Greetings from Davidson/ Lake Norman, NC, where Carolina heat and humidity have descended, causing daily afternoon storms like the one pictured nearby. This week, we will focus the entire issue on Verizon, analyzing their recent tactics against the backdrop of a multi-year growth strategy. Because of the length of this analysis, the market commentary will be shorter than usual.

A quick reminder – as a result of a job change that we will artiulate in a couple of weeks, the Brief will be altering its format (at least through the summer) to bi-weekly. We will not publish a Brief on July 4 but will on July 11 and 25.

The week that was

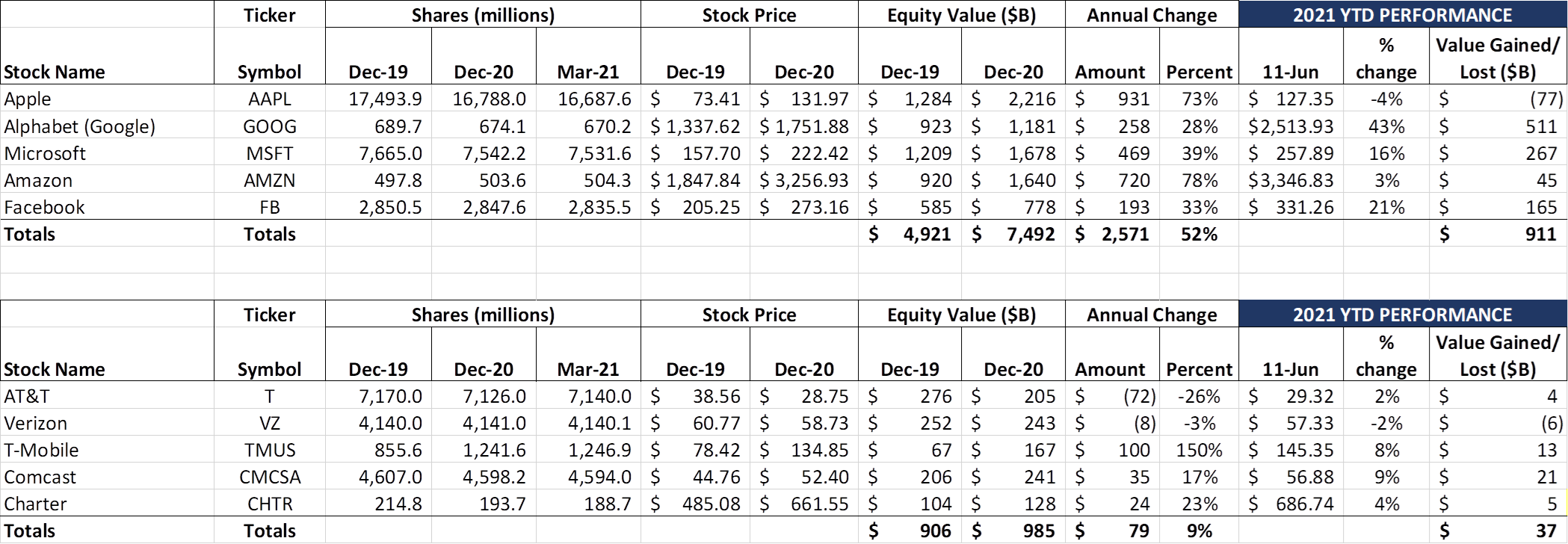

The phrase summarizing Fab Five market activity this week was “steady progress.” Each of the five stocks contributed to a $193 billion weekly gain. Amazon had a particularly strong week (+$71 billion) as investors await Prime Day results later in June. The Telco Top Five also gained $2 billion in value this week, and remains on track to deliver as much value as they did in 2020. (Note: For every dollar the Telco Top Five grew in thus far in 2021, the Fab Five has gained $25).

