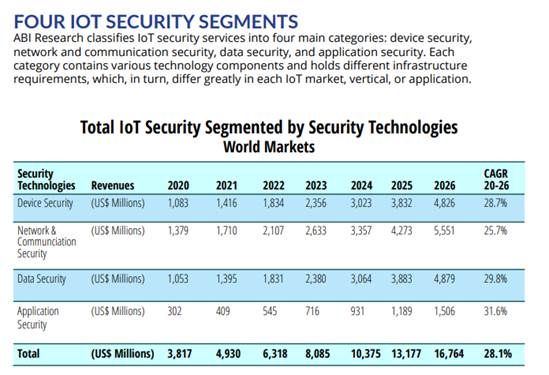

Revenues from the sale of cybersecurity solutions in the IoT sector will jump to $16.8 billion by 2026, according to ABI Research, as the number of IoT connections nearly triples from 8.6 billion to 23.6 billion connections in the same period.

The growth forecast stretches from a start figure of $4.9 billion in 2021, the firm said (see graph). It alluded to the “limited” availability of IoT security solutions because of the fragmented nature of the market itself.

ABI Research said cybersecurity will, invariably, become ‘big business’ in the next few years, as the exponential growth in IoT connections introduces a “slew of new threat vectors and vulnerabilities”. It cited opportunities for IoT service providers, vendors, platform operators, and IT/OT security organizations from the sale of cybersecurity solutions.

Michela Menting, digital security research director at ABI Research, said: “ Concerns about security of IoT are widespread… Security gaps run the gamut from devices that are incapable of being secured to manufacturers and vendors often choosing to accept the risk rather than remediate it, as well as functional safety-type IoT devices that prioritize availability and cannot simultaneously ensure confidentiality… [They] offer a tremendous revenue potential for players in IoT security.”

Growth in the IoT market – notably from digitisation efforts in “utilities, industrial, infrastructure, and smart cities” – will be driven by the trend to automate machines and processes, which has in turn been accelerated by the Covid-19 pandemic, said ABI Research. Spending by vertical markets will differ, said ABI Research, according to the perceived criticality of their operations and the sensitivity of their data, and not in line with the volume of IoT deployments in each sector.

Mentiny commented: “This is due to the multi-faceted level of security and management requirements that provide the foundation for other key operations and valuable services, including for intelligence operations and analytics, life cycle management and predictive maintenance, firmware updates, and device and data integrity.”

The firm said digital security services will “enter the ROI equation significantly faster” in the next three years, as “both security vendors and IoT players will better understand how to protect the key monetization applications related to their IoT strategies.” The company has issued a report to go with the market forecast.