June greetings from Davidson/ Lake Norman, Dallas (TX), and the mountain town of Murphy, NC. After a busy week, the Briefer took some R&R time with friends in the mountains. Pictured is the Chatuge Lake view from the Chatuge Shores Golf Course which is on the border of North Carolina and Georgia. Our guys group stayed at McGuire’s Millrace Farm which is normally reserved for weddings in June (see link) but the accommodations would be terrific for any group.

This week, after a brief market commentary, we will dive into the strategic future of Charter Communications (known to many through their Spectrum brand). While there are many similarities between Charter and last week’s subject (Comcast), we think that Charter has a material opportunity to increase value through their focused “mobile + High Speed Internet” approach and their rural fiber diversification strategy.

A quick reminder – we will be celebrating the Independence Day holiday next week, and, as a result, there will be no Brief. Jim will be starting a new position on the leadership team of American Broadband (ABB), a small but quickly growing rural-focused broadband company. As a result of their small community focus, they frequently operate as both the cable and telephone company. ABB operates using their legacy names including Cameron Communications (Louisiana and Texas), Blair Telephone Company (Nebraska), Eastern Nebraska Telephone Company, and TelAlaska. We are currently actively seeing small rural cable and telephone companies to join our fiber movement. Besides giving plenty of geographies for the opening line of the soon-to-be bi-weekly Brief, you will now get a field view of one of the most dynamic parts of the telecom world – local fiber access. More insights to come in future Briefs – there’s a lot to learn.

