Father’s Day greetings from Dallas, TX, and Davidson/ Lake Norman, NC. The opening picture is from last Friday’s Lake Norman boat ride with our neighbors. Having my Dad and Mom nearby is a blessing. We hope each of you has a similarly joyous celebration of fatherhood.

This week, we will explore what’s on Comcast’s plate. Unlike AT&T, Comcast is not shedding their satellite or media businesses. This leads to the question noted in this week’s title – Can they execute? We think so, and will explain why they are in a unique position for a communications company.

A quick reminder – as a result of a job change that we will artiulate next week, the Brief will be altering its format (at least through the summer) to bi-weekly. We will not publish a Brief on July 4 but will on July 11 and 25.

The week that was

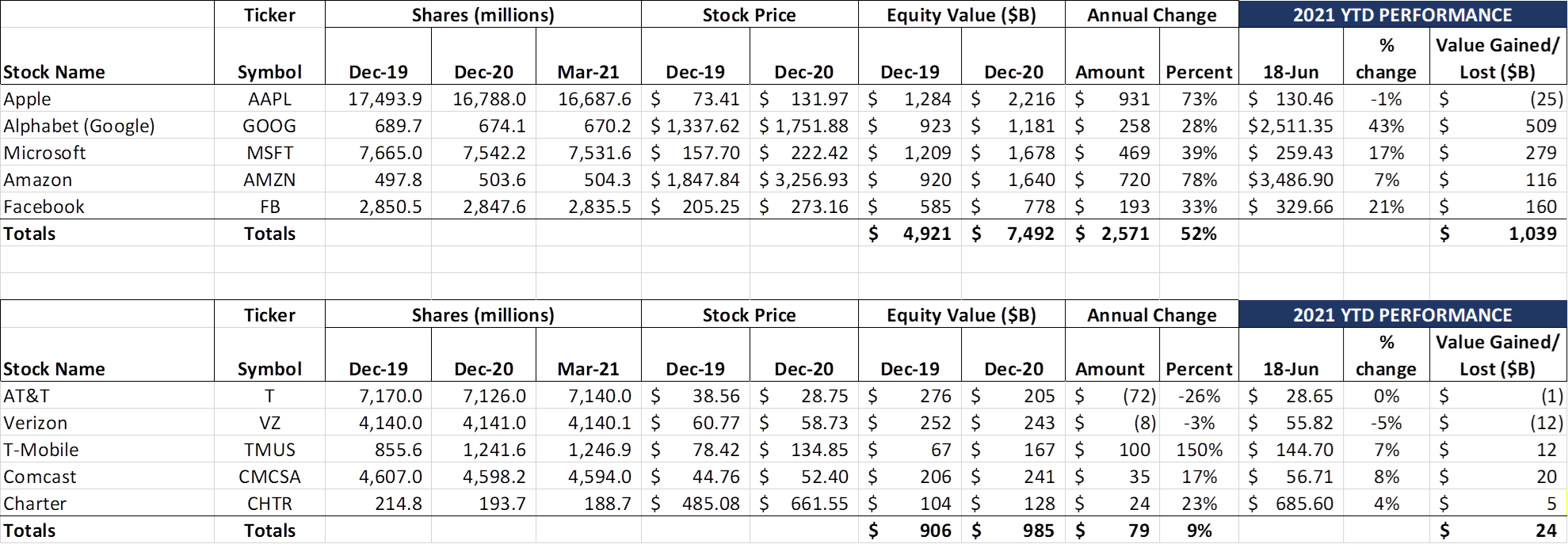

The best word to describe markets this week was “choppy.” For all of the headline declines and Federal Reserve-related volatility, the Fab Five managed to gain $128 billion this week (+$321 billion over the last two weeks). Many investors are rotating from Dow component stocks like Microsoft (+17% YTD) into other Dow components like Apple (-1%), while others are focusing on interest rate-sensitive stocks like Bank of America, Goldman Sachs, and American Express. Google and Facebook are not in the Dow average, but have enjoyed recovery-like returns this year as advertising explodes (more on that in the Comcast discussion below).

