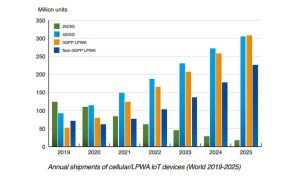

Global cellular IoT module shipments increased by 14% in 2020, reaching 303 million, according to a recent Berg Insight report. Even though the impact of the COVID-19 pandemic was felt by the industry, the result represents a new record level of shipments. In 2019, for comparison, the firm found that cellular IoT module shipments reached 265 million units.

Berg Insight, however, anticipates the global chipset shortage will have a broader impact on the market in 2021 than the pandemic, ultimately curbing the growth of IoT device shipments in the near term. The forecast indicates that, until 2025, cellular IoT module shipments will grow at a compound annual growth rate (CAGR) of 15.8% to reach 629.6 million units.

The report found that annual revenues grew slower than previous years at 8%, reaching $3.4 billion, and that the five largest module vendors include Quectel, Sierra Wireless, Sunsea AIoT, Fibocom and Thales, which combined have 71% of the market in terms of revenues.

“The performance of the top vendors varied markedly in the year, to some extent due to different exposure to geographical and vertical markets that were affected by the COVID-19 pandemic,” commented Fredrik Stalbrand, senior analyst at Berg Insight.

The range of available IoT devices that support 5G will widen in 2021 and the years following as network coverage expands and IoT-optimized modems become available at a more accessible price point.

Berg Insight also indicated that support for reduced capability (RedCap) devices — to be introduced in the 3GPP Release 17 — will be another key accelerator for the adoption of 5G in the IoT market. RedCap devices, expected to hit the market in 2023, offer higher data rates than LPWA technologies like LTE-M and NB-IoT, while also costing less than 5G devices currently available.