Greetings from Davidson/ Lake Norman, NC, where the wildlife is plentiful. Pictured is a red-tailed hawk that was on our dock this week. Herons, ducks, geese (and goslings), hawks, buzzards, loons, osprey… we have it all on the Lake.

This week was originally going to be focused on up and coming companies who had recently received funding, but that has been preempted by news from AT&T concerning WarnerMedia (which broke shortly after last week’s Brief was published) and less important but still relevant news from the Deutsche Telekom (DT) Analyst Day on Thursday. The key theme to both of these events is the cash/investment considerations that both AT&T and DT face as they seek ways to inprove shareholder value.

Prior to diving into the week’s market news, a quick note that we will not be publishing a Brief over the Memorial Day weekend but will resume on June 6.

The week that was

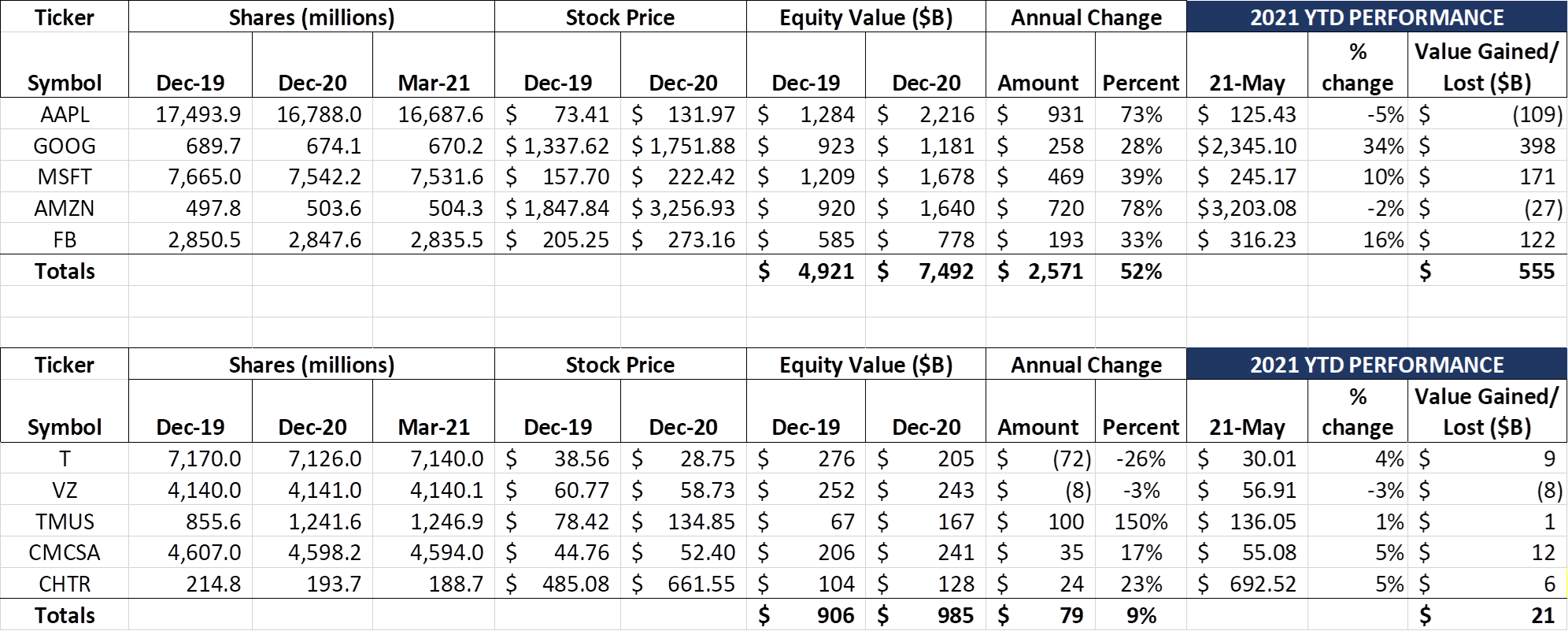

The phrase to describe this week’s activity is “jittery” – not the kind of feeling when you have had too many cups of coffee, but the suspense-driven anxiousness when you feel like something just isn’t right. The Fab Five lost less equity value this week than the previous two (-$46 billion vs. -$177 billion last week and -$135 billion two weeks ago), and, as a group, movement is bifurcated (Google and Facebook gaining, with the remainder coming off of recent highs). Overall, $555 billion of cumulative YTD equity market capitalization gains is nothing to sneeze at, and the group as a whole still is worth $8 trillion, but there’s a lot of nervousness in the air.