The big news of the week was Apple’s 2021 Worldwide Developer Conference (WWDC – full coverage from CNET here, and interesting article from Ars Technica on many smaller iOS 15 features here). The feature that got the greatest attention from the telecom world was the inclusion of browser-based FaceTime, which allows non-Apple customers to participate in Facetime sessions (see nearby picture). With one link, FaceTime gets more users and engagement. Contrary to recent analysis, these FaceTime improvements will not kill Zoom Conferencing, but will engender more app loyalty (vs. initiating a separate Zoom session for all participants). It’s not FaceTime for Android, but allows Apple a quick and easy way to claim some interoperability.

Another late breaking Friday headline centered around five bills introduced in the House of Representatives that would give regulators more money to police larger companies (New York Times article here and Wall Street Journal summary here). Parts of the new legislation are uniquely focused on a handful of companies. Per the WSJ article:

“Four of the five bills narrowly focus on big technology companies. The definitions of companies targeted by the bills say they must have a market capitalization of $600 billion or more, must have more than 50 million active monthly users or 100,000 monthly active business users, and must be a “critical trading partner” that has the ability to restrict or impede another business’ access to customers or services.

While the bills don’t name any companies, only Amazon, Apple, Facebook and Google currently meet the parameters laid out in those bills, according to the person familiar with the matter. They are the same companies that the House panel investigated as part of its probe into Big Tech. Walmart Inc., for instance, operates an online marketplace and has private-label products, but only has a $392 billion market valuation, so wouldn’t be subject to the restrictions.”

This legislation is in early innings in the House and there is no assurance that it would survive an evenly divided Senate. There appear to be several House Republicans willing to sign on to some of the five bills, however, and that’s why the tech industry is taking this legislation very seriously. More updates to come, but the legislative ball is rolling.

Verizon’s strategy: More cable MVNO, more coverage, more products

Last week, we covered Igal Elbaz’s (AT&T) and Neville Ray’s (T-Mobile) appearances at the UBS Future of 5G Event. We came to the conclusions that each compay was approaching 5G from different legacies, and that T-Mobile likely has the upper hand over the next couple of years as AT&T deals with WarnerMedia, DIRECTV, and an accelerated fiber expansion.

Where does this leave Verizon, a brand built on premium network quality? In a few respects, there are elements of AT&T within Verizon: a) both are large bureaucratic organizations; b) both have historically played more defense than offense with respect to customer acquisition; c) both consistently demonstrate global and national enterprise/ business leadership; d) both are incumbent operators of local copper and fiber networks, and e) both return value to shareholders through generous dividends (AT&T’s current yield is 7.1% while Verizon’s is 4.4%).

There are many differences between AT&T and Verizon, however. Until recently, AT&T was balancing financial needs between content/ programming production (including HBOMax), FTTH and wireless network construction and augmentation, and

costs related to DirecTV. Verizon’s FiOS capital spending is now focused on laterals (nearly all of the initial construction is done – no 3 million incremental homes passed target), and Big Red is not going out of their way to save FiOS video customers (Q1 video losses were 82K, and the last four quarter’s losses of ~295K have shrunk the video base by 7% to 3.8 million connections). As discussed below, Verizon has chosen to aggregate wireless and FiOS subscribers to gain pricing leverage.

The differences do not end there. Verizon has embarked on an aggressive out-of-region home Internet strategy that now encompasses parts of 40 metropolitan areas (see latest additions here). Their pricing for 5G Home Internet is also very attractive at $50/ mo. (inclusive of taxes and fees) for current Verizon Wireless customers, and $70/ mo. for customers of other wireless providers. Verizon has not disclosed the current number of 5G Home Internet customers, but has indicated that they plan to grow their total fixed wireless coverage from 15 million homes to 50 million homes over the next 4.5 years (see chart from the March Investor Day presentation nearby). If the millimeter wave signal can reach your home, Verizon will go out of their way to entice you to switch to their network.

Another substantial change lies in Verizon’s aggressive courtship of a small set of wholesale customers, particularly the cable companies, as a hedge against potential retail postpaid losses. As Ronan Dunne, CEO of Verizon’s Consumer Group, described it earleir this month at the Bernstein Strategic Decisions Conference (transcript here):

“if a party is going to enter the market on an MVNO basis or wholesale basis is — no matter what anyone else will tell you, if they’re entering the market, a facilities-based carrier is always economically better off to be the provider of wholesale than not. Always, make no bones about it. And people will say, “Well, it’s on your network and whatever else.” Simple math, be — rest assured, it’s always economically more attractive to be the wholesale provider, rather than just simply lose customers to that new entrant. And so respectfully, I need to remind people because sometimes they lose sight of that.”

