Last week, Qualcomm released a glut of IoT solutions, variously offering Wi-Fi and 5G connectivity for enterprise and industrial IoT applications. The firm, compelled by rising demand for higher-grade IoT units as a consequence in part of changing Covid-era work practices, has released seven solutions in one go. It said the new releases, mostly available now, will drive digital change in industry.

A full summary of the new releases can be found here; below, Enterprise IoT Insights chats with Nagaraju Naik, director of product development for cellular IoT software and strategy at Qualcomm, about the significance of the company’s seven new QCS/QCM units, and how they will bring industrial-grade connectivity into crossover enterprises sectors, notably warehousing, logistics, transportation, and retail. All the answers below are from Naik.

…

Can you explain the significance of the naming system for the new QCS and QCM products? What does the S and M stand for?

“You can look at QCS as a Snapdragon processor – an application processor system, which also comes with integrated Wi-Fi connectivity. Typically, the Wi-Fi is [available] as an ‘attach’ that goes with the main processor subsystem. But QCS offers an integrated solution with Wi-Fi, which can enable all sorts of products. QCM effectively means it is modem-enabled. That is what the M stands for in that case – with integrated cellular as well. So 5G, say, is not a separate ‘attach’ [in QCM solutions]. The difference with QCS is you get an app processor with integrated Wi-Fi, and the option of 5G as an external ‘attach’. So 5G is not integrated, but it can be added externally.”

So why would a customer choose to add 5G or LTE to a QCS variant, rather than just going for the QCM variant straight off the bat?

“Mostly just for design flexibility – to be able to stick with Wi-Fi integration, and attach 5G as required. But it depends on the use case as well. Take warehouse management; the QCS variant works for customers wanting to leverage existing Wi-Fi connectivity, and avoid the cost burden of a 5G modem. But the moment they want to manage inventory outdoors, for shipping and distribution, they need mobility. So customers will have Wi-Fi based QCS products for managing products within a premise and QCM products for when they go into the transportation network. So that’s often how these products are used.”

Will the rise of private cellular networks in the enterprise space – to work alongside Wi-Fi networks, or to replace them – mean these enterprises will be inclined to take QCM modules? Equally, will their relative inexperience with cellular compel them also to take pre-approved cellular QCM products from the start?

“So, yes, private cellular has evolved to enable large enterprises to have in-house LTE networks, and lately their own in-house 5G networks. It is not a market that has evolved [yet to include bespoke] private cellular solutions. But that will change with 5G, we think, and large enterprise customers will start to migrate their Wi-Fi deployments onto 5G. That’s also what Qualcomm wants to happen – because 5G can enable a variety of [applications]. But it’s something that requires enterprises to build cellular knowledge, and [build] the ecosystem – which is the transformation we need to happen with 5G. It will happen, but it will take time.”

Does that mean most of the new generation of enterprise IoT devices, enabled by these Qualcomm solutions, will be based on the QCS line, with cellular modules being plugged in as required – at least in the early days, as the deployment of private cellular builds more slowly?

“Our industrial ODM customers are building two variants of products – one with QCS and one with QCM – and presenting both to [big] customers like Walmart, or whoever, and saying, this is for managing the warehouse with Wi-Fi, and this is for managing shipping with cellular. At the same time, ODMs know the flexibility 5G will bring… [and many] would like to have a 5G integrated product ready for when large enterprises are ready to move. So many are asking for 5G-integrated solutions already, so they can build products for when large enterprises are ready to migrate. But, at a high level today, we see QCS/QCM distribution at about 50/50.”

With regards to 5G, these are Release 15 products. Clearly there will be more industrial 5G products to come, and the gaps in the product names suggest there is room to expand the family. But there is a sense from the Industry 4.0 market – looking to automate production with 5G, for example – that properly capable Release 16 5G products are still unavailable, and that Release 17 modules are a way off. Just talk a little more about the schedule and timing of next-gen 5G units from Qualcomm, and what these new products offer. Because presumably, to an extent, they are really designed to migrate consumer-like go-faster 5G mobility into the industrial environments, and not really to replace industrial Ethernet for factory-of-the-future type scenarios?