Contrast that with the Telco Top Five, who lost an equal amount of equity market capitalization to the Fab Five off of a much smaller base. Comcast had no headlines to speak of this week but was down $17 billion. AT&T, who dropped strategic as well as a dividend bombs this week, ended up down $16 billion. Verizon and T-Mobile, who should have gained this week, lost $8 billion and $7 billion respectively on concerns about AT&T’s newfound competitive intensity due to their renewed wireless/ fiber focus. Second quarter earnings comparisons can’t come soon enough.

Outside of the DT Analyst Day and AT&T’s strategic retreat (discussed below), there were plenty of fireworks in the Apple/ Epic trial, with Apple CEO Tim Cook taking the stand as the proceedings wound down. Judge Yvonne Gonzalez Rogers (pictured nearby) and he had a frank exchange on the App Store business model at the end of the day (full exchange is at the bottom of this article from The Verge). For those of you who have not been following the case between Apple and Epic (the game developer of the popular Fortnite series), the charge against Apple is that they exert monopolistic control over developers through punitive rules, specifically their 30% commission on in-app purchases.

After an admission that most of the App Store revenues are generated by in-app purchases from games (not surprising to most Apple users), Cook and Judge Rogers had an interesting exchange concerning subsidies (full text in above link):

Rogers: So what is the problem with allowing users to have choice, especially in a gaming context, to have a cheaper option for content?

Cook: I think they have a choice today. They have a choice between many different Android models of smartphone or an iPhone, and that iPhone has a certain set of principles behind it, from safety and security to privacy.

Rogers: But if they wanted to go and get a cheaper Battle Pass or V-Bucks, and they don’t know they’ve got that option, what is the problem with Apple giving them that option? Or at least the information that they can go and have a different option for making purchases?

Cook: If we allowed people to link out like that, we would in essence give up our total return on our IP.

Rogers: But you could also monetize it a different way, couldn’t you? I mean, that is, the gaming industry seems to be generating a disproportionate amount of money relative to the IP that you are giving them and everybody else. In a sense, it’s almost as if they’re subsidizing everybody else.

Cook: The bulk of the apps on the App Store are free, so you’re right that there is some sort of subsidy there. However, the way I look at that, Your Honor, is that by having such a large number of apps that are free on the store, it increases the traffic to the store dramatically, so the benefit somebody gets is a much higher audience to sell to than they would otherwise if there weren’t free apps there.

Rogers: So your logic then is that it’s more of a customer base, not an IP, then?

Cook: It’s both, because we need a return on our IP. We have 150,000 APIs that we create and maintain, and numerous developer tools, and the customer service piece of dealing with all these transactions.

As we mentioned in last week’s Brief, the judge at one point appeared to be leaning toward prohibiting Apple’s anti-steering policy (see Judge Rogers’ question on Battle Pass and V-Bucks above). While nearly all media accounts seem to focus on the judge’s “grilling,” we think Cook not only answered the questions (rare for a CEO) but also made a cogent case for the App Store business model. We should know the verdict by the end of the summer.