Amazon (+$71 billion) and Apple (+$52 billion) accounted for $123 billion of the $128 billion gain this week, with a smaller gain from Microsoft (+$12 billion) more than offsetting Facebook (-$5 billion) and Google (-$2 billion) losses.

The Telco Top Five was more subdued, with Verizon and AT&T accounting for the lion’s share of the capitalization losses ($11 billion of the $13 billion loss). Charter, Comcast, and T-Mobile were basically flat. AT&T and Verizon’s stock prices are now matching their March lows (when the debt realities of the C-Band license auction were fully sinking in). The benefits of the WarnerMedia/ Discovery merger and the sale of Verizon’s media unit to Apollo, as well as AT&T’s robust wireless results, appear to have worn off. The gap between T-Mobile and AT&T’s market capitalizations reached a record low, with only $24 billion separating the two companies. When AT&T completes merging WarnerMedia into Discovery, the remaining wireless and telecom stock will inevitably be worth less than TMUS.

We’ve seen firsthand the impact of chip shortages on automobile inventories, and the impact of lumber shortages (and skyrocketing prices) on housing starts. It was only a matter of time before it began to impact the telecom industry. This week, Wave7 Research reported that because of COVID-19 impacts to production in Vietnam and India, Samsung is beginning to report Galaxy S21 (including + and Ultra variants) shortages. We saw small backlogs at Verizon (puny compared to the iPhone 12 launch last year), but not at national distributors or at any of the other carriers. Stay tuned.

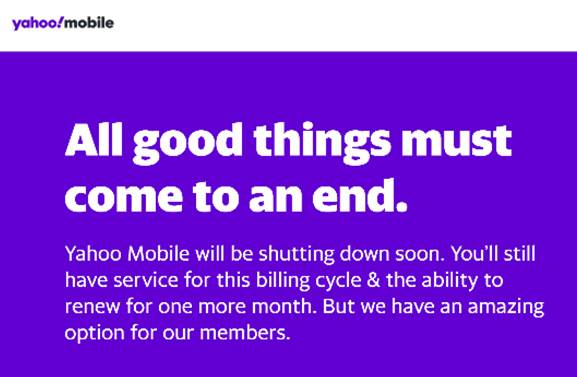

In other Verizon news, one of their MVNO brands, Yahoo! Mobile, announced that they would be winding down operations. This is not too surprising as many were asking the question following last month’s announcement that Apollo Global Management was purchasing Verizon’s Media Unit for $5 billion. This follows the shutdowns of Yahoo Groups and Yahoo Answers. Yet another brand unable to break through the MVNO barrier.

