Greetings from Hilton Head Island (SC), Davidson/ Lake Norman (NC) and Omaha (NE). Pictured is a long-time friend and former colleague, Christopher (“Topher”) Wren and I having a terrific conversation and dinner at Stokes in downtown Omaha. Topher is currently the Senior Vice President of Information Technology at Boys Town, a not-for-profit focused on “care and treatment of children.” He and I worked together at Sprint in the early days of Multichannel Multipoint Distribution Service (MMDS), now the basis for T-Mobile’s mid-band (2.5 GHz) strategy. We had a lot of catching up to do… it’s good to be back on the road again.

This week, after some market commentary and a review of the proceedings in the Apple/ Epic case, we will explore the plight of the resurrected telco. On top of being a great way to examine an important trend, it also introduces several meaningful comments from some non-Telco Top Five companies.

The week that was

The word to describe market activity for this week is “inflated.” Prices for basic goods (especially gasoline on the East Coast, but also lumber, corn, copper, used cars, even fresh cut flowers) are skyrocketing (Bureau of Labor Statistics report here). Inflation spooked the market, and many investors cashed in their stock “winners” as a hedge.

In addition, there are over-inflated expectations about the shape and sustainability of the US and global recoveries. If Disney+ (DIS -7.1% from highs this week) and Netflix (NFLX -11.1% from their pre-earnings announcement levels) do not add enough subscribers in the quarter, that’s reason to dump their stocks.

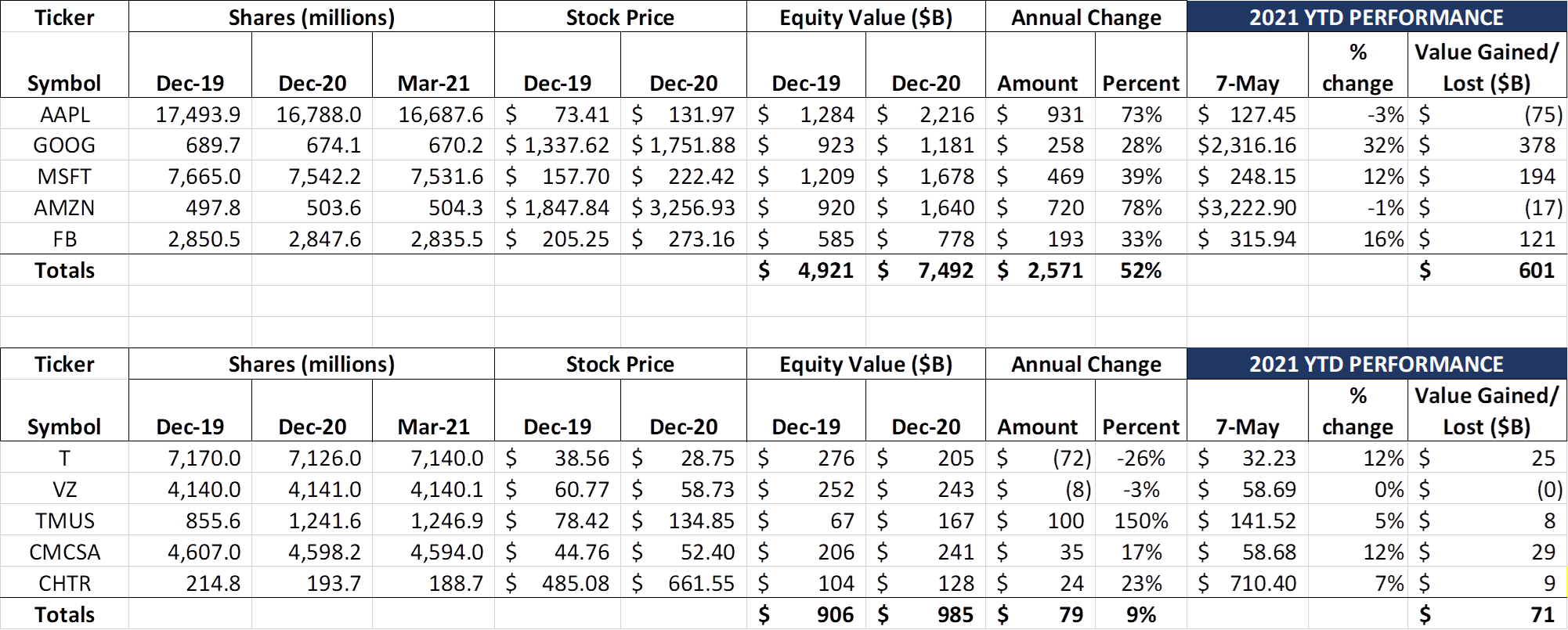

As of Friday’s close, investors were split between which Fab Five stocks were over-inflated. Clearly there is concern about Apple (-$46 billion wk/wk) and Amazon (-$34 billion wk/wk). But, as the above chart clearly shows, they were the two biggest 2020 gainers (AAPL +73%, and AMZN +78%). Apple is still up 74% since the beginning of 2020 and Amazon up 75% – the market is awaiting the next earnings catalyst. No one who has been in these stocks over the last five years is crying.

