July greetings from Blair/ Omaha, Nebraska (fresh off a memorable College World Series, and home of this week’s PGA Senior Open) and Davidson/ Lake Norman, North Carolina. Pictured is a wonderful fireworks shot my neighbor captured from last Sunday’s celebration. It is great to be back on the road again, this time in a new position as Chief Strategy Officer of American Broadband. Terrific management team (see announcement here) with a difficult yet fulfilling charter to enable fiber speeds in less populated markets.

This week, after our market commentary (which will discuss President Biden’s broad-based executive order), we move to 2Q earnings. Our focus will be on the two earliest reporting companies, Verizon and AT&T. Here’s the full earnings announcement schedule for the Fab Five and the Telco Top Five (as of July 10):

Company Earnings Date Before Open/ After Close

Verizon Wednesday, 7/21 before market open

AT&T Thursday, 7/22 before market open

Apple Tuesday, 7/27 after market close

Google Tuesday, 7/27 after market close

Facebook Wednesday, 7/28 after market close

Microsoft Wednesday, 7/28* after market close

Comcast Thursday, 7/29 before market open

Amazon Thursday, 7/29* after market close

Charter Friday, 7/30 before market open

T-Mobile Thursday, 8/5* after market close

*estimated day

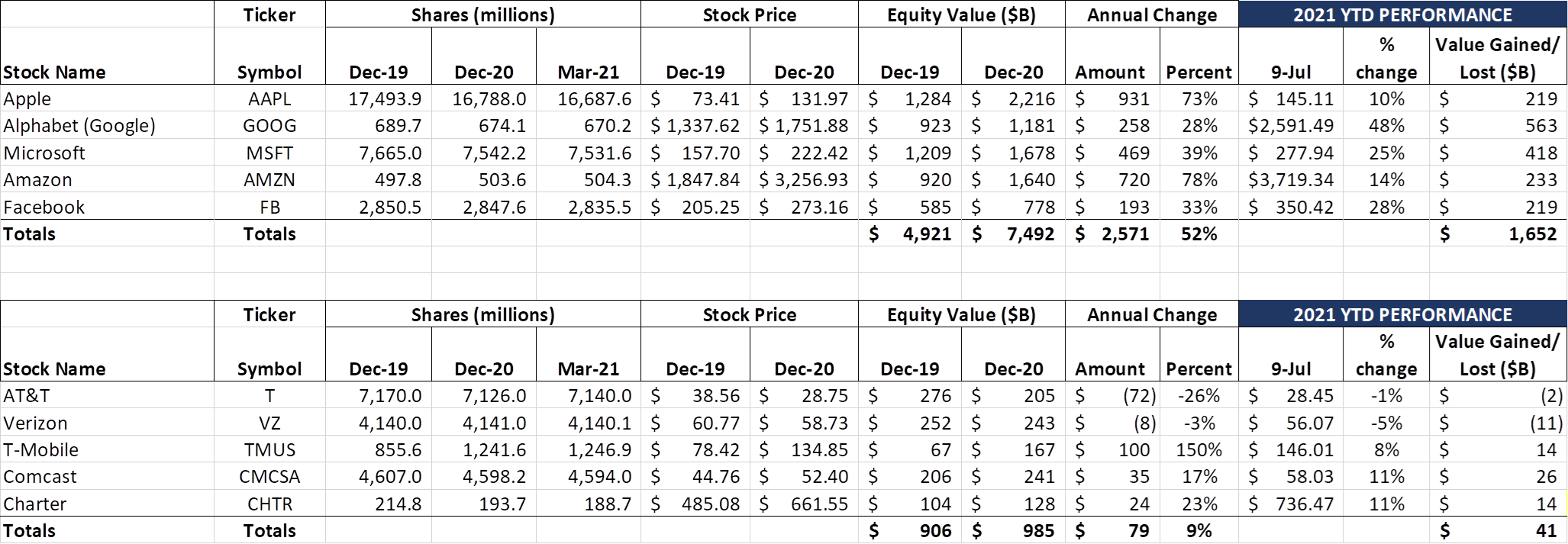

The week that was

The two weeks straddling the July 4th holiday have historically been good for the Fab Five: a 2019 gain of $153 billion from 6/28 to 7/11/2019, a 2020 gain of $724 billion from 6/29 to 7/10/2020), and a $518 billion gain in the two weeks ending July 9, 2021. In the last eight weeks, the Fab 5 gas gained more than $1 trillion (or the entire value created in the entire history of the Telco Top Five). While news outlets search for daily clues moving the markets, we think there’s a seasonal pattern among institutional investors, and that, with cash and marketable securities balances exceeding $600 billion for the Fab Five as of the end of March, there’s a “safety factor” in big tech.

The wealth created by The Fab Five ($4.8 trillion excluding dividend payments since the end of 2018) has drawn the attention of the Biden administration, who issued a sweeping set of executive orders on Friday (Tim Wu’s tweet nearby with FTC chairperson Lina Khan, full text of the order here, and The Wall Street Journal take on the executive order here). Here are the considerations in the order pertaining to the FCC chair:

(i) adopting through appropriate rulemaking “Net Neutrality” rules similar to those previously adopted under title II of the Communications Act of 1934 (Public Law 73-416, 48 Stat. 1064, 47 U.S.C. 151 et seq.), as amended by the Telecommunications Act of 1996, in “Protecting and Promoting the Open Internet,” 80 Fed. Reg. 19738 (Apr. 13, 2015);

(ii) conducting future spectrum auctions under rules that are designed to help avoid excessive concentration of spectrum license holdings in the United States, so as to prevent spectrum stockpiling, warehousing of spectrum by licensees, or the creation of barriers to entry, and to improve the conditions of competition in industries that depend upon radio spectrum, including mobile communications and radio-based broadband services;