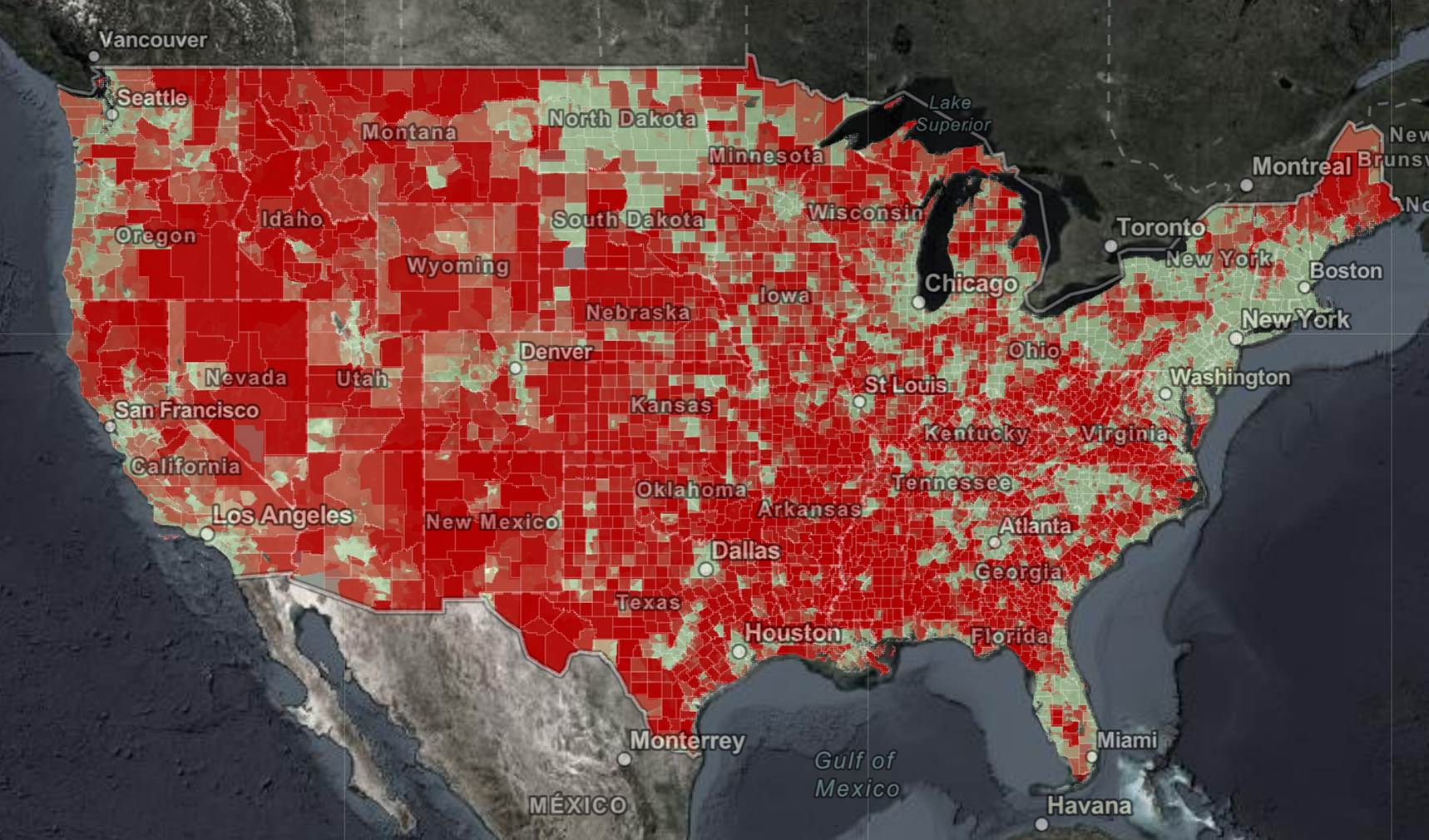

On the broadband front, the National Telecommunications and Information Administration (NTIA) announced their latest broadband availability map this week (link here). Unlike other iterations, this version included both Ookla and Microsoft data – an attempt to validate the observed (versus offered) speeds. Here’s the map as it currently stands (note that information is available at the county and/or the census block level depending on the metric):

Needless to say, there’s a lot of red on the map. To avoid being red, here are the conditions that had to be met:

- County level: Median speed tests above 25/3 (as determined by M-Lab)

- County level: 75% or more of fixed devices connecting to Microsoft updates have median speeds more than 25 Mbps (down)/ 3 Mbps (up)

- Census tract level: Ookla median fixed wireline speeds above 25/3

- American Community Survey (census tract level): less than 25% of households report no internet devices (tablets, smartphones, computers, etc.)

- American Community Survey (census tract level): less than 25% of households report no Internet access

- Census block level: At least one provider reports consumer services at the 25/3 benchmark (FCC Form 477 reporting)

The degree to which all of the above criteria were met determined the “green-ness” of the given geography. The bottom line is that there continue to be wireline broadband gaps in many parts of rural America, and that T-Mobile’s focus on rural markets as a fixed wireless opportunity is well-reasoned. More to come on this important topic in future Briefs.

Finally, two CNBC interviews bookended the Federal Reserve announcement concerning the possibility of a 2023 interest rate hike. First, hedge fund manager Paul Tudor Jones warned about the consequences of not addressing inflation head on (interview exerpts here and here). That was followed at the end of the week by St. Louis Federal Reserve President Jim Bullard’s comments on the Federal Reserve’s possible end to the purchase of mortgage-backed securities, as well as his perference that interest rate hikes start next year (interview exerpts here and here). Both are worth watching and analyzing.