Meanwhile, the remaining Fab Five stocks (Google, Facebook and Microsoft) have gained about $700 billion in total year-to-date even with the recent selloff. Each of the Fab Five will be the beneficiaries of a rolling recovery, with masks off first in the USA, then followed by Europe and APAC end of summer and the rest of the world as we end the year. This will drive more commerce, advertising, applications, and computing needs. If the dollar remains weak (we are changing our tune on how weak the dollar will get given Washington’s gridlock), global revenues will grow even faster. Recent stock sales aside, the Fab Five ended Friday with a cumulative value of $8.1 trillion.

The Telco Top Five story is more closely tied to the US recovery. AT&T is beginning to return to life along with the rest of the economy, and Comcast is very well positioned to be the “sleeper stock” of the Telco Top Five. Both of these stocks have international holdings (and AT&T will be launching HBO Max globally in 2021), but the vast majority of earnings starts and stops in the US. For the week, the Telco Top Five gained $9 billion; cumulative market value has now increased $79 billion in 2021. Verizon is clearly this year’s stock laggard and facing “third largest” status if AT&T continues to recover at its current trajectory (Comcast $270 billion market cap, Verizon $243 billion, and AT&T $230 billion as of Friday). With T-Mobile closing above $140/ share this week (~+8% post-earnings announcement), there’s smiles all around except in Basking Ridge.

Before moving to this week’s main topic, a word about the Apple/ Epic trial (more from Bloomberg here and a great Chronicle from The Wall Street Journal here). The Bloomberg article hints at where the case might turn. Rather than ban Apple from the current commission structure and process, they would loosen (or perhaps even drop) their anti-steering policy. This would allow Fortnite users to see where they could possibly obtain tokens/ currentcy less expensively (this is currently prohibited). It’s an imcomplete solution from Epic’s perspective, and the beginning of the dismantling of iTunes from Apple’s perspective (which probably means it’s going to produce an effective compromise). The trial should wrap up by next Friday, with Apple CEO Tim Cook taking the stand next Tuesday… stay tuned.

The plight of the resurrected telco

Being a wireless-less telco provider has been a tough job for the last three decades. First came network-clogging dial IP providers and the never-ending colo and space requirements of competitive LECs. Then came the advent of unlimited wireless (including unlimited talk and text), which suffered from coverage gaps at first, but got a lot better with the use of 600 MHz (mostly T-Mobile) and 700 MHz (all wireless carriers) low-band spectrum. And, because most wireless coverage areas (called MTAs) were larger than traditional LATAs, terminating switched access revenues were rapidly decreasing.

Then came cable broadband and the triple play, which captured 20-25% market share in five years. Then came Netflix, YouTube, and smartphones (particularly the use of Facetime and other video applications over Wi-Fi). Bandwidth grew far faster than anyone expected, and cable elected to deploy excess cash to build more DOCIS-capable systems rather than raise dividends or buy back shares.

After two decades of constant attack, there’s new talk about our fibered future which proponents argue will eliminate the digital divide and enable telehealth, telelearning, teleworking and telewhatever. We are fiber fans (for those of you who are new to the Brief, we have had an annual column entitled “Fiber Always Wins – Until it Doesn’t” which chronicles the successes and pitfalls of deployments), but nonetheless cringe at some of the claims made by the most ardent fiber advocates. More fiber helps cure a lot of ills, but, as we will see below, increased deployments do not guarantee big payouts.