Cable plays a key role in Verizon’s Network Monetization vector. While the exact terms of cable’s MVNO agreement are not known, it’s highly likely that Comcast and Spectrum were able to convince Verizon that prioritized data (known as QCI 9 or the lowest priority data on Verizon’s network – see explanation here) should be given more favorable pricing than other data types (voice calls are still processed with higher priority). Selling more data without having to augment capacity is the textbook definition of network monetization.

Our view is that Verizon keeps at least a form of MVNO with the cable industry through 2025. Should cable continue to grow at their current rates, Xfinity + Spectrum Mobile will exceed 16 million total subscribers by that time and they will have engineered a more seamless way to move between cable-owned CBRS and Verizon’s network. Meanwhile, Verizon could earn as much as $4 billion annually from their cable partners and use the excess free cash flow to reduce debt.

More Coverage. Increased 5G Coverage became Verizon’s top objective even before the C-Band auction ended. The success of the C-Band rollout is going to determine the long-term competitiveness of Verizon. Any slips in the schedule will prevent Verizon from owning “best network” designation for any given metropolitan area. Already, as we have discussed in several previous Briefs, Verizon’s RootMetrics RootScore reports are pointing to 2H 2021 being a “tie” between AT&T and Verizon. Better coverage will improve RootMetrics’ Network Availability score. The fastest way for Verizon to improve coverage is through C-Band deployment on macro towers, followed by small cell densification as needed.

Verizon’s aggressive in-metro fiber deployments are also critical to coverage. Verizon CTO Kyle Malady was a participant in the Wells Fargo Virtual Media Telco & Fiber Day last Tuesday (transcript here). Eric Leubchow, a Wells Senior analyst, asked Kyle about Verizon’s One Fiber initiative:

Lubechow: …you have this OneFiber project where you’re building in north of 60 cities. Has that continued at its pace

that it was at last year? Has it slowed down at all? And at what point is most of the network core already built and you’ve really flipped to more kind of success-based fiber CapEx once you get beyond the core build?

Malady: …we’re getting there on the core build. I’d say maybe 80% there roughly. And now it’s more connecting

in a lot of markets. It’s more connecting the cell sites into it and making what we call laterals. So building the fiber laterals to cell sites or what have you and connecting back to the core. So we got a couple, 2, 3 more years left on our fiber build here. And then primarily, it will be just success-based builds.