A follow-up to last week’s Brief

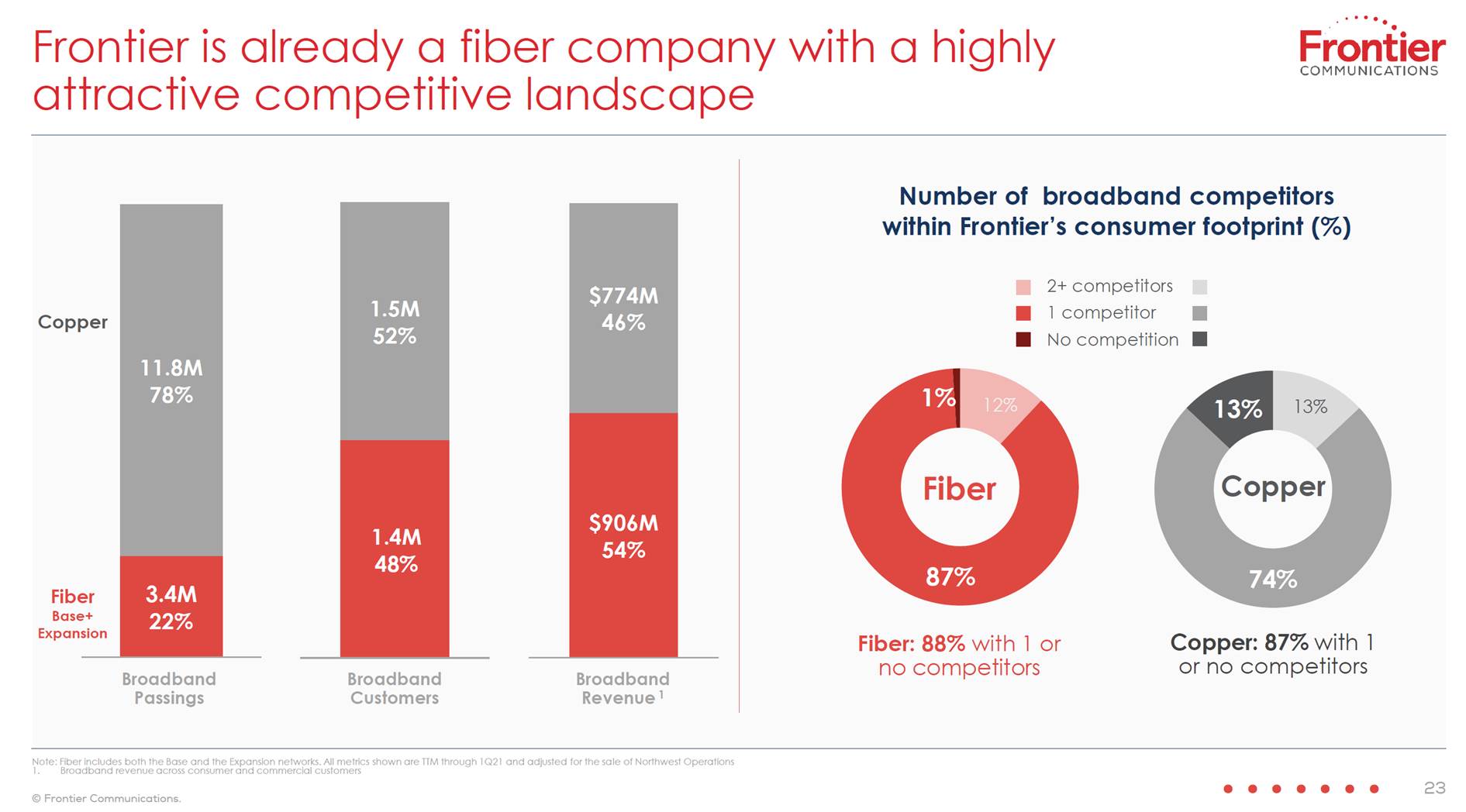

Before diving into AT&T and Deutsche Telekom’s announcements, a quick thank you for the dozens of comments, emails and the like concerning fiber. Since I shared this slide from Frontier’s earnings announcement with many of you, I thought it would be worth an additional mention (full link to slides here):

The left side of the page shows the extent to which cable has eaten telco’s lunch. In copper territories, Frontier has a 13% consumer market share. To reach a 40-50% market share in a current copper territory, they will not only need to convert all of the base but also convince 33% of cable’s customers to switch (and stay). To put this into context, Frontier will need to do to cable in broadband what cable did to Frontier 15 years earlier with residential phone. Not to say it’s impossible, but starting from a current 13% market share certainly engenders rational skepticism.