Can Comcast do it all?

This week, our company focus turns to Comcast, the most valuable company in the Telco Top Five (equity market capitalization of $261 billion, total enterprise value of $353 billion as of Friday according to Yahoo Finance) . Traditionally viewed through the lens of their legacy cable operations, the company is emerging from COVID-19 with a wide variety of growing businesses: Broadband Internet, Enterprise Services, Mobile, NBC Universal, and Theme Parks. Perhaps the only weaknesses in the Comcast portfolio are their video and home phone products, and the unusually poor performance of the Philadelphia Flyers (who failed to make the NHL playoffs this year).

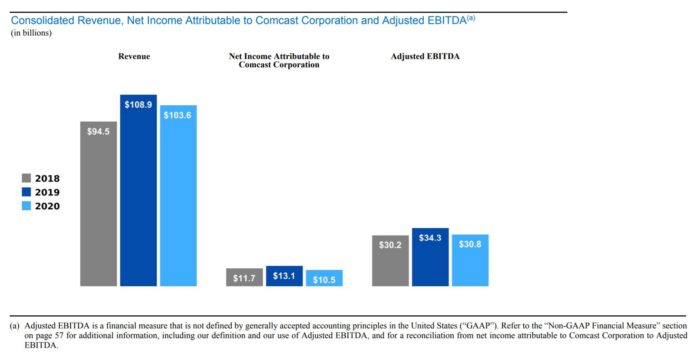

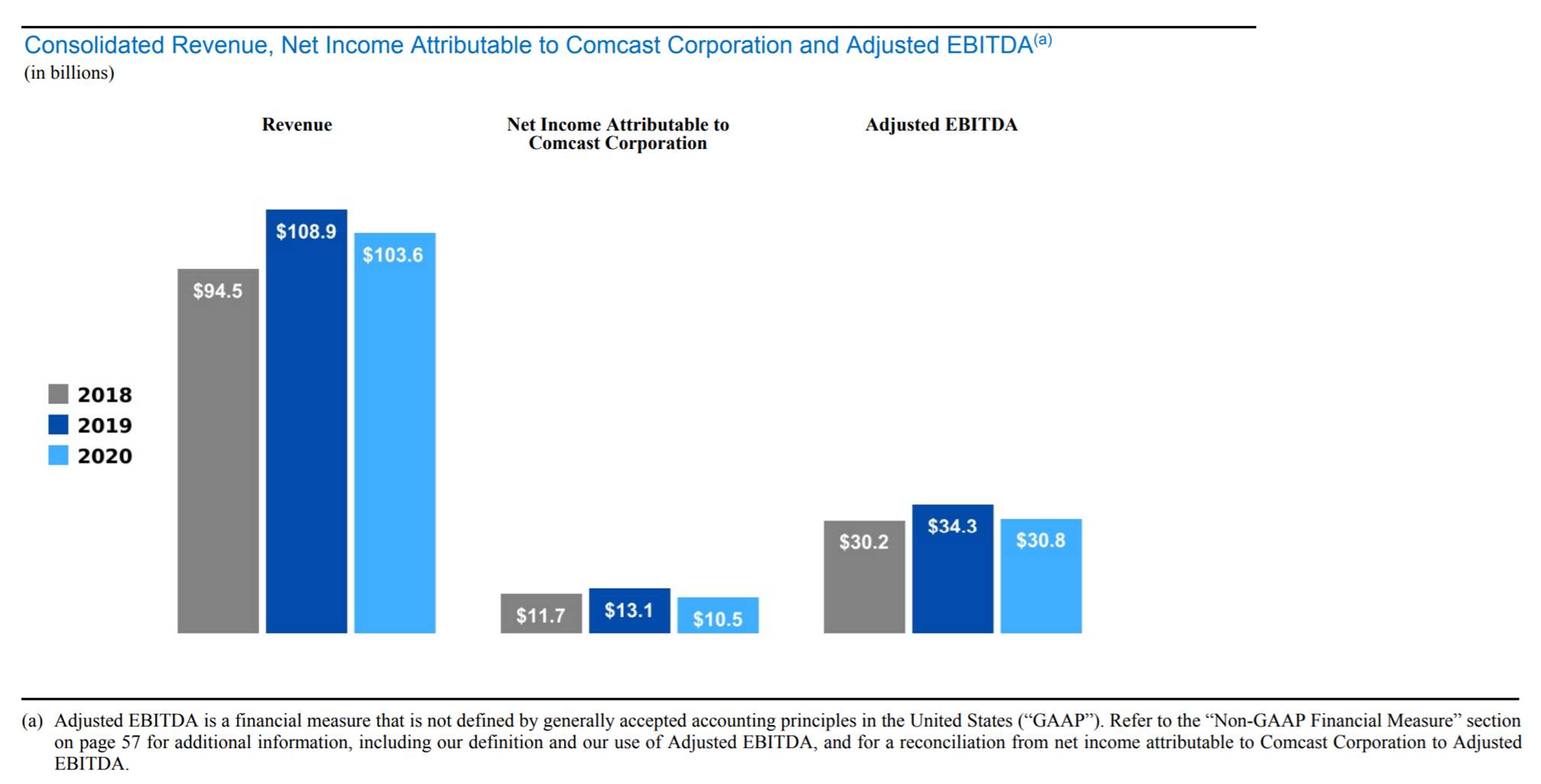

Here’s a brief view of the Comcast portfolio per their latest annual report (note that 2019 and 2020 reflect a full year of Sky’s revenue and EBITDA):

The execution task list for Comcast yields many opportunities:

- Manage cable growth. Specifically, grow their high-speed internet base revenues at a pace where cash profits (measured by EBITDA) outpace losses in video and voice. Due to programming cost inflation (the vast majority of which are not inter-company payments), video profitability is lower than either voice or Internet. Voice is in secular decline thanks to wireless and other substitution (now including streaming services such as Facebook Portal and Zoom Video).

We could consume the rest of this Brief discussing the risks and opportunities facing the cable communications unit. However, we will let Dave Watson’s recent comments from the Moffett Nathanson conference (transcript here) do it for us:

“One of the hallmarks, I think, of Comcast and Comcast Cable has been just constant focus on being ahead of the curve. You don’t produce consistent results over time without anticipating what’s happening in the marketplace and getting there early and sustaining that competitive advantage, constantly being curious around what does the customer want? Where is the marketplace going? Breaking the market down by segment. So you go back over… the last 10 years is a good base to understand what’s going to happen next. But we’ve added 14 million HSD relationships over that period of time, very consistent performance…. We’ve increased EBITDA by 77% over this period of time. So you look for the future, you can certainly see what’s possible. What are the applications with 1.2, with multi gig, with constantly improving speeds, the downstream multi-gig capability, constantly improving the upstream capability, coverage, the streaming capability, combining great products like mobile and serving business customers very differently in the future. For us, it’s just seamless experiences between fixed capability, wireless capability, us being a leader in delivering those broadband-rich applications that we’re not going to stand still.”

Whether enterprise, mobility, or internet, cable needs to stay ahead of the curve. That will require additional capital to further extend fiber to the node (and perhaps to and throughout the apartment building), as well as additional advertising and marketing expense to promote the value of their lower-priced Xfinity Mobile family plans. The X1 platform, however, is built and ready to launch new services (in the aforementioned discussion with Craig Moffett, Dave reminds investors that Flex was born out of the X1 platform).

As Craig Moffett describes in his latest analysis titled “It’s Time to Take Cable’s Wireless Business Seriously,” there’ a lot of runway for Comcast because of their existing broadband (and voice) relationships. We agree, and would gladly trade lower-margin video losses for Gigabit per second Internet gains.