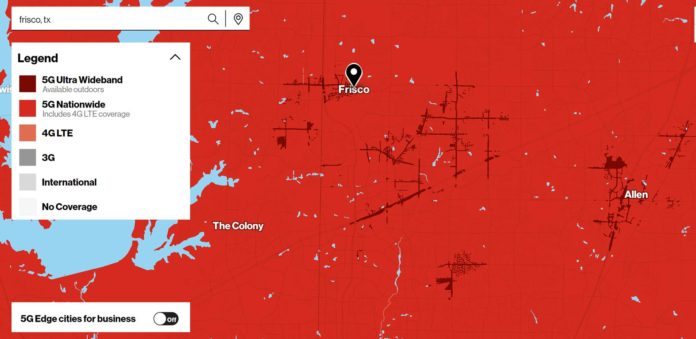

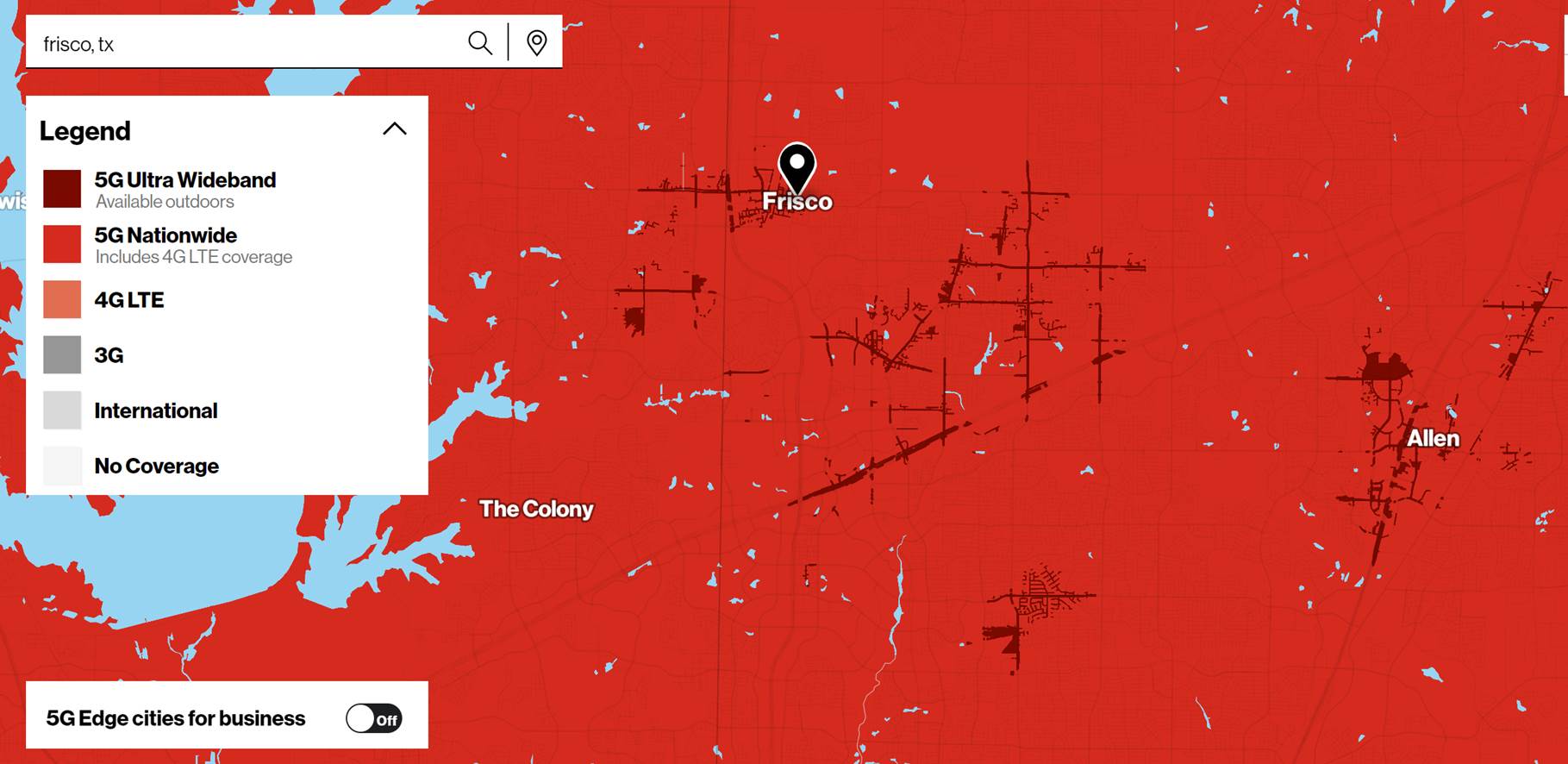

Verizon’s latest coverage maps (updated on July 12) show that in many markets, there’s a lot less than 80% built. For example, here’s the Plano + Allen + Frisco, TX network deployment (link to Verizon’s coverage map here – the millimeter wave deployment for 5G Home Internet coverage is shown in dark red):

This is an area that has both single-family residential, multi-family residential and commercial office locations. Around 625,000 people live in the North Dallas area with population growth exceeding 9% over the next decade.

Coverage in downtown Dallas is decent, and coverage by AT&T stadium and Globe Life Park in Arlington is also good. But there’s a lot more to do in Dallas to reach 80%.