(iii) providing support for the continued development and adoption of 5G Open Radio Access Network (O-RAN) protocols and software, continuing to attend meetings of voluntary and consensus-based standards development organizations, so as to promote or encourage a fair and representative standard-setting process, and undertaking any other measures that might promote increased openness, innovation, and competition in the markets for 5G equipment;

(iv) prohibiting unjust or unreasonable early termination fees for end-user communications contracts, enabling consumers to more easily switch providers;

(v) initiating a rulemaking that requires broadband service providers to display a broadband consumer label, such as that as described in the Public Notice of the Commission issued on April 4, 2016 (DA 16–357), so as to give consumers clear, concise, and accurate information regarding provider prices and fees, performance, and network practices;

(vi) initiating a rulemaking to require broadband service providers to regularly report broadband price and subscription rates to the Federal Communications Commission for the purpose of disseminating that information to the public in a useful manner, to improve price transparency and market functioning; and

(vii) initiating a rulemaking to prevent landlords and cable and Internet service providers from inhibiting tenants’ choices among providers.

There are other sections in the order that deal with horizontal and vertical merger rules with an encouragement to revisit previously approved transactions. While this appears to be focused on hospital and other health care industry mergers (and also the creation of Internet platforms), there’s a small possibility it opens the door for a relook at the Brighthouse/ Time Warner Cable/ Charter three-way merger or even the highly contentious Sprint/ T-Mobile merger.

As we discussed with respect to the NTIA map distributed about a month ago (see Brief here), different measurements across different platforms can yield different results. For example, using Ookla speed test (www.speedtest.net) might indicate one speed, a run through Google’s speed test another, and fast.com (our favorite and we believe most accurate) an entirely different result. Crowdsourced tests using an iPhone 7 might result in different speeds than an iPhone 12. And any test over a VPN will likely be slower. The focus should be on speed test improvements against an increasingly higher standard for that locale. More to come in future Briefs.

The spectrum hoarding position is clearly a shot across the Dish bow. There’s not much doubt that this administration will not be extending their spectrum deployment deadlines. The more interesting question revolves around C-Band winners such as Nextlink and Viareo (big winners in rural America) and whether they should be held to the same scrutiny as Dish and larger wireless providers. We think section (ii) is open to a lot of interpretation, and that the vast majority of spectrum has been or will be deployed in a timely manner (see C-Band commentary below).

