This article is taken from a new Enterprise IoT Insights report on Industrial 5G SLAs. The full article, including additional sections, along with the rest of the report – with commentary from the likes of Accenture, Appledore Research, EXFO, Nokia, Lufthansa Industry Solutions, and Vodafone – is available to download here. Note, it borrows heavily from previous posts, including on ‘The weird science of Industry 4.0‘ and ‘The case for carrier-led private 5G‘.

The question about the kinds of service level agreements (SLAs) that will go to support industrial 5G is a powder keg – for industry and for telecoms. Because it asks almost-impossible questions about both the content and ownership of the fundamental networking apparatus being positioned to power Industry 4.0. These twin narratives, hard to disentangle, are alternatively highly speculative and intensely emotive. Because so much is new, so much is promised, and so much is at stake. Why so much?

Before we set the fuse, and survey the wreckage, we should momentarily consider the dimensions of the bomb, itself – and its explosive potential. ABI Research has the projection: the combined value of the private LTE and 5G markets will be around $65 billion in 2030 (with about $37 billion going on 5G), from a couple of billion dollars today. Industrial manufacturing, which this report focuses on, will spend biggest in the period, with a little under a quarter (around $15 billion) of the spend.

Anecdotally, to pin the spend to network management SLAs, test and measurement company EXFO has done the sums on the back of an envelope to suggest 50 percent of all 5G revenues – including common-or-garden smartphone subscriptions – will be subject to SLAs as soon as 2025 (see report). But the ABI forecast goes into the long-term, too, covering the tail-end of 4G-LTE, the rise of 5G-NR, and probably the emergence of an entirely new (6G) generation of cellular.

It describes a seismic shift in the core sales and investment strategy for network building in the cellular market. Spending on private and shared enterprise networks will surpass spending on public cellular networks in about 15 years. The balance tilts decisively towards enterprises in about 2036. Which means this 5G bomb is a big one, with the kind of big-bang charge to remake the telecoms world completely. The stakes, then, could not be higher.

It describes a seismic shift in the core sales and investment strategy for network building in the cellular market. Spending on private and shared enterprise networks will surpass spending on public cellular networks in about 15 years. The balance tilts decisively towards enterprises in about 2036. Which means this 5G bomb is a big one, with the kind of big-bang charge to remake the telecoms world completely. The stakes, then, could not be higher.

Old familiars in the carrier community, the same as the young guns in the vanguard, must make camp in a new landscape. The difference is that they have always had the place to themselves; for the first time in five generations of mobile technology, they are strangers, here, like everyone else, with competition on all sides. So, bang…

PERFORMANCE METRICS

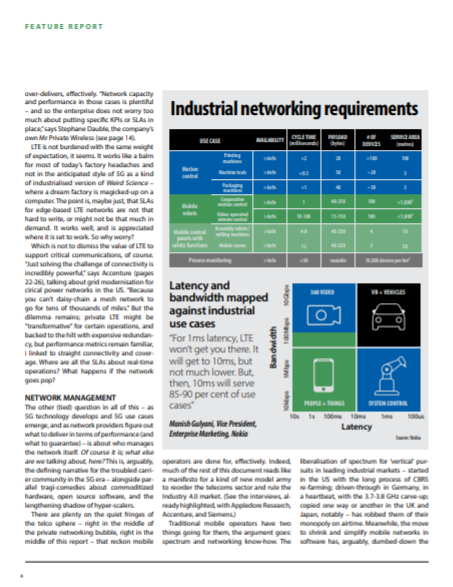

But let’s deal with that first question first; about the content of these industrial 5G SLAs. In terms of performance, the industry knows, on paper, what the technology offers and what the applications require (see report). But as the Lufthansa Technik case study makes clear (page 28-30), these are industry measures – useful, but highly subjective, and effectively worth the paper they are written on. But the real problem is that so little is known.

For all the fanfare, very little in the way of factory operations is running on 5G. But for some minor proofs-of-concept in ringfenced production lines, away from the real business of actually making things, there just ain’t that much happening. This is partly because there are hardly any industrial 5G devices available. Lufthansa Technik, one of the few companies really rolling with this stuff (see report), has only just taken receipt of its first proper 5G unit, to attach to its twin private 5G setups in Hamburg.