The Week That Was

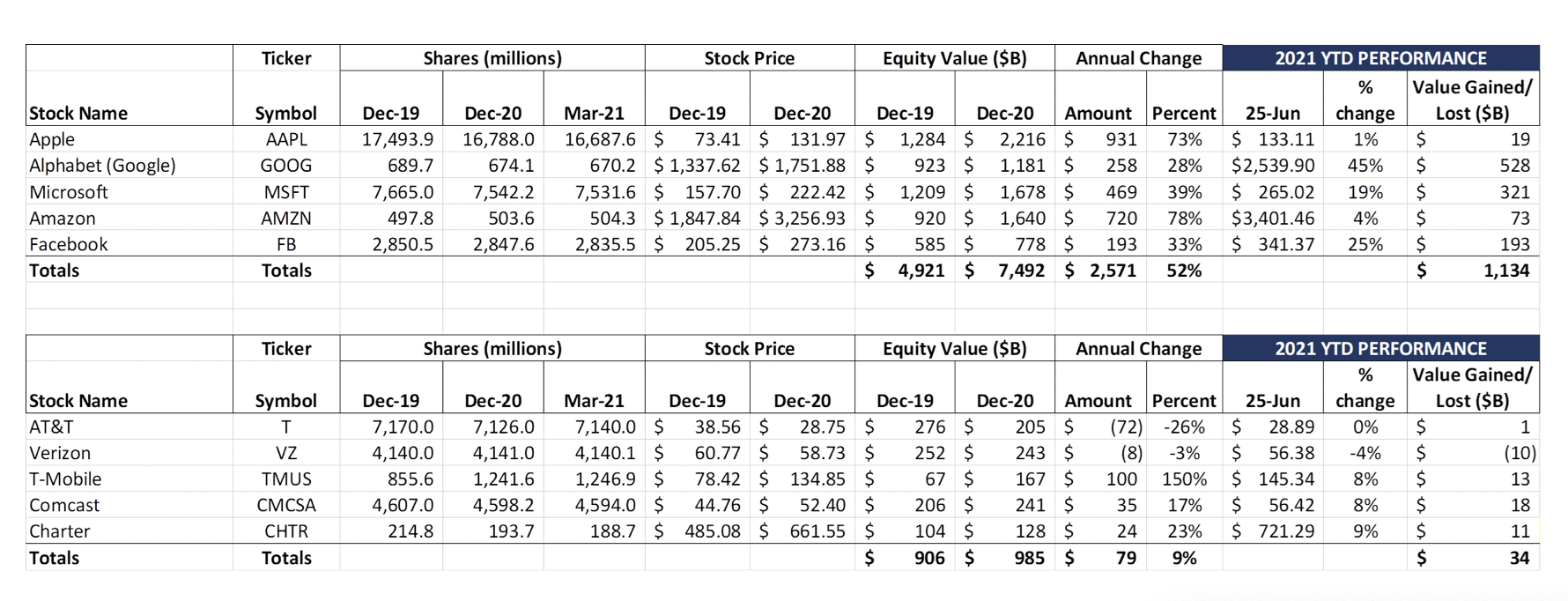

This was a good week for both the Fab Five (+$95 billion wk/wk) and the Telco Top Five (+$34 billion). Over the past five weeks, the Fab Five have added $579 billion in market capitalization, bringing their year-to-date total well above one trillion dollars. Amazon was the only value loser in the Fab Five with Prime Day failing to live up to elevated expectations (company announcement here; CNBC/ Bank of America’s analysis here). No worries, however, with the Seattle giant increasing shareholder wealth by nearly $800 billion since Jan 1 2020 (Amazon’s Friday close was the lowest seen since… June 16, 2021).

Outside of Prime Day, the biggest news of the week was the Microsoft Windows 11 announcement on June 17. As Ars Technica summarized, this is more than “a new theme slapped on to Windows 10.” Microsoft went out of their way to stress the interoperability of their new operating system, revealing that the next Windows release would seamlessly interoperate with Android apps. While Microsoft has been cozying up to Android ever since they announced they were exiting Windows Mobile in 2017 (that development took over two additional years to materialize), this announcement is still a very big move. Besides the Ars article mentioned above, CNET has a very good analysis of Windows 11 features. Microsoft’s integration into other parts of the company (especially Xbox) is apparent and welcome.

More changes are afoot in the smartphone world as well, with Jeff Moore of Wave7 reporting that Verizon is significantly reducing their in-store portfolio, with LG out (as expected), and Samsung models reduced (not expected). As we discussed last week, those Samsung SKUs that remain are currently not in stock. Based on our online checks (and Wave7’s store checks two weeks ago), Verizon is seeing widespread backlogs on the Galaxy S21 5G, Note 20 Ultra, A42 5G, and S20 5G Fan Edition. Only the Galaxy S21+ 5G in black or silver appears to be readily available.