But wait – there’s Frontier’s performance with existing fiber. Remember, Frontier started with 1.6 million broadband subs (see Fierce Telecom’s coverage of the announcement here). We chronicled Frontier’s missteps with the Verizon transition in our Brief here, and estimate that Frontier bottomed out at 1.2 million subs at the end of 2Q 2017. Then there was a long period (Q3 2017 – Q4 2019) where fiber subscribers treaded water; Frontier’s cumulative loss across these 10 quarters was less than 40K. As the Q1 2021 earnings presentation rightly pointed out, 2020 was a relatively strong year with 33K net adds (and an additional 11K in Q1 helped as well). Frontier’s only evidence that they can grow market share occurred during COVID. Inorganic market share gains (Verizon received over $10 billion for their heavy lifting) do not translate into challenger market share gain certainty. We are skeptical and dis-believe for good reasons.

Cash comes a-callin’

There’s been a lot of “see I told you so – vertical integration doesn’t work” commentary after AT&T’s announcement last Monday morning that they would merge WarnerMedia with Discovery (announcement and presentation here). We could rehash that commentary, but you can go to CNBC here and Bloomberg here to get some good quotes.

Our take on the deal is as follows:

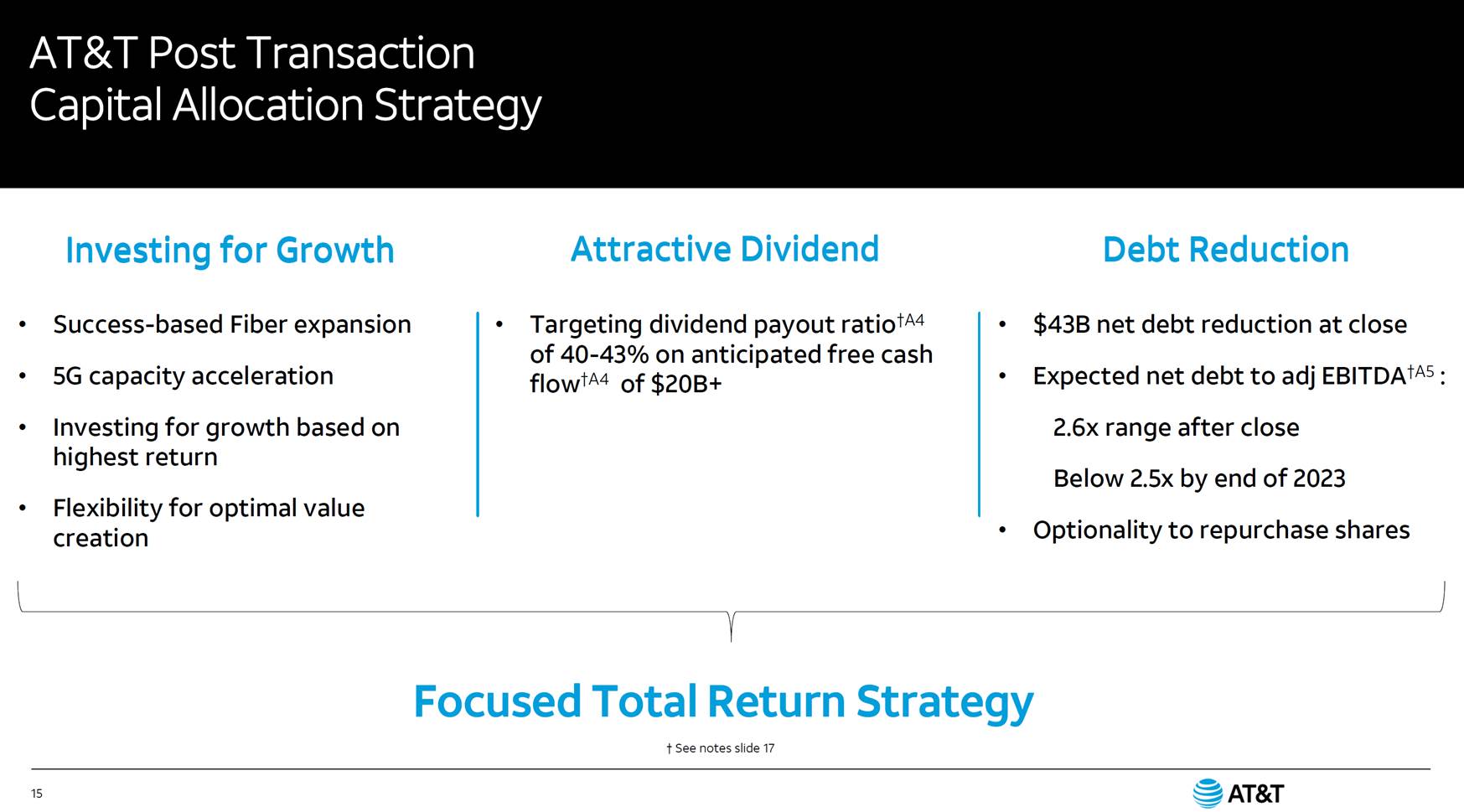

- AT&T faced a sizeable cash crunch as C-Band deployments, fiber deployments, and other initiatives competed with content production costs for capital. It’s likely that the early returns from AT&T’s 2020/2021 fiber deployments are reinforcing the fact that faster deployments generate more value for the core business.

- Management and the Board thoughtfully and carefully analyzed many scenarios, including doing nothing which would have involved a “peanut butter” approach to cash outlays. The core mobility business would have been impacted the most because AT&T’s current strategy of offering new customer promotions to all customers is more expensive in the short term.