Both Lumen (earnings link here), Consolidated (earnings link here), and Frontier (link here) had a lot to say about fiber on their earnings (or in Frontier’s case, post-bankruptcy) calls. Here’re some quotes:

From Lumen CEO Jeff Storey, on the potential sale of non-core businesses (and specifically copper-based assets):

“…if you’re looking at Denver and the network that we operate here in Denver, there’s a strong tie between some of our commercial business and some of our mass market business. If you look in other markets, that’s not as strong. So what we will look at with respect to the consumer copper network, that type of thing, would be looking at markets that we don’t think are necessarily core to our platform in fiber strategy. I haven’t – I don’t want to be very specific about what those could be or might be. But I do want to emphasize that we’re open to looking at divestitures, and we actively pursue them. Now I’m not ready to announce any deal because we don’t have one. But I do want to reinforce that this isn’t just CEO talk. It isn’t just me saying, oh, yea, we’re open to whatever… we’re focused on the core of what’s going to drive success for Lumen back to the fiber network, back to our platform capabilities, things like edge computing, dynamic connections.”

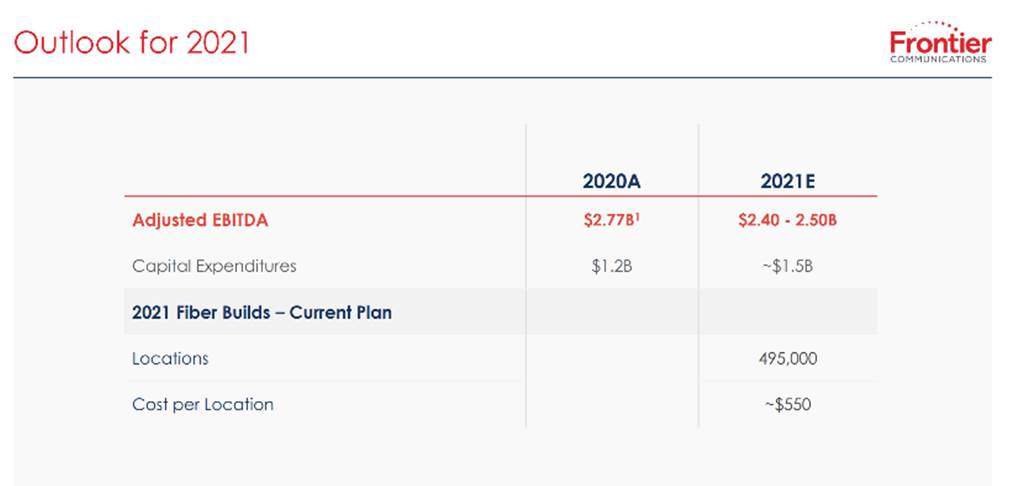

From Frontier CEO Nick Jeffery on the opportunity as Frontier emerges from bankruptcy (their less pleasant outlook is also shown nearby):

“Frontier’s purpose is to be a leader in building Gigabit America. We will connect more rural areas, upgrade our lower network speeds, make quality Internet more accessable, and play our role in providing the US with the digital infrastructure it needs to succeed over the coming years.”

From Consolidated Communications CEO Robert Udell on competition (webcast here – comments start at roughly 32:30):

“We assumed that we were in a duopoly position in all cases. In reality, 81% of our market overlaps with one competitor, and there’s small percentage (3 or 4%) that has two competitors. The rest, roughly 11%, has no competitor. The majority of the builds are in a duopoly situation. Our experience is we end up with a 35+% percent penetration in a duopoly situation when we have a 1 Gbps offering. And in fact, in some of the more mature areas, after about 3 years, we’ve got 40%+… 42% in some cases. Our initial experience in our fiber cohorts are, where there’s no competition, really, we’re in the 60%+ in a matter of 6 months, and where there is competition after roughly two years we’re at 36%… So I think mid-30%, which is what it is in our model, is very doable, and our expectation is 40%-plus.”

The common theme here is that fiber will save the day. In fact, from listening to the earnings calls, the gains from fiber are formulaic – deploy Gigabit-capable Passive Optical Networks (GPON) to existing homes passed (where voice market share is dwindling by the day), and watch customers flock to higher speeds and improved lives. Show up, and 50% market share at $48-55 monthly data ARPUs can be yours. And, using overinflated exit multiples driven by extremely low borrowing costs, this asset magically turns into a 20x EBITDA juggernaut. If only it were as easy as it sounds.

We at The Sunday Brief entered this industry via the Sprint Local Telecommuncations Division (LTD). In the early days of Digital Subscriber Line (DSL) deployment (pre-DOCSIS deployment), we learned quickly that a very small number of customers generated a very large percentage of the overall profits (subsidies masked a ratio that was greater than the 80/20 rule). Twenty-five years later, this ratio has only minimally changed.