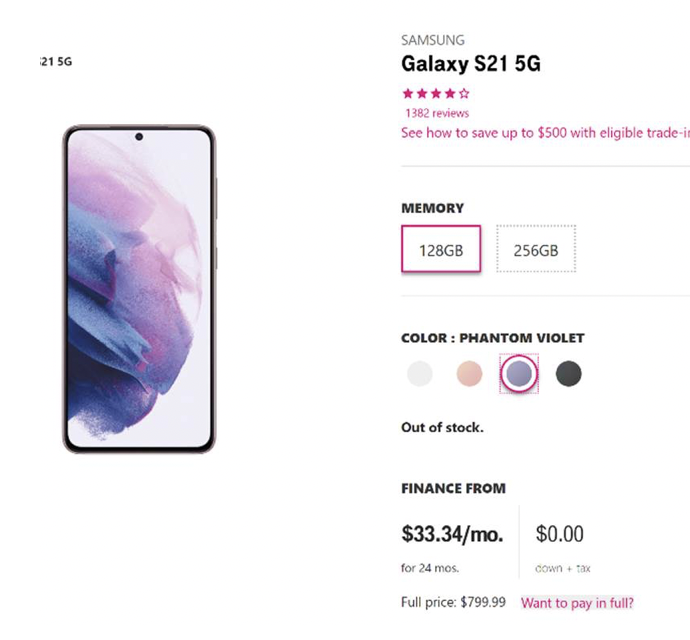

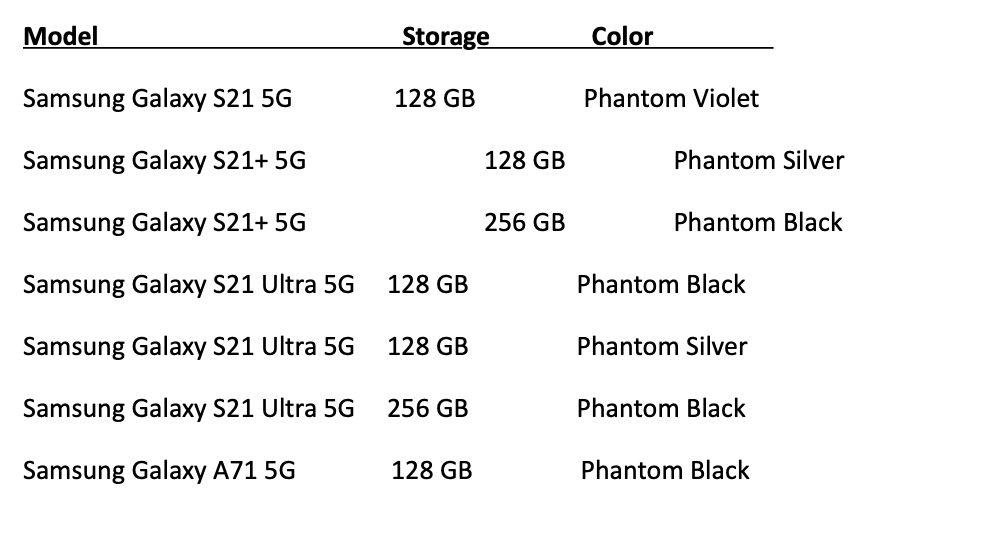

As we discussed last week, we knew that the supply chain issues hitting Verizon could not be far behind for other carriers, and T-Mobile confirmed that this week with “out of stock” (no backorder dates given) on the following Samsung models:

Remember, these are not the model/ storage matches that are on backorder – there are many more combinations with “on backorder” listed (including, as Jeff Moore points out, the popular and free Samsung Galaxy A32 5G, now shipping between July 27 and August 17) These are the model/ storage/ colors where T-Mobile is unwilling to predict when they will be available. Telecom needed it’s post-COVID “shortage” and it came in spades with Samsung.

How these shortages will impact T-Mobile’s efforts to convert legacy Sprint customers over to their new 5G network (and therefore allow Magenta to rip out the existing CDMA network) remains unclear. But two Congressmen from Colorado (Dish’s home state), who also happen to be members of the House antitrust subcommittee, want the Department of Justice to investigate whether T-Mobile is reneging on its commitment to regulators through their announcement to Dish that they are taking down their legacy CDMA network in the next 9 months. More details on the investigation request and T-Mobile’s response from Margaret Harding McGill of Axios here.

There were committee votes on six bills last Wednesday and Thursday, and they have the Fab Five on edge – so much so that Apple’s Tim Cook placed a call to fellow Californian House Speaker Nancy Pelosi earlier in the week to discuss (New York Times take on the discussion is here). Speaker Pelosi stated to Cook that he should “allow the process to play out.” It did, and all six bills passed the committee. The most controversial bill, the Ending Platform Monopolies Act, only passed 21-20 after Representative Cori Bush, a Democrat from Missouri, changed her vote from “not present” to “yes.” Three other committee members who had a history of voting for antitrust measures in the past, did not vote. When the final House vote will actually occur is anyone’s guess, but this legislation will ignite a lobbying effort from the Fab Five that we have not seen in some time.

Charter Communications – Formulaic Diversification

Two weeks ago, we prepared for second quarter earnings discussing Verizon’s strategy: more MVNO, more C-Band coverage, and more content bundling. Last week, we looked at Comcast’s ability to deliver profit breadth across theme parks, advertising, content production, broadband, and enterprise (and contrasted that with AT&T’s struggles and likely divestitures).

This week we look at Charter Communications, a company with less business breadth than Comcast, but more entrepreneurial drive than Verizon and AT&T combined. They are living in a uniquely golden age for the company: a) Brighthouse/ Time Warner Cable/ legacy Charter merger synergies nearly complete; b) Extraordinary, pandenic-driven broadband growth; and c) New growth sources from mobile and a resurgent post-COVID economy. Even with this mixture of cash flow goodness, the company is smartly pursuing additional growth sources that we describe below.