- AT&T’s shareholders (but not necessarily AT&T as a whole) receive an asset that will be completely independent of “Bell head” thinking. While the new company will have sizeable debt ($43 billion), they will also have very healthy cash flow.

- AT&T will likely continue to be a major distributor of HBO Max (and now Discovery+). The ARPU and margin impact of having content bundles in higher-priced plans (and probably ad-assisted HBO Max for all Cricket prepaid customers) is still intact.

- AT&T will likely augment HBO Max and Discovery+ apps with other sports-related or theatrical content, but their “lead” product will continue to be from the new content company.

- Post WarnerMedia, AT&T is still sick (see our Brief here with the full diagnosis). T-Mobile’s wireless internet product is going to continue to gain market share with AT&T DSL customers (until fiber alternatives are available), and Comcast and Spectrum are going to ramp up wireless competitive intensity for small and medium business customers. With an assumed equity value of the WarnerMedia asset of ~$56-57 billion (see AT&T board member Glenn Hutchins’ interview here), the post-transaction AT&T equity value will be less than T-Mobile USA (TMUS) and substantially less than Verizon or Comcast.

Here’s the closing slide from the Monday’s announcement that outlines the knock-on effect of the WarnerMedia-Discovery merger:

AT&T is going to preserve more cash by lowering the dividend to $8.0-8.6 billion (from 2020’s full year dividends paid of slightly less than $15 billion). An additional $20-30 billion in reduced dividends over the next 3-4 years covers additional spending on fiber. Roughly speaking, we estimate that every additional billion in fiber will cover at least 1.5 million homes (Note: this estimate assumes suburban/ urban deployment – as homes per fiber mile density decreases, however, coverage per billion dollars also decreases). If AT&T wants to grow to 30 million homes passed with fiber from today’s 14-15 million, that’s likely around $9-11 billion in incremental capital.

Bottom line: This was definitely the biggest week of John Stankey’s CEO tenure. AT&T is still sick, but the prognosis for a full recovery moved from bad to good.