“So in terms of the schedule of these products, all of them except for the 6490 have been released already, and a lot of customer designs are happening and [devices are in] production. With the 6490, both the chipset and the software solution will be available to customers for commercialisation in Q3 – but early previews are with customers, so they can start working in parallel. But Q3 is when customers will really start development and have products ready.

“In terms of Industry 4.0, and how these products fit with that, you’re right. If you look at what is needed for the whole manufacturing pipeline, and how that is to change [then there is a lot to do] – with upgrading gateways, improving operational equipment like robots and scanners, and all of the security aspects. You can use existing products for all of that. Customers are deploying premium-level products to build robust [5G] solutions for industrial environments.

“But to replace industrial grade Ethernet with 5G requires URLLC, this ultra-reliable low-latency 5G solution, which is Release 17, like you said. That is not part of the QCS6490. But it’s a product [line] we have in development-mode. And once we have it, we will enable transformation of that part of the segment in Industry 4.0 as well. We are working closely with segment leaders on that. But that infrastructure is not something that can be replaced overnight. It will take time and effort. The transformation will happen, but given its complexity and scale, it will take some time.”

If we zoom out, for context; has Covid-19 influenced Qualcomm’s thinking in terms of the schedule of these releases? Is the message that Qualcomm has rushed them out, in some fashion, because of rising demand for higher-grade IoT solutions for the ‘new normal’? Or is the point that, actually, Covid-19 just highlights the way things are going, and the need for these solutions?

“Many industrial customers have come to us – because of collaborative and remote working, or because of a need for new handheld or POS solutions – asking for products to be developed sooner, with certain additional capabilities. They have wanted to know what chipset variants we have, and what solutions. We had been looking at it slightly before this [Covid-19] dynamic, and we were ready to go, but not necessarily on all of the chipsets.

“So we’ve had to accelerate the schedule on some [hardware]. At the same time, we have had to go through a lot of internal prioritization planning to enable the software capabilities required for some of these use cases. So yes, there we made some priority calls to address specific software features needed in some segments and use cases. We had to get features enabled on the products – whether connectivity related features, or camera capabilities, or a variety of other feature enablement.”

How important is this set of releases for Qualcomm? It feels like a mother lode. Can you just frame it for me?

“Well, generally, Qualcomm has released one chipset at a time, based on a schedule we had. But this was an opportunity to assemble all of [these devices] together, into one release. The key thing is we have seen the transformation across all of these segments, and demand for more advanced use cases, especially in the last couple of years, with everything the world is going through.

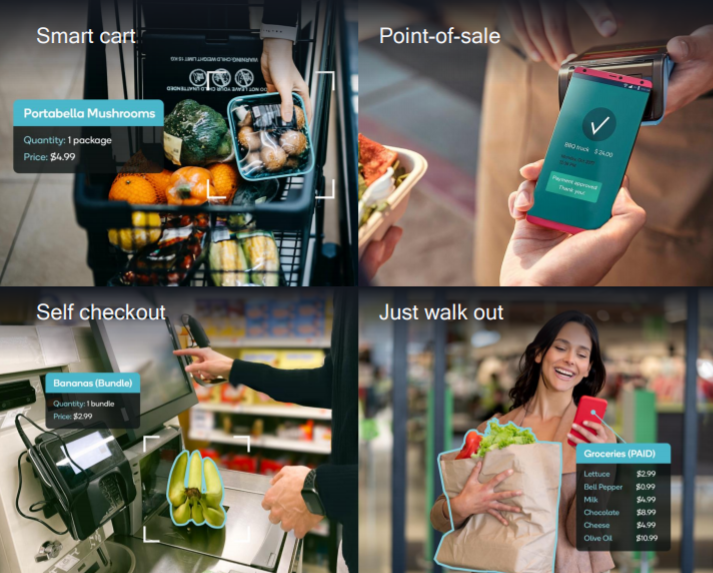

“The work style is changing. Which requires improvements in work-based collaboration tools. A lot of customers have said they want this product with this capability. It is the same with retail – with all the self-checkouts and smart carts. And we saw all of this, and the solutions we are launching now address all of these segments, where digital transformation [is gathering momentum]. That is the message we want to send – that we now have a family of products to address all of that.”