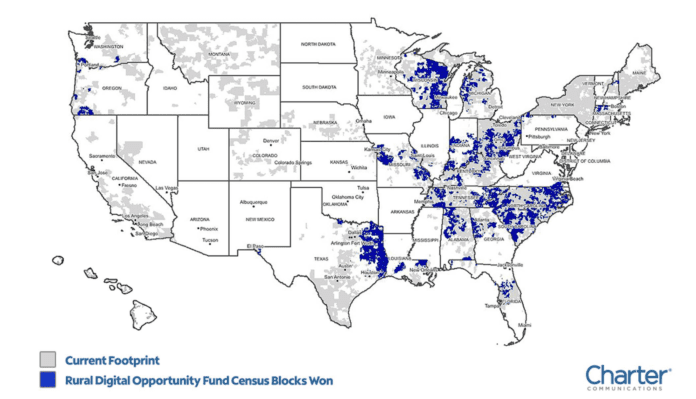

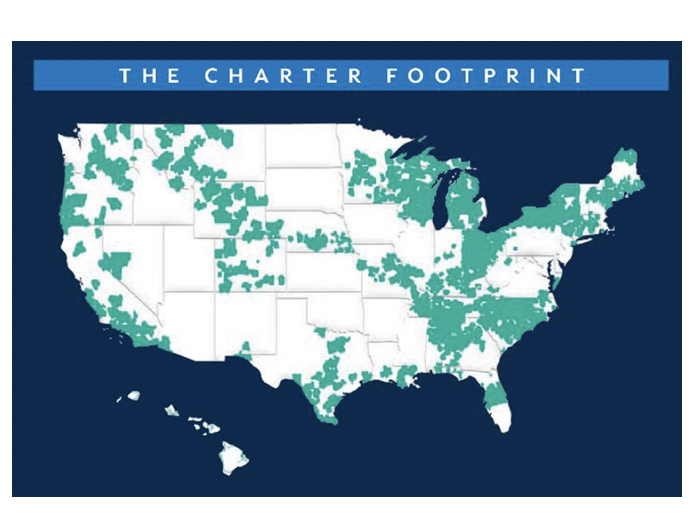

For those of you who are not familiar with Charter, here’s their map:

New York City, Los Angeles, Dallas/ Ft Worth, San Antonio, Tampa/ St. Petersburg, Orlando, San Diego, Charlotte, Cleveland, Columbus, Cincinnati, Austin, Saint Louis, and Raleigh/ Durham are their main metropolitan areas. But Charter also has a lot of second tier cities that are growing quickly including the Boston suburbs, upstate New York, and northern Alabama. They are highly clustered (which improves operational efficiencies) and have worked diligently to grow their small and medium business presence in the community (currently under the leadership of Bill Archer, but heavily influenced by his predecessor, Phil Meeks).

Entering the second quarter of 2021, here’s what was on Charter’s strategic plate:

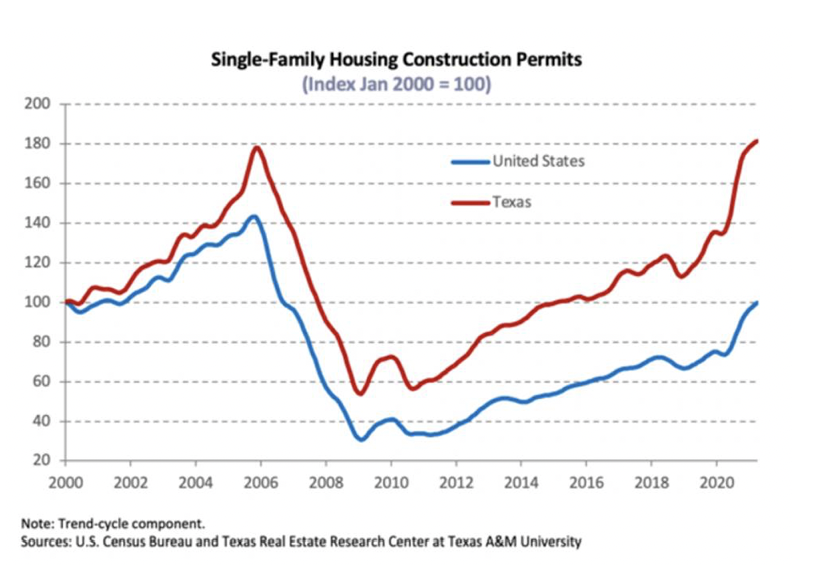

- Managing existing market RGU growth (especially in Texas). Charter already has a strong market share in Texas, but they stand to be the largest share loser once AT&T completes their 3 million fiber-to-the-home (FTTH) commitment. Texas is booming – jobs are plentiful (and growing), jobs growth continues to be strong (especially with $70/ barrel oil), and competition until now has been relatively limited to AT&T’s highest yielding communities. AT&T’s easiest way to meet their 2021 FTTH target begins with Texas. Charter grew their total passings by 1.15 million units and their residential customer relationships by 1.8 million in 2020, and we suspect a large part of that growth was driven by the Lone Star State. The single family construction permits chart nearby, from the Texas A&M Texas Real Estate Research Center, tells the tale, and, while a lot of growth comes from the Houston metro, the vast majority of growth originates from the Dallas-Austin-San Antonio corridor (full report here).