This is not the only market with questionable coverage. tlanta north of Buckhead has no millimeter wave on Verizon’s map (with the exception of a sliver at the new Braves Stadium). Alphretta, another Atlanta suburg, has good 5G coverage, but no 5G Home Internet capabilities whatsoever. Charlotte, one of the fastest growing large cities in the US, has minimal coverage outside of the Uptown area. These towns seem to be a perfect match for the “mover” segment but there’s a coverage mismatch. A link to Verizon’s coverage map is here.

That’s why C-Band 5G deployments are foundational to Verizon’s 5G Home Internet initiative. Macro tower-based deployments can cover much larger areas than millimeter wave. This eliminates the need for very tactical (“street by street”) marketing that Verizon is not accustomed to doing. Ronan Dunne said as much at the Bernstein conference:

“The other thing I would say to you from a marketing point of view is marketing millimeter wave, where you’re in parts of a building or in a street, but not in the street beside it makes the marketing somewhat inefficient. That’s not something that we didn’t realize before we started. But deliver the C-band into that same area and all of a sudden you can go back to those places and start to blanket market rather than tactical marketing as we’re doing today.”

We are tempted to jump on the “millimeter wave fiber investments are a bust” trend, but cannot make that conclusion quite yet. Being first to deploy local fiber in many of these neighborhoods could prove to be very valuable when they are talking to ExteNet and Crown Castle in the future. Even though retail 5G might not meet expectations (it’s a hard business case to justify without significant SMB last mile access savings), the fiber footprint, if complete and not partially done, could be swapped for other fibers that Verizon needs in the suburbs. The company has not articulated this strategy yet, preferring instead to market One Fiber to business customers, but a well orchestrated supplier fiber swap might reduce the risk.

