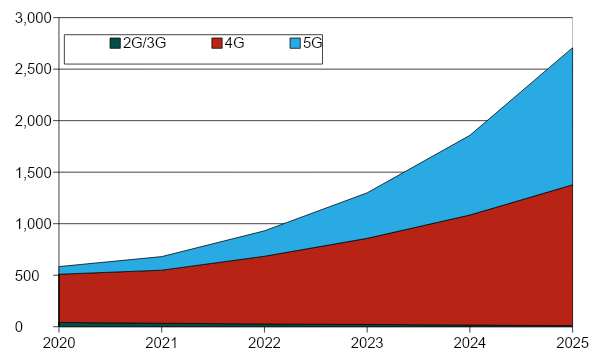

5G New Radio offers mobile operators access to new frequency bands, such as the C-Band, 3.3 to 4.2 GHz spectrum, as well as access to millimeter wave (mmWave) bands. This has helped operators to create 3 main spectrum categories for 5G: (i) Low Band (< 1 GHz), (ii) Mid Band (1 to 6 GHz), and (iii) High Band or mmWave (24 to 100 GHz). On the back of the growing mobile data traffic demand and the access to higher frequency bands, mobile operators can optimize their spectrum allocations to meet their rapidly changing traffic demands. T-Mobile was the first to coin the term “Layer Cake” to explain their strategy for spectrum deployment. Having an optimum spectrum strategy will be essential as data traffic management are evolving. According to ABI Research, by 2025, mobile data traffic will reach 2,700 exabytes (EB), growing at a CAGR of about 35% from 2021 to 2025.

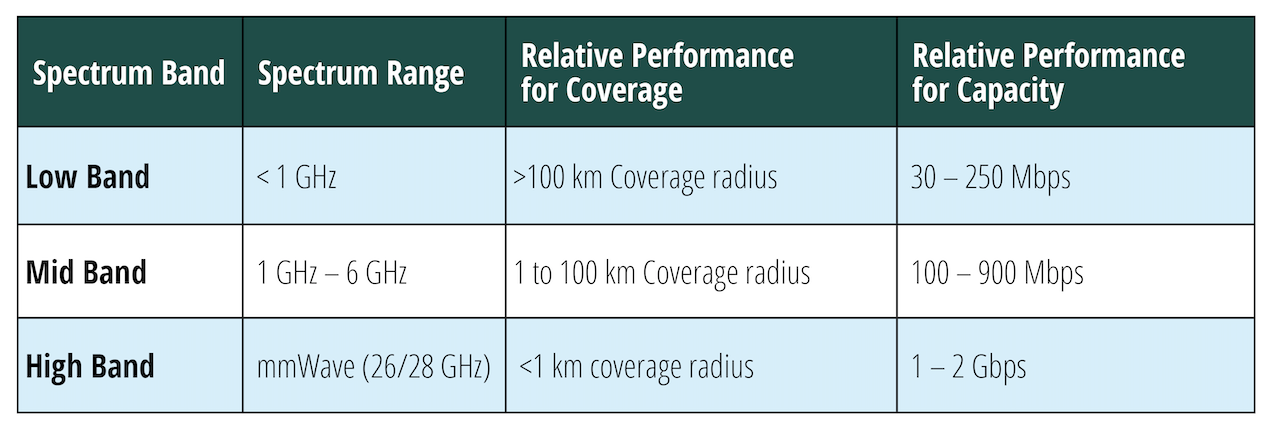

Comparative value of low, mid, and high bands

The High Band has the potential to offer very high throughputs (>1 GigaBits/s) and therefore can meet the capacity needs of a densely populated area, making it best suited for urban city centers. The Mid Band is often referred as “best of both worlds” band, where it has better propagation characteristics than the High Band while providing faster data throughput than the Low Band. The Low Band is crucial in providing an effective coverage layer across large areas (typically a radius of > 100 km).

Based on the GSA’s May 2021 report, it is expected that there will be at least 33 auctions/assignments world-wide expected for 700 MHz by end of 2022. This highlights the growing interest in the 700 MHz band and its importance to operators and economies. Recently spectrum activities around the 700 MHz band include the first Latin America country, Chile, whose operators have been allocated 700 MHz. Europe issued a formal decision, the “EC Implementing Decision (EU) 2016(687)”, back in 2016 to harmonize the 700 MHz band for terrestrial systems and make it available by the end of June 2020. For example, in France, there are already more than 10,000 sites which support the 700 MHz according to its spectrum authority, ANFR (L’Agence Nationale des Fréquences). In the Asia-Pacific region, China, Japan, and Australia are some of the countries who have started their journey of building out 700 MHz mobile infrastructure.