Over the last two decades, the cable industry has been growing their overall market share (see our recent Brief here for the numbers). But cable has taken even more value share in their markets, thanks to their deftly executed triple play strategy (where they eliminated the need for two connections into most homes and small businesses).

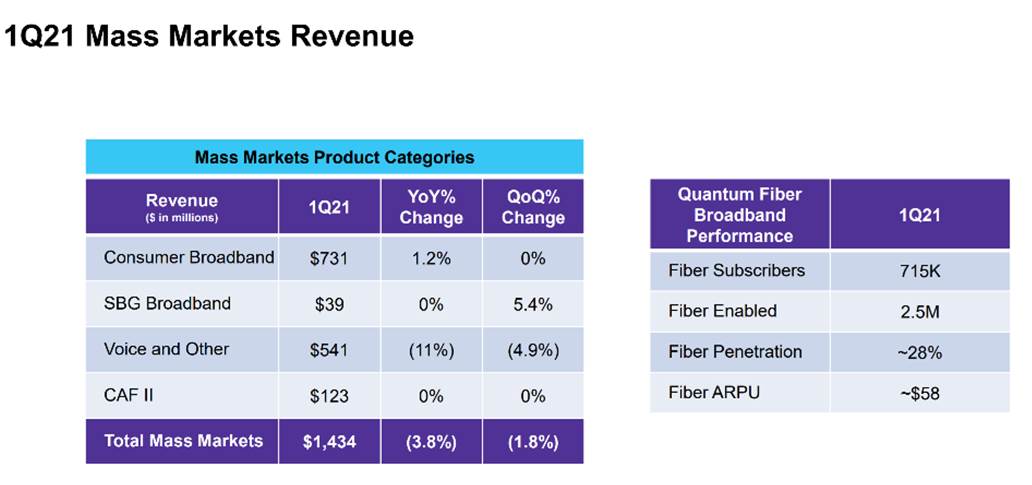

Telcos now return to these former telephone customers with fiber, while showing initial success with their existing copper base. Subscriber metrics grow, but value does not (see AT&T’s earnings here for an idea of what the trend line could look like). Telcos have merely substituted one physical medium (copper) with another (fiber). Residential customers that had 25 Mbps/3 Mbps (or worse) service now pay the same for 50 Mbps/50 Mbps service. Operating costs may be lower, but attributing disproportionate value creation to that customer base after a decade and a half of value shifts to cable is misleading.

Telcos need to get their value-generating customers back, but cable is not standing still. Here’s some Q1 earnings commentary from Tom Rutledge, Charter’s CEO, on DOCSIS 3.1 developments:

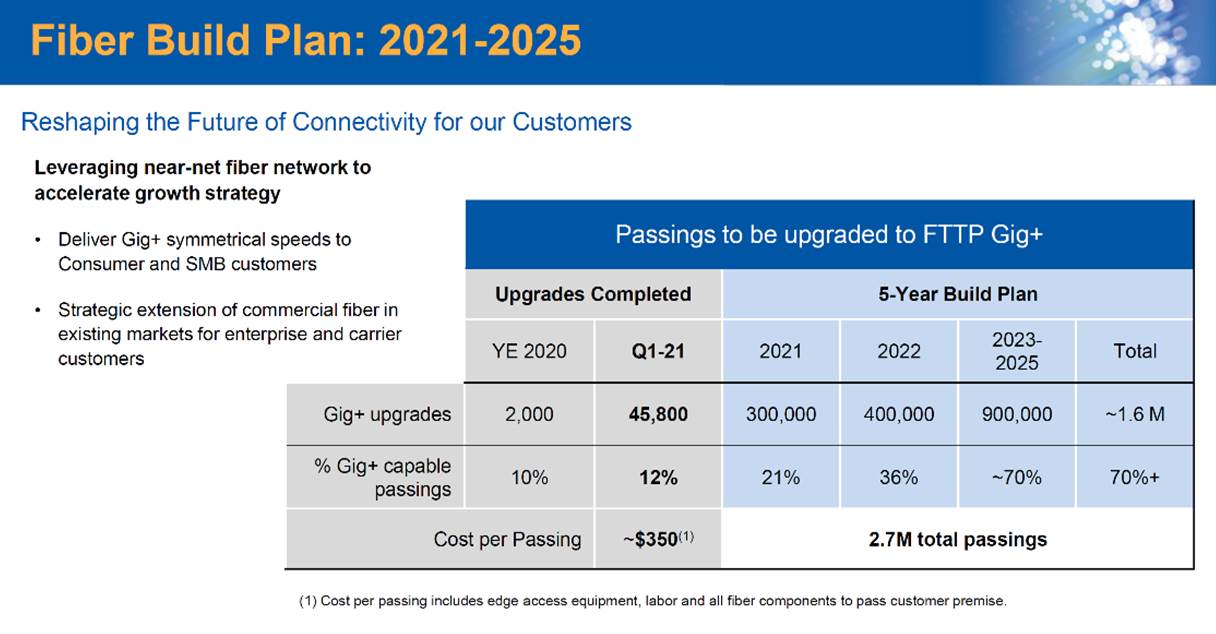

“We’re continuously increasing the capacity in our core and hubs and augmenting our network to improve speed and performance at a pace dictated by customers in the marketplace. We have a cost-effective approach to using DOCSIS 3.1, which we’ve already deployed, to expand our network capacity 1.2 gigahertz, which gives us the ability to offer multi-gigabit speeds in the downstream and at least 1 Gbps in the upstream. In addition, we have DOCSIS 4.0 and other emerging technologies to cost-efficiently offer multi-gigabit speeds in both the downstream and in the upstream, serving heavy data usage needs of our customers with quality connectivity services. While we have a great network asset, which is fully deployed and has a capitally efficient path to deliver even higher capabilities, our strategy is founded on saving customers’ money while providing state-of-the-art products.”

Telcos deploy fiber, and cable responds with DOCSIS 3.1 upgrades (at low incremental capital levels), eliminating the “cable is not symmetric” switching reason for high value-adding customers. This places further pressure on telcos to lower prices to attract high-value switchers, resulting in lower margins and a lower long-term growth multiple for the business.

All of this happens in the aforementioned duopoly structure – the fun begins when you add in additional competitors.

Enter T-Mobile, with local distribution through their wireless stores, and something most telcos mentioned above lack – a world-class marketing organization. As we examined in a previous Brief (here), T-Mobile’s offer will not resonate with every segment but will be investigated by smaller home sizes (2-3 people). If T-Mobile can deliver 100 Mbps/ 20 Mbps to homes in rural locations for $60/ month with no government subsidies, as well as deliver $54.99/ mo. YouTube TV, how does that fit into the calculus described in the Consolidated Communications commentary?