Siemens has released ‘the first’ industrial 5G router, it reckons (see report); so has Minnesota-based IoT module maker MultiTech, it turns out. Either way, the total supply amounts to a handful of devices, at most. There is a whole discussion about who blinks first over the supply and demand of industrial 5G chips, between the likes of Qualcomm and Bosch, say – and that, in the end, neither will budge until the delayed standards-releases for 5G-proper come into view.

A study from ARC Advisory Group, from January, said that will not happen until the end of 2022, at the earliest, when Release 16 devices flood-in. So despite all the press releases about private 5G deployments, there is a lot of thumb-twiddling in the Industry 4.0 ranks. Just about everything is on LTE.

Ask Athonet or Quortus or Druid Software, or any of the new-breed private network specialists; LTE is where the business is being done. Ask Metaswitch; actually don’t ask Metaswitch! Ask Nokia, instead; visitors to its factory in Oulu, in Northern Finland, say the word on the shop floor is LTE is animating its production lines. 5G? Nokia’s factory engineers shrug a bit, the story goes.

Nokia’s marketing team, in the Enterprise IoT Insights podcast on private wireless, says the same: 5G will come, and will matter, but 80 percent (or something) of industrial use cases can be served with LTE. “Industrial 5G is something to think about later,” says Appledore Research (see report). And it suggests that, even then, high-end 5G applications, requiring more stretching SLAs, will be “very niche”.

JUST COVERAGE

Which returns us to the question about what, exactly, to write down in a contract, really, when the technology is being used to either replace misfiring Wi-Fi networks or to play in the industrial IoT sandbox – or, tentatively, to run non-critical manufacturing processes? Because no one is betting their factory on cellular, yet. No manufacturing company is putting SLAs against 5G performance, yet – until the systems are tested and proven, and humming like a turbojet (to borrow a line).

And, going backwards, nothing is humming because there is nothing to connect, in any volume, and in any serious industrial garb. Because 5G has not yet been fully developed and standardised. But more than this, the question about SLAs is difficult because the kind of ultra-reliable low-latency (URLLC) use cases 5G is supposed to prop-up after 2022/3 are hard to discern, as yet.

The job to construct a matrix in three dimensions to tally unknowable use cases against unknowable networking KPIs, against an unknowable Industry 4.0 market (even manufacturing is hard to pin down), is an almost futile one, at this stage.

What about SLAs for LTE? Back to Nokia; the Finnish vendor has been selling ‘critical’-grade wireless networks “for years”; at last count, it claimed 260 customers for some combination of its various private LTE and 5G wares. The message is that private LTE over-delivers, effectively. “Network capacity and performance in those cases is plentiful – and so the enterprise does not worry too much about putting specific KPIs or SLAs in place,” says Stephane Dauble, the company’s own Mr Private Wireless (see report).

LTE is not burdened with the same weight of expectation, it seems. It works like a balm for most of today’s factory headaches and not in the anticipated style of 5G as a kind of industrialised version of Weird Science – where a dream factory is magicked-up on a computer. The point is, maybe just, that SLAs for edge-based LTE networks are not that hard to write, or might not be that much in demand. It works well, and is appreciated where it is set to work.

LTE is not burdened with the same weight of expectation, it seems. It works like a balm for most of today’s factory headaches and not in the anticipated style of 5G as a kind of industrialised version of Weird Science – where a dream factory is magicked-up on a computer. The point is, maybe just, that SLAs for edge-based LTE networks are not that hard to write, or might not be that much in demand. It works well, and is appreciated where it is set to work.

So why worry? Which is not to dismiss the value of LTE to support critical communications, of course. “Just solving the challenge of connectivity is incredibly powerful,” says Accenture (see report), talking about grid modernisation for critical power networks in the US. “Because you can’t daisy-chain a mesh network to go for tens of thousands of miles.”

But the dilemma remains; private LTE might be “transformative” for certain operations, and backed to the hilt with expensive redundancy, but performance metrics remain familiar, i linked to straight connectivity and coverage. Where are all the SLAs about real-time operations? What happens if the network goes pop?

NETWORK MANAGEMENT

The other (old) question in all of this – as 5G technology develops and 5G use cases emerge, and as network providers figure out what to deliver in terms of performance (and what to guarantee) – is about who manages the network itself. Of course it is; what else are we talking about, here? This is, arguably, the defining narrative for the troubled carrier community in the 5G era – alongside parallel tragi-comedies about commoditized hardware, open source software, and the lengthening shadow of hyper-scalers.