Finally, for multi-dwelling units or MDUs (vii above), it’s important to remember that all complexes are different. How a rule treats a new 500+ unit complex in Katy, TX, might not be the best solution for a 100+/- unit complex in Blair, NE. Said differently, there actually might be a very solid case to limit “tenants’ choices among providers” from a wired perspective since a $50,000+ fiber install for each provider for a 100-unit complex ($500 per unit capital cost) might warrant some commitment to meet business case requirements. Hopefully this does not effectively ban the concept of “bandwidth as an amenity” which is currently being used in many smaller complexes in under-served areas.

One last thought on MDUs since we have readers from several federal agencies: Wireline service providers cannot solve the problem of aging inside wire. Bringing fiber to the telco closet does not guarantee Gigabit speeds. If the federal government wants to address the bandwidth gap through wired (as opposed to wireless) means, then they need to provide incentives for all parts of the value chain – that includes apartment complex owners. We have a perfect example of how that was addressed in Houston, TX, (inner city complex) if there is interest in how this problem is being solved without government assistance.

Bottom line: Outside of the corny lamentations about the death of newspapers, there’s a lot of serious policy recommendations in the above text. Having Lina Khan at the helm of the FTC and Merrick Garland as Attorney General (see Justice Department statement on revisiting merger guidelines here) is going to create a higher bar for approval. We don’t think any previous telecom mergers are in jeopardy, but also don’t think there will be a Suddenlink/ Altice/ Sparklight/ Cox Communications and any other cable party merger in the near future (although we think that the FTC and FCC will look at the Astound/ WOW! Merger announcement favorably).

Mid-tear report – AT&T, Verizon earnings preview

As we noted above, two of the three largest wireless providers are going to be announcing earnings prior to the next Brief (now bi-weekly). Rather than recap their Q1 earnings and offer cheap commentary on how year-over-year comps will be easy because of the 2020 pandemic, we thought it would be good to highlight several questions that we hope will be asked.

- When will the Tracfone acquisition be approved? At what point does it make more sense for Tracfone to be a valued MVNO customer? We don’t think it was a coincidence that Verizon committed in late June to extending the time period that Tracfone will offer Lifeline services to three years following merger close (see FCC Ex Parte meeting notes here). Being “first up” after the executive order described above, even for a seasoned veteran like Verizon, can’t be easy. The FCC can extract additional business conditions for Verizon (e.g., building out Reading, PA, with fiber or allowing customers who switch wireless services to another provider more time to pay off their equipment installment plans) that would make the merger less attractive. Verizon’s commitment to offer 5G services to all Tracfone customers within six months of close is a “sleeves off the vest” concession – they need to move all customers quickly to 5G to repurpose LTE spectrum.

- How is AT&T’s fiber to the home rollout (3 million additional homes passed in 2021; 30 million total homes passed by 2025) progressing? New CEO John Stankey and AT&T Communications CEO Jeff McElfresh have staked the company’s future (and their legacies) on fiber to the home. And, with Jeff’s disclosure that 70% of fiber gross additions are new to AT&T (see transcript here), how is AT&T converting fiber (single-product) customers to wireless and other services? Our prediction is that AT&T will post numbers that are ahead of expectations, but that supply chain (including labor) shortages are keeping them from even faster growth. Also, to the MDU comments above, it will be interesting to see if AT&T counts fiber to the apartment complex as “passed” compared to fiber to the apartment unit. We suspect they are counting telco closet connections (and all corresponding units) as passed.

The implications of their fiber deployment answer to cable cannot be ignored. Fiber services are more symmetric than DOCSIS or VDSL. As we have discussed in previous Briefs (most notably here), the impact to Comcast and Charter is minimal to moderate, especially with customers who still enjoy traditional linear TV services (bundled as a “double play”). With AT&T’s video services soon to be in a JV, one has to believe that the economics will be worse than they were while under one roof. That complexity could be cable’s short-term savior.