T-Mobile’s parent (Deutsche Telekom) – cash for dad

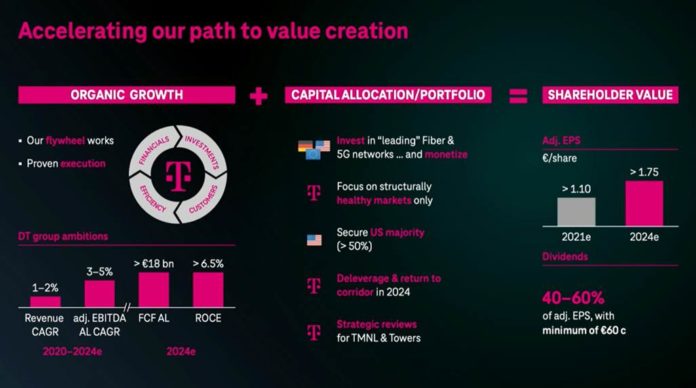

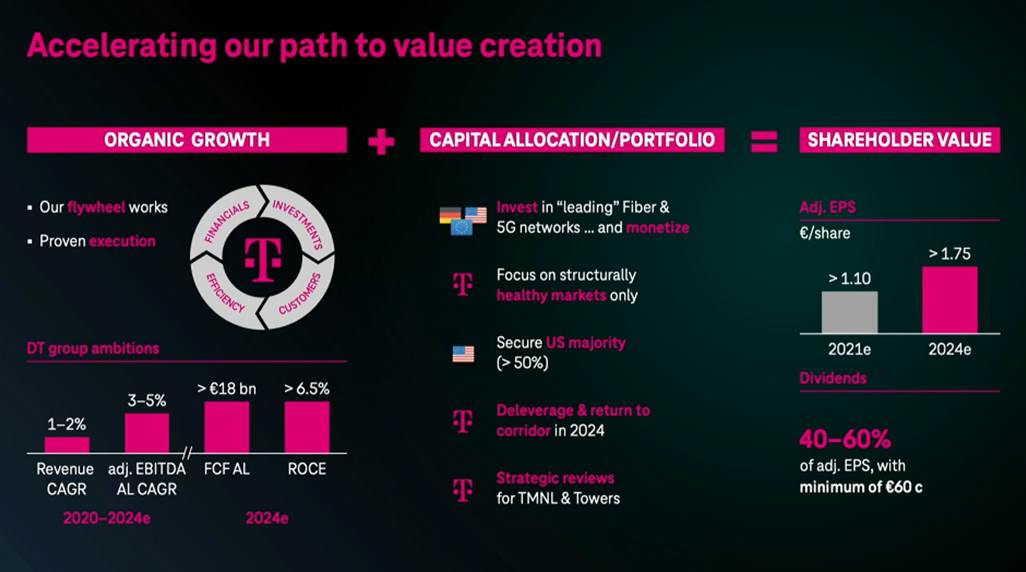

On Thursday, T-Mobile USA (TMUS) executives participated in Deutsche Telekom’s Capital Markets Day. Tim Hoettges, CEO of DT, led off the day with the announcement that the parent would secure the remaining stake in Softbank within the next three years (see nearby slide). Based on current market prices, that would equate to ~$12 billion in stock purchases.

Softbank sold some of their TMUS stake last June (raising $14.8 billion in the process), and DT obtained the right to purchase 44.9 million shares ~$100 per share, a steep discount to the current selling price. They also obtained the right to purchase any remaining shares (roughly 57 million) from Softbank at their previous 20-day moving average (which would be in the $132-133 range using today’s prices). They would need to purchase both tranches to gain majority voting control of TMUS.