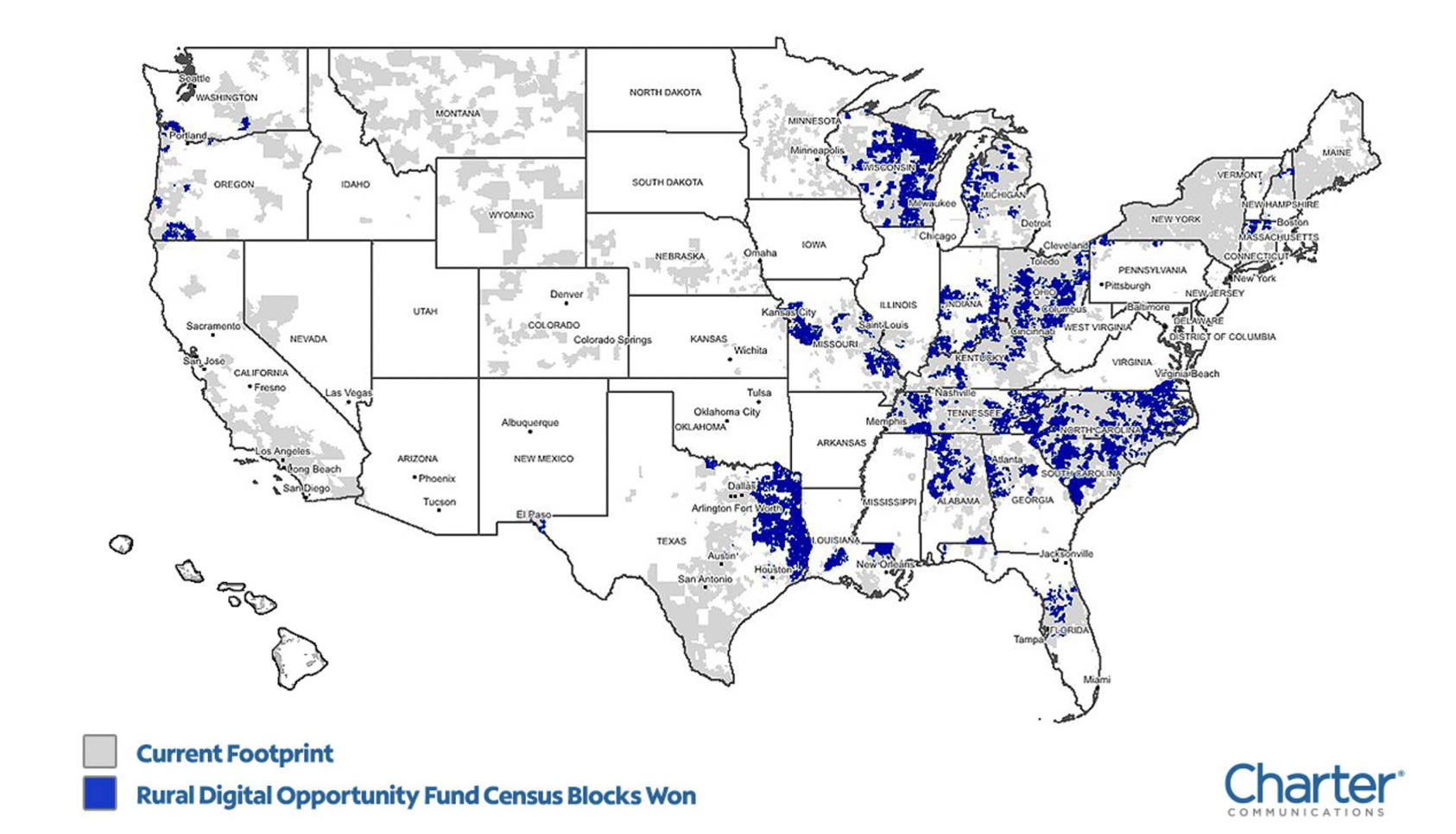

- Growing rapidly in rural markets. Charter was a big winner in the Rural Development Opportunity Fund (RDOF) process conducted at the end of 2020, snagging $1.2 billion in funds to build out 5,366 Census Block Groups across 24 states (roughly 1 million homes) – announcement here. While the company has asked for waivers for a small fraction of their win due to mapping inaccuracies (or the fact that Massachusetts had already awarded funds to another provider), this will still be a very big initiative. Here is a map of Charter’s current and RDOF footprint overlay:

The “fill in” nature of the build is quite apparent from the map. For the most part, Charter is “edging out” into adjacent territories (East Texas being the notable exception). The impact of this will be heavest on AT&T and rural providers such as TDS (Wisconsin). Charter’s RDOF commitment is for Gigabit-speed, low-latency solutions, something that CFO Chris Winfrey has indicated will take time (although he indicated in a recent interview that the company is moving as fast as they can).

