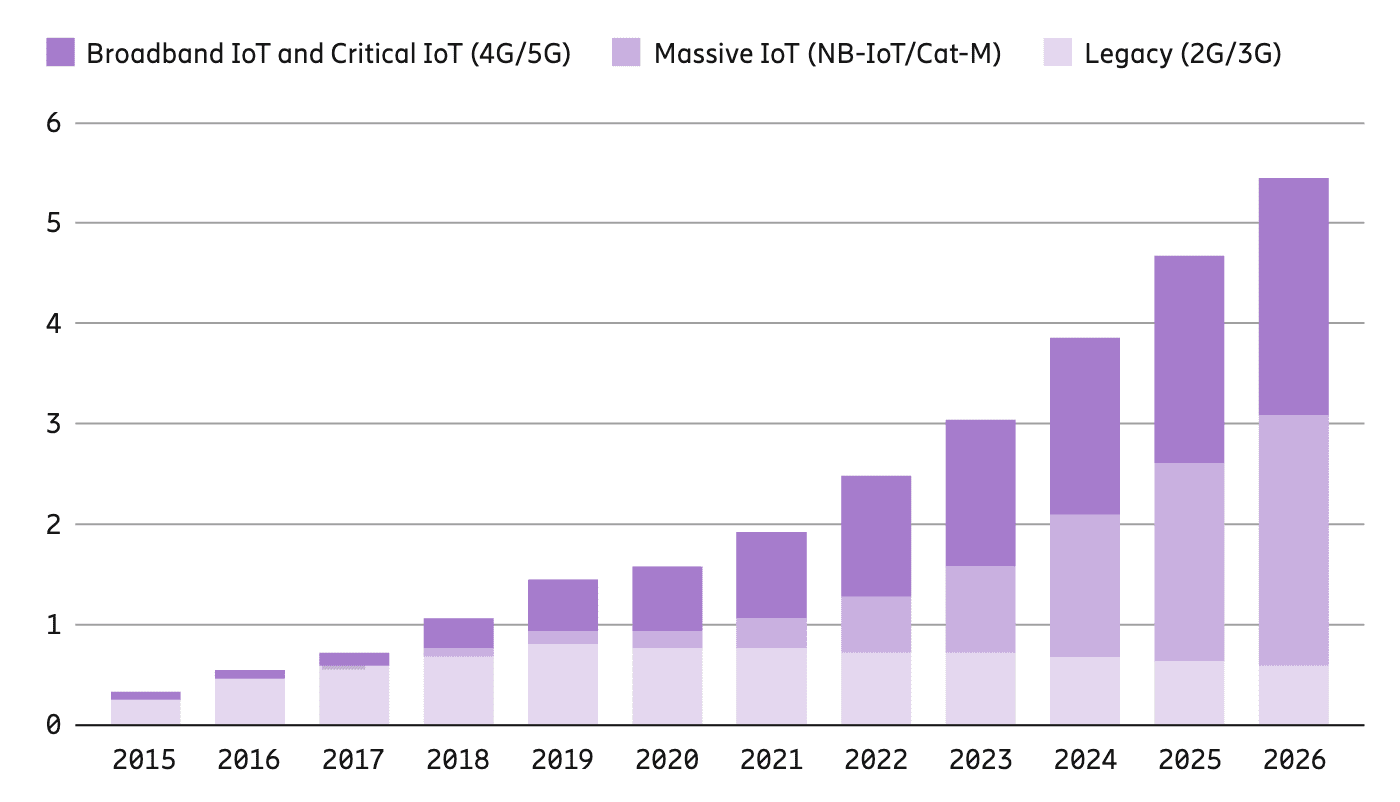

IoT traffic on latest-generation mobile ‘broadband’ 4G and 5G infrastructure will outrun IoT traffic on old-generation ‘broadband’ 3G and old-school 2G networks in 2021, reckons Ericsson. The terminology gets confusing, but the message from the Swedish vendor’s latest ‘mobility report’ is IoT momentum is gathering fast around newer cellular tech, including narrowband IoT (NB-IoT) and LTE-M / Cat-M low-power wide-area (LPWA) variants.