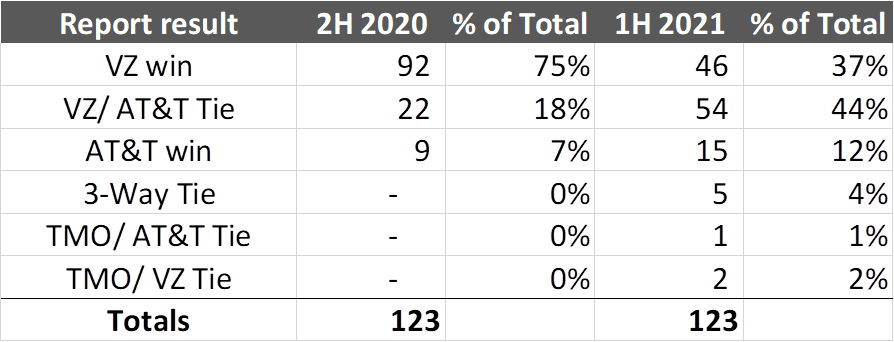

- Is Verizon still the best network? What is the basis of that statement? AT&T’s 2019 and 2020 FirstNet-driven wireless network investments are showing up in third-party performance results, namely RootMetrics RootScore Reports (here). We have periodically reported progress in previous Briefs, but nearly all locations are now in and the preliminary results are not encouraging for Verizon:

Of the 123 metropolitan areas reported, Verizon’s overall award totals (no tie) have fallen by 50% in six months. To Verizon’s credit, they have been the outright winner in very large markets like Los Angeles, New York, Chicago, Atlanta, Boston, and Washington, DC. But the more likely result now across the US is “tied with AT&T,” usually with the supporting comment that “T-Mobile’s average download speed increased materially.”

C-Band cannot come quickly enough for Verizon. It’s going to be difficult for them to use RootMetrics as the basis for their claim of “best network” (as Hans Vestburg did just this week on CNBC) given these results. The company relies heavily on RootMetrics for their claim, and there are no other third-party results that provide supporting evidence.

4. Will AT&T maintain exclusivity over HBO Max for mobile bundling after the spin is completed? How is that in the best interest of the spin-out company’s shareholders? Confining AT&T’s conference call to one hour (and Q&A to 20-30 minutes) makes it easy for management to dodge some difficult questions. Before the WarnerMedia/ Discovery merger announcement, AT&T was all about HBO (nearby slide from the March Analyst Day says it all). After the spinoff occurs, there are competing priorities. AT&T Fiber customers might be just as easily enticed by a Netflix offer (e.g., upgrade to Netflix 4K for free when you subscribe to AT&T Fiber) than the prospect of free HBO Max. In turn, there are other broadband and wireless providers who would love to bundle HBO Max (particularly their ad-supported version due this year) with their core offerings. How is AT&T unwinding their wireless messaging to exclude HBO Max?

There are many, many more questions to address: WarnerMedia “day and date” theatrical decisions for 2022; progress report on Verizon’s 5G Home Internet as well as their One Fiber initiatives; AT&T’s dividend update (if any); and supply chain constraints on Verizon Samsung devices (see here) and other elements critical to 5G buildout (including labor) for both companies.

Bottom line: We like to listen to what’s not addressed by management in their opening statements. Our guess is that we will not hear a lot about DIRECTV, business wireline, 5G Home Internet, RootMetrics results, or the Verizon Media spinoff (and perhaps no Tracfone merger update) in the opening comments. FirstNet, new residential passings, broadband ARPU growth, and low postpaid phone churn will dominate the dialogue. The Q&A should be particularly interesting this time around.

That’s it for this Brief. In two weeks, we will dive into AT&T and Verizon’s results and look at the implications for cable ARPU and net additions. We will also keep a vigilant eye on the ever-changing regulatory landscape. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals and Go Royals and Go Sporting KC!