The rural market initiative could also generate revenue growth for video, as fiber-enabled homes could be a source of growth (and satellite losses). At his recent interview at the Evercore conference (webcast here), Winfrey indicated that a lack of density (and therefore lack of active users) actually made fiber to the home more attractive.

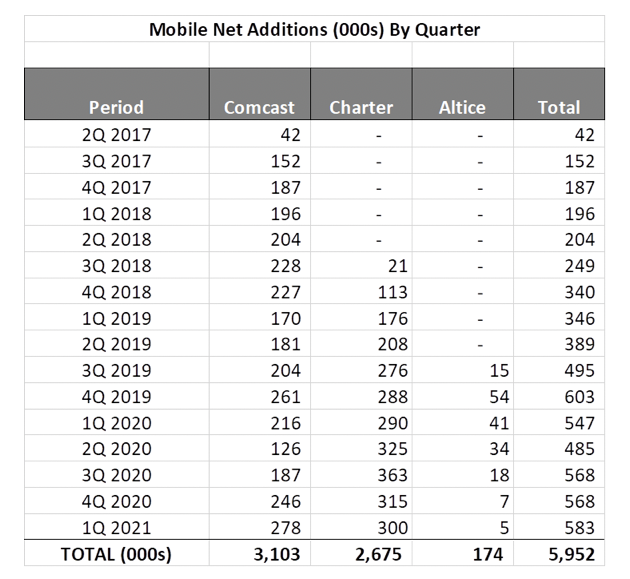

- Growing Spectrum Mobile’s acceptance and importance to broadband customers. While we applaud Charter’s rural push (we agree with Winfrey that “it’s the right thing to do”), we think that the company’s single greatest opportunity is wireless (Charter’s wireless product is Spectrum Mobile). Phone availability issues aside, their methodic approach to mobile is unassailable:

a. Market to the current High Speed Internet base of customers. According to recent research from Parks Associates, the “broadband + mobile” double play accounted for 19% of their surveyed home Internet base, paying an average of $128/ month (see release here). Mobile stems the growth of single primary service units. With Charter’s triple play penetration at ~22% (mobile is excluded), a new solution is needed, and mobile fits that bill to a tee.

b. Grow the product value of wireless to each High Speed Internet customer. This is currently experienced today with faster speeds thanks to upgraded metro Wi-Fi deployments, but in the future will come with enhanced rollout of their 20 MHz Citizens Band Radio Spectrum (CBRS). Spectrum Mobile’s prices also include taxes and fees (especially helpful in the New York City area). Verizon is a very good wireless network partner for Spectrum and Comcast, but it’s only a matter of time until CBRS deployments are a part of the standard fiber build plan. As Chris indicated in the Evercore interview linked above (roughly 15:38 in the video) “More mobile success means more CBRS.”

c. Increase High Speed Internet speeds to enhance the value of the bundled product to mobile customers. Spectrum’s quick adoption of DOCSIS 3.1 as the post-merger standard architecture made the process of upgrading to new baseline speeds relatively easy. Chris spoke to the adoption of a new “Hi-split” architecure which would enable faster download speeds in the Evercore interview. Our view is that Charter will announce a speed upgrade (likely up to 400 Mbps for $49.99 for the first year) in late 2021 and complete the upgrade in 2022.

This is a “rinse and repeat” model. No surprise that Charter has chosen to fuse mobile and High Speed Internet — it makes a lot of sense. While we are not willing to go out on the “mobile penetration will be as successful as digital phone” limb (the Triple Play introduction was unique and preceded the growth of substitute products such as Netflix for content and Mint Mobile for wireless), we are confident that a mobile + High Speed Internet strategy is the best one for cable.

Bottom line: As a result of tough decisions made during the Brighthouse + Time Warner Cable + Charter merger process, the new Charter has set the table for diversified growth. The degree of difficulty here is (thankfully) not as high as managing “day and date” theatrical production issues or theme park reopenings. There’s no risk (or reward) from Olympic viewership, and success is not based on third parties or other restructurings. Mobile + rural + Texas (and perhaps the Carolinas and Florida) are the keys to the next $100 billion of growth. It’s an understandable and measurable investment thesis, and the primary reason why, even with the threat of fiber-based competition, we think they are big winners.

That’s it for this week. Since we are moving to a bi-weekly format for the summer (at least), our July 11 issue will likely be focused on macroeconomic trends that will impact second quarter earnings (that could change). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals and Go Royals and Go Sporting KC!