or “broadband” losses, sometimes due to new fiber builds, but also because, as one industry insider put it to me last month, “Why would anyone go back to DSL?”

Like AT&T, FiOS is fighting declines in their video (down 298K subscribers for full year 2020) and voice (down 314K subscribers) product lines. While video has a much lower gross margin than broadband, FiOS voice does not (voice carries incremental gross margins of 75-80% – between broadband’s sky high levels and programming-rich video).

Verizon also indicated in their March Analyst Day that they would be adding a number of homes passed throughout the year and “grow revenue in 2022.” Any fixed wireless revenue momentum will be greeted positively.

Bottom line: AT&T has the most to prove with broadband thanks to their ambitious plans to grow their fiber footprint. Our forecast is that they will post a net +40-50K net additions (IP Fiber gains less non-IP fiber losses) with continued pressure on legacy DSL. AT&T will also have a slow start to incremental fiber homes added, placing more pressure on 2H 2021 (back to school/ movers) to hit their targets. Verizon will begin to unwind their non-FiOS broadband gains from 2020 and return to their slow bleed of the base. Both AT&T and Verizon will take any “price ups” to make up for continued video and voice pressures.

In addition to the common themes described above, we expect commentary on the following:

- DirecTV will have a “transition” quarter. Investors will be looking for light at the end of the tunnel (re: this is still an important double play component, as last week’s Brief showed).

- HBO Max transfer pricing will likely get more airplay in the earnings release. As many of us remember, there were some large changes in broadband and video margins due to “transfer pricing.” While this eliminates at the corporate level, it might shed some light on how value is being generated.

- We have not heard of any widespread issues, but commentary on smartphone supply shortages would be a negative. Conversely, higher upgrades to 5G (% of postpaid base) would be a positive.

- HBO International and ad-supported (AVOD) launch plans. As we discussed in the March 14 Brief, HBO Max has a very ambitious plan to grow globally. Confirmation of launch and commentary on value proposition will assuage many analysts who are concerned about their ambitious goals. Also, HBO Max has had a full quarter on Roku (launched 12/17/2020) and Amazon TV (launched 11/17/2020) – the impact of this should help total numbers.

- Direct distribution changes (more store transfers to affiliates for AT&T). Verizon is back to “normal” but does that mean store traffic levels are equal to pre-COVID?

- Any changes in capital priorities as a result of the C-Band build. AT&T’s residential fiber build is sacrosanct, but what’s the impact on other capital priorities (e.g., LTE densification)? Do these tradeoffs open the door for T-Mobile to capture additional market share gains (see Ookla’s most recent report here which T-Mobile wasted no time publicizing)?

- Tracfone approval clarity. If RootMetrics metro RootScore reports continue their trajectory, Verizon is going to need to change the conversation in the second half of 2021 (as we stated in a previous Brief, “tied for the RootMetrics win” is not going to have the same appeal). Tracfone presents Verizon’s greatest single opportunity to change the story.

- Now that they have received their Priority Access Licenses (PALs), Verizon’s CBRS plan, particularly for business customers, should be ready for prime time.This is different from their current use of CBRS Generally Available Access (GAA) which has been in the works for some time. Their ability to frame the CBRS narrative ahead of Comcast, Charter or Dish is very important.

Verizon and AT&T’s value is closely tied to their ability to grow faster – much faster – than they have prior to the C-Band auction results. They have historically shown the ability to transition (from dial-up to broadband, from clamshells to smartphones, from on-prem computing to cloud), but this challenge is different and the stakes are larger. Any evidence that they are on their way to outsized growth will go a long way toward restoring confidence in their overall valuation.

That’s it for this week. Next week, will review AT&T’s and Verizon’s results and preview Comcast and Charter. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Have a great week and Go Davidson Wildcats!