Marvell is a recognized leader in the data center chipsets market. However, when it comes to cellular space, despite being a valuable silicon provider to major network vendors, Marvell has largely remained away from the limelight. But that is set to change with the industry pivoting toward virtual, open, and cloud-native RAN architectures. The company, capitalizing on its technology expertise, end-to-end portfolio, and strong partnerships, is set to play a key role in 5G, as networks with these new architectures are starting to get rolled out.

Silent partner to leading cellular infra players

For the last few years, much before the virtual and Open RAN frenzy, Marvell has been providing data, baseband, and network processors for radio base stations. The majority of tier-1 global cellular infra vendors, including Nokia, Samsung, Fujitsu, and others, except Huawei are Marvell’s customers.

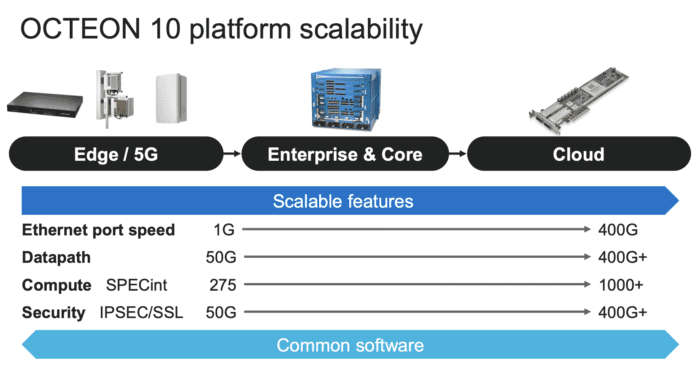

Marvell not only supplies off-the-shelf merchant silicon solutions but also offers the flexibility to customize some portions of those solutions (aka custom ASICs) to better suit customer’s needs. Its standard offerings include Octeon Fusion, Octeon TX2, and newly introduced Octeon 10 Data Processing Units (DPUs) as well as a slew of networking products. The latest—Octeon 10—announced in June 2021, is its tenth-generation solution and boasts many industry firsts.

| For a merchant provider of data infrastructure silicon, custom ASICs are somewhat unique to Marvell. The customization has allowed infra vendors to offer differentiation in legacy networks, where the software and hardware are proprietary. At the same time, it has allowed Marvell to develop crucial technology such as massive MIMO (aka mMIMO or MaMIMO). The acquisition of Avera Semi from Global Foundries in 2019, significantly expanded Marvell’s customization capabilities. |

Large opportunity with virtual and Open RAN

The remarkable growth of 5G and the significant global traction for virtual and Open RAN architecture are expanding an already large opportunity for Marvell. Granted that the vast majority of today’s 4G/5G networks are based on the legacy architecture, and deployment of fully open multi-vendor networks might take some time to become mainstream. However, the RAN virtualization is surely underway. Many of the new major deployments, such as c-band in the USA, will be fully virtualized. Additionally, green-field opportunities such as Dish and many major operators in Europe are committed to Open RAN as well.

There are two aspects that position Marvell very well for this fast-emerging attractive market opportunity: Technology and product expertise gained through building products for the traditional macro networks, and excellent relationships with the leading cellular infra vendors.

Technology and product expertise built through merchant and custom silicon

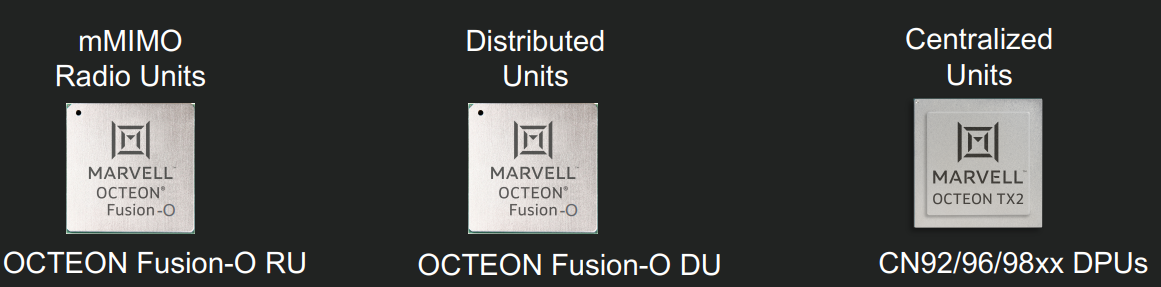

The technology expertise of legacy networks can be easily ported over to virtual and Open RAN systems. This is because the new architectures simply define how the same radio and baseband functions are distributed among the virtual Radio Unit (RU), Distributed Unit (DU), and Central Units (CU).

For example, a popular vRAN configuration known as Split 7.2 divides the physical layer (aka PHY) into two parts—the first part (with latency-sensitive functions) known as Low-PHY or L1-Low that resides in the RU and the second part known as High-PHY or L1-High in the DU. DU will also support MAC and RLC layers (aka L2). The remaining parts of the baseband functions will reside in the CU. This means that you will need processors of different capabilities in RU, DUs, and CUs.

Marvell’s Octeon family of solutions is flexible and well-suited to enable virtual and Open RAN. One of the radio solutions supporting L1-low is used for RUs, Octeon Fusion processor supporting L1-high, and L-2 is used for DUs, and Octeon TX2 is used for CUs. These new variants of existing processors are aptly named Octeon Fusion-O RU, DU, and CU.

The flexibility has also allowed Marvell to offer an end-to-end portfolio supporting the full virtual and Open RAN network blocks.

Close relationships that will make the difference

It is quite telling that every major cellular infra vendor other than Huawei has embraced virtual and Open RAN architecture—legacy players such as Ericsson more reluctantly and new entrants such as Samsung much more enthusiastically. Marvell’s close relationship with the major infra vendors is key to winning in the new landscape.

Early this year Samsung and Marvell announced the joint development of MaMIMO SoCs. This vividly demonstrates Samsung’s confidence in Marvell, and a natural progression of the work both have done on Marvell’s silicon. This collaboration might include joint IP development as well.

Last year Nokia also chose to develop its 5G baseband units with customized versions of Marvell’s solutions. It is worth noting that this was to replace Nokia’s earlier decision of using FPGAs, which turned out to be more expensive and power-hungry. It found a good partner in Marvell to develop custom ASICs.

Another interesting collaboration Marvell has is with Facebook—the driving force behind Telecom Infra Project (aka TIP). This collaboration is to supply chipsets for Facebook’s Evenstar program. Evenstar is an effort to build open reference designs for RU and DU that enable plug-and-play multi-vendor systems. The first versions of the RU have already completed lab validation and are headed to field trials. Marvell will be providing processors for Evenstar’s DU designs. Evenstar will have a huge potential, if it can ultimately make RAN software and hardware truly open and portable, without any inter-dependencies. Expect more from me on this.

In closing

Marvell’s profile is rapidly rising in the cellular space, thanks to the increased industry attention on virtual and Open RAN architectures. Marvell indeed has an interesting product mix, and technology expertise to be a force to reckon with. Its strong relationships with major infra players position it very well in the changing landscape. It will be interesting to watch how Marvell will exercise its strengths to lead in this market.

Meanwhile, for more articles like this, and for an up-to-date analysis of the latest mobile and tech industry news, sign-up for our monthly newsletter at TantraAnalyst.com/Newsletter, and listen to our Tantra’s Mantra podcast.