Operators are focused on leveraging Open RAN to lower per-site TCO, according Dell’Oro Group VP

Telecoms industry analyst Stefan Pongratz, vice president of the Dell’Oro Group, this week told attendees to the Open RAN Forum that as operators connect radio site total cost of ownership with savings presented by new Open RAN architectures, revenues derived from disaggregated systems could overtake proprietary revenues in the 2025 timeframe.

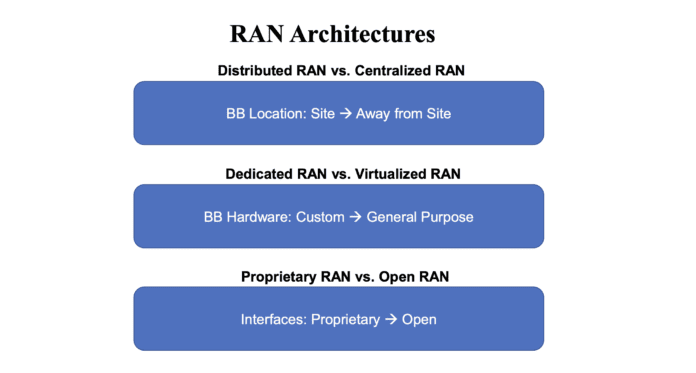

Pongratz identified “three broad architecture trends” being addressed by operators and vendors to essentially “do more with less.”:

- A shift from centralized to distributed RAN as baseband functionality is moved away from sites;

- a move from custom baseband hardware to general purpose hardware supporting virtualized RAN;

- and a move from closed, proprietary RAN interfaces to Open RAN interfaces.

Pongratz said a big driver here is operators’ wanting more vendor optionality as opposed to working with Ericsson, Huawei and Nokia, which control about 80% of global RAN market share. “They want to see more suppliers,” he said. “It’s not necessarily they want more to work with once they decide…but they want to have a broader selection from the get-go. When it comes to the decision-making then of course there’s going to be some collective good kind of thinking, but I also think a lot of the decisions from operators will ultimately boil down to maximizing that TCO over the lifespan of the product.”

He also gave a bit of a breakdown of RAN costs noting that wireless capex is around $150 billion to $160 billion per year with RAN representing between 20% and 25% of the capital spend. Drilling down to individual radio sites, this represents between 10% and 20% of total operating budgets. In terms of lowering TCO by switching to Open RAN, vRAN, or a combination of the two, “The likelihood is the majority of [the cost saving] is coming from the non-RAN bucket,” things like automation, reducing headcount and improving energy efficiency. “There’s a significant non-RAN component to keep in mind.”

Pongratz tracked spending on Open RAN solutions showing significant increases from around $100 million in the first half of 2020, to around $1 billion in the first half of 2021. And, “We have just upped short-term and longer-term projections,” as more than 80% of the top 20 global service providers by revenue have deployed, committed to deploy, or are otherwise evaluating Open RAN.

“When it comes to how Open RAN will be deployed going forward, I think we kind of envisioned it would be multiple phases,” he said. “Some large Tier 1 European operators will say the technology, the architecture, will not be ready for primetime until lets say 2022 or 2025. That’s when we see that the Open RAN revenues will actually surpass more traditional solutions. At the same time we now have operators in Japan that have gone from let’s say 0% Open RAN to more than 75% or 80% Open RAN in just a couple quarters with 5G. Not all Open RAN is the same; they’re doing something different.”

Going forward from this initial phase will include increasing focus on multi-vendor deployments, more vRAN, then layering in RAN Intelligent Controller software platforms and white box hardware. “It will take some time to realize the full Open RAN vision,” Pongratz said.