The case for 700 MHz band

The 700 MHz band holds significant promise for mobile operators to provide nationwide coverage and deep indoor coverage. The ability of Low Band to provide coverage for the widest area among the three frequency bands position is the most economical for mobile operators to meet their nationwide coverage requirements. Mobile operators must optimize the cost of investment when they build out their network infrastructure. Furthermore, the 700 MHz also provides support for Internet of Things (IoT), as well as for users (both consumers and enterprise) that are travelling at speed (e.g., cars, commercial vehicles, trains).

Internet of Things: IoT devices have low data throughput requirements (typically 1 MegaBits/s or lower) but require a very reliable connection. Often these IoT devices transmit small packets of data but over a large area. In addition, equipment that interfaces with cellular IoT technology can be located both indoors and outdoors. Therefore, the 700 MHz is ideal to support IoT applications and services. In Europe, regulators, such as Ofcom, have released the 700 MHz to operators in a bid to support the development of IoT applications. Based on ABI Research’s forecast, by 2026, the number of 4G and 5G IoT connections is expected to grow at a CAGR of 19% to reach 560 million connections.

Connectivity on the cove: Users with high mobility range, from truck drivers on highways to end-users on intercity trains, will benefit from the 700 MHz band. The 700 MHz, with its wide and deep coverage capability, provides the essential layer to keep users connected seamlessly throughout their journey. Having a single coverage layer will also mitigate any potential disruption in service due to poor handover which could arise when operators use Mid or High frequency bands. Aside from mobility on land, we should also take note of activities offshore. 5G is set to bring about value creation in the enterprise segment and drive Industry 4.0 adoption in oil and gas exploration, fisheries, marine conservation, etc. For example, T-Mobile and Tampnet have both secured 700 MHz spectrum licenses for use on the Dutch Continental Shelf.

The Importance of an ecosystem: Globally, the industry is also building momentum in the 700 MHz band ecosystem. Industry momentum is an important factor which highlights the growing maturity of the ecosystem. TPG Telecom has successfully rolled out its 5G standalone 700 MHz band services in Australia to provide coverage to 85% of Australia’s population. KDDI (Japan) started its 5G 700 MHz rollout in March 2021, with the goal of providing enhanced 5G experience by improving indoor and outdoor coverage. However, the most significant deployment in 2021 comes from China. China Broadcasting Network (CBN) and China Mobile are building out more than 480,000 5G base-stations at 700 MHz band. The CBN’s deal, reported to be about US$6 billion (RMB 38 billion), will substantially increase the number of 5G base stations in China by more than 60% in 2021 alone. Huawei secured the largest share (60.9%) of the infrastructure contracts, followed by ZTE (30.9%), and the remaining 8.2% acquired by Nokia, Datang, and Ericsson.

700 MHz-enabled devices:. Another crucial aspect for industry momentum is the devices and products ecosystem for 700 MHz band. Without the devices and products available for consumers and businesses to use, the momentum of 700 MHz band will not accelerate. Based on the GSA’s report in June 2021, the number of devices which supports 5G ecosystem has reached more than 300 for the “n28 band” (APT700), the highest among all the Low Bands for 5G. The growth has been remarkable, as just prior in June 2020 the number of devices announced for n28 band was approximately 40. In the same GSA document, there are about 100 devices announced which supports the n12 band (700 MHz, Lower SMH). More than just the number of devices, the industry players have also collaborated and advanced the development for the 700 MHz band. For example, Qualcomm is collaborating with Vivo, Quectel, Fibocom, and Gosuncn for devices which support the 700 MHz band. Qualcomm’s Snapdragon X55 5G modem-RF system, which supports the 700 MHz, was launched in 2020 and was utilized in CBN’s 5G trials. This will also generate benefits for consumers as economies of scale build.

Conclusion and summary

Telecom operators need to optimize their Total Cost of Ownership through the most effective use of spectrum bands, base-station deployment, population coverage, and capacity management. The capabilities of each respective spectrum band should be tailored to fit the needs of specific applications. The 700 MHz low band is an ideal spectrum band to help telecom operators achieve population coverage and reliable connections while balancing the cost of investment.

Various players, ranging from regulators to device manufacturers, are already accelerating the development of the 700 MHz device and infrastructure ecosystem. This underlines the future potential of 700 MHz to be an invaluable frequency band with a rapidly maturing ecosystem to support 5G networks.