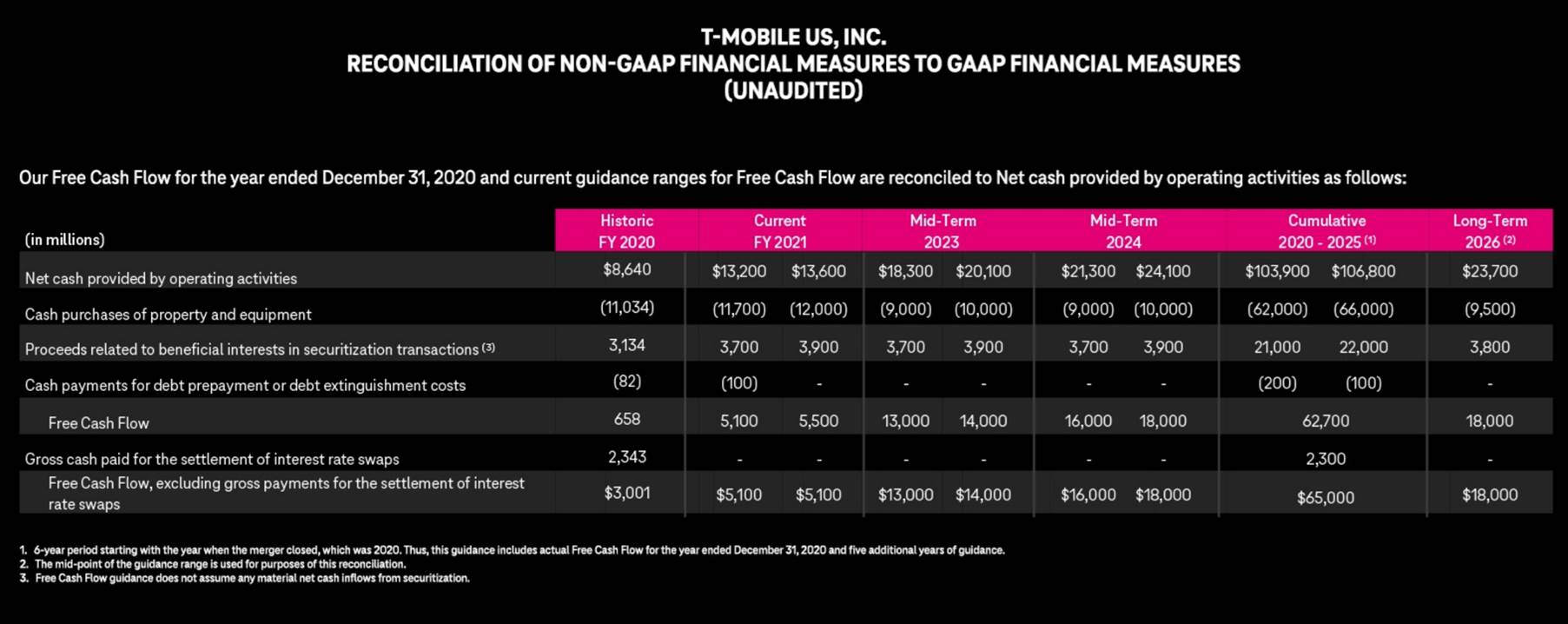

Where will that cash come from? One likely source, based on their presentation, is from T-Mobile USA. Here’s the view of cash flows that back T-Mobile USA’s projection of up to $60 billion in free cash flow by 2025:

As TMUS CEO Mike Sievert and CFO Peter Osvaldik outlined in their respective presentations (here), there will be plenty of options in 2022 and 2023 for the US operations to generate free cash flow. Peter presented projections that totaled $34–37.5 billion from 2021-2023. Having already stated their intent to use excess cash flow to repurchase shares, it’s likely they could use a portion ($8-9 billion) of next year’s FCF to purchase the remaining Softbank or other outstanding shares, bringing DT’s stake into the mid to upper 40%s.

The remaining stake could come through accelerated repayment of the note due to DT which totaled $4.7 billion as of March 31. DT could use the note repayment proceeds to purchase $4.5 billion of discounted shares from Softbank. Regardless of the method used, T-Mobile USA’s cash generation potential is sorely needed by the fiber-ambitious parent. The quicker DT can consolidate results and reduce global leverage ratios, the faster they can achieve their ambitious returns on investment.

Bottom line: Gone are the days of cash draws for T-Mobile USA from their parent. Now that they are cash generators, they will become more integrated into DT’s global funding mechanism. While T-Mobile USA might not have fiber ambitions, they will be supporting their European parent’s upgrades.

That’s it for this week. We’ll take a break from the Brief next weekend to celebrate Memorial Day, but will be back with additional insights on June 6. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals and Go Royals and Go Sporting KC!