There are plenty on the quiet fringes of the telco sphere – right in the middle of the private networking bubble, right in the middle of this report – that reckon mobile operators are done for, effectively. Indeed, much of the rest of this document reads like a manifesto for a kind of new model army to reorder the telecoms sector and rule the Industry 4.0 market. (See the interviews, already highlighted, with Appledore Research, Accenture, and Siemens.)

Traditional mobile operators have two things going for them, the argument goes: spectrum and networking know-how. The liberalisation of spectrum for ‘vertical’ pursuits in leading industrial markets – started in the US with the long process of CBRS re-farming; driven-through in Germany, in a heartbeat, with the 3.7-3.8 GHz carve-up; copied one way or another in the UK and Japan, notably – has robbed them of their monopoly on airtime. Meanwhile, the move to shrink and simplify mobile networks in software has, arguably, dumbed-down the whole networking discipline.

Suddenly, anyone can license airtime and manage a network. Suddenly, anyone can be a mobile operator. And anyway; who says Deutsche Telekom or Vodafone, or any other of the old dogs of telecoms can manage such a diverse customer base? Running one national network, one way, for millions of customers, is very different from running a million networks, millions of different ways, for millions of customers. Is it not easier for each customer to run its own network, or networks, for its own idiosyncratic ends?

Well, yes and no. It’s too simplistic – and neat, in this remade industrial landscape – to say that; such a deathly outlook is a symptom of an early-adopter market, where the freakish tier-one (‘tier-zero’?) manufacturing brands are going about like a band of war-painted Schwarzeneggers with digital grenades to light a fire under the whole Industry 4.0 picture, while a whole army of extras plays in the smoke. But as the smoke clears, we will see the cast of characters is only multiplying; the old faces are not exiting, stage-left, or being replaced, necessarily.

There is a whole sell-build-run process that needs to be worked through, for every-sized enterprise in every-sided industry, which will find roles for every kind of supplier, including traditional operators. It is like what the DIY low-power end of the market says about IoT as a team sport. It sounds naive, but it also seems likely everyone, new and old, will play a role – it is just some will just play more of a role.

FOR ALL AND NONE

For Vodafone, which speaks for everyone and no one else in the operator market, the value carriers can bring in the Industry 4.0 market is with network management. Its message is that service providers, of whatever stripe, will be required to offer second and third-line support for industrial-grade private 5G networks. In most cases, enterprises themselves will take charge of firstline operations. This much is clear; everyone here agrees.

But Vodafone implies this support will not, likely, come from network vendors or system integrators, which get bundled into the Industry 4.0 mix for 5G ‘service provision’. Nor will it come from mobile operators, necessarily. As mentioned, it is talking for everyone in telecoms, and also for no one but itself. But arguments about cultural differences between the two sides are hokum, it suggests.

It has no interest to run the factory; just to offer support to run the 5G network, as a “performant” utility, and guarantee ultra-reliable design and “faultless resolution”. Telecoms is telecoms, after all, it says. Vendors sell, integrators build, operators run. For Vodafone, the difference with 5G is the run-phase will be shared with enterprises, which will be equipped to provision 5G networks according to operational requirements, and to run at least some diagnostics, as well.

The extent of their run-remit, and of Vodafone’s in support, will depend on their size, invariably, and capacity to recruit 5G expertise. But the picture has changed, by the end of this magazine (see report). The idea anyone can be a network operator, suddenly, with box-fresh private cellular is simplistic (of course); the notion the old dogs of telecoms will be left out of pocket with industrial 5G is exaggerated (of course). System integrators can’t do it and network vendors won’t do it, according to this late counter-narrative.

Maybe, maybe not; it depends who you believe. More significantly, the sell-build-run narrative is reversed – and subsumed by a new consultancy-phase, as a compulsory preamble to every other stage in the process. It is discussed by Accenture and Lufthansa Industry Solutions in these pages as well.

Which is where the real battle is, of course, and the real story – where system integrators and network vendors are already jostling for position. As the interviews in this document – which are too good to be stitched into a single narrative – foretell. What else is there to say? Bang; there’s the tangled fuse, and the wreckage and the mess. Time to hand over to the experts.