IoT traffic on legacy 2G and 2G networks, much of it from a pre-IoT machine-to-machine (M2M) era, is being matched finally by the rush over LTE-based 4G and incoming 5G, as the price of hardware has reduced, the variety of apps has multiplied, and business cases have become clearer. Combined with decent growth for rival non-cellular LPWA technologies, like LoRaWAN and Sigfox, the promise of ‘massive’ IoT looks closer, the story goes.

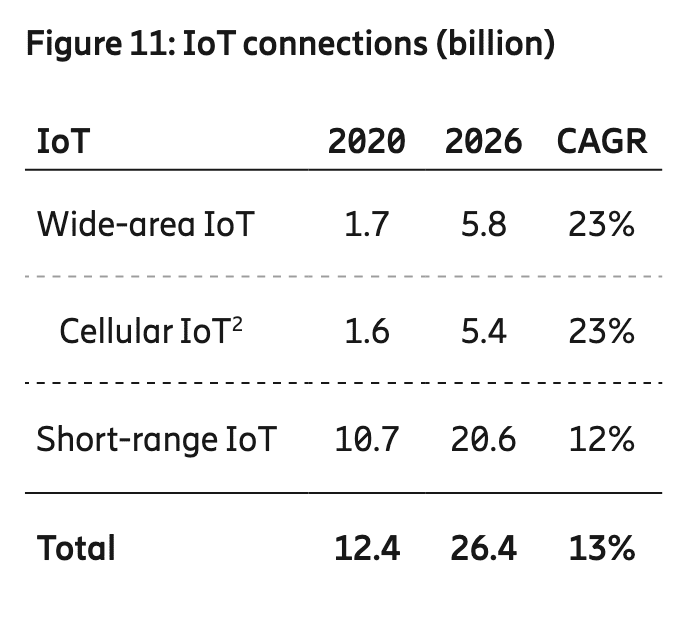

Ericsson forecasts there will be over 26.4 billion IoT connections in 2026, up from its six-month-ago forecast of 24.6 billion. The lion’s share (almost four-fifths) of these are on short-range IoT technologies, like Wi-Fi and Bluetooth. Ericsson has raised its five-year forecast, moved six months in the interim, for cellular IoT (5.4 billion) and short-range IoT (20.6 billion) connections in line with compound growth rates from six months ago (compare here).

It said massive IoT connections on NB-IoT and LTE-M – running with 120-odd and 55-odd mobile operators, respectively, with about 40 crossing-over on both – will increase by almost 80 percent during 2021 to reach close to 330 million. NB-IoT and LTE-M, geared for low-cost tracking and monitoring use cases, will make up 46 percent of all cellular IoT connections in 2026 (about 2.48 billion out of 5.4 billion).

By 2026, 44 percent (2.16 billion) of cellular IoT connections will count as ‘broadband IoT’ in Ericsson’s terminology, on either 4G or 5G. The rest (about 10 percent) will be on old 2G and 3G networks. Ericsson said 5G will extend to more IoT devices during the second half of 2021, including to cameras, virtual reality headsets, and unmanned aerial vehicles (UAVs / drones), and into more sensitive “time-critical communications” in 2022.

But 4G will remain the dominant cellular IoT technology in 2026, it said. Support for time-critical communications, with ultra-reliable low-latency (URLLC) aspects in Release 16 and 17 releases of the 5G standard – for remote control of robots, cloud robotics, cloud gaming, and, notably for Industry 4.0, with the introduction of time-sensitive networking (TSN) for niche industrial automation – will comprise a minor share of the broadband IoT count.

Ericsson has revised-down its 2020 estimate of cellular IoT connections from 1.7 billion to 1.6 billion on account of inactive cellular IoT connections in China. It said last year’s 5G-based IoT devices were limited to supporting 5G non-standalone (NSA) architecture, whereas 5G SA-capable modules have become available from a handful of vendors in 2021 so far. “5G [will] extend its reach to more IoT device types during the second half of 2021,” it said.