- Grow advertising revenues in NBC Universal. At the Credit Suisse Communications conference (June 14 – transcript here), NBC Universal CEO Jeff Shell described the current advertising landscape (apologies for the length):

“There’s 2 things, I think, going on… [the] first thing that’s going on is pretty basic supply and demand… You had, during the pandemic, couple of points, 3, 4 points of viewership moved from advertising-supported platforms to non-advertising-supported platforms. People who were watching broadcast or cable networks or whatever moving over to Netflix or Disney+ or other platforms. And so as you come out of the pandemic and as lots of companies are trying to advertise and get strength coming out, as the market recovers,they’re just not as many — not as much rating points to buy in the market. So you have kind of a classic supply squeeze…

“The second thing, that dynamic, that’s happened is you’ve really seen kind of a barbell start to form in the market where advertisers as kind of linear is declining are just trying to find reach wherever they can find reach. Reach is increasingly difficult to find in the market. And if you have reach, then you have a commodity that’s very valuable. And if you can’t get reach, what advertisers want is they want granularity of data and addressability and knowing exactly who is seeing their ad and how they’re engaging with it. And so it’s kind of a barbell. And I think the way we’ve set up, we launched Peacock, thank God, a year ago, we chose the right business model. And so we really have Peacock with our linear networks gives us a really good — gave us a really good platform to hit this market exactly right where we have reach. And we have granularity, and we sell it as one platform, and we have got big events next year. So that is where it resulted in numbers well above what we expected for the upfront.”

2020 was a dismal year for advertising with the deferral of the Tokyo Olympics and disruptions for other spors-related activities. From 2018 to 2020, Comcast’s Broadcasting division saw a decrease of nearly $2 billion in advertising revenues (nb: this is super high margin business – 90% not uncommon).

If broadcasting advertising revenues can rebound into the upper-$8 billion level in 2021, that will provide an incremental $600 to $700 million in cash flow to the company. It sounds like from Jeff’s comments like they re on the right track.

- Theme park rebound. At the same Credit Suisse conference, Jeff also discussed the dynamics surrounding theme parks. Here are his insights on Orlando (the furthest along with respect to the recovery – emphasis added):

“The demand side of Orlando, we have virtually no international visitation yet, which normally, depending on the time of year is between 20% and 30% of our attendance. And yet, without any of that attendance, we’re already hitting our capacity and doing better in some cases than 2019, which is remarkable, given how soon coming out of this we are. One of the things you’d expect actually is with less international and more domestic visitation, you’d expect per caps to be lower. And we’re actually not seeing that. So people are not only coming back to our Theme Park and enjoying the experience out of their house, but they’re buying stuff. They’re buying Harry Potter wands and all sorts of things. So very pleased with how the Theme Parks in Orlando are doing.”

Jeff then went on to talk about the reopening of the state of California (also bullish) as well as Japan and China (bullish for 2023 more than 2022). Returning theme parks to 2019 EBITDA levels will result in an additional $3 billion in cash flow to the company. And, based on a second burst of demand from interational visitors, the number could be even higher in 2022.

Going back to the bar chart above, does Comcast have a clear path to $40 billion in adjusted EBITDA in 2022? Absolutely, especially with back-to-back Olympic years. The question becomes “What will they do with all of this cash?” Do they increase spending on CBRS and make good resale economics even better? Do they go upstream with Cox and Charter and form a single unit to serve enterprise customers (perhaps through joint investment in a managed service provider)? Do they buy or build more content production capabilities (perhaps in partnership with Amazon or Apple)? Or do they simply increase their share buyback level? Many choices emerge post-recovery.

Back to the opening question: “Can Comcast Do it All?” Are they spread too thin, especially with Sky? We feel differently then we did with AT&T (see our comments in Delta Sky Magazine’s 2015 article here), but cannot rule out execution risk if mid-level executives depart. The secret to Comcast’s success lies in localizing decisions where appropriate, and enabling management to take calculated, data-based risks. AT&T lacked that leeway, and DIRECTV collapsed as a result.

We also think that a couple of additional non-cable partnerships like Verizon (critical to Xfinity Mobile’s wireless trajectory) will also make it easier to sustain growth (WalMart for Flex-embedded TV distribution, or Microsoft for an X-Box led edge MDU partnership would be places to start). It’s not a slam dunk, but we think Comcast can do it all with the existing cable karietsu and a few well-managed non-cable strategic relationships.

That’s it for this week. Next week, we will close out June with an assessment of Charter. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals and Go Royals and Go Sporting KC!