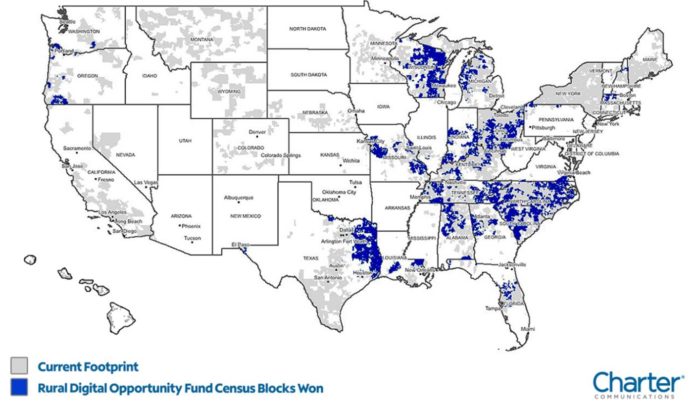

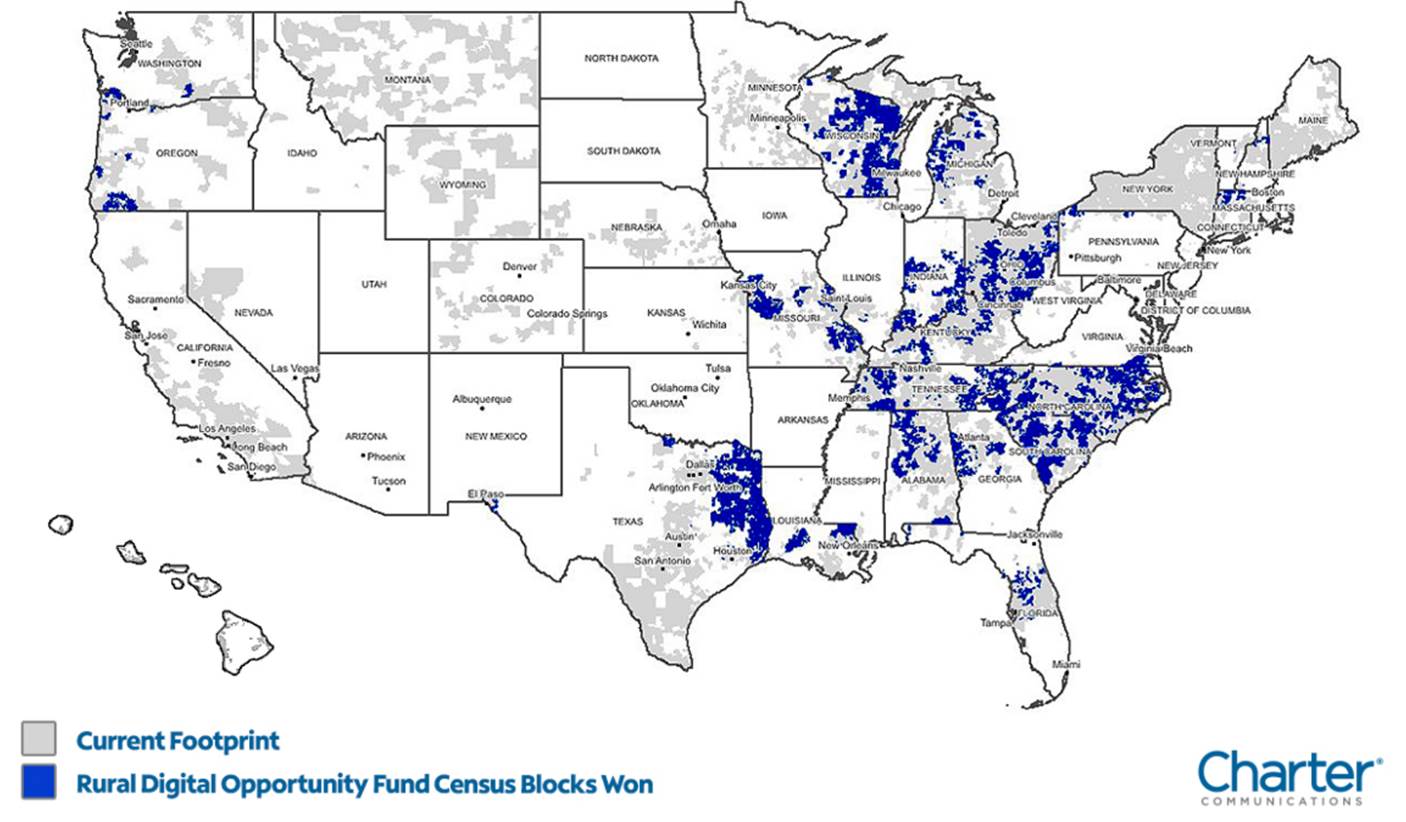

Then comes the Rural Digital Opportunity Fund (RDOF) winners. The RDOF was established to replace traditional telco subsidies and used a reverse auction mechanism. The first phase will pay out $9.2 billion over the next ten years to support buildouts to approximately six million homes (roughly $1500 per home – more than enough to cover most rural locations). Of the top 10 winners, only three are incumbent telcos: Windstream ($523 million over 10 years), Frontier ($371 million), and Lumen ($262 million). These amounts represent a fraction of the funding they received from previous government assisstance such as Connect America Fund.

RDOF introduced several new entrants, however. The highest recipient was LTD Broadband, a Minnesota-based fixed wireless company who will receive $1.3 billion over the next 10 years (current coverage map is here). The second largest recipient was Charter Communications ($1.2 billion) – see their announcment here (and nearby map) on how they will use these funds to expand rural deployments which may include their CBRS spectrum. Third was the Rural Electric Cooperative Consortium at $1.1 billion, and last but not least was none other than Elon Musk’s SpaceX corporation with slightly less than $900 million in funding. (Full list of winners here from Light Reading).

Not all RDOF networks are fiber, and none of them have been built out, but the auction winners have obligations, and will certainly create a more competitive environment than their Wi-Fi focused predecesors. Per the FCC webpage, the second round of RDOF funding will be even richer with up to $11.2 billion in subsidies.

Bottom line: Telecoms without wireless have a shot at transforming into broadband providers, but it’s no guarantee. Cable will fight to the death to retain value-adding customers in the market, and the FCC just introduced a spate of new competitors in edge-out Charter, rural electric companies, and even Elon Musk. If telecom can make broadband as hip as wireless/ smartphones, then look out. Otherwise, the plight of the resurrected telco may end in tragedy.

That’s it for this week. Next week, we’ll talk about three Up and Comers (and provide updates on some of the previous winners). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals and Go Royals!