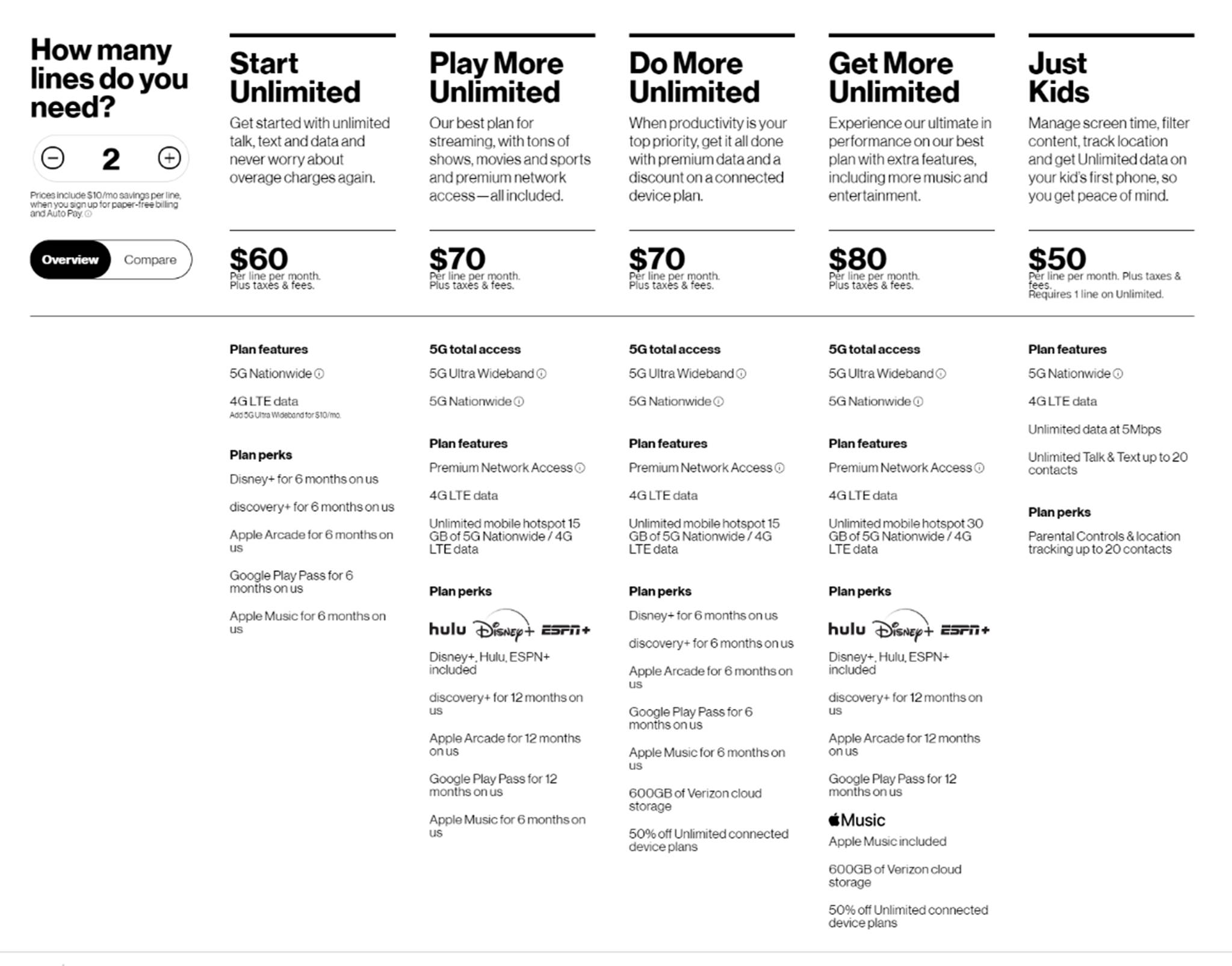

More Products. Verizon is loading up their plans content and gaming offerings, furthering themselves from AT&T’s HBO Max shotgun approach. Here’s a copy of their current plans (two-line prIcing shown):

To fans of Disney+ or Google Play or Discovery+, this can be a great way to experience Verizon’s network (noting that none of these applications would appear or behave any differently across an LTE or a 5G network today).

Ronan Dunne discussed their strategy as follows:

“To the 6- and 12-month, the key there is you get 30 days free of something and you know people are doing it as a promo for their benefit. If you get 6 months or 12 months, you’ve a proper objective opportunity to see whether or not this is something that you value. And then we give customers the choice of, say, inclusions within our premium tiers, which says, “As well as getting other benefits, you can also get essentially the best pricing on content that you’ve determined over the 6 to 12 months is something that you genuinely value.”

And all of our customers are essentially getting wholesale or better pricing for these inclusions because we’re using our purchasing power to transfer that value. And customers understand that. If somebody buys a handset for the customer, they pay $1 per dollar. If I can spend $0.50 to give a full dollar of value to a customer, that creates real value for them, but also creates much greater yield and choice for me.”

This is a very good articulation of Verizon’s consumer product strategy: Purchase the most popular plan types at wholesale prices, improve loyalty through six and twelve-month promotions, and let the customer decide after that time if they value the service. Content subsidies yield a better ROI than handset subsidies.

The irony of this is that Verizon just introduced a handset subsidy promotion (which results in a free handset for switchers) combined with the plans above – a doubling down on customer value generation. It looks more like a clearance sale on older iPhone models than anything else, but another indication that there’s an increasingly higher cost to attract switchers.

Bottom line: Verizon is the only stock in the Telco Top Five that is underwater in 2021. Since the end of 2018, they have created an additional $17 billion in shareholder value (excluding dividends paid). That equates to a 7% return for the last 29+ months or about 2.9% annually, far below their peer group (Charter +$69 billion, Comcast + $111 billion over the same period) and the market even with dividends included. Their consumer strategy is on the right track but the organization as a whole needs to be more nimble (and local). Their 5G Home Internet strategy needs momentum (and perhaps renewed focus and commitment). How Big Red weathers the storm prior to full C-Band deployment is the determining critical factor. RootMetrics results will not help Verizon (more on that next week), and the company appears to be reacting to competitive activity. T-Mobile and AT&T are not going to settle into a cozy triopoly – Verizon needs play more offense.

That’s it for this week. Next week, we will continue with our strategic analysis of Comcast. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals and Go Royals and